Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Nevertheless, the market faces a substantial obstacle in the form of inconsistent interoperability among various payment service providers. The prevalence of fragmented, proprietary QR standards frequently compels merchants to maintain separate codes for different digital wallets. This lack of unification creates operational friction that complicates the customer experience and restricts the seamless, universal adoption necessary for the market's long-term expansion.

Market Drivers

The rise of integrated super apps and digital wallet ecosystems serves as a major engine for market expansion by merging financial services with lifestyle amenities into unified platforms. By incorporating QR code scanning directly into popular applications, providers minimize payment friction, encouraging frequent use for transactions ranging from small payments to significant transfers. This volume driven by ecosystems is clear in key markets; for example, Worldline's 'India Digital Payments Report for 2H 2024', released in April 2025, noted that UPI transaction volumes grew by 42% year-on-year, reaching 93.23 billion in the latter half of 2024. Such extensive throughput illustrates how app-based ecosystems successfully normalize QR payments in everyday life.Furthermore, the development of interoperable national and cross-border QR standards hastens adoption by removing the fragmentation that once required merchants to handle multiple proprietary codes. Unified frameworks simplify acceptance infrastructure, enabling one QR code to process transactions from various banks and wallets, while cross-border connections allow travelers to pay easily using their home currency. This standardization fuels substantial engagement; the Bank of Indonesia's January 2025 statement reported that QRIS transactions grew by 175.2% year-on-year in 2024. Moreover, innovation continues to draw users; Ant Group reported in 2025 that the Alipay Tap! service gained over 100 million users within 11 months, underscoring global demand for seamless contactless options.

Market Challenges

A major hurdle hindering the Global QR Code Payment Market is the absence of standardized interoperability among payment service providers. The use of proprietary QR standards imposes an administrative strain on merchants, who must maintain multiple acceptance codes and reconcile funds from various digital wallets. This fragmentation leads to "counter clutter" and operational difficulties that discourage merchant adoption, especially among small businesses seeking efficient financial workflows. Consequently, the user experience suffers due to uncertainty regarding acceptance at points of sale, which diminishes the frequency of digital transactions and hampers total reliance on the system.Without a unified framework, the market's transaction velocity is restricted, preventing the ecosystem from achieving its maximum volume potential. The magnitude of this lost opportunity becomes clear when contrasting fragmented markets with those possessing established interoperability. For instance, the National Payments Corporation of India reported in January 2025 that the Unified Payments Interface processed 16.99 billion transactions. This level of activity underscores that without a shared standard to enable smooth cross-provider transfers, the broader global market will struggle to support the high-frequency usage required for sustained industry growth.

Market Trends

The incorporation of Central Bank Digital Currencies (CBDCs) into QR wallets marks a fundamental shift in payment settlements, evolving beyond simple interface changes to modify the underlying currency infrastructure. Governments are increasingly integrating sovereign digital currencies within existing QR frameworks to reduce transaction costs and improve financial oversight without necessitating new hardware investments. This direct-to-wallet model circumvents traditional intermediary friction, facilitating programmable payments and promoting swift merchant acceptance through lower fees. According to an October 2025 article by Ledger Insights, digital yuan payment volumes reached RMB 14.2 trillion through September 2025, demonstrating the immense scale of state-backed digital currency adoption via scan-to-pay methods.Concurrently, the widespread adoption of QR-based ticketing in public transit systems is cementing the technology's role in high-frequency, everyday applications. Transit operators are transitioning from proprietary smart card readers to standardized QR scanners, enabling commuters to buy single or season tickets via mobile apps and avoid physical lines. This seamless utility encourages habitual usage that extends into retail environments as passengers get used to scanning for access. As reported by DT Next in September 2025, the Chennai Metro Rail Limited saw a ridership of 99.09 lakh passengers in August 2025, a number significantly supported by the convenience of mobile QR ticketing solutions.

Key Players Profiled in the QR Code Payment Market

- PayPal Holdings, Inc.

- Square, Inc.

- UnionPay International Co., Ltd.

- Google Pay

- WeChat Pay

- Alipay

- One97 Communications Ltd.

- Revolut Ltd.

- Clover Network, LLC

- Maya

Report Scope

In this report, the Global QR Code Payment Market has been segmented into the following categories:QR Code Payment Market, by Offerings:

- Solution

- Services

QR Code Payment Market, by Solution:

- Static QR code

- Dynamic QR code

QR Code Payment Market, by Payment Type:

- Push Payment

- Pull Payment

QR Code Payment Market, by End-user:

- Restaurant

- Retail & E-commerce

- E-ticket Booking

- Others

QR Code Payment Market, by Region:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global QR Code Payment Market.Available Customization

The analyst offers customization according to your specific needs. The following customization options are available for the report:- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The key players profiled in this QR Code Payment market report include:- PayPal Holdings, Inc.

- Square, Inc.

- UnionPay International Co., Ltd.

- Google Pay

- WeChat Pay

- Alipay

- One97 Communications Ltd.

- Revolut Ltd.

- Clover Network, LLC

- Maya

Table Information

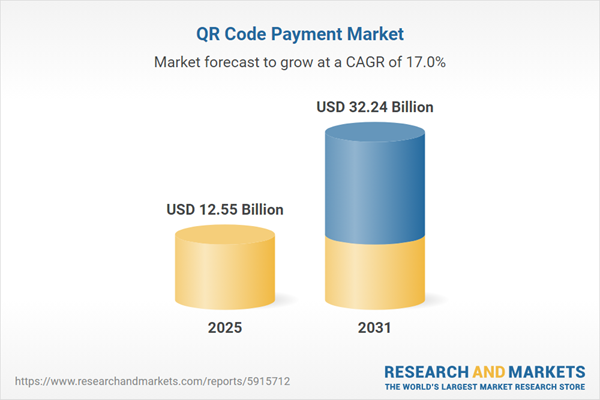

| Report Attribute | Details |

|---|---|

| No. of Pages | 185 |

| Published | January 2026 |

| Forecast Period | 2025 - 2031 |

| Estimated Market Value ( USD | $ 12.55 Billion |

| Forecasted Market Value ( USD | $ 32.24 Billion |

| Compound Annual Growth Rate | 17.0% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |