Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

The Steam Generator market refers to a sector within the broader energy and industrial equipment industry that focuses on the design, manufacturing, and distribution of equipment specifically engineered to generate steam. Steam generators are critical devices utilized in various applications across industries such as power generation, manufacturing, and industrial processes. Their primary function is to produce high-pressure steam, typically by heating water, which can then be used for a wide range of purposes.

In power generation, steam generators play a central role in thermal power plants, where they convert heat energy into mechanical energy, which drives turbines to generate electricity. They are also essential in nuclear power plants, where they transfer heat from nuclear reactors to produce steam for power generation.

Furthermore, industries such as oil and gas, chemical manufacturing, pharmaceuticals, and food processing rely on steam generators for various processes, including heating, sterilization, and material processing. Steam generators are also integral in renewable energy systems like concentrated solar power (CSP) plants, where they produce steam from solar heat, as well as in geothermal and biomass power generation.

The Steam Generator market encompasses a wide array of technologies, ranging from traditional boilers to advanced systems employing supercritical and ultra-supercritical steam generation. As the global demand for electricity, industrial processes, and cleaner energy sources continues to rise, the Steam Generator market plays a crucial role in providing efficient and reliable steam generation solutions to meet these diverse needs. Manufacturers and stakeholders in this market continually strive to innovate and improve the efficiency and environmental sustainability of steam generation technologies to address evolving industrial and environmental challenges.

Key Market Drivers

Increasing Demand for Electricity Generation

Steam generators play a crucial role in electricity generation, especially in thermal power plants. One of the primary drivers of the global steam generator market is the ever-increasing demand for electricity. As the global population continues to grow, industrialization expands, and digitalization becomes more prevalent, the need for reliable and efficient electricity generation also rises.Traditional thermal power plants, which rely on steam generators to convert heat energy into electricity, remain a significant source of power in many countries. Additionally, combined-cycle power plants, which use both gas and steam turbines, require advanced steam generators to enhance overall efficiency. As governments and utilities strive to meet the growing electricity demand while minimizing environmental impacts, there is a continuous push for more efficient and advanced steam generators, driving innovation and market growth.

Innovations in steam generator technology, such as supercritical and ultra-supercritical steam generators, have enabled power plants to operate at higher temperatures and pressures, leading to improved efficiency and reduced emissions. This technology evolution further fuels the demand for steam generators, making them a critical component in the global energy landscape.

Expansion of Industrial Processes

Steam generators are not limited to electricity generation; they also play a vital role in various industrial processes. Industries such as chemicals, petrochemicals, food processing, and pharmaceuticals heavily rely on steam for heating, sterilization, and process control. As these industries continue to expand globally, the demand for steam generators to support these processes grows in tandem.Efficient steam generation is essential for maintaining product quality and safety in many industrial applications. Therefore, industries are investing in modern, high-performance steam generators to ensure reliability and energy efficiency. Additionally, the adoption of cleaner fuels and technologies in industrial processes, such as cogeneration and waste heat recovery, drives the need for advanced steam generator solutions.

Furthermore, emerging economies are experiencing rapid industrialization, resulting in increased demand for steam generators to support new manufacturing facilities. This industrial growth, particularly in sectors like steel production, textiles, and paper manufacturing, contributes significantly to the steam generator market's expansion.

Renewable Energy Integration

While the world is moving towards renewable energy sources like wind and solar power, steam generators continue to have a role to play in these systems. Steam generators are used in concentrated solar power (CSP) plants and some biomass and geothermal power plants to produce steam for electricity generation. As the share of renewable energy in the global energy mix grows, the demand for steam generators in these applications is expected to increase.CSP plants use mirrors or lenses to concentrate sunlight onto a receiver, where a heat transfer fluid is heated to produce steam. This steam is then used to drive a turbine and generate electricity. The development of advanced solar technologies and the integration of energy storage systems have made CSP more efficient and reliable, boosting the steam generator market.

In biomass and geothermal power generation, steam generators play a key role in converting heat from renewable sources into electricity. As governments and organizations worldwide invest in clean energy solutions, the demand for steam generators in these applications is poised to grow, further driving the market's expansion.

Replacement and Upgradation of Aging Infrastructure

Many existing steam generators in power plants and industrial facilities have reached the end of their operational life or become obsolete in terms of efficiency and emissions standards. Consequently, there is a growing need for the replacement and upgradation of aging steam generator infrastructure.Older steam generators often operate at lower efficiency levels, resulting in higher fuel consumption and increased emissions. This inefficiency can be costly and environmentally damaging. Therefore, power plants and industrial facilities are increasingly investing in modern steam generator technology to improve their operational efficiency and reduce environmental impact.

Furthermore, stricter environmental regulations and emissions standards are driving the retirement of older, less efficient steam generators. To comply with these regulations and maintain operational viability, many facilities are opting for advanced steam generators that produce lower emissions and reduce their carbon footprint.

Expansion of the Nuclear Power Sector

The nuclear power sector continues to expand, with several countries investing in new nuclear power plants and upgrading existing ones. Steam generators are a critical component in nuclear power plants, as they transfer heat from the reactor core to produce steam for electricity generation. The growth of the nuclear power sector is a significant driver of the steam generator market.Nuclear power is considered a reliable and low-carbon energy source, making it an attractive option for countries looking to reduce their reliance on fossil fuels and lower greenhouse gas emissions. As a result, there is a growing demand for advanced steam generators that meet stringent safety and performance standards in the nuclear industry.

Modern nuclear steam generators incorporate advanced materials and design features to enhance safety and efficiency. This ongoing development and expansion in the nuclear power sector contribute to the sustained growth of the global steam generator market.

Technological Advancements and Innovation

Advancements in steam generator technology continue to drive market growth. Manufacturers are constantly developing innovative solutions to enhance performance, increase efficiency, and reduce environmental impact. These technological advancements cater to a wide range of applications, from small-scale industrial steam generators to large power plant installations.One notable technological advancement is the development of combined-cycle power plants that integrate gas turbines with steam generators. This configuration improves overall efficiency by utilizing waste heat from the gas turbine to produce steam. Additionally, research into materials science has led to the creation of more durable and corrosion-resistant materials for steam generator components, extending their operational lifespan.

Moreover, digitalization and the adoption of Industry 4.0 practices are transforming the way steam generators are monitored and maintained. Predictive maintenance algorithms and remote monitoring systems enable operators to optimize performance and reduce downtime, enhancing the overall value proposition of steam generators.

In conclusion, the global steam generator market is driven by a combination of factors, including the increasing demand for electricity, expansion of industrial processes, renewable energy integration, replacement of aging infrastructure, growth in the nuclear power sector, and ongoing technological advancements. These drivers collectively contribute to the market's growth and shape the future of steam generator technology.

Government Policies are Likely to Propel the Market

Energy Transition and Renewable Energy Incentives

As the world grapples with climate change and the need to reduce greenhouse gas emissions, many governments have implemented policies to promote the transition to cleaner and renewable energy sources. These policies often include incentives and subsidies for renewable energy projects such as wind, solar, and geothermal power. While these sources are considered more sustainable, they often require steam generators for efficient electricity production.One key policy instrument is feed-in tariffs, which guarantee a fixed price for electricity generated from renewable sources, making them financially attractive for investors. Additionally, governments may offer tax credits, grants, or low-interest loans to facilitate the installation of renewable energy systems that rely on steam generators for electricity generation.

For instance, the United States provides the Investment Tax Credit (ITC) and the Production Tax Credit (PTC) to incentivize renewable energy projects, including those using steam generators. These policies not only drive the adoption of cleaner energy but also stimulate the steam generator market, as these systems are essential components of renewable energy infrastructure.

Carbon Pricing and Emissions Reduction Targets

To combat climate change and reduce carbon emissions, many governments have introduced carbon pricing mechanisms, such as carbon taxes or cap-and-trade systems. These policies impose a cost on carbon emissions, incentivizing businesses and industries to reduce their emissions footprint. Steam generators, which are often used in power generation and industrial processes, play a crucial role in meeting emissions reduction targets.Carbon pricing encourages the adoption of more efficient and cleaner technologies in steam generation, such as combined-cycle power plants and advanced steam generator designs. These technologies help reduce carbon emissions per unit of electricity generated, aligning with the government's environmental goals.

Furthermore, some governments allocate revenue generated from carbon pricing to fund research and development efforts aimed at improving steam generator efficiency and reducing emissions. This creates a positive feedback loop, where policy-driven investments in technology ultimately benefit the steam generator market.

Nuclear Energy Regulations and Safety Standards

Nuclear energy remains a significant part of the global energy mix in many countries. However, due to the potential risks associated with nuclear power generation, governments have stringent regulations and safety standards in place. These policies are critical for ensuring the safe operation of nuclear power plants, including the steam generators used in these facilities.Regulations governing nuclear steam generators cover aspects such as materials used, design criteria, and inspection procedures. Governments establish and enforce these policies to protect public health and the environment from nuclear accidents and to maintain the integrity of steam generator components.

For example, the Nuclear Regulatory Commission (NRC) in the United States sets rigorous standards for nuclear power plant operations, including steam generator safety. Adherence to these regulations is essential for obtaining and maintaining operating licenses for nuclear facilities, which, in turn, influences the demand for nuclear steam generators.

Energy Efficiency Standards and Labeling

Many governments worldwide have recognized the importance of improving energy efficiency in various sectors, including industrial processes that rely on steam generators. To promote energy conservation, governments often establish energy efficiency standards and labeling programs.These policies mandate that steam generators and related equipment meet specific efficiency criteria, encouraging manufacturers to design and produce more energy-efficient systems. Steam generators that meet or exceed these standards may receive energy efficiency certifications or labels, making them more attractive to consumers and businesses.

In Europe, for instance, the European Union's Energy Labeling Directive sets efficiency requirements and mandates energy labels for products, including steam generators. This policy not only helps consumers make informed choices but also drives manufacturers to innovate and improve the efficiency of their steam generator offerings.

Research and Development Funding

Government policies often include provisions for funding research and development (R&D) efforts related to steam generators and associated technologies. These R&D investments support innovation, drive technological advancements, and enhance the competitiveness of the steam generator market.Governments may allocate funds to research institutions, universities, and private companies to develop more efficient and environmentally friendly steam generator designs. These initiatives aim to improve the overall performance, safety, and environmental impact of steam generators across various applications.

For instance, the Advanced Research Projects Agency-Energy (ARPA-E) in the United States provides funding for innovative energy technologies, including those related to steam generation. Such policies promote collaboration between government agencies, academia, and industry players to accelerate the development and commercialization of cutting-edge steam generator solutions.

Export and Import Regulations

Government policies related to international trade can significantly impact the steam generator market, especially for countries that export or import these products. Export controls and import tariffs can influence the availability and pricing of steam generators on a global scale.Countries may impose export restrictions on advanced steam generator technologies to protect national security interests. Conversely, governments may incentivize exports of steam generators to stimulate domestic manufacturing and economic growth.

For instance, export controls on certain steam generator components may impact the global supply chain, affecting manufacturers and users alike. Tariffs and trade agreements can also impact the cost competitiveness of steam generators, influencing market dynamics.

In conclusion, government policies play a pivotal role in shaping the global steam generator market by incentivizing renewable energy adoption, promoting emissions reductions, ensuring nuclear safety, enhancing energy efficiency, funding R&D efforts, and regulating international trade. These policies not only drive market demand but also influence technological innovation and sustainability in the steam generator industry.

Key Market Challenges

Environmental Regulations and Emissions Reduction

One of the foremost challenges confronting the global Steam Generator market is the ever-increasing stringency of environmental regulations and the pressing need for emissions reduction. Governments and international organizations worldwide are intensifying their efforts to combat climate change and mitigate the adverse impacts of air pollution. In this context, steam generators, which are integral components in various industrial processes and power generation facilities, face heightened scrutiny and stringent emissions standards.Regulatory Complexity and Compliance Costs:

One key challenge is the complexity of environmental regulations. Different regions and countries often have distinct emissions limits, reporting requirements, and compliance procedures, making it challenging for global manufacturers to navigate the regulatory landscape. Compliance with these regulations can entail significant costs, including investments in emissions control technologies, monitoring systems, and compliance reporting infrastructure.

Moreover, as emissions standards become stricter over time, steam generator manufacturers must continuously innovate and invest in research and development to meet evolving regulatory requirements. This demands substantial financial resources and technical expertise.

Emissions Reduction Targets and Carbon Pricing:

Governments worldwide are setting ambitious emissions reduction targets, and many have implemented carbon pricing mechanisms to incentivize emissions reductions. These policies directly impact the Steam Generator market by influencing the choice of energy sources, adoption of cleaner technologies, and demand for more efficient steam generators.

Carbon pricing, through mechanisms like carbon taxes or cap-and-trade systems, imposes a cost on carbon emissions. This can drive up operational expenses for industries that rely on steam generators, particularly those using fossil fuels. Companies must either absorb these higher costs, pass them on to consumers, or invest in emissions reduction measures.

In regions where carbon pricing is in place, such as the European Union, steam generator users are motivated to transition to cleaner energy sources or adopt technologies that improve energy efficiency. This transition can reduce the demand for traditional steam generators that run on fossil fuels, posing a challenge to manufacturers.

Innovation and Sustainability Pressures:

To remain competitive and meet emissions reduction targets, steam generator manufacturers must innovate and develop more sustainable solutions. This includes designing advanced combustion systems, improving heat recovery technologies, and enhancing materials to withstand higher temperatures and pressures.

While these innovations are necessary to address environmental challenges, they often require significant investment in research, testing, and certification. Additionally, manufacturers may face difficulties in convincing customers to adopt new technologies, as they may be hesitant to embrace unfamiliar systems with potential operational risks.

Global Market Variability:

The global nature of the Steam Generator market adds complexity to the challenge of complying with varying environmental regulations. Steam generator manufacturers often supply products to a global customer base, which means that they must adapt their offerings to meet the specific emissions requirements of each market they serve.

This variability can result in increased design complexity, production costs, and administrative burdens. Manufacturers must also monitor regulatory changes in different regions to ensure ongoing compliance, which can be resource-intensive.

Technological Advancements and Market Competitiveness

Another significant challenge in the global Steam Generator market is the rapid pace of technological advancements and the need to remain competitive in an evolving landscape. This challenge encompasses several key aspects:Continuous Innovation Pressure:

As technology evolves, steam generator manufacturers face constant pressure to innovate and develop more efficient, reliable, and sustainable solutions. This includes advancements in combustion technology, materials science, control systems, and integrated energy solutions. Meeting these demands requires ongoing investments in research and development, which can strain resources.

Market Competitiveness:

The Steam Generator market is highly competitive, with numerous manufacturers vying for market share. To remain competitive, manufacturers must balance the pursuit of innovation with cost-effectiveness. Innovations that drive up production costs may lead to pricing challenges in a competitive market.

Complexity of Integration:

Many steam generators are part of complex systems, such as power plants or industrial processes. Integrating new and advanced steam generators into existing systems can be technically challenging and costly. Compatibility issues, system retrofits, and downtime during installation can pose obstacles.

Rapid Technology Obsolescence:

The speed of technological advancements can result in the rapid obsolescence of existing steam generator designs. Manufacturers must carefully manage their product lifecycles to ensure that investments in research and development yield returns before technology advancements make their products outdated.

Adoption Hurdles:

While advanced steam generator technologies offer benefits in terms of efficiency and sustainability, their adoption can be slow due to factors such as perceived risk, high upfront costs, and the need for specialized training. Manufacturers must invest in customer education and support to overcome these adoption hurdles.

Global Competition

The global nature of the Steam Generator market means that manufacturers must not only compete with domestic rivals but also with international competitors. Some countries may offer lower production costs or different regulatory environments, affecting the competitiveness of manufacturers in various regions.In conclusion, the global Steam Generator market faces multifaceted challenges related to environmental regulations, emissions reduction, technological advancements, market competitiveness, and global variability. Navigating these challenges requires a delicate balance of innovation, compliance, cost management, and adaptability for manufacturers in this dynamic industry.

Segmental Insights

Martensitic Insights

The Martensitic segment held the largest Market share in 2022. Martensitic stainless steels, while known for their strength and toughness, may not provide the same level of corrosion resistance as Austenitic stainless steels. Corrosion resistance is a critical factor in steam generators, especially those in contact with high-temperature steam and water. Steam generators often operate at high temperatures and pressures. The material used needs to withstand these extreme conditions without deformation or failure. Austenitic stainless steels are known for their stability at high temperatures. Steam generators are typically long-term investments, and the choice of material should ensure the longevity of the equipment with minimal maintenance requirements. Austenitic stainless steels are often chosen for their durability and low maintenance needs. In some industries, there are specific regulations and standards that dictate the materials to be used in steam generators. These standards often prioritize safety and corrosion resistance. The cost of materials can also influence the choice of material. Martensitic stainless steels may be less expensive than Austenitic stainless steels, but they may not provide the same level of performance in terms of corrosion resistance.Utilities Insights

The Utilities segment held the largest Market share in 2022. The Utilities sector is primarily responsible for generating electricity to meet the demands of residential, commercial, and industrial consumers. Steam generators are integral components in power generation facilities, whether they are conventional thermal power plants or advanced combined-cycle power plants. These facilities, operated by utilities, rely on steam generators to convert heat energy into electrical power efficiently and reliably. Utilities typically operate large-scale power plants that require significant steam generation capacity. Given the substantial electricity demand, utilities often invest in sizable power generation facilities, where steam generators play a pivotal role. These facilities produce electricity in megawatts (MW) or gigawatts (GW), and steam generators must provide the necessary steam at high levels of efficiency and reliability. Utilities utilize a diverse range of energy sources, including coal, natural gas, nuclear, and renewable sources such as biomass or geothermal energy. Steam generators are adaptable to various fuel types and are employed in power plants using these different energy sources. This flexibility allows utilities to meet energy needs while considering factors like cost, emissions, and availability. Utilities operate under stringent regulatory standards and emissions limits, requiring them to employ efficient and environmentally compliant steam generator technology. Compliance with environmental regulations is essential, and utilities invest in advanced steam generators to meet these standards while ensuring reliable power generation. As the energy sector evolves, utilities continue to invest in advanced technologies to improve power plant efficiency, reduce emissions, and enhance operational reliability. This includes the adoption of state-of-the-art steam generators and combined-cycle power plants, driving innovation in the Steam Generator market. The ever-growing global demand for electricity, driven by population growth, urbanization, and increased energy-intensive industries, underscores the significance of utilities in the Steam Generator market. As the demand for electricity continues to rise, utilities remain at the forefront of ensuring a stable power supply, necessitating investments in steam generation capacity. Utilities also prioritize the maintenance and upgrading of existing power plants and steam generators to extend their operational life, improve efficiency, and meet changing energy needs. This ongoing commitment to modernization sustains the demand for steam generator technologies.Regional Insights

Asia Pacific

The Asia Pacific region is expected to continue to dominate the global steam generator market in the coming years. This is due to the rapid growth of the power and industrial sectors in the region. China, India, and Japan are the major markets for steam generators in the Asia Pacific region.The Asia Pacific region is the largest market for steam generators, accounting for over 35% of the global market share. The region is home to some of the fastest-growing economies in the world, which is driving the demand for electricity and industrial products. This is leading to a growing demand for steam generators in the region.

The major markets for steam generators in the Asia Pacific region are China, India, and Japan. China is the largest market for steam generators in the region, accounting for over 50% of the Asia Pacific market share. The Indian steam generator market is also growing rapidly, driven by the increasing demand for electricity from the growing population and industrial sector. The Japanese steam generator market is relatively mature, but it is still expected to grow at a moderate pace in the coming years.

North America

The North American steam generator market is expected to grow at a moderate pace in the coming years. This is due to the increasing demand for electricity from the growing shale gas industry. The United States is the major market for steam generators in North America.The North American steam generator market is the second-largest market in the world, accounting for over 25% of the global market share. The United States is the major market for steam generators in North America, accounting for over 90% of the North American market share.

The North American steam generator market is driven by the increasing demand for electricity from the growing shale gas industry. The shale gas industry is a major source of natural gas in the United States, and it is expected to continue to grow in the coming years. This is driving the demand for steam generators in the country.

Europe

The European steam generator market is expected to grow at a slower pace than the Asia Pacific and North American markets. This is due to the relatively mature power and industrial sectors in the region. Germany, the United Kingdom, and France are the major markets for steam generators in Europe.The European steam generator market is the third-largest market in the world, accounting for over 20% of the global market share. The major markets for steam generators in Europe are Germany, the United Kingdom, and France.

The European steam generator market is driven by the need to replace aging steam generators in power plants and industrial facilities. The region is also investing in renewable energy sources, such as solar and wind power. However, steam generators are still required to provide a stable source of electricity when the sun is not shining and the wind is not blowing.

Report Scope:

In this report, the Global Steam Generator Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Steam Generator Market, By Rated Power:

- Up to 30 MW

- 31-100 MW

- Above 100 MW

Steam Generator Market, By Material:

- Martensitic

- Ferritic

- Austenitic

Steam Generator Market, By End User:

- Utilities

- Chemical

- Pharmaceutical

- Refineries

- Pulp & Paper

Steam Generator Market, By Region:

- North America

- United States

- Canada

- Mexico

- Europe

- France

- United Kingdom

- Italy

- Germany

- Spain

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Kuwait

- Turkey

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Steam Generator Market.Available Customizations:

Global Steam Generator Market report with the given Market data, the publisher offers customizations according to a company's specific needs.This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Babcock & Wilcox Enterprises, Inc

- Foster Wheeler Energy Corporation

- Alstom SA

- Siemens AG

- General Electric Company

- Doosan Heavy Industries & Construction Co., Ltd.

- Bharat Heavy Electricals Limited

- Harbin Boiler Group Co., Ltd.

- Mitsubishi Heavy Industries, Ltd.

- Hitachi Zosen Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 178 |

| Published | November 2023 |

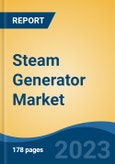

| Forecast Period | 2023 - 2028 |

| Estimated Market Value ( USD | $ 16.08 Billion |

| Forecasted Market Value ( USD | $ 20.76 Billion |

| Compound Annual Growth Rate | 4.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |