Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Organizations worldwide are undergoing digital transformation to remain competitive in the modern business landscape. This process involves adopting advanced technologies, data-driven decision-making, and the development of customer-centric applications. Wireless Power Receiver solutions are at the forefront of this transformation, enabling organizations to modernize their legacy systems, embrace cloud-native architectures, and create agile, user-friendly applications that meet the demands of the digital era.

The pace of technological innovation is accelerating at an unprecedented rate. Emerging technologies such as artificial intelligence (AI), machine learning, the Internet of Things (IoT), and blockchain are continuously reshaping business operations and customer expectations. To harness the benefits of these innovations, organizations need to revamp their legacy applications into modern, tech-savvy solutions. Wireless Power Receiver technology facilitates the seamless integration of these cutting-edge technologies into existing systems, enabling businesses to stay at the forefront of innovation.

In today's fiercely competitive market, customer experience is a vital differentiator. Modern consumers expect seamless, personalized, and efficient interactions with businesses. Wireless Power Receiver solutions enable organizations to revitalize their customer-facing applications, ensuring they are responsive, intuitive, and capable of delivering real-time insights. This enhancement in customer experience leads to improved customer engagement, fosters brand loyalty, and drives revenue growth.

Legacy applications often come with high maintenance costs, security vulnerabilities, and scalability limitations. Wireless Power Receiver initiatives are aimed at addressing these challenges by optimizing IT spending, reducing operational overhead, and enhancing resource utilization. By transitioning to cloud-based infrastructures, organizations can achieve cost-efficiency, scalability, and improved performance, all of which contribute to a healthier bottom line.

With the rising frequency and sophistication of cyber threats, security and regulatory compliance have become paramount concerns. Wireless Power Receiver solutions incorporate security enhancements that safeguard data, applications, and infrastructure. By modernizing applications and adhering to security best practices, organizations can mitigate risks, protect sensitive information, and maintain compliance with industry-specific regulations.

The global shift towards remote work has necessitated the adaptation of applications to support remote collaboration, secure access, and seamless communication. Modernized applications enable employees to work effectively from anywhere, fostering productivity and business continuity, even in challenging circumstances.

Wireless Power Receiver technology isn't just about keeping pace with the competition; it's also about gaining a competitive edge. Organizations that successfully transform their applications can respond quickly to market changes, launch new services faster, and innovate more effectively. This agility allows them to outperform rivals and capture a larger share of the market.

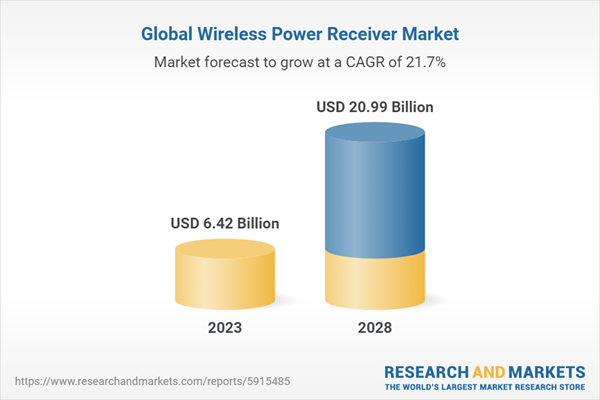

In conclusion, the Global Wireless Power Receiver Market is experiencing remarkable growth due to the imperatives of digital transformation, rapid technological advancements, the need for enhanced customer experiences, cost optimization, security and compliance concerns, remote work trends, and the pursuit of a competitive advantage. As organizations continue to adapt to the evolving technology landscape, Wireless Power Receiver technology will remain a central driver in shaping the future of IT strategies and enabling innovation and resilience across industries.

Key Market Drivers:

Advancements in Wireless Charging Technologies:

The Global Wireless Power Receiver Market is being propelled forward by remarkable advancements in wireless charging technologies. Wireless power transfer, often referred to as wireless charging, has evolved significantly in recent years, making it a compelling driver of market growth. One of the key advancements is the widespread adoption of resonant wireless charging technologies. Resonant wireless charging allows for greater spatial freedom, enabling users to charge their devices without needing to place them precisely on charging pads. This convenience is a significant driver for the adoption of wireless power receivers in various applications.

Furthermore, the power and efficiency of wireless charging have improved. Modern wireless power receivers can efficiently transfer power over longer distances and through various materials, making them versatile for a wide range of applications. This has been especially important in industries such as automotive, where electric vehicle (EV) manufacturers are increasingly integrating wireless charging capabilities into their designs.

The growth in wireless charging standards, such as Qi, PMA, and A4WP, has also played a critical role. Standardization ensures compatibility between various devices and charging infrastructure, fostering broader adoption. This, in turn, encourages more manufacturers to incorporate wireless power receivers into their products, driving market growth.

Proliferation of Wireless Charging-Enabled Devices:

The widespread adoption of wireless charging-enabled devices is a substantial driver in the Global Wireless Power Receiver Market. Consumers' increasing reliance on smartphones, wearables, and other electronic devices has prompted manufacturers to integrate wireless charging capabilities into their products.

Smartphones, in particular, have played a significant role in driving the demand for wireless power receivers. As the primary communication and entertainment devices for billions of people globally, smartphones are commonly used throughout the day, making charging a frequent activity. Wireless charging simplifies this process by eliminating the need for plugging and unplugging cables. As a result, many smartphone manufacturers now offer wireless charging as a standard feature, further popularizing the technology.

Moreover, wireless charging has expanded into other device categories. Wearable devices, such as smartwatches and fitness trackers, are increasingly incorporating wireless power receivers. These devices are worn continuously, making the convenience of wireless charging highly appealing to users.

Automotive manufacturers have also embraced wireless charging for electric vehicles (EVs). Wireless charging pads installed in parking spaces and garages allow EV owners to charge their vehicles without plugging in. This has simplified the EV charging process, encouraging more consumers to adopt electric vehicles and contributing to the growth of the Global Wireless Power Receiver Market.

Growing Ecosystem of Charging Infrastructure:

The growing ecosystem of wireless charging infrastructure is another significant driver for the Global Wireless Power Receiver Market. As wireless charging gains traction, an increasing number of public spaces, businesses, and homes are installing wireless charging stations.

In public spaces such as airports, cafes, and shopping centers, wireless charging pads have become a common sight. These locations provide convenient charging solutions for users on the go. Businesses see the value in offering wireless charging to attract customers, enhance their experience, and increase foot traffic.

Furthermore, businesses are integrating wireless charging into their products. For example, furniture manufacturers are embedding wireless charging pads into tables and desks. This innovation is becoming particularly popular in office settings, where employees can charge their devices while working without the hassle of cords and cables.

Homes are also part of the growing wireless charging ecosystem. Consumers are adopting wireless charging pads and stands to simplify their daily charging routines. As more homes become equipped with wireless charging infrastructure, the demand for wireless power receivers in consumer electronics continues to grow.

The automotive industry is not left behind, with wireless charging infrastructure expanding to include EV charging pads in homes and public parking areas. This infrastructure growth encourages vehicle manufacturers to incorporate wireless charging capabilities into their EV models.

In summary, the Global Wireless Power Receiver Market is driven by advancements in wireless charging technologies, the proliferation of wireless charging-enabled devices, and the growing ecosystem of charging infrastructure. These factors collectively contribute to the increasing adoption of wireless power receivers across various applications and industries.

Key Market Challenges

Compatibility and Standardization Challenges:One of the significant challenges in the Global Wireless Power Receiver Market is the issue of compatibility and standardization. The market has witnessed a proliferation of various wireless charging standards and technologies, which can create confusion for consumers, manufacturers, and infrastructure providers.

The lack of a universal wireless charging standard has led to a fragmented landscape where different devices and charging pads may not be compatible with each other. This incompatibility can frustrate users and hinder the widespread adoption of wireless charging technology.

The most prominent wireless charging standards include Qi, PMA, A4WP, and proprietary technologies from various manufacturers. Each standard has its unique specifications, frequencies, and power levels. Devices designed to work with one standard may not function with another, limiting interoperability and user convenience.

Manufacturers and infrastructure providers often need to choose which standard to support, leading to a potential divide in the market. This lack of standardization can result in consumers needing multiple charging pads or devices, making it less attractive for users to adopt wireless charging as their primary charging method.

Efforts to address this challenge include attempts to create a universal standard for wireless charging. However, achieving consensus among industry stakeholders is a complex process. Until a single standard prevails, the Global Wireless Power Receiver Market may continue to face compatibility challenges that impede broader adoption.

Limited Range and Efficiency:

Another challenge in the Global Wireless Power Receiver Market is the limited range and efficiency of current wireless charging technologies. Most wireless charging solutions, such as inductive or resonant charging, require close proximity or physical contact between the charging pad and the device to be charged.

While this proximity charging works well for smaller devices like smartphones and wearables, it presents challenges for charging larger devices or electric vehicles (EVs). For EVs, for instance, wireless charging pads must be precisely aligned with the vehicle's charging coil, making it less convenient than plugging in a charging cable. This limitation can deter users from adopting wireless charging for larger devices, and it may not align with the convenience users expect from wireless technology.

The efficiency of wireless charging can also be a concern. In some cases, wireless charging may result in energy losses due to the conversion of power and heat generation. While these losses are relatively low for small devices, they can become more significant for larger applications, contributing to inefficiencies in power transfer.

To address these challenges, research and development efforts are ongoing to improve the range and efficiency of wireless charging technologies. Innovations like resonant wireless charging and extended-range charging technologies are being explored to enable charging over greater distances and for larger devices. However, overcoming these limitations remains an ongoing challenge for the market.

Infrastructure Deployment and Cost Considerations:

Deploying wireless charging infrastructure poses another challenge in the Global Wireless Power Receiver Market. While wireless charging pads are becoming more prevalent in public spaces, homes, and businesses, the installation of infrastructure on a larger scale, such as wireless charging highways or widespread public charging networks, is a complex and costly endeavor.

For electric vehicles, the deployment of wireless charging infrastructure on roadways requires substantial investment and planning. Creating a comprehensive network of wireless charging stations necessitates coordination among governments, businesses, and infrastructure providers. Moreover, infrastructure deployment must consider factors like charging standards, power levels, and compatibility, adding complexity to the planning process.

Additionally, the cost of infrastructure deployment can be a significant barrier. Building and maintaining wireless charging infrastructure, including the necessary technology and hardware, can be expensive. Infrastructure providers may face challenges in recovering these costs and achieving profitability, especially in regions with limited adoption of wireless charging technology.

To overcome these challenges, governments, industry associations, and stakeholders are working together to develop infrastructure deployment strategies and financial models. The aim is to accelerate the rollout of wireless charging infrastructure for electric vehicles and other applications. Despite these efforts, infrastructure deployment remains a complex challenge in the Global Wireless Power Receiver Market.

Key Market Trends

Growing Adoption of QLC (Quad-Level Cell) Wireless Power Receiver

A prominent trend in the Global Wireless Power Receiver Market is the increasing adoption of QLC (Quad-Level Cell) Wireless Power Receiver technology. QLC represents a significant advancement in memory storage, offering even higher storage density than its predecessors. While traditional Wireless Power Receiver utilizes SLC (Single-Level Cell), MLC (Multi-Level Cell), or TLC (Triple-Level Cell) configurations, QLC takes it a step further by storing four bits of data in each memory cell. This greater density means that QLC Wireless Power Receiver can provide cost-effective high-capacity storage solutions, making it particularly attractive for applications in the consumer, enterprise, and data center sectors.One of the key drivers of QLC adoption is the ever-increasing demand for large-scale data storage, driven by the proliferation of data-intensive applications, such as high-resolution video content, AI, and big data analytics. QLC Wireless Power Receiver provides a cost-effective way to address this demand, allowing organizations to store massive volumes of data efficiently. Moreover, QLC's affordability is making it accessible to a broader range of businesses, helping to democratize high-capacity storage solutions.

However, the adoption of QLC Wireless Power Receiver is not without challenges. QLC tends to have lower endurance compared to SLC, MLC, and TLC variants, which means that it may wear out faster, especially in high-write environments. To mitigate this, manufacturers are implementing advanced error correction and wear-leveling algorithms. As the technology continues to mature, QLC Wireless Power Receiver is expected to play an increasingly pivotal role in addressing the growing need for cost-effective, high-capacity storage across various industries.

The integration of artificial intelligence (AI) in various aspects of business and technology has become a transformative trend in the Global Wireless Power Receiver Market. As AI applications continue to evolve and diversify, there's a growing need for memory solutions that can support the data-intensive requirements of AI workloads efficiently.

AI-optimized Wireless Power Receiver solutions are designed to provide the high-speed data access and storage capacity necessary for AI training and inference tasks. These solutions incorporate features like faster data transfer speeds, optimized memory controllers, and enhanced data processing capabilities. The goal is to reduce latency, improve data throughput, and ensure that AI algorithms can access the necessary data in real time, enhancing the performance of AI applications. One of the areas where AI-optimized Wireless Power Receiver is making a substantial impact is in edge computing and IoT (Internet of Things) applications. These environments require memory solutions that can handle the demands of local data processing and analysis, particularly in real-time or near-real-time scenarios. By providing memory solutions that cater to these requirements, AI-optimized Wireless Power Receiver is enabling the deployment of advanced AI capabilities at the edge, fostering innovation in fields like autonomous vehicles, smart cities, and industrial automation.

However, the challenge with AI-optimized Wireless Power Receiver lies in balancing high performance with cost-efficiency. AI applications often demand substantial memory resources, and organizations need to find the right balance to ensure that their infrastructure remains economically viable. Manufacturers are addressing this challenge by developing memory solutions that offer a combination of speed, capacity, and affordability, meeting the unique needs of AI workloads.

Increased Focus on Sustainable Wireless Power Receiver Solutions

Sustainability has emerged as a significant trend in the Global Wireless Power Receiver Market. With growing concerns about the environmental impact of technology, including energy consumption and e-waste, organizations are actively seeking more eco-friendly memory solutions.One of the key drivers of this trend is the focus on reducing energy consumption in data centers and computing systems. High-performance Wireless Power Receiver solutions, while offering remarkable data access speeds, can also be power-hungry. To address this, manufacturers are developing more energy-efficient variants that aim to minimize the carbon footprint of data storage.

Sustainable Wireless Power Receiver solutions also take into account the entire product lifecycle. This includes not only reducing power consumption during operation but also considering factors such as materials sourcing, manufacturing processes, and end-of-life disposal. Manufacturers are increasingly using environmentally friendly materials and implementing recycling programs to ensure that memory modules are disposed of responsibly, reducing e-waste.

Furthermore, organizations are looking for Wireless Power Receiver solutions that can be integrated into energy-efficient data center designs, leveraging technologies like renewable energy sources and advanced cooling methods. As governments and regulatory bodies implement stricter environmental standards, the demand for sustainable memory solutions is expected to rise.

In conclusion, the Global Wireless Power Receiver Market is witnessing several important trends. These include the growing adoption of QLC Wireless Power Receiver for high-capacity storage, the emergence of AI-optimized memory solutions for enhanced AI performance, and the increasing focus on sustainable memory solutions to reduce environmental impact. These trends are reshaping the memory industry and offering new opportunities and challenges for businesses and technology professionals.

Segmental Insights

Technology Insights

Near-field technology (NFT) is the dominating segment in the global wireless power receiver market by technology. The dominance of the NFT segment is due to a number of factors, including:Higher efficiency: NFT-based wireless power receivers are more efficient than far-field technology (FFT)-based wireless power receivers. This means that less power is lost during transmission, which can lead to longer battery life for devices equipped with NFT-based wireless power receivers.

Shorter range: NFT-based wireless power receivers have a shorter range than FFT-based wireless power receivers. This makes them ideal for applications where close contact between the power transmitter and receiver is required.

Lower cost: NFT-based wireless power receivers are less expensive than FFT-based wireless power receivers. This makes them more affordable for a wider range of applications. Other technology segments in the global wireless power receiver market include FFT and resonant wireless power transfer (RWPT). However, the NFT segment is expected to remain the dominating segment in the market in the coming years.

Regional Insights

Asia Pacific is the dominating region in the global wireless power receiver market. The dominance of the Asia Pacific region is due to a number of factors, including:The presence of major wireless power receiver manufacturers in the region: Asia Pacific is home to some of the world's largest wireless power receiver manufacturers, such as Samsung Electronics, SK Hynix, and Toshiba. These companies have a strong presence in the region and are well-positioned to meet the growing demand for wireless power receivers.

The growing demand for wireless power receivers in consumer electronics, automotive, and industrial applications in the region: Asia Pacific is a major market for consumer electronics, automotive, and industrial products. All of these products rely heavily on wireless power receivers for their operation. The growing demand for these products is driving the growth of the wireless power receiver market in the region.

The government support for the development of the wireless power receiver industry in several countries in the region: Governments in several Asia Pacific countries, such as China and Japan, are providing support for the development of the wireless power receiver industry. This support is in the form of financial incentives, tax breaks, and research and development funding. This support is helping to accelerate the growth of the wireless power receiver market in the region.

Report Scope:

In this report, the Global Wireless Power Receiver Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Wireless Power Receiver Market, By Technology:

- Near-Field Technology

- Far-Field Technology

Wireless Power Receiver Market, By Type:

- Devices with Battery

- Devices without Battery

Wireless Power Receiver Market, By Application:

- Receiver

- Transmitter

Wireless Power Receiver Market, By Region:

- North America

- United States

- Canada

- Mexico

- Europe

- France

- United Kingdom

- Italy

- Germany

- Spain

- Belgium

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- Indonesia

- Vietnam

- South America

- Brazil

- Argentina

- Colombia

- Chile

- Peru

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Turkey

- Israel

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Wireless Power Receiver Market.Available Customizations:

Global Wireless Power Receiver market report with the given market data, the publisher offers customizations according to a company's specific needs.This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Qualcomm Inc.

- Texas Instruments Incorporated

- ON Semiconductor Corporation

- NXP Semiconductors N.V.

- Würth Elektronik Group

- Vishay Intertechnology, Inc.

- Renesas Electronics Corporation

- Integrated Device Technology, Inc. (IDT)

- ROHM Co., Ltd.

- Analog Devices, Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 183 |

| Published | November 2023 |

| Forecast Period | 2023 - 2028 |

| Estimated Market Value ( USD | $ 6.42 Billion |

| Forecasted Market Value ( USD | $ 20.99 Billion |

| Compound Annual Growth Rate | 21.6% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |