Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Despite this strong potential, the market encounters significant obstacles due to the high initial capital investment required for these systems, which often discourages small and medium-sized enterprises from adoption. This financial barrier, alongside technical complexities, continues to restrict widespread commercial scalability. Data from the International Federation of Robotics indicates that global sales of professional agricultural robots reached approximately 19,500 units in 2025. This figure suggests that while automation technology is advancing, economic hurdles persist as a constraint on broader market penetration.

Market Drivers

The intensification of agricultural labor shortages and increasing wage expenses act as the primary economic force propelling the Global Agricultural Robots Market. As urbanization draws the workforce away from rural regions, farm operators struggle with a critical deficit of manual labor needed for time-sensitive activities like harvesting and weeding. This structural gap has transformed automation from a convenience into an operational requirement, as producers must sustain output levels despite a shrinking labor pool. Financial pressures are further exacerbated by legally mandated wage increases in key regions; for instance, the USDA National Agricultural Statistics Service reported in its November 2024 'Farm Labor' document that the annual average gross wage for hired farm workers in the United States rose to $19.10 per hour, a 3% increase over the prior year.Concurrently, the rising adoption of precision agriculture is reshaping market demand by prioritizing efficiency and sustainability. Modern agricultural robots are increasingly outfitted with advanced sensors and AI to apply fertilizers and pesticides with sub-millimeter accuracy, significantly reducing chemical waste and environmental impact. This shift enables farmers to maximize margins by lowering variable input costs, a key advantage in a volatile economic environment. This demand for high-tech efficiency is evident in industry performance; Deere & Company’s January 2024 '2023 Business Impact Report' noted that revenue for its Production and Precision Agriculture segment hit $26.8 billion, driven by price realization and shipment volumes. Furthermore, the sector remains attractive to capital, with AgFunder reporting in 2024 that the Farm Robotics, Mechanization, and Equipment category raised $760 million globally during the previous year.

Market Challenges

A major impediment to the expansion of the Global Agricultural Robots Market is the substantial initial capital investment required for autonomous systems. High upfront acquisition costs create a severe financial barrier, particularly for small and medium-sized farming enterprises that operate on narrow profit margins. These operators often lack the liquidity necessary to absorb the financial risks associated with expensive automation technology, regardless of the potential for long-term operational efficiency. Consequently, the return on investment timeline remains unattractively long for many potential adopters, compelling them to defer modernization and persist with traditional labor-intensive methods.This economic pressure directly limits market scalability, as financial caution leads to a widespread postponement of capital-intensive purchases across the sector. The inability of smaller entities to justify or secure funding for these assets concentrates adoption among large-scale agribusinesses, thereby hindering wider market penetration. This trend of reduced investment is reflected in recent industrial metrics; according to the VDMA, global orders for agricultural machinery and equipment dropped by 28% in 2024 compared to the previous year. This contraction highlights how significant cost burdens are actively suppressing demand and stalling the commercial growth of agricultural robotics.

Market Trends

The shift toward autonomous electric tractors and modular platforms is fundamentally transforming farm machinery by replacing conventional diesel-powered equipment with cleaner, programmable alternatives. These systems decouple field operations from fossil fuel volatility and offer modularity that allows a single unit to perform multiple tasks, such as mowing and spraying, through swappable implements. This transition is attracting significant venture capital, validating the commercial viability of electrified autonomy in high-value crop sectors like vineyards and orchards where emissions and noise reduction are critical. For example, Monarch Tractor announced in a July 2024 press release that it secured $133 million in Series C funding to accelerate the global deployment of its MK-V smart electric tractor, highlighting the growing investment in these sustainable hardware platforms.Simultaneously, the expansion of drone applications from monitoring to precision spraying is evolving aerial robotics from passive data collectors into active operational tools. Modern agricultural drones are increasingly utilized for heavy-payload tasks, such as spot-spraying crop protection products and broadcast seeding, which were previously restricted to ground rigs or manned aircraft. This operational evolution allows for the treatment of fragmented or inaccessible terrain with speed and accuracy, significantly reducing chemical runoff compared to traditional blanket methods. According to DJI Agriculture’s 'Agriculture Drone Industry Insight Report 2023/2024' released in July 2024, the global fleet of agricultural drones expanded to over 300,000 units by the end of 2023, underscoring the rapid scale at which these active aerial systems are being integrated into daily farming workflows.

Key Players Profiled in the Agricultural Robots Market

- Deere & Company

- Trimble Inc.

- AGCO Corporation

- CNH Industrial N.V.

- Kubota Corporation

- Yamaha Motor Co., Ltd.

- DJI

- Topcon Positioning Systems, Inc.

- Harvest Automation, Inc.

- Lely Holding S.A.R.L

Report Scope

In this report, the Global Agricultural Robots Market has been segmented into the following categories:Agricultural Robots Market, by Application:

- Milking

- Planting & Seeding Management

- Spraying Management

- Monitoring & Surveillance

- Harvest Management

- Livestock Monitoring

- Others

Agricultural Robots Market, by Type:

- Driverless Tractors

- UAVs

- Dairy Robots

- Material Management

Agricultural Robots Market, by Offering:

- Software

- Hardware

- Services

Agricultural Robots Market, by Region:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Agricultural Robots Market.Available Customization

The analyst offers customization according to your specific needs. The following customization options are available for the report:- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The key players profiled in this Agricultural Robots market report include:- Deere & Company

- Trimble Inc.

- AGCO Corporation

- CNH Industrial N.V.

- Kubota Corporation

- Yamaha Motor Co., Ltd.

- DJI

- Topcon Positioning Systems, Inc.

- Harvest Automation, Inc.

- Lely Holding S.A.R.L

Table Information

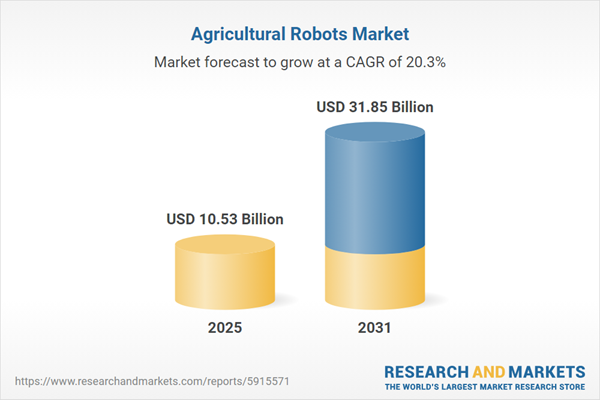

| Report Attribute | Details |

|---|---|

| No. of Pages | 180 |

| Published | January 2026 |

| Forecast Period | 2025 - 2031 |

| Estimated Market Value ( USD | $ 10.53 Billion |

| Forecasted Market Value ( USD | $ 31.85 Billion |

| Compound Annual Growth Rate | 20.2% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |