Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

EHS solutions are becoming a core part of every business organization to bring transformation in business continuity, profitable growth, corporate social responsibilities, and operational excellence related to environmental interaction. The integrated environment of government regulations, legal forces, economic conditions, and technologies have convinced organizations from multiple industries to implement EHS solutions as a basic operational need. More importantly, organizations are trying to avoid any future operational expenses due to environmental protection and risks involved with hazardous situations.

Key Market Drivers

Risk Management

Risk management is a pivotal driver propelling the growth of the Global Environment, Health, and Safety (EHS) market. In today's dynamic business landscape, organizations face an array of environmental, health, and safety risks that can significantly impact their operations, reputation, and bottom line. Stringent regulatory frameworks globally demand a proactive approach to managing these risks, pushing companies to adopt comprehensive EHS solutions. The multifaceted nature of risks, encompassing environmental impact, workplace safety, and regulatory compliance, necessitates a strategic and integrated approach. EHS solutions provide a structured framework for organizations to identify, assess, and mitigate risks across their operations. These platforms leverage advanced technologies, including artificial intelligence and data analytics, to analyze vast datasets, enabling a more nuanced understanding of potential hazards.Moreover, the interconnectedness of global business operations accentuates the need for standardized risk management practices. Companies with diverse geographical footprints must navigate a complex web of regulations, making EHS solutions integral to ensuring compliance across borders. The ability of EHS technologies to streamline processes and harmonize risk management strategies contributes to operational efficiency and consistency in meeting regulatory requirements. Beyond regulatory compliance, companies recognize that effective risk management has broader implications for their sustainability and corporate social responsibility (CSR) efforts. Stakeholders, including customers, investors, and the wider community, increasingly scrutinize companies' EHS practices. Robust risk management not only safeguards against environmental incidents and workplace accidents but also positions companies as responsible global citizens committed to ethical practices and sustainability.

In an era where unforeseen challenges, such as the COVID-19 pandemic, underscore the importance of resilience, EHS solutions play a crucial role in pandemic response and preparedness. The integration of health monitoring and risk assessment tools within these platforms addresses the evolving landscape of workplace health and safety. In essence, the emphasis on risk management serves as a catalyst for the continued expansion of the Global EHS market, driving innovation, technological advancements, and a collective commitment to creating safer, more sustainable workplaces on a global scale.

Technological Advancements

The Global Environment, Health, and Safety (EHS) market are experiencing a transformative surge propelled by rapid technological advancements. As industries evolve, so do the challenges associated with environmental sustainability, occupational health, and safety. Technological innovations are at the forefront of addressing these challenges, making EHS solutions more sophisticated, comprehensive, and indispensable for businesses worldwide.One of the key drivers is the integration of cutting-edge technologies such as artificial intelligence (AI) and machine learning (ML) into EHS platforms. These technologies empower organizations to analyze vast datasets, identify patterns, and predict potential risks with unprecedented accuracy. AI-driven EHS systems not only enhance the efficiency of risk management but also enable proactive decision-making, preventing environmental incidents and workplace accidents before they occur. Furthermore, the rise of the Internet of Things (IoT) is revolutionizing how companies monitor and manage EHS aspects. IoT sensors and devices provide real-time data on environmental conditions, machinery performance, and employee well-being. This constant stream of data allows for timely interventions, ensuring that organizations can respond promptly to emerging risks and maintain a proactive stance in mitigating environmental and safety concerns.

Data analytics plays a pivotal role in extracting meaningful insights from the vast amounts of information generated by EHS systems. Advanced analytics tools enable organizations to derive actionable intelligence, facilitating evidence-based decision-making for risk mitigation and compliance. This data-driven approach not only enhances operational efficiency but also supports strategic planning for long-term sustainability.

The use of immersive technologies, such as virtual reality (VR) and augmented reality (AR), is another dimension of technological progress influencing the EHS market. These technologies are employed for training programs, allowing employees to simulate and experience potential hazards in a controlled virtual environment. This immersive training enhances safety awareness and preparedness, reducing the likelihood of accidents in real-world scenarios. In conclusion, technological advancements are driving a paradigm shift in the Global EHS market. Organizations that embrace these innovations gain a competitive edge by not only meeting regulatory requirements but also by fostering a culture of continuous improvement in environmental sustainability and occupational health and safety. As technology continues to evolve, the EHS market is poised for sustained growth, offering solutions that align with the ever-changing needs of modern businesses striving for a safer, more sustainable future.

Key Market Challenges

Diverse Regulatory Landscape

The diverse regulatory landscape presents a formidable challenge to the Global Environment, Health, and Safety (EHS) market, potentially hindering seamless adoption and standardization across industries. EHS practices are intricately linked to compliance with an array of regional, national, and international regulations, each with its unique set of requirements. Navigating this complex web of regulations demands a significant investment of time, resources, and expertise, contributing to a potential impediment for organizations aiming to implement consistent EHS strategies. Multinational corporations, in particular, face the arduous task of ensuring compliance with diverse regulatory frameworks across the various jurisdictions in which they operate. Regulatory variations pertaining to environmental standards, workplace safety, and health regulations require organizations to tailor their EHS practices to the specific requirements of each region, introducing complexity and potentially impeding the scalability of EHS solutions.The rapid evolution of regulations further exacerbates this challenge. As governments worldwide enact new laws or revise existing ones to address emerging environmental and safety concerns, organizations must continuously update their EHS strategies to stay compliant. This perpetual need for adaptation places a strain on resources and can lead to delays in implementing EHS initiatives. Additionally, the lack of standardization in regulatory requirements can result in ambiguity for organizations seeking a cohesive approach to risk management. Varied interpretations and enforcement mechanisms across different regions may lead to inconsistencies in EHS practices, diminishing the effectiveness of global risk mitigation efforts.

Addressing the challenge posed by the diverse regulatory landscape requires collaboration between regulatory bodies, industry stakeholders, and EHS solution providers. Establishing industry standards and promoting regulatory harmonization can streamline compliance efforts, making it easier for organizations to implement and maintain effective EHS programs. EHS solution providers can play a crucial role by developing flexible and adaptable systems that can accommodate diverse regulatory requirements, helping organizations navigate the intricate regulatory landscape with greater ease. Ultimately, achieving a balance between regulatory compliance and operational efficiency is pivotal for the continued success and widespread adoption of EHS practices globally.

Cost of Implementation

The Global Environment, Health, and Safety (EHS) market confronts a significant impediment in the form of the cost of implementation, which can potentially hamper widespread adoption across industries. The implementation of comprehensive EHS solutions involves a substantial upfront investment, encompassing the acquisition of EHS software, hardware infrastructure, training programs, and the hiring or training of skilled personnel. This financial commitment may present a barrier, particularly for small and medium-sized enterprises (SMEs) with limited resources. The initial cost of implementing EHS systems can be perceived as prohibitive for some organizations, deterring them from embracing these critical risk management tools. SMEs, in particular, may face challenges allocating budgets for EHS initiatives, diverting resources from other operational needs. The perceived high cost of implementation can lead to a reluctance to invest in EHS technologies, despite the long-term benefits they offer in terms of risk mitigation, compliance, and sustainability.Moreover, the complexity of EHS solutions, especially those incorporating advanced technologies such as artificial intelligence and IoT, can contribute to higher implementation costs. Organizations may need to invest in specialized training programs to ensure that their workforce can effectively navigate and utilize these sophisticated systems, adding to the overall expense.

To overcome this challenge, EHS solution providers need to emphasize the long-term return on investment (ROI) that organizations can achieve through the implementation of these systems. Demonstrating how EHS technologies can lead to cost savings through accident prevention, regulatory compliance, and operational efficiency is crucial. Additionally, offering scalable solutions that cater to the specific needs and budget constraints of diverse organizations can enhance market accessibility. Government incentives and industry initiatives that promote the adoption of EHS practices, particularly among smaller businesses, can also play a pivotal role. By addressing the perceived financial barriers and emphasizing the broader benefits of EHS implementation, the market can overcome the challenge of the cost of implementation and foster a culture of proactive risk management and sustainability in organizations of all sizes.

Data Security and Privacy Concerns

Data security and privacy concerns pose substantial challenges to the growth and widespread adoption of the Global Environment, Health, and Safety (EHS) market. As organizations increasingly rely on EHS solutions to manage environmental impact, occupational health, and safety risks, the handling of sensitive data becomes a critical focal point. The very nature of EHS systems involves the collection, processing, and analysis of large volumes of confidential information, ranging from employee health records to intricate environmental impact assessments. One of the primary challenges is the need to ensure robust data security measures to safeguard against unauthorized access, breaches, and potential cyber threats. Given the sensitive nature of the information handled by EHS platforms, any compromise in data security could have severe consequences, including legal repercussions, damage to corporate reputation, and the compromise of individuals' privacy.The regulatory landscape surrounding data protection further intensifies these challenges. As global data protection regulations, such as the General Data Protection Regulation (GDPR) and other regional frameworks, become more stringent, EHS providers and organizations must navigate complex compliance requirements. This involves implementing rigorous privacy policies, ensuring transparent data practices, and obtaining explicit consent for data processing. Moreover, the challenge extends to the interoperability of EHS systems with other enterprise systems. Integrating EHS solutions with existing systems while maintaining data security standards can be intricate, requiring meticulous planning and execution to prevent vulnerabilities.

Organizations that operate on a global scale face the added complexity of adhering to different data protection laws in various jurisdictions. This diversity of regulatory requirements necessitates a nuanced approach to data security and privacy to ensure compliance across regions. Addressing data security and privacy concerns in the EHS market requires a collaborative effort among technology providers, regulatory bodies, and organizations. This involves ongoing investments in cybersecurity measures, employee training on data protection best practices, and the development of transparent policies to build trust among stakeholders. Successfully navigating these challenges is imperative for the continued growth of the EHS market, as organizations seek to balance the benefits of data-driven insights with the imperative to protect sensitive information and uphold individual privacy rights.

Key Market Trends

Focus on Occupational Health and Well-being

A significant driver propelling the Global Environment, Health, and Safety (EHS) market is the increasing focus on occupational health and well-being within organizations. Recognizing the intrinsic link between a healthy workforce and overall operational success, companies are prioritizing initiatives that go beyond traditional safety measures to encompass the broader spectrum of employee well-being. This holistic approach to EHS not only enhances workplace safety but also contributes to improved productivity, employee satisfaction, and corporate reputation. The global shift toward prioritizing occupational health and well-being is underscored by the realization that a healthy workforce is a more productive and engaged workforce. EHS programs now extend beyond hazard prevention to include comprehensive health and wellness initiatives. Companies are investing in technologies and strategies that monitor and enhance the physical and mental well-being of employees, fostering a culture of care and support.The COVID-19 pandemic has further accelerated this trend, highlighting the importance of employee health and safety in unprecedented ways. Organizations are integrating health monitoring tools, wellness apps, and mental health support programs into their EHS frameworks. Technologies such as wearable devices and digital platforms enable real-time tracking of health metrics, facilitating early intervention and preventive measures. Beyond regulatory compliance, the emphasis on occupational health and well-being aligns with the broader goals of attracting and retaining top talent. Companies that prioritize employee welfare create a positive workplace culture, leading to increased employee loyalty and reduced absenteeism.

The integration of occupational health and well-being initiatives into EHS strategies also serves as a proactive risk management approach. By addressing health concerns and promoting a healthy lifestyle, organizations can potentially reduce the incidence of workplace injuries and illnesses, resulting in long-term cost savings and enhanced operational resilience. In conclusion, the increasing focus on occupational health and well-being is transforming the landscape of the Global EHS market. Companies that champion employee welfare not only fulfill their moral and ethical responsibilities but also position themselves as employers of choice in an increasingly competitive global marketplace. As this trend continues to gain momentum, it is poised to drive innovation and investment in EHS solutions that prioritize the health and well-being of the workforce.

Digital Transformation in EHS

The ongoing digital transformation is emerging as a powerful driver propelling the Global Environment, Health, and Safety (EHS) market to new heights. The integration of digital technologies into EHS practices is fundamentally reshaping how organizations approach environmental sustainability, occupational health, and safety. This digital evolution is not merely a technological upgrade; it represents a paradigm shift, fostering efficiency, transparency, and innovation in EHS management. Cloud-based EHS solutions are at the forefront of this transformation, offering organizations the ability to centralize and streamline their EHS data and processes. Cloud platforms facilitate real-time collaboration, enabling stakeholders to access critical information from anywhere, at any time. This accessibility enhances the agility of EHS programs, allowing organizations to respond swiftly to emerging risks and regulatory changes.Mobile applications and connected devices play a pivotal role in the digital transformation of EHS. These technologies empower frontline workers to collect and report data in real-time, enhancing the accuracy and timeliness of information. Wearables and sensors contribute to a more granular understanding of workplace conditions, providing insights that facilitate proactive risk management and improve overall occupational safety. Data analytics is a key enabler of informed decision-making within EHS. Advanced analytics tools process vast datasets, offering actionable insights that support strategic planning and risk mitigation. Predictive analytics models can anticipate potential hazards, allowing organizations to implement preventive measures and enhance overall safety performance.

Furthermore, digital transformation in EHS aligns with broader organizational goals related to sustainability and corporate social responsibility (CSR). The ability to monitor, measure, and report environmental impact data digitally allows companies to demonstrate their commitment to sustainable practices transparently. As the global business landscape continues to evolve, organizations recognize that digital transformation is not only a technological imperative but a strategic necessity. EHS solutions that embrace digital technologies are not only more efficient but also contribute to a culture of continuous improvement, innovation, and resilience. In essence, the ongoing digital transformation in EHS is driving the market forward by providing organizations with the tools they need to navigate a complex regulatory environment, enhance operational efficiency, and meet the growing expectations for environmental and occupational safety standards.

Segmental Insights

Deployment Type Insights

Cloud segment is expected to hold the largest share of Environmental Health & Safety Software Market for during the forecast period.Regional Insights

North America is expected to dominate the market during the forecast period. North America, particularly the United States and Canada, has been a significant market for EHS software. The region has stringent environmental and occupational health and safety regulations, driving the adoption of EHS software solutions. Additionally, industries such as manufacturing, energy, and healthcare in North America have been early adopters of EHS software to manage compliance, safety, and risk mitigation.Moreover, the region has a strong foothold of EHS software vendors contributing positively to the market's growth. Some vendors based out of North America include Intelex Technologies Inc., VelocityEHS, Sai Global Pty Limited, Dakota Software Corporation, and Gensuite.

Several players are taking the initiative to strive for zero safety incidents and minimize the impact of their operations on the environment. For instance, ProcessMAPCorporation, a data-intelligence-driven software solutions provider which helps empower customers to transform into a sustainable enterprises, recently announced that Fortune Brands Home & Security, Inc., a Fortune 500 company, will drive the digital transformation of its global EHS and ESG initiatives by leveraging ProcessMAP'ssmart and actionable data-intelligence solutions.

Vendors in the region are enhancing their EHS software solutions. VelocityEHS, a player in cloud-based environmental, health, safety (EHS), and sustainability software, recently acquired Kinetica Labs, a pioneer in developing sensing and simulation technology for occupational safety and health in Ann Arbor.

Similarly, VelocityEHS recently acquired OneLook Systems, an Irish software firm. The acquisition will boost its enterprise-wide platform services and capacity to assist users in addressing emerging risk management concerns related to the COVID-19 outbreak and beyond.

Report Scope:

In this report, the Global Environmental Health & Safety Software Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Global Environmental Health & Safety Software Market, By Deployment Mode:

- Cloud

- On-Premises

Global Environmental Health & Safety Software Market, By End-user Vertical:

- Oil and Gas

- Energy and Utilities

- Healthcare and Life Sciences

- Construction and Manufacturing

- Chemicals

- Mining and Metals

- Food and Beverages

- Other

Global Environmental Health & Safety Software Market, By Region:

- North America

- United States

- Canada

- Mexico

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Indonesia

- Europe

- Germany

- United Kingdom

- France

- Russia

- Spain

- South America

- Brazil

- Argentina

- Middle East & Africa

- Saudi Arabia

- South Africa

- Egypt

- UAE

- Israel

Competitive Landscape

Company Profiles: Detailed analysis of the major companies presents in the Global Environmental Health & Safety Software Market.Available Customizations:

Global Environmental Health & Safety Software Market report with the given market data, the publisher offers customizations according to a company's specific needs.This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Enablon (Wolters Kluwer N.V.)

- Intelex Technologies, ULC

- VelocityEHS Holdings Inc.

- Cority Software Inc.

- Sphera Solutions, Inc.

- Sai Global Pty Limited (Intertek Group Plc)

- Dakota Software Corporation

- Benchmark Digital Partners LLC

- ProcessMAP Corporation

- Quintec GmbH

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 190 |

| Published | November 2023 |

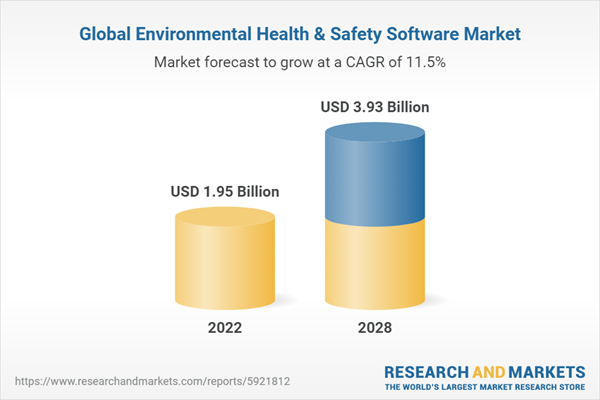

| Forecast Period | 2022 - 2028 |

| Estimated Market Value ( USD | $ 1.95 Billion |

| Forecasted Market Value ( USD | $ 3.93 Billion |

| Compound Annual Growth Rate | 11.4% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |