Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

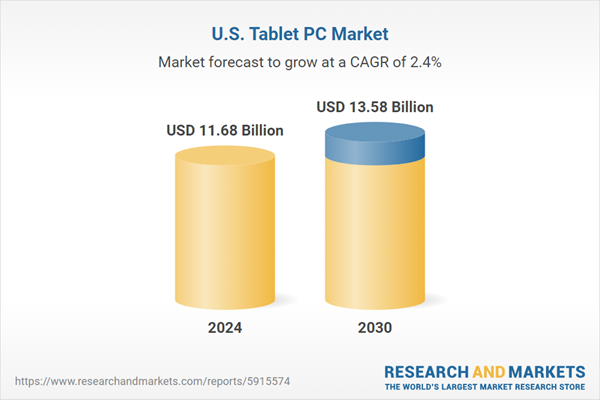

The United States Tablet PC Market represents a rapidly evolving segment of the consumer electronics and computing industry, encompassing portable, touchscreen-enabled devices designed for media consumption, business productivity, education, and healthcare applications. The market includes devices operating on major platforms such as iOS, Android, and Windows, and offers a wide range of screen sizes, connectivity options, and performance capabilities to meet diverse user requirements. Over the past several years, tablets have gained prominence as versatile alternatives to traditional laptops, offering enhanced portability, long battery life, and increasingly powerful hardware suitable for multitasking, gaming, and professional workflows. The market’s growth is being driven by multiple factors, including the widespread adoption of digital education tools, the expansion of remote work and telehealth services, and the increasing integration of tablets into corporate environments for tasks such as presentations, fieldwork, and mobile data access.

Additionally, consumer preferences for lightweight, compact devices for streaming, gaming, and social media interaction have further fueled demand. Technological advancements, such as high-resolution displays, faster processors, improved connectivity with 5G and Wi-Fi 6, and enhanced security features, have made tablets more attractive to both individual and enterprise users. Leading technology companies continue to invest in research and development to introduce innovative features like stylus support, foldable displays, augmented reality capabilities, and enhanced AI-driven functionalities, which further boost market appeal. Furthermore, the growing trend of hybrid devices that combine tablet portability with laptop-like performance is expanding the use cases and attracting new user segments.

Government initiatives to promote digital learning and increased availability of affordable tablets for educational institutions are also significant contributors to market expansion. As connectivity infrastructure improves and content availability continues to rise, the United States Tablet PC Market is expected to experience sustained growth. Market players are focusing on strategic partnerships, product launches, and expansion of distribution channels to capture a larger consumer base. Overall, the market is poised for robust growth in the coming years, driven by technological innovation, evolving user needs, and the increasing reliance on mobile computing devices across personal, educational, and professional domains.

Key Market Drivers

Technological Innovations Propelling the United States Tablet PC Market

In the dynamic ecosystem of the United States Tablet PC Market, technological innovations stand as a cornerstone driver, continually reshaping the landscape by introducing advanced solutions that enhance efficiency, accessibility, and user experience across financial transactions. These advancements include the integration of artificial intelligence for predictive billing analytics, blockchain for secure transaction ledgers, and mobile applications that facilitate seamless real-time payments, all of which streamline the process from bill generation to settlement, reducing operational complexities for businesses and consumers alike. For example, the adoption of open banking APIs allows for interoperable platforms where users can aggregate bills from multiple providers into a single interface, simplifying management and encouraging higher engagement rates.Moreover, machine learning algorithms are employed to automate fraud detection during the presentment phase, preemptively identifying anomalies and safeguarding sensitive data, which is essential in maintaining trust within the market. The evolution of contactless payment technologies, such as near-field communication enabled devices, has further accelerated market growth by enabling instant bill settlements in retail and service environments, aligning with the fast-paced demands of modern commerce. This driver is amplified by the proliferation of cloud-based infrastructures that offer scalable storage and processing capabilities, allowing small and medium-sized enterprises to adopt sophisticated Tablet PC systems without prohibitive upfront investments.

Innovations in user interface design, incorporating intuitive dashboards and voice-activated commands, have democratized access, making these systems more inclusive for diverse demographics, including the elderly and tech-novices. The United States Tablet PC Market benefits from these technological strides as they foster competitive differentiation among service providers, who vie to offer the most robust, feature-rich platforms. Research initiatives funded by industry consortia have led to breakthroughs in biometric authentication, such as fingerprint and facial recognition for payment approvals, enhancing security while expediting the process.

Additionally, the advent of Internet of Things integrations enables automated bill presentment for connected devices, like smart meters in utilities, which trigger payments based on real-time usage data, optimizing cash flow for providers. This technological momentum is crucial for addressing legacy system inefficiencies, where traditional paper-based billing incurs high costs in printing and mailing, now mitigated through digital alternatives that cut expenses by significant margins. Standardization efforts, such as the development of uniform data exchange protocols, ensure compatibility across disparate systems, facilitating broader market penetration and reducing integration barriers. As innovations mature, they also support sustainability objectives by minimizing paper usage and carbon footprints associated with physical bill delivery, resonating with corporate social responsibility agendas.

In essence, these technological enhancements not only propel market expansion but also position the United States as a vanguard in global fintech, where collaborations between startups and established banks accelerate the rollout of cutting-edge features. The ongoing refinement of data analytics tools allows for personalized billing experiences, where predictive models forecast payment behaviors and offer tailored reminders or incentives, boosting on-time payment rates. Furthermore, the rise of decentralized finance elements within Tablet PC frameworks introduces peer-to-peer transaction capabilities, bypassing intermediaries and lowering fees. This driver manifests in increased investment inflows, as venture capital targets promising technologies like quantum-resistant encryption to future-proof the market against emerging threats.

Challenges such as interoperability with outdated infrastructures are being overcome through hybrid solutions that bridge analog and digital realms, ensuring a smooth transition for all stakeholders. Ultimately, technological innovations underpin the resilience of the United States Tablet PC Market, adapting to trends like the gig economy where flexible, on-demand payment options are paramount.

By continuously elevating capabilities, these advancements drive revenue streams through subscription-based models for premium features and create ecosystems where value-added services, such as financial advisory integrations, enhance user retention. The market, therefore, thrives on this innovative foundation, translating technological prowess into tangible economic benefits, operational efficiencies, and transformative shifts in how bills are presented and paid in the digital age. (Word count: 905)

According to the Federal Reserve Bank of San Francisco's 2025 Diary of Consumer Payment Choice, United States consumers made an average of 48 payments per month in 2024, up from previous years and continuing an upward trend since 2021. This increase was driven by higher credit card usage and remote payments, with cash usage declining to 83 percent of consumers in the prior 30 days from 87 percent in 2023, while check payments dropped similarly, reflecting a shift toward digital methods enabled by technological advancements in payment systems.

Key Market Challenges

Intense Competition and Price Sensitivity

The United States Tablet PC Market faces significant challenges stemming from intense competition and high price sensitivity among consumers. Leading technology companies, including Apple, Samsung, and Microsoft, constantly innovate and release new models, creating a highly dynamic and competitive environment. This rapid product turnover pressures manufacturers to maintain technological relevance while managing production costs, marketing expenditures, and profit margins. Furthermore, the increasing presence of low-cost tablets from emerging brands intensifies price competition, compelling established players to offer discounts or bundle solutions, which can erode profitability. Consumers in the United States are highly price-conscious, often comparing specifications and price points across multiple brands before making purchase decisions.The expectation for regular updates in hardware, software, and design amplifies the cost of research and development while shortening the product life cycle. Additionally, the market’s saturation in certain segments, particularly among casual users and students, limits opportunities for substantial growth. Companies must balance innovation with cost-efficiency, ensuring that products remain attractive to consumers without compromising on quality.

This competitive pressure also extends to marketing strategies, where significant investments are required to maintain brand loyalty and visibility. Retailers and online platforms play a pivotal role in influencing purchasing decisions, further complicating market dynamics. The necessity to differentiate products through features, user experience, and ecosystem integration has become critical for market participants. Overall, intense competition and price sensitivity pose a persistent challenge, compelling businesses to optimize operational efficiency, innovate strategically, and implement targeted marketing to sustain market share and profitability.

Key Market Trends

Rising Adoption of Hybrid and Convertible Tablets

A prominent trend in the United States Tablet PC Market is the rising adoption of hybrid and convertible tablets, which combine the portability of traditional tablets with the functionality of laptops. Consumers and enterprises increasingly prefer devices that offer both touchscreen interfaces and physical keyboards, enabling seamless transitions between media consumption, professional productivity, and creative tasks. This trend is particularly significant in corporate and educational environments, where flexibility, mobility, and multi-functionality are highly valued. Hybrid tablets allow users to perform complex tasks, such as content creation, data analysis, and video conferencing, without the limitations of conventional tablets. Manufacturers are responding by introducing innovative designs with detachable keyboards, adjustable hinges, and enhanced stylus support to improve user experience.Additionally, these devices are often equipped with high-performance processors, larger storage capacities, and extended battery life to meet the demands of multitasking and professional workloads. The increasing integration of operating systems that support desktop-like functionalities, such as Windows and certain Android platforms, has further accelerated the adoption of hybrid tablets.

This trend is reinforced by remote working policies and digital learning initiatives that necessitate versatile computing devices capable of supporting a wide range of applications. Hybrid and convertible tablets are also driving enterprise adoption, as organizations seek cost-effective alternatives to traditional laptops without compromising on performance or productivity. As innovation continues in design, functionality, and performance, hybrid tablets are expected to capture a larger share of the United States Tablet PC Market, influencing purchasing decisions across both individual and organizational segments.

Key Market Players

- Apple Inc.

- Samsung Electronics Co., Ltd.

- Microsoft Corporation

- Lenovo Group Limited

- Amazon.com, Inc.

- Huawei Technologies Co., Ltd.

- AsusTek Computer Inc. (ASUS)

- Acer Inc.

- Dell Technologies Inc.

- Google LLC.

Report Scope:

In this report, the United States Tablet PC Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:United States Tablet PC Market, By Operating System:

- Android

- iOS

- Windows

United States Tablet PC Market, By Connectivity:

- Wi-Fi

- Cellular (4G/5G)

- Bluetooth

United States Tablet PC Market, By End-user:

- Education

- Healthcare

- Retail and E-commerce

- Government and Public Sector

- Corporate/Enterprise

- Others

United States Tablet PC Market, By Region:

- South US

- Midwest US

- North-East US

- West US

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the United States Tablet PC Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Apple Inc.

- Samsung Electronics Co., Ltd.

- Microsoft Corporation

- Lenovo Group Limited

- Amazon.com, Inc.

- Huawei Technologies Co., Ltd.

- AsusTek Computer Inc. (ASUS)

- Acer Inc.

- Dell Technologies Inc.

- Google LLC.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 85 |

| Published | September 2025 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 11.68 Billion |

| Forecasted Market Value ( USD | $ 13.58 Billion |

| Compound Annual Growth Rate | 2.3% |

| Regions Covered | United States |

| No. of Companies Mentioned | 10 |