The increasing demand for convenience food products and carbonated beverages has fuelled the growth of the food-grade industrial gases industry significantly.

Market Segmentation

The report titled “Food-Grade Industrial Gases Market Report and Forecast 2025-2034” offers a detailed analysis of the market based on the following segments:The industry can be divided based on types as:

- Carbon Dioxide

- Nitrogen

- Oxygen

- Others

The industry can be divided based on applications as:

- Freezing and Chilling

- Packaging

- Carbonation

- Others

The industry can be broadly categorised based on its end-uses into:

- Beverages

- Meat, Poultry, and Seafood Products

- Dairy and Frozen Products

- Fruits and Vegetables

- Convenience Food Products

- Bakery and Confectionery Products

- Others

The industry can be divided based on the mode of supply as:

- Bulk

- Cylinder

Looks into the regional markets of food-grade industrial gases like:

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Market Analysis

The global food-grade industrial gases industry is driven by the introduction of new products in the food industry and the advancements in packaging technology. The freezing and chilling segment is expected to represent the biggest share of the market for food-grade gases. Freezing also slows many enzymatic processes, making food products stable. It reduces the danger of bacterial growth by freezing a food item. To prevent spoilage, the freezing and chilling of food are essential. As these techniques are demanded by producers, customers, and distributors, the use of food-grade industrial gases is anticipated to accelerate in the forecast period. With the advancements in packaging technologies, carbon dioxide demand is expected to stay the highest in the market for food-grade industrial gases.Competitive Landscape

The report presents a detailed analysis of the following key players in the global food-grade industrial gases market, looking into their capacity, market shares, and latest developments like capacity expansions, plant turnarounds, and mergers and acquisitions:- The Linde Group

- Air Products & Chemicals, Inc. (NYSE: APD)

- Air Liquide

- The Messer Group GmbH

- Taiyo Nippon Sanso

- SOL Group

- Others

Table of Contents

Companies Mentioned

The key companies featured in this Food-Grade Industrial Gases market report include:- Linde Plc

- Air Products and Chemicals, Inc.

- Air Liquide S.A.

- Messer Group GmbH

- Taiyo Nippon Sanso Corporation

- SOL Group

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 177 |

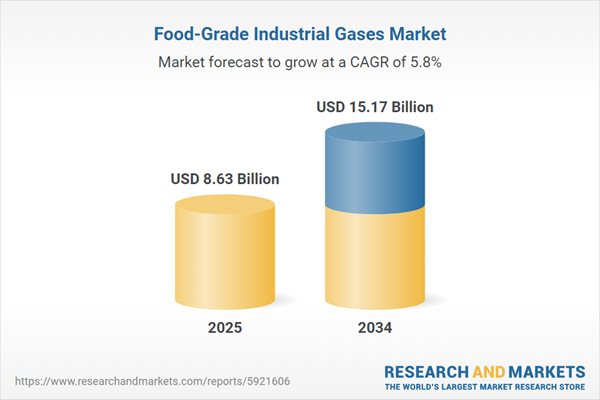

| Published | August 2025 |

| Forecast Period | 2025 - 2034 |

| Estimated Market Value ( USD | $ 8.63 Billion |

| Forecasted Market Value ( USD | $ 15.17 Billion |

| Compound Annual Growth Rate | 5.8% |

| Regions Covered | Global |

| No. of Companies Mentioned | 7 |