Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Despite the optimistic outlook, the market faces certain challenges. One of the key challenges is the dependency on imports for raw materials, which can potentially hinder the growth potential. Additionally, the lack of advanced manufacturing technologies poses another hurdle that needs to be addressed. However, it is important to note that ongoing research and development activities are being conducted to overcome these obstacles.

Nevertheless, the Indian market is expected to overcome these hurdles and continue its upward trend in the electronic chemicals and materials market. In fact, it is poised for substantial growth in the coming years. As the country continues to embrace digitalization and increase its manufacturing capabilities, the demand for electronic chemicals and materials is set to spike, offering numerous opportunities for players in this market.

In conclusion, the electronic chemicals and materials market in India is on the precipice of significant growth. With the increasing focus on digitalization and the efforts to boost domestic manufacturing, the market is expected to thrive. By addressing the challenges and leveraging research and development activities, India is likely to establish itself as a key player in the global electronic chemicals and materials market.

Key Market Drivers

Growth in Electronic Industry

Electronic chemicals and materials, including wet chemicals, PCB laminates, and silicon wafers, play a crucial role in powering the electronic devices we rely on every day. From semiconductors to integrated circuits, these components form the backbone of modern technology. As India's electronic industry continues to expand at a rapid pace, the demand for these essential materials is surging in tandem, driven by the need for cutting-edge innovation and advanced manufacturing processes.The Indian electronics industry has experienced a remarkable resurgence in recent years, fueled by a combination of increased consumer demand and the government's ambitious 'Make in India' initiative. This strategic push to promote domestic manufacturing and attract foreign investment has created a favorable ecosystem for the growth of the electronics sector. With a thriving consumer market and a supportive policy framework, India has emerged as a global hub for electronics manufacturing.

In conclusion, the electronic chemicals and materials market in India is poised for significant growth, driven by the flourishing electronics industry and the country's commitment to technological advancement. As India continues to enhance its manufacturing capabilities, invest in research and development, and embrace digitalization, the demand for electronic chemicals and materials is set to skyrocket. This presents a promising future for the market, with ample opportunities for domestic and international players to contribute to and benefit from this dynamic industry.

Surge in Technological Advancements

Technological advancements in the electronics industry play a vital role in driving the electronic chemicals and materials market. These advancements, including nanotechnology, have had a profound impact on the market, leading to a notable shift towards Micro-Electro-Mechanical Systems (MEMS) and Nano-Electro-Mechanical Systems (NEMS). The emergence of cutting-edge technologies such as 5G and Artificial Intelligence (AI) further fuels the demand for semiconductors, which in turn require a diverse range of electronic chemicals and materials for their production.As technology continues to evolve at a rapid pace, it is expected that the demand for electronic chemicals and materials will continue to rise. This growth is primarily driven by the increasing number of electronic devices being used worldwide and the ongoing advancements in the electronics industry. The relentless pursuit of innovation and the integration of advanced technologies into various sectors contribute to the continuous expansion of India's electronic chemicals and materials market.

In conclusion, the surge in technological advancements serves as a major driving force behind the growth of India's electronic chemicals and materials market. As the country embraces these innovations and strives to stay at the forefront of technology, the market is poised for significant expansion in the coming years, presenting abundant opportunities for industry players and stakeholders alike.

Key Market Challenges

Volatility in Supply of Raw Materials

The frequent and persistent disruptions in raw material supplies often lead to significant market volatility. These disruptions can result from various factors such as export restrictions, bilateral dependencies, geopolitical tensions, and a lack of transparency in supply chains. The price volatility of raw materials, especially in the electronics sector, poses an ongoing challenge for businesses operating in this industry.In the case of India's electronic chemicals and materials market, any fluctuation in the supply of critical raw materials like wet chemicals, PCB laminates, and silicon wafers can have far-reaching consequences. Not only can it impact production schedules and costs, but it can also disrupt the overall market stability, affecting both manufacturers and consumers alike. This highlights the need for a proactive approach to managing raw material supply chains and mitigating the risks associated with market fluctuations.

Given the volatile nature of raw material supply, building resilience has become a key strategy for success in the electronics industry. Manufacturers are now focusing on developing robust and flexible supply chains that can withstand unforeseen disruptions. This includes diversifying supplier networks to reduce dependence on a single source, investing in advanced technology solutions to improve supply chain visibility and forecasting capabilities, and fostering strong relationships with suppliers built on trust and collaboration.

Implementing these strategies not only helps mitigate the impact of high raw material costs but also enables companies to navigate the uncertainties and challenges posed by a dynamic global market. By embracing resilience and adopting proactive measures, businesses in the electronics sector can enhance their competitiveness, ensure smoother operations, and better meet the evolving demands of their customers.

Key Market Trends

Growing Demand of Green Electronics

Green or eco-friendly electronics refer to electronic devices that are energy-efficient, manufactured using environmentally recyclable materials, and designed to be easily recyclable. The rising awareness about environmental sustainability among consumers and businesses has led to an increased demand for these green electronics. Not only do they help conserve energy and reduce waste, but they also contribute to the overall conservation of our planet.The shift towards green electronics manufacturing has had a profound impact on the electronic chemicals and materials market. As the demand for green electronics increases, so does the need for eco-friendly chemicals and materials used in their production. Manufacturers are now focusing on developing electronic chemicals and materials that have a lower environmental impact. This includes reducing the use of hazardous substances and opting for renewable or recyclable materials, such as bioplastics and bio-based materials.

In conclusion, the growing demand for green electronics is a significant trend shaping India's electronic chemicals and materials market. As more businesses and consumers prioritize sustainability, the market for green electronic chemicals and materials is set to experience substantial growth, promising a brighter and greener future for the electronics industry. By adopting green practices and embracing eco-friendly technologies, we can pave the way for a more sustainable and environmentally conscious world.

Segmental Insights

Type Insights

Based on the category of type, the silicon wafers segment emerged as the dominant player in the Indian market for Electronic Chemicals & Materials in 2023. Silicon wafers, thin slices of crystalline silicon, are of utmost importance in the realm of electronics manufacturing. They serve as the foundation for microelectronic devices, which are meticulously built both in and over them. Integrated circuits (ICs), the heart and soul of almost all electronic devices, heavily rely on these silicon wafers. This extensive application not only underscores their significance but also positions them as a leading segment in the electronic chemicals and materials market.The semiconductor industry, currently witnessing a global boom, owes its growth trajectory to the soaring demand for electronic devices. From smartphones and tablets to laptops and IoT devices, the world's hunger for cutting-edge technology shows no signs of abating. As a result, the demand for silicon wafers, being an integral component in semiconductor production, continues to surge in direct correlation with the growth of the semiconductor industry.

Application Insights

The printed circuit boards (PCBs) segment is projected to experience rapid growth during the forecast period. PCBs (Printed Circuit Boards) serve as the fundamental backbone of virtually all electronic devices, providing the necessary mechanical support and electrical connections for seamless functionality. With their intricate network of conductive pathways, PCBs play a pivotal role in the production of various electronic components, making them an indispensable part of the electronics industry.These compact yet vital components hold immense significance in the electronic chemicals and materials market, owing to their critical function. The demand for PCBs exhibits notable growth, primarily driven by the ever-expanding consumer electronics sector. Recent reports indicate that the India PCB market is expected to be dominated by consumer electronics, reflecting the increasing trend of digitization and the rising demand for smart devices. This surge in demand has consequently led to a substantial increase in the production of PCBs, further solidifying their position in the market.

As technology continues to advance, PCBs will continue to evolve and adapt to meet the demands of the ever-changing electronics landscape. Their role as a foundational element in electronic devices remains crucial, contributing to the seamless integration and efficient functioning of modern technology.

Regional Insights

West India emerged as the dominant player in the India Electronic Chemicals & Materials Market in 2023, holding the largest market share in terms of value. West India, comprising states like Maharashtra and Gujarat, is renowned for its robust industrial landscape. These states have emerged as major manufacturing hubs, fostering a thriving ecosystem for various industries. With a concentration of electronics manufacturing units, the demand for electronic chemicals and materials in this that plays region plays a has a pivotal role pivotal role in facilitating seamless role in facilitating seamless movement of in facilitating seamless movement of goods witnessed a significant upswing.In addition to its vibrant manufacturing sector, West India boasts exceptional infrastructure that plays a pivotal role in facilitating seamless movement of goods and services. The well-established transportation and logistics facilities ensure efficient supply chain management, while the presence of multiple seaports further enhances the import and export capabilities of electronic chemicals and materials.

Report Scope:

In this report, the India Electronic Chemicals & Materials Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:India Electronic Chemicals & Materials Market, By Type:

- Wet Chemicals

- PCB Laminates

- Silicon Wafers

- Others

India Electronic Chemicals & Materials Market, By Application:

- Semiconductors & Integrated Circuits (IC)

- Printed Circuit Boards (PCBs)

India Electronic Chemicals & Materials Market, By Region:

- North India

- East India

- West India

- South India

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the India Electronic Chemicals & Materials Market.Available Customizations:

India Electronic Chemicals & Materials Market report with the given market data, the publisher offers customizations according to a company's specific needs.This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Maharishi Solar Technology (P) limited

- BASF India Limited

- Ashland India Private Limited

- Merck Performance Materials Pvt. Ltd.

- SunEdison Energy India Pvt. Ltd.

- E.I. DuPont India Pvt. Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 77 |

| Published | November 2023 |

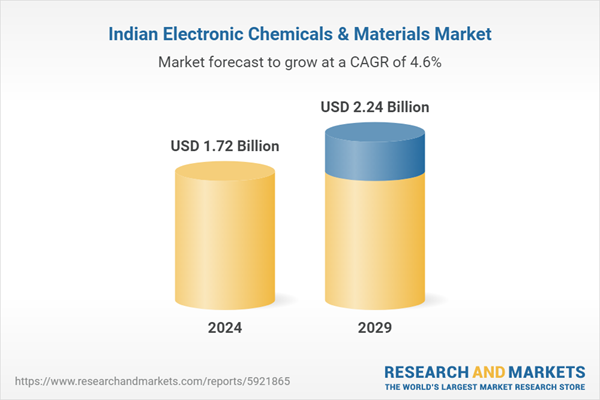

| Forecast Period | 2024 - 2029 |

| Estimated Market Value ( USD | $ 1.72 Billion |

| Forecasted Market Value ( USD | $ 2.24 Billion |

| Compound Annual Growth Rate | 4.5% |

| Regions Covered | India |

| No. of Companies Mentioned | 6 |