The Asia-Pacific is the fastest-growing region for the industry. An increase in energy demand in countries, including China, India, and Australia has led to an increase in coal requirements. The increasing demand for coal is directly proportional to the use of mining equipment, which is aiding the market growth.

Market Segmentation

The report titled “Mining Remanufacturing Components Market Report and Forecast 2025-2034” offers a detailed analysis of the market based on the following segments:Based on the components, the industry can be divided into:

- Engine

- Hydraulic Cylinder

- Axle

- Differential

- Transmission

- Torque Converter

- Final Drive

The industry can be divided into:

- Coal

- Metal

- Others

The industry can be broadly categorised based on equipment into:

- Hydraulic Excavator

- Mine/Haul Truck

- Wheel Loader

- Wheel Dozer

- Crawler Dozer

Looks into the regional markets of mining remanufacturing components like:

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Market Analysis

The growth of mining activities, especially in developing countries and the increased demand for resource exploration, have a positive impact on the remanufacturing components market. Factors like lower costs of remanufacturing mining components compared with new parts are driving the growth of the industry. Wheel loader is expected to witness the highest demand in the forecast period owing to its flexibility.Competitive Landscape

The report presents a detailed analysis of the following key players in the global mining remanufacturing components market, looking into their capacity, competitive landscape, and latest developments like capacity expansions, plant turnarounds, and mergers and acquisitions:- Caterpillar Inc. (NYSE: CAT)

- Liebherr Group

- Hitachi Construction Machinery

- Komatsu Limited

- VOLVO Construction Equipment

Table of Contents

Companies Mentioned

The key companies featured in this Mining Remanufacturing Components market report include:- Caterpillar Inc.

- Liebherr-International Deutschland GmbH

- Hitachi Construction Machinery Co. Ltd.

- Komatsu Ltd

- VOLVO Construction Equipment (Volvo CE)

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 169 |

| Published | August 2025 |

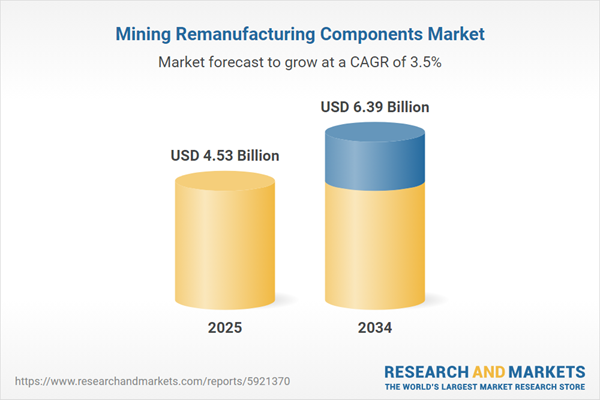

| Forecast Period | 2025 - 2034 |

| Estimated Market Value ( USD | $ 4.53 Billion |

| Forecasted Market Value ( USD | $ 6.39 Billion |

| Compound Annual Growth Rate | 3.5% |

| Regions Covered | Global |

| No. of Companies Mentioned | 6 |