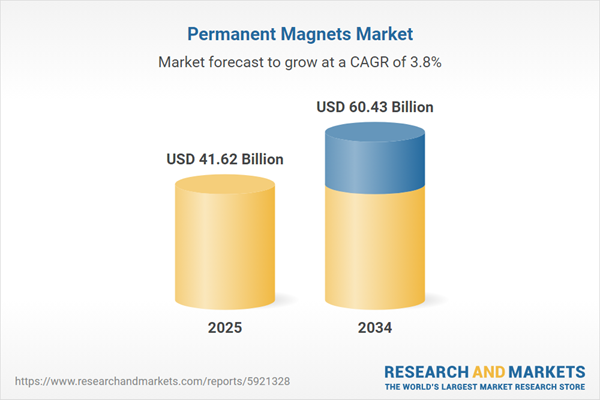

Global Permanent Magnets Market Growth

A permanent magnet is an object that maintains its magnetic properties even when there is no external magnetizing force. The magnetic field is produced by the material's internal structure. These magnets are made from specific alloys like iron, nickel, and cobalt, and they have low permeability. They are used in various industrial and commercial applications, including the production of loudspeakers, motors, and HVAC systems, among others.The permanent magnets demand growth is largely attributed to their growing application in the automotive industry. These magnets are essential in vehicle production, serving important functions in motors, actuators, sensors, and suspension systems to enhance vehicle performance. Furthermore, the rising application of permanent magnets in consumer electronics is expected to positively impact market growth, fuelled by rapid digitalization and a growing consumer desire for digital devices.

Global Permanent Magnets Market Analysis

The permanent magnets industry growth is being fueled by the rising global demand for electric vehicles (EVs), with rare-earth magnets, particularly neodymium, becoming essential components in electric motors. Furthermore, permanent magnets are crucial in wind turbine generators. As nations focus on renewable energy sources, significant investments are being directed towards the development of wind farms.The automotive sector, beyond just electric vehicles, is increasingly utilizing permanent magnets in various applications such as advanced driver-assistance systems (ADAS), sensors, and actuators. These components play a crucial role in improving vehicle safety, efficiency, and performance, which in turn drives greater adoption. As the industry pushes forward with innovations in autonomous driving technologies, the need for magnetic sensors and motors is anticipated to grow, further propelling the growth of permanent magnet market.

The permanent magnets market dynamics and trends are largely influenced by the increasing demand for smaller and more efficient electronic devices, which in turn drives innovation in permanent magnet technology. These magnets play a crucial role in various consumer electronics, such as smartphones, laptops, and wearable gadgets. As the industry moves towards miniaturization, companies are focused on creating more powerful magnets that occupy less space while still enhancing functionality. This trend is also apparent in the medical field, where compact and efficient magnetic components are utilized in diagnostics, imaging, and therapeutic devices. The capability to manufacture high-performance magnets in smaller sizes is propelling the market forward, especially in sectors that prioritize precision and efficiency.

With the increasing use of automation in manufacturing and logistics, permanent magnets are becoming more common in industrial robots for precise movement and actuation. As various industries embrace robotics to improve efficiency and production, the need for magnets in robotic systems is on the rise, which in turn is boosting the demand of permanent magnets market.

Permanent Magnets Industry Outlook

According to the industry reports, in 2010, global electric vehicle (EV) sales across major regions, including China, Europe, and the U.S., began modestly with fewer than 100,000 units sold, primarily concentrated in early-stage battery electric vehicles (BEVs) and plug-in hybrid electric vehicles (PHEVs). By 2011, sales remained below 200,000 units, with China and Europe leading in BEV sales. Sales started to accelerate in 2014, crossing the 400,000 units mark, as the EV market expanded significantly in China. By 2016, global EV sales reached nearly 1 million units, with China BEV contributing the largest share, surpassing 700,000 units. From 2017 to 2019, sales surged rapidly. In 2017, global EV sales hit around 1.3 million units, with China accounting for over 50% of these sales, driven by aggressive local production of BEVs. By 2019, global EV sales crossed 2 million units, with China leading at nearly 1.2 million units sold, Europe at around 560,000, and the U.S. at over 320,000. The market share of EVs globally rose to nearly 3% by 2019, reflecting broader market adoption and growth in charging infrastructure. This indicates that the rising sales of electric vehicles (EVs) are fueling the permanent magnets market revenue. EVs rely on permanent magnets, particularly rare-earth magnets, for their electric motors due to their efficiency and power density.The wind energy capacity in Europe experienced significant growth between 2020 and 2021. Germany led the region, expanding its wind turbine capacity from 62.2 gigawatts (GW) in 2020 to 63.8 GW in 2021, adding nearly 1 GW in just a year. Following closely behind, Spain increased its capacity from 26.8 GW in 2020 to 27.5 GW in 2021, showing a robust expansion rate. France’s wind capacity reached 18.7 GW in 2021, up from 17.5 GW in 2020, marking a notable increase of over 1 GW. The United Kingdom followed with 27.1 GW in 2021, compared to 24.5 GW in the prior year. Other prominent markets included Sweden, which expanded from 10.0 GW in 2020 to 12.1 GW in 2021, and the Netherlands, which saw growth from 6.6 GW to 7.8 GW during the same period. The rising wind turbine capacity is driving demand for rare-earth permanent magnets, especially neodymium-iron-boron (NdFeB), used in turbine generators. This demand is boosting the permanent magnets industry revenue as renewable energy projects expand globally.

Increasing demand for electric vehicles (EVs) boosts the permanent magnets market demand.

- Expanding applications in electronics, renewable energy, and industrial automation.

- Advancements in magnetic materials enhance efficiency and reduce production costs.

- High production costs for advanced magnetic materials, limiting market penetration.

- Environmental concerns around mining and processing rare earth materials.

- Development of recycling techniques for rare earth elements to reduce environmental impact and supply chain risks.

- Growth in consumer electronics and automotive sectors opens new avenues for market expansion.

- Geopolitical tensions affect global supply chains, particularly between China and other countries.

- Competition from alternative technologies, such as electromagnets or newer materials.

Global Permanent Magnets Industry Segmentation

“Global Permanent Magnets Market Report and Forecast 2025-2034” offers a detailed analysis of the market based on the following segments:Market Breakup by Type

- Ferrite

- Neodymium Iron Boron

- Aluminum Nickel Cobalt

- Samarium Cobalt

Market Breakup by End Use

- Computer Hard Disk Drives (HDD), CD, DVD

- Hybrid Electric Vehicles

- Electric Bicycles

- Heating, Ventilating and Air Conditioners (HVAC)

- Wind Turbines

- Others

Market Breakup by Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Permanent Magnets Market Share

Hybrid Electric Vehicles (HEVs) are driving the growth of the permanent magnets industry. This surge is mainly attributed to rising demand, faster adoption rates, and continuous technological progress in the automotive field. The shift towards eco-friendly transportation has led to a greater reliance on neodymium magnets in electric motors, driving considerable market growth.The growth of permanent magnets market is being significantly driven by the rising popularity of electric bicycles (e-bikes), which is outpacing the growth linked to heating, ventilating, and air conditioning (hvac) systems. E-bikes have become an increasingly popular eco-friendly and cost-effective mode of transportation, especially in urban areas. Their electric motors rely heavily on neodymium-iron-boron (NdFeB) magnets due to their high power-to-weight ratio, making them essential for lightweight, efficient performance. As the global demand for e-bikes rises, particularly in regions focused on reducing carbon emissions, the need for these high-performance magnets grows rapidly. Moreover, government regulations further support the e-bike market. Many countries are actively promoting electric mobility to reduce traffic congestion and pollution, offering subsidies or incentives for e-bike adoption.

Leading Companies in the Permanent Magnets Market

The companies specialise in the development and manufacturing of a wide range of magnetic products and solutions, in the development and manufacturing of a wide range of magnetic products and solutions.Adams Magnetic Products Co.

Partnered with High Street Capital in 2023 to expand its production capabilities and innovation in magnetic solutions. Invested in advanced technology to meet rising demands in renewable energy and electric vehicle markets.

Arnold Magnetic Technologies

Collaborated with Cyclic Materials to develop a rare earth recycling program aimed at enhancing supply chain resilience. Expanded its permanent magnet capabilities to support the aerospace, automotive, and medical sectors with advanced magnetic solutions.The Bunting® Magnetics Co.

Advanced rare earth magnet recycling through its support of the SUSMAGPRO project. Introduced Cerium-doped NdFeB magnets to reduce rare earth consumption, improving sustainability.

Advanced Technology & Materials Co., Ltd. (AT&M)

Advanced the production of amorphous and nanocrystalline magnetic powders using innovative cooling technologies. Expanded its manufacturing capacity to deliver over 10,000 tons of soft magnetic alloys annually.Other key players in the market include Hitachi Metals, Ltd., Industrial Magnetics, Inc., and MASTER MAGNETICS, Inc., among others.

Table of Contents

Companies Mentioned

The key companies featured in this Permanent Magnets market report include:- Adams Magnetic Products Co.

- Arnold Magnetic Technologies

- The Bunting® Magnetics Co.

- Advanced Technology & Materials Co., Ltd. (AT&M)

- Hitachi Metals, Ltd.

- Industrial Magnetics, Inc.

- MASTER MAGNETICS, Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 179 |

| Published | August 2025 |

| Forecast Period | 2025 - 2034 |

| Estimated Market Value ( USD | $ 41.62 Billion |

| Forecasted Market Value ( USD | $ 60.43 Billion |

| Compound Annual Growth Rate | 3.8% |

| Regions Covered | Global |

| No. of Companies Mentioned | 8 |