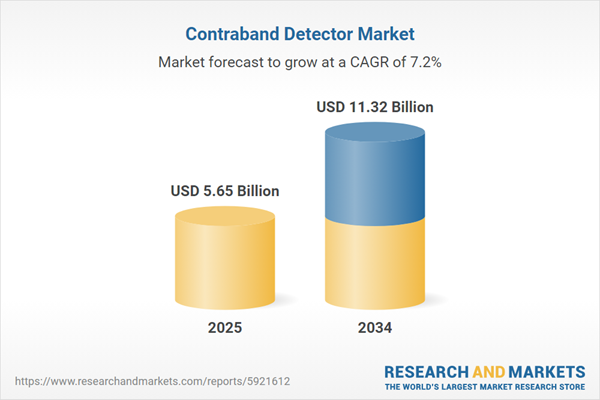

Global Contraband Detector Market Growth

The contraband detector market plays a crucial role in boosting security, curbing illegal activities, and enhancing operational efficiency. These systems identify prohibited items such as weapons, drugs, and explosives, improving safety at high-risk locations like borders and airports. They assist law enforcement, minimise smuggling, and streamline customs processes by improving inspection procedures. In 2022, the U.S. TSA screened over 670 million passengers, highlighting the need for efficient contraband detection technologies. This drives airports to adopt advanced screening solutions to ensure safety and improve processing times.Advanced technologies, including AI and automation, enhance detection accuracy and efficiency while offering cost savings, and influencing contraband detector market dynamics and trends. Contraband detector strengthen trade security, reduce risks, and ensure compliance with regulations. They act as a deterrent to criminals, lower the risk of terrorism, and foster public trust by protecting transportation systems and public areas.

Key Trends and Recent Developments

The contraband detector market value is being driven by the adoption of advanced detection technologies, integration of artificial intelligence, growing security concerns, and expansion in transportation applications.October 2024

Rapiscan Systems introduced a sophisticated cargo scanner for seaports and airports, incorporating advanced imaging technologies to ensure comprehensive inspections of containers and cargo vehicles while boosting operational efficiency.September 2024

Ametek unveiled a new X-ray inspection system designed to improve contraband detection in cargo screening. This advanced technology provides detailed imaging to efficiently identify concealed items, streamlining the inspection process.June 2024

Thermo Fisher Scientific launched a cutting-edge chemical detector for the rapid identification of hazardous materials. This advanced system is specifically designed for law enforcement and border control to enhance safety protocols.January 2024

Astrophysics Inc. introduced an advanced X-ray scanner for security checkpoints at airports and borders. This state-of-the-art detector enhances contraband detection, ensuring thorough inspections while reducing the need for manual intervention to improve efficiency.Adoption of Advanced Detection Technologies Fueling Growth of Contraband Detector Market

The market for contraband detector is rapidly embracing advanced technologies like X-ray imaging, millimeter-wave scanners, and chemical detection systems. These innovations improve both accuracy and speed in detecting illegal items, increasing the demand for more advanced detection solutions across various industries. In March 2024, Nuctech launched a state-of-the-art X-ray inspection system for cargo screening at ports, boosting detection accuracy and operational efficiency to meet the growing security needs of transportation hubs.Integration of Artificial Intelligence Impacting Contraband Detector Market Revenue

Incorporating artificial intelligence (AI) and machine learning into contraband detection systems significantly improves threat assessment and reduces false positives. AI algorithms enable real-time data analysis, increasing security operations' efficiency. In April 2024, Smiths Detection launched an AI-powered detection system designed to enhance security screening at airports, leveraging machine learning to accurately identify potential threats.Rising Security Concerns Driving Demand of the Contraband Detector Market

Increasing concerns over terrorism and organised crime are spurring investments in contraband detection technologies. Governments are strengthening security measures, leading to a higher demand for effective detection systems in public spaces. In December 2023, Bruker introduced an advanced chemical detection system for law enforcement and border control, addressing global security concerns and improving hazardous material identification.Growth in Transportation Applications Creating Opportunities in the Contraband Detector Market

The transportation sector is a significant driver of the market due to the high risk of illicit materials being transported through airports, seaports, and railway stations. Advanced screening technologies are essential to ensure safety in these critical areas. In June 2024, Garrett Metal Detector unveiled a new handheld scanner for airport security, improving the detection of concealed weapons and enhancing passenger safety during screenings.Global Contraband Detector Industry Segmentation

The report titled “Global Contraband Detector Market Report and Forecast 2025-2034” offers a detailed analysis of the market based on the following segments:Market Breakup by Technology

- X-Ray Imaging

- Metal Detection

- Spectrometry and Spectroscopy

- Others

Market Breakup by Target Based Screening

- People Screening

- Baggage and Cargo Screening

- Vehicle Screening

- Others

Market Breakup by Deployment Type

- Fixed

- Portable

Market Breakup by Mode of Application

- Transportation

- Government

- Retail

- Hospitality

- Commercial

- Industrial

- Education

- Events and Sports

- Others

Market Breakup by Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Global Contraband Detector Market Share

According to the contraband detector market analysis, X-ray imaging leads the market by offering fast and non-invasive inspection capabilities, enabling security personnel to effectively detect concealed contraband within luggage and cargo. Its ability to generate detailed images improves detection accuracy, reduces false positives, and enhances efficiency at checkpoints, airports, and border crossings. In October 2024, LINEV Systems launched a new contraband X-ray body scanner designed for law enforcement, enhancing security in prisons and border crossings by detecting hidden illegal goods on individuals.Metal detection technology is essential for identifying metallic contraband, such as weapons and explosives, concealed in bags or cargo. Its high sensitivity provides quick alerts to security personnel, improving safety in public spaces, airports, and prisons. In March 2024, Fisher Research Labs introduced a new multi-frequency metal detector to enhance contraband detection in security applications, improving accuracy across various environments.

The growth of the contraband detector market is further supported by spectrometry and spectroscopy techniques, which analyse material composition to identify illicit substances like drugs or explosives through their unique spectral signatures. These methods enhance detection precision and provide valuable information about the materials being inspected. In June 2024, PerkinElmer launched an advanced Fourier-transform infrared (FTIR) spectrometer to improve material analysis in security applications, aiding law enforcement in the swift and accurate detection of hazardous substances during inspections.

Competitive Landscape

The contraband detector market key players provide innovative solutions across sectors such as defence, intelligence, civil, and commercial industries. These companies are renowned for their advanced systems in communications, air traffic management, avionics, and surveillance, playing a crucial role in contraband detection. Their state-of-the-art technologies, including sensors, X-ray imaging, and AI-driven systems, are employed to identify illegal or prohibited items, thereby improving security at borders, airports, and critical infrastructure.L3Harris Technologies, Inc.

Founded in 2006 and headquartered in Melbourne, Florida, L3Harris Technologies is a prominent player in aerospace, defence, and communications. The company provides advanced technology solutions, including contraband detection systems, serving industries such as security, military, and law enforcement globally, enhancing operational efficiency and safety.

Smiths Detection Group Ltd

Founded in 2006 and based in London, United Kingdom, is a leader in security and threat detection. The company develops cutting-edge technologies for detecting contraband, explosives, and hazardous materials, providing solutions for industries such as aviation, transportation, and defence to enhance public and facility safety.ADANI Systems, Inc. (Linev Group)

ADANI Systems, part of the Linev Group and established in 2003, is headquartered in Ahmedabad, India. The company delivers integrated security solutions, focusing on contraband detection systems for airports, ports, and government facilities, aiming to enhance safety, compliance, and risk management in critical infrastructure.Nuctech Company Ltd

Founded in 1997 and headquartered in Beijing, China, Nuctech specialises in advanced security technologies. The company provides innovative contraband detection systems for high-risk sectors such as airports, railways, and ports, enhancing global safety and security through its advanced detection and surveillance solutions.Other key players in the contraband detector market report include Metrasens, Rapiscan Systems, Inc., and Campbell/Harris Security Equipment Company (CSECO), among others.

Table of Contents

Companies Mentioned

The key companies featured in this Contraband Detector market report include:- L3Harris Technologies. Inc.

- Smiths Detection Group Ltd.

- ADANI Systems, Inc. (Linev Group)

- Nuctech Company, Ltd

- Metrasens

- Rapiscan Systems, Inc.

- Campbell/Harris Security Equipment Company (CSECO)

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 176 |

| Published | August 2025 |

| Forecast Period | 2025 - 2034 |

| Estimated Market Value ( USD | $ 5.65 Billion |

| Forecasted Market Value ( USD | $ 11.32 Billion |

| Compound Annual Growth Rate | 7.2% |

| Regions Covered | Global |

| No. of Companies Mentioned | 8 |