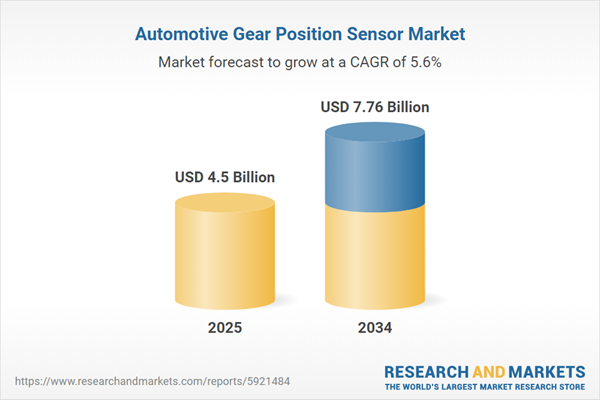

Automotive Gear Position Sensor Market Growth

The growth of the automotive gear position sensor market is due to the increasing demand for shift-by-wire technology that uses actuators for transmission, thus improving the efficiency and reducing the weight of the vehicles. APAC holds the largest market share in the market as a result of growing demand for automatic transmission in the region.Automotive Gear Position Sensor Market Trends

The global automotive gear position sensor demand is being driven by the increasing need for automotive fuel effectiveness. The development in triple-clutch transmission system is aiding the growth of the industry. The growing acceptance of automatic transmission system is increasing the demand for automotive gear position sensors. The high preference of shift-by-wire devices over mechanical connection for transmission is further driving the growth of the industry. Asia-Pacific region is leading the market due to rising demand for automatic transmission systems in the area.Recent Developments

As per the automotive gear position sensor market dynamics and trends, Hero MotoCorp announced the launch of a Karizma XMR motorcycle in India in August 2023. This motorcycle is equipped with liquid-cooled 210 cc DOHC 4V engine and 25.5 PS of maximum power at 9250 rpm and 20.4 Nm torque at 7250 rpm.Industry Outlook

According to European Automobile Manufacturers’ Association (ACEA), in 2022, global new car registrations reached 66.2 million units, matching 2021 figures. As per the automotive gear position sensor industry analysis, this recovery was supported by improved semiconductor supplies and a boost in sales during the final quarter of the year.In Europe, passenger car registrations fell by 10.4% to 12.8 million units in 2022. The region continued to grapple with semiconductor shortages. Additionally, the ongoing conflict in Ukraine severely impacted the Eastern European market, with Ukraine and Russia experiencing sharp declines of 64.7% and 62.7%, respectively, which also hindered the growth of the automotive gear position sensor industry.

The production figures of passenger cars in various European countries from 2019 to 2022 reveal significant trends. Germany, the largest producer, experienced fluctuations but saw a notable 13.2% increase in 2022, reaching 3,336,116 units. Spain and the Czech Republic showed recovery with 6.5% and 8.7% growth, respectively. France and Romania demonstrated strong rebounds, with France increasing by 10.3% to 940,690 units and Romania by 20.6% to 507,269 units. Italy, Hungary, and Belgium also showed positive recovery trends, with respective increases of 6.5%, 6.0%, and 6.0% that can boost the automotive gear position sensor industry revenue. Sweden experienced a modest recovery with a 1.6% rise. Conversely, Slovakia struggled, with a slight decrease of 1.3% in 2022. These trends indicate a general recovery in Europe's automotive industry post-pandemic, with varying degrees of success among the countries, highlighting the resilience and challenges faced by the sector across the continent.

Factors Contributing to the Growth of the Global Market Globally

- Rise of electric and hybrid vehicles boosts market growth.

- Technological advancements improve sensor accuracy and reliability.

- Consumer demand for advanced vehicle features fuels automotive gear position sensor demand growth.

- Emerging markets witness rising demand due to industrialization and urbanization.

Challenges Faced by Manufacturers in the Global Market

- High development and production costs limit profitability.

- Intense competition from both established and new market players.

- Maintaining accuracy and reliability under extreme conditions is difficult and hinders automotive gear position sensor market opportunities.

- Fluctuating demand in the automotive industry affects production volumes.

- High level of customization for different vehicle models adds complexity.

Key Growth Opportunities in the Global Market

- Increasing automotive safety regulations boost sensor demand.

- Emerging markets provide expanding business prospects and boost automotive gear position sensor market value.

- Focus on fuel efficiency supports need for optimized sensors.

- Development of smart manufacturing drives demand for precise sensors.

Automotive Gear Position Sensor Industry Segmentations

“Automotive Gear Position Sensor Market Report and Forecast 2025-2034” offers a detailed analysis of the market based on the following segments:Market Breakup by Application

- Automatic Transmission

- Manual Transmission

Market Breakup by Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Automotive Gear Position Sensor Market Regional Analysis

The Asia-Pacific region accounts for a major market share owing to the growth of the automotive sector in the region. Increased adoption of high-end vehicle technologies in the countries such as China and Japan also boost the demand of automotive gear position sensor market.Competitive Landscape

The report presents a detailed analysis of the following key players in the global automotive gear position sensor industry, looking into their capacity, market shares, and latest developments like capacity expansions, plant turnarounds, and mergers and acquisitions:- TE Connectivity Corp.

- ZF Friedrichshafen AG

- Honeywell International Inc.

- Infineon Technologies AG

Table of Contents

Companies Mentioned

The key companies featured in this Automotive Gear Position Sensor market report include:- TE Connectivity Ltd.

- ZF Friedrichshafen AG

- Honeywell International Inc.

- Infineon Technologies AG

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 166 |

| Published | August 2025 |

| Forecast Period | 2025 - 2034 |

| Estimated Market Value ( USD | $ 4.5 Billion |

| Forecasted Market Value ( USD | $ 7.76 Billion |

| Compound Annual Growth Rate | 5.6% |

| Regions Covered | Global |

| No. of Companies Mentioned | 5 |