Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

On the other hand, the availability of cheap and alternative pumps is a significant factor that restrains the growth of the market in the upcoming period.

With projects, like Namami Gange and Clean Yamuna Project, in December 2017, India announced the construction of 90 sewage treatment plants to treat the river Ganga alone. The projects are expected to be operational in the future, thus creating significant opportunities for the dosing pump market. With anticipated growth in industries in the chemical sector and water treatment plants in countries like India and China, the Asia-Pacific region is expected to dominate the market in the forecast period.

Key Market Drivers

Technological innovations have played a significant role in shaping the dosing system market

Companies are continually developing and enhancing dosing systems to meet the evolving needs of industries. These advancements encompass aspects such as precision, automation, connectivity, and adaptability.Example: Smart dosing systems equipped with IoT (Internet of Things) capabilities allow for remote monitoring and control. In the water treatment industry, these systems can automatically adjust chemical dosing based on real-time water quality data, ensuring optimal treatment and resource efficiency. Regulatory compliance is a driving force in the dosing system market. Industries like pharmaceuticals, healthcare, and food processing must adhere to stringent regulations governing the accuracy and safety of dosing processes. This has led to increased adoption of sophisticated dosing systems to meet compliance standards. In pharmaceutical manufacturing, the FDA (Food and Drug Administration) mandates precise dosing of active pharmaceutical ingredients (APIs). Dosing systems with advanced control mechanisms ensure compliance with these regulations, minimizing the risk of errors and product recalls.

The market demand for dosing systems is escalating due to several factors, including population growth, urbanization, and industrialization. As industries expand and consumer expectations rise, the need for efficient and reliable dosing solutions becomes paramount. In agriculture, the demand for precision farming practices has surged. Dosing systems that accurately apply fertilizers, pesticides, and herbicides based on soil and crop conditions enhance crop yields while minimizing resource usage.

Environmental Concerns

Growing environmental awareness and the need for sustainable practices have driven the adoption of dosing systems. These systems enable precise control over substance usage, reducing waste and environmental impact. Municipalities worldwide are implementing dosing systems in wastewater treatment plants to reduce chemical consumption and minimize the release of harmful pollutants into the environment. This not only improves water quality but also reduces the ecological footprint. Efficiency gains and reduced resource consumption associated with dosing systems translate into significant cost savings for industries. Businesses are increasingly recognizing the economic benefits of investing in dosing technologies. The automotive industry relies on dosing systems for adhesive application during vehicle assembly. Precise dosing ensures optimal bond strength while minimizing adhesive waste, resulting in substantial cost savings. Dosing systems enhance workplace safety by minimizing exposure to hazardous substances. Automated dosing eliminates the need for manual handling of chemicals, reducing the risk of accidents and occupational health issues. In the mining industry, dosing systems are used to accurately inject chemicals into the ore processing circuit. This eliminates the need for workers to handle toxic substances, improving safety and reducing health risks.In conclusion, the dosing system market is driven by a combination of technological advancements, regulatory requirements, market demand, environmental concerns, cost savings, and safety considerations. The examples provided demonstrate how these factors manifest in various industries and highlight the importance of dosing systems in optimizing processes, ensuring compliance, and contributing to a more sustainable future. As industries continue to evolve, the dosing system market is poised for further growth and innovation, playing a crucial role in shaping the way substances are measured and delivered across diverse applications.

Key Market Challenges

Complexity of Substances

One of the foremost challenges in the dosing system market is dealing with a wide range of substances, each with unique properties. Some substances are corrosive, viscous, or prone to crystallization, making dosing a complex task. Adapting dosing systems to handle different substances can be challenging. In the chemical industry, dosing systems must accurately dispense highly corrosive acids for various processes. Designing and maintaining dosing equipment that can withstand the corrosive nature of these substances is a significant challenge.Precision and Accuracy

Precision and accuracy are paramount in dosing systems, especially in industries like pharmaceuticals and healthcare. The challenge lies in consistently achieving the desired dosage, as even slight variations can have significant consequences. In the pharmaceutical industry, a minor error in dosing medication can result in ineffective treatment or, worse, adverse health effects for patients. Ensuring precise and accurate dosing is essential to meet regulatory requirements and safeguard patient well-being.Maintenance and Calibration

Dosing systems require regular maintenance and calibration to ensure they function correctly over time. Neglecting maintenance can lead to downtime, inaccurate dosing, and potentially costly repairs. In the water treatment sector, dosing systems are used to add chemicals for disinfection and pH adjustment. Failure to maintain and calibrate these systems can result in suboptimal water quality, posing health risks to consumers and necessitating costly emergency repairs.Cost of Implementation

The initial cost of implementing dosing systems can be a barrier for some industries, particularly smaller businesses. Investing in high-quality dosing equipment and infrastructure can be expensive, which may deter potential users. Small-scale agricultural operations may struggle to justify the cost of precision dosing equipment for fertilizer application, even though it could enhance crop yields and reduce resource usage in the long run. Compatibility and Integration

Integrating dosing systems into existing industrial processes can be challenging. Ensuring compatibility with existing equipment and systems, as well as seamless integration, requires careful planning and customization. Manufacturers in the food and beverage industry often face challenges when integrating dosing systems into their production lines. These systems must be tailored to fit existing conveyors, fillers, and packaging equipment, which can be a complex process.Regulatory Compliance

Many industries that rely on dosing systems, such as pharmaceuticals and water treatment, are subject to strict regulatory requirements. Meeting these regulations can be complex and expensive, as compliance often involves extensive documentation, validation, and audits. In the healthcare sector, pharmaceutical companies must adhere to Good Manufacturing Practices (GMP) regulations enforced by agencies like the FDA. Compliance with GMP requirements for dosing equipment adds complexity and cost to the manufacturing process.Key Market Trends

Precision Dosing and Nanotechnology

Advancements in precision dosing are gaining prominence. Manufacturers are developing dosing systems capable of handling nanoscale quantities of substances. This trend is particularly relevant in pharmaceuticals, where precise dosing of active ingredients is crucial. In pharmaceutical research and development, dosing systems are used to dispense nanoliter or picoliter volumes of drug compounds for high-throughput screening. This precision allows for the rapid identification of potential drug candidates.Sustainable Dosing Solutions

Sustainability is a growing concern in various industries. Dosing systems are being designed to minimize substance waste, reduce environmental impact, and optimize resource usage. In agriculture, sustainable dosing systems aim to reduce fertilizer and pesticide usage by precisely targeting specific areas of crops. This reduces the ecological footprint while maintaining crop yields.Customization and Modular Systems

Customization and modular dosing solutions are gaining traction. Industries are seeking dosing systems that can be tailored to their specific needs, allowing for flexibility and scalability. In the food and beverage industry, modular dosing systems can be configured to handle various products, from liquids to powders, and accommodate different container sizes. This flexibility is crucial for manufacturers producing a wide range of products.Advanced Control and Automation

Enhanced control and automation capabilities are at the forefront of dosing system trends. Integration with advanced control systems, such as PLCs (Programmable Logic Controllers) and SCADA (Supervisory Control and Data Acquisition), enables precise and adaptive dosing. In chemical manufacturing, dosing systems are integrated with SCADA systems to monitor and adjust chemical dosing based on real-time process parameters. This ensures consistent product quality and minimizes chemical waste.High-Pressure Dosing

High-pressure dosing systems are becoming increasingly important in applications such as waterjet cutting, high-pressure cleaning, and industrial processes requiring extreme precision.In the aerospace industry, high-pressure dosing systems are used to dispense adhesives for bonding critical aircraft components. The high-pressure capability ensures strong and reliable bonds in demanding environments.Segmental Insights

Application Insights

A dosing pump is a positive displacement pump that assists in transporting exact flow rates of different fluids and chemicals into another fluid stream. Dosing systems are used in water and sewage treatment for multiple purposes. Operations like pH maintenance of boiler water, protection against corrosion, and precipitation are performed using dosing pumps. Germany, which has the largest capacity of wastewater in Europe, with more than 3,500 treatment plants by 2021, has an extensive usage of dosage pumps. This, in turn, culminates in the growth of the market. Several companies in the United Kingdom treat a billion liters of wastewater on a daily basis. A dosing pump plays a crucial role in injecting a product such as chlorine into a water or fluid stream to cause a chemical reaction. For instance, Thames Water treated 4.6 billion liters of wastewater every day for the year ended March 2022. It also provides 2.5 billion liters of drinking water every day to more than 15 million customers in London and the Thames Valley region. In June 2022, water treatment solutions provider Daiki Axis Japan announced the setting up of its second plant in India at Haryana with an investment of INR 200 crore. The plant, with a capacity to produce 1,000 sewage treatment units with Japanese "Johkasou" technology, is coming up in Palwal, Haryana, India. Owing to the above-mentioned points, the water and sewage treatment sector is expected to dominate the dosing system market during the forecast period..Regional Insights

Asia Pacific is expected to dominate the market during the forecast period. Asia-Pacific is expected to dominate the market for dosing systems, with growth expected in chemical, water treatment, and petrochemicals in the forecast period. China and India are the leading markets in the oil refining sectors, with a collective capacity of more than 20,000 thousand barrels per day, holding significant application in dosing pumps.Also, wastewater technology is primarily used in municipal wastewater treatment by the municipal authority of various cities across India. As per the World Bank, India, along with China, Indonesia, Nigeria, and the United States, will lead the world's urban population surge by 2050. To fulfill the scarcity of water, the Council on Energy, Environment, and Water (CEEW), in association with the 2030 Water Resources Group, has been planning to improve wastewater management in India, along with increasing private investments to build wastewater treatment plants.

The Delhi government is building India's largest sewage treatment plant (STP) in the Okhla subdivision of Delhi, capable of treating 564 million liters of wastewater per day. It was expected to be completed by the end of 2022. In July 2022, Delhi Jal Board (DJB) developed a technology to treat water in its sewage treatment plants. This technology, called ISASMA-CD (Intelligence Self-Administered Self Monitored Automatic Chemical Dosing), has been introduced at four DJB plants at Yamuna Vihar and Okhla with the objective of reducing BOD (Biological Oxygen Demand) and TSS (Total Suspended Solids) to less than 10 PPM (parts per million).

In Beijing, the government is aiming to invest in wastewater treatment and sewer networks to achieve 100% domestic and industrial wastewater treatment. This is going to increase the demand for dosing systems significantly in the forecast period. With the rapid growth in the sewage and water treatment, refining, and food processing industries, Asia-Pacific is expected to dominate the market for dosing systems in the forecast period.

Report Scope:

In this report, the Global Dosing System Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Global Dosing System Market, By Type:

- Diaphragm Pump

- Piston Pum

- Other Types

Global Dosing System Market, By Application:

- Oil and Gas

- Water and Sewage Treatment

- Chemicals

- Other Applications

Global Dosing System Market, By Region:

- North America

- United States

- Canada

- Mexico

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Indonesia

- Europe

- Germany

- United Kingdom

- France

- Russia

- Spain

- South America

- Brazil

- Argentina

- Middle East & Africa

- Saudi Arabia

- South Africa

- Egypt

- UAE

- Israel

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Dosing System Market.Available Customizations:

Global Dosing System Market report with the given market data, the publisher offers customizations according to a company's specific needs.This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Apple Inc.

- Adobe Inc.

- Avid Technology Inc.

- Yamaha Corporation

- Ableton AG

- Digital Performer

- Acoustica

- Native Instruments

- MAGIX

- PreSonus

Table Information

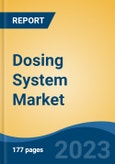

| Report Attribute | Details |

|---|---|

| No. of Pages | 177 |

| Published | November 2023 |

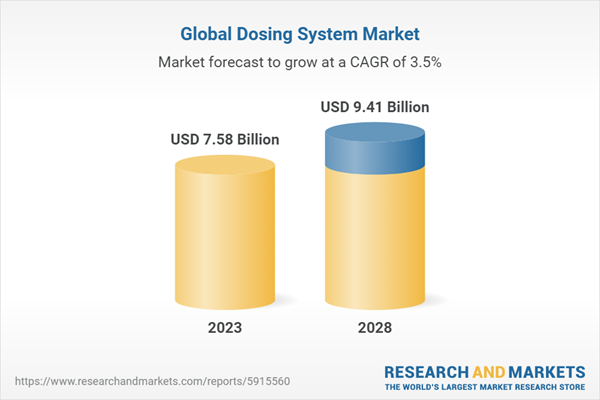

| Forecast Period | 2023 - 2028 |

| Estimated Market Value ( USD | $ 7.58 Billion |

| Forecasted Market Value ( USD | $ 9.41 Billion |

| Compound Annual Growth Rate | 3.5% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |