Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

With limited arable land available for cultivation and the adverse effects of climate change posing additional challenges, the need for efficient weed control solutions has become paramount. Isoxaflutole offers an effective and reliable means of addressing this challenge, allowing farmers to maximize crop yields by curbing weed infestations. This herbicide's broad-spectrum control of various weed species makes it a versatile choice for a range of crops, including corn, soybeans, and sugarcane. Furthermore, the adoption of genetically modified (GM) crops, such as herbicide-tolerant soybeans and corn, has further amplified the demand for isoxaflutole. These GM crops have been engineered to withstand herbicide applications, including isoxaflutole, enabling farmers to target weeds without harming their crops. This compatibility between isoxaflutole and herbicide-tolerant GM crops has made the herbicide an indispensable tool for modern agriculture, contributing to increased productivity in response to the global food demand.

Key Market Drivers

Adoption of Genetically Modified (GM) Crops

The global isoxaflutole market has experienced a significant boost thanks to the widespread adoption of genetically modified (GM) crops, which has revolutionized modern agriculture. GM crops engineered for herbicide tolerance, such as herbicide-tolerant soybeans and corn, have reshaped farming practices and contributed to the increased demand for herbicides like isoxaflutole. GM crops engineered to tolerate specific herbicides, including isoxaflutole, offer several advantages to farmers. They allow for efficient and targeted weed control, as the crops can withstand herbicide applications that would otherwise harm non-GM counterparts. This compatibility with isoxaflutole has made the herbicide an indispensable tool for weed management in GM crop systems.Key Market Challenges

Herbicide Resistance

Herbicide resistance has become a major challenge in the global isoxaflutole market, raising concerns about its long-term effectiveness in weed control and sustainability in modern agriculture. Isoxaflutole, a selective herbicide widely utilized across various crops, has encountered growing resistance in recent years, diminishing its reliability as a weed management solution. One of the primary factors driving this resistance is the repeated and continuous application of isoxaflutole in crop production. Weeds, known for their adaptability, can gradually develop resistance through natural selection, reducing the herbicide’s efficacy over time. As farmers rely on isoxaflutole season after season, resistant weed populations can emerge, making control increasingly difficult.The implications of herbicide resistance are significant. The proliferation of resistant weeds can lead to increased competition for essential resources, ultimately reducing crop yields and overall agricultural productivity. This not only places financial pressure on farmers but also raises concerns about global food security. Addressing herbicide resistance requires the implementation of integrated weed management strategies, such as rotating or alternating herbicides with different modes of action. However, these approaches can be complex and costly, requiring in-depth knowledge of local weed populations, careful planning, and potentially the use of multiple herbicides. Proactive resistance management is essential to preserving the long-term efficacy of isoxaflutole. This includes routine weed monitoring, early detection of resistance, and educating farmers on best practices to mitigate its impact.

Key Market Trends

Shift Towards Sustainable Agriculture

The global isoxaflutole market is experiencing a boost thanks to the growing shift towards sustainable agriculture practices. Sustainable agriculture, characterized by reduced environmental impact and a focus on responsible resource management, has become a dominant trend in modern farming. Researchers are actively investigating the potential of artificial intelligence (AI) to enhance agricultural sustainability. AI-driven models analyze historical weather patterns, soil conditions, and other critical factors to provide more accurate crop yield predictions.Additionally, AI-powered irrigation systems utilize sensor-equipped hardware and real-time data analytics to optimize water distribution based on soil moisture levels and plant requirements. This approach not only minimizes water consumption but also significantly improves overall water-use efficiency. Isoxaflutole, a selective herbicide, is playing a pivotal role in supporting these sustainable practices, and this shift is positively impacting its market demand.

One of the key drivers of this trend is the increasing awareness and concern for environmental sustainability. Consumers, regulatory bodies, and farmers alike are increasingly recognizing the importance of reducing the ecological footprint of agricultural activities. Isoxaflutole, when used judiciously, can contribute to sustainable weed management by minimizing the need for extensive tillage, which can lead to soil erosion and compaction. The herbicide's targeted action helps conserve soil structure and biodiversity, aligning with sustainable farming principles.

Key Market Players

- BASF SE

- Bayer AG

- CHEMOS GmbH & Co. KG

- Merck KGaA

- Santa Cruz Biotechnology, Inc.

- Shanghai E-Tong Chemical Co., Ltd.

- Shijiazhuang Awiner Biotechnology ltd

- Wanko Chemical Co. Ltd

Report Scope:

In this report, the Global Isoxaflutole Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Isoxaflutole Market, By Crops:

- Vegetables

- Sugarcane

- Almonds

- Peaches

- Maize

- Apple

- Others

Isoxaflutole Market, By Region:

- North America

- United States

- Canada

- Mexico

- Europe

- France

- United Kingdom

- Italy

- Germany

- Spain

- Asia Pacific

- China

- India

- Japan

- Australia

- South Korea

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Isoxaflutole Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- BASF SE

- Bayer AG

- CHEMOS GmbH & Co. KG

- Merck KGaA

- Santa Cruz Biotechnology, Inc.

- Shanghai E-Tong Chemical Co., Ltd.

- Shijiazhuang Awiner Biotechnology ltd

- Wanko Chemical Co. Ltd

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 185 |

| Published | April 2025 |

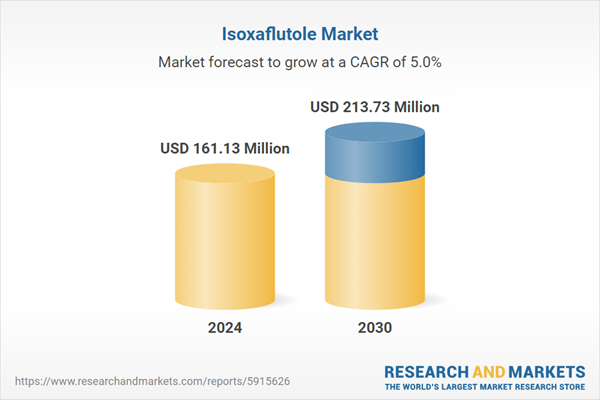

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 161.13 Million |

| Forecasted Market Value ( USD | $ 213.73 Million |

| Compound Annual Growth Rate | 5.0% |

| Regions Covered | Global |

| No. of Companies Mentioned | 8 |