Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

The Indian acetic anhydride market is a significant component of the country's chemical industry, serving as a vital reagent and intermediate in various industrial processes. Acetic anhydride, a colorless liquid with a pungent odor, is employed in a wide range of sectors, including pharmaceuticals, textiles, and the manufacturing of cellulose acetate and other chemicals. India's expanding industrial landscape and the growth of industries such as pharmaceuticals and textiles have driven the demand for acetic anhydride.

The Indian acetic anhydride market has experienced substantial growth in recent years, primarily due to its significance in various industrial processes. Acetic anhydride is a critical chemical reagent and intermediate, playing an indispensable role in pharmaceutical synthesis, textile processing, and the manufacturing of cellulose acetate, a primary component in cigarette filters.

The pharmaceutical sector is a major driver of the acetic anhydride market in India. It is used in the synthesis of various pharmaceuticals, including pain relievers and anti-inflammatory drugs. The growth of the pharmaceutical industry has significantly increased the demand for acetic anhydride.

Acetic anhydride is employed in the textile industry for the acetylation of fibers and fabrics. This process improves the qualities of textiles, such as wrinkle resistance and flame retardancy. As India's textile sector continues to expand, the demand for acetic anhydride grows. Acetic anhydride serves as a versatile intermediate in the production of various chemicals, including acetyl compounds and cellulose acetate. As India's chemical sector grows, the demand for acetic anhydride as a chemical reagent and intermediate also increases.

Acetic anhydride is highly reactive and poses safety risks, particularly during transportation and handling. Stringent adherence to safety protocols is essential. The production and use of acetic anhydride can generate environmental concerns, particularly in terms of emissions and waste disposal. Compliance with environmental regulations is crucial.

There is a growing emphasis on adopting green and sustainable practices in acetic anhydride production. The industry is exploring cleaner and more environmentally friendly production methods. Research and development in the pharmaceutical sector are driving the demand for acetic anhydride as new drugs and pharmaceuticals are synthesized. The market's growth is closely linked to innovations in the pharmaceutical industry.

The future outlook for the Indian acetic anhydride market remains positive. As India's pharmaceutical, textile, and chemical sectors continue to grow, the demand for acetic anhydride is expected to persist. The industry is also likely to adapt to emerging trends, with a strong focus on green and sustainable practices in production, aligning with global efforts to promote environmental responsibility.

In conclusion, the Indian acetic anhydride market is an integral player in supporting the country's pharmaceuticals, textiles, and chemical industries. As India advances on its path of industrialization and environmental awareness, the market is poised to evolve and thrive, reinforcing its significance in the chemical and manufacturing landscape of the nation.

Key Market Drivers

Growing Demand for Pharmaceutical Production Propels Indian Acetic Anhydride Market Growth

The Indian acetic anhydride market is currently experiencing significant growth, primarily driven by the increasing demand for acetic anhydride in pharmaceutical production. Acetic anhydride, a vital chemical intermediate, plays a crucial role in various pharmaceutical manufacturing processes, and this demand is a major driver behind the expansion of the Indian acetic anhydride market.One of the key factors contributing to the surge in demand for acetic anhydride in India is the flourishing pharmaceutical industry. India has become a global pharmaceutical hub, producing a wide range of medicines, active pharmaceutical ingredients (APIs), and pharmaceutical intermediates. The pharmaceutical sector is a fundamental part of India's industrial landscape, contributing significantly to the country's economic growth and providing essential medicines to domestic and international markets.

Acetic anhydride is an indispensable component in the production of pharmaceuticals, serving as a key reagent in the synthesis of various APIs and pharmaceutical intermediates. It is employed in reactions such as acetylation, esterification, and amidation, which are essential for the synthesis of pharmaceutical compounds. As the pharmaceutical industry continues to expand its product portfolio and meets the increasing demand for medications, the need for acetic anhydride as a chemical reagent remains robust.

Furthermore, acetic anhydride is used in the production of aspirin, a widely used over-the-counter pain reliever and anti-inflammatory drug. Aspirin, also known as acetylsalicylic acid, is produced through the acetylation of salicylic acid with acetic anhydride. The growing demand for pain relief and anti-inflammatory medications, both in prescription and non-prescription forms, contributes to the demand for acetic anhydride in the pharmaceutical industry.

The production of various antibiotics, analgesics, and other pharmaceutical compounds also involves the use of acetic anhydride. The pharmaceutical industry encompasses a wide range of medications for various health conditions, and acetic anhydride is integral to the synthesis of many of these drugs.

The Indian pharmaceutical industry has witnessed significant growth in recent years, driven by factors such as increasing healthcare needs, a growing population, and the country's role as a global supplier of generic medicines. As the industry continues to evolve and expand, the demand for acetic anhydride in pharmaceutical manufacturing processes remains strong.

Moreover, the development and manufacturing of specialty pharmaceuticals, including complex formulations and targeted therapies, often require the use of acetic anhydride as a versatile reagent. The expansion of specialty pharmaceuticals, precision medicine, and biopharmaceuticals in India contributes to the demand for acetic anhydride as a key intermediate in their production.

In conclusion, the growing demand for acetic anhydride in pharmaceutical production, driven by the pharmaceutical industry's continued growth and the need for a wide range of medicines and pharmaceutical compounds, is a significant driving force behind the growth of the Indian acetic anhydride market. Acetic anhydride's essential role in the synthesis of APIs, pharmaceutical intermediates, aspirin, and various pharmaceutical compounds positions it as a crucial component of India's pharmaceutical manufacturing landscape. As India's pharmaceutical industry continues to expand and innovate to meet domestic and international healthcare needs, the demand for acetic anhydride remains strong, contributing to the country's economic development and the production of high-quality pharmaceuticals.

Rising Demand from the Different Industry for Chemical Manufacturing Propels India's Acetic Anhydride Market Growth

The Indian acetic anhydride market is currently experiencing significant growth, primarily driven by the increasing demand for acetic anhydride in various industries, especially in chemical manufacturing. Acetic anhydride, a versatile and vital chemical intermediate, plays a crucial role in numerous chemical processes and serves as a key reagent in the synthesis of various chemical compounds. This demand is a major driver behind the expansion of the Indian acetic anhydride market.One of the key factors contributing to the surge in demand for acetic anhydride in India is the booming chemical manufacturing industry. India is a significant player in the global chemical manufacturing landscape, producing a wide range of chemical products, including specialty chemicals, petrochemicals, agrochemicals, pharmaceutical ingredients, and more. The chemical industry is a fundamental part of India's industrial landscape, contributing significantly to the country's economic growth and export revenue.

Acetic anhydride is a versatile and indispensable component in chemical manufacturing, serving as a key precursor in the synthesis of various chemical compounds. It is used in a wide array of chemical reactions, including acetylation, esterification, and amidation, which are crucial to produce chemical intermediates and specialty chemicals. As the chemical industry diversifies and expands its product range to meet the needs of various applications, the demand for acetic anhydride as a chemical reagent remains robust.

The pharmaceutical industry in India is a major consumer of acetic anhydride, utilizing it in the synthesis of active pharmaceutical ingredients (APIs) and pharmaceutical intermediates. The growth of the pharmaceutical industry, driven by domestic and international demand for affordable and high-quality medicines, further contributes to the demand for acetic anhydride.

Moreover, acetic anhydride is used in the production of various specialty chemicals employed in various sectors, including cosmetics, personal care products, detergents, and cleaning agents. The growing consumer demand for specialty chemicals, driven by personal hygiene, beauty products, and home care, fuels the expansion of the chemical industry and, consequently, the demand for acetic anhydride.

The plastics and polymers industry are another significant consumer of acetic anhydride. It is used in the production of acetylated polymers, which have a wide range of applications, including adhesives, coatings, films, and synthetic fibers. The demand for specialty polymers with enhanced properties, such as adhesion, toughness, and chemical resistance, contributes to the use of acetic anhydride in this sector.

In addition, the textiles and apparel industry employ acetic anhydride in the acetylation of cellulosic fibers, a process that improves the fibers' dyeability, strength, and moisture absorption characteristics. As consumers seek high-quality textiles and apparel products, the demand for acetic anhydride in this industry remains strong.

The food and beverage industry also uses acetic anhydride in the acetylation of food additives and flavoring agents. It is employed in various food processing applications to enhance the stability and functionality of these additives. As the demand for processed and convenience foods grows, the use of acetic anhydride in food production continues to rise. Furthermore, acetic anhydride is employed in the production of acetate esters, which have various applications in the automotive, coatings, and plastics industries. These esters are used as solvents, plasticizers, and additives in various products.

In conclusion, the rising demand for acetic anhydride in various industries, driven by the need for chemical intermediates, pharmaceuticals, specialty chemicals, plastics, and other chemical products, is a significant driving force behind the growth of the Indian acetic anhydride market. Acetic anhydride's essential role in chemical manufacturing processes and the synthesis of a variety of chemical compounds positions it as a crucial component of India's industrial growth and product manufacturing. As India's chemical industry continues to diversify and expand to meet the demands of various applications and sectors, the demand for acetic anhydride remains strong, contributing to the country's economic development and the production of high-quality chemical products.

Rising Demand form Textile Industry Propelling the India Acetic Anhydride Market Growth

The Indian acetic anhydride market is currently witnessing significant growth, primarily driven by the rising demand from the textile industry. Acetic anhydride, a crucial chemical reagent, plays an essential role in various textile processes and serves as a key reagent in the acetylation of cellulose fibers, which enhances their dyeability and overall properties. This demand is a major driver behind the expansion of the Indian acetic anhydride market.One of the key factors contributing to the surge in demand for acetic anhydride in India is the thriving textile industry. The textile sector in India is one of the largest in the world, contributing significantly to the country's economy and providing employment to millions of people. India is renowned for its diverse range of textiles, including clothing, home textiles, technical textiles, and more. As the textile industry continues to evolve, innovate, and expand its product range, the demand for acetic anhydride as a chemical reagent remains robust.

Acetic anhydride is an essential component in the textile industry, especially in the acetylation of cellulosic fibers like cotton, rayon, and viscose. This process, known as the acetylation of cellulose, significantly improves the fibers' properties. It enhances their dyeability, strength, moisture absorption, and overall performance in various textile applications. As consumers seek high-quality textiles and apparel products with enhanced characteristics, the demand for acetic anhydride in this industry remains strong.

Moreover, the textile industry produces a wide range of products, including fashion apparel, home textiles, industrial textiles, and technical textiles. Each of these categories has its unique requirements for textile processing and performance. Acetic anhydride is used to modify and enhance the properties of cellulose fibers in line with the specific requirements of these diverse textile products.

The use of acetic anhydride in the textile industry is not limited to enhancing the physical properties of fibers but also includes achieving specific colors and finishes in textile products. Acetic anhydride is used in the acetylation of dyes and pigments, which are then applied to textiles to create vibrant and long-lasting colors and patterns. This process contributes to the textile industry's ability to provide consumers with a wide range of aesthetically appealing and visually attractive textile products.

As the textile industry continues to meet evolving consumer preferences, including sustainable and eco-friendly options, the use of acetic anhydride aligns with the global trend toward environmentally responsible practices. This includes the utilization of eco-friendly dyes, finishes, and textile processes. Acetic anhydride plays a vital role in achieving eco-friendly and sustainable solutions in textile production.

In conclusion, the rising demand from the textile industry, driven by the need for high-quality and aesthetically appealing textiles, is a significant driving force behind the growth of the acetic anhydride market in India. Acetic anhydride's essential role in the acetylation of cellulose fibers and dyes positions it as a crucial component of India's textile manufacturing landscape. As the textile industry continues to evolve and expand to meet the demands of diverse applications and consumer preferences, the demand for acetic anhydride remains strong, contributing to the country's economic development and the production of high-quality textiles.

Key Market Challenges

Highly Reactive and Safety Risks

The India Acetic Anhydride market faces significant obstacles due to its highly reactive nature and associated safety risks. Acetic anhydride is a versatile chemical compound used in various industries, such as pharmaceuticals, textiles, and the production of cellulose acetate fibers and plastics. However, its reactivity poses substantial safety challenges.Handling and storing acetic anhydride demand strict safety measures, as the chemical can cause severe burns upon contact with the skin and is highly flammable. Moreover, exposure to acetic anhydride fumes can irritate the eyes, nose, and throat and, in severe cases, lead to respiratory problems.

Stringent safety regulations and risk management are crucial to ensuring the safe production and handling of acetic anhydride, but these measures often increase operational costs. Moreover, the transportation and disposal of waste materials generated during production require careful management to avoid environmental contamination.

To navigate these safety concerns, the India Acetic Anhydride market must invest in advanced safety technologies, secure storage solutions, and rigorous safety protocols. It should also engage in close collaboration with regulatory authorities to ensure the responsible production and handling of this highly reactive chemical, promoting safety and mitigating associated risks.

Environmental Concerns

Environmental concerns are becoming a significant barrier to the India Acetic Anhydride market. Acetic anhydride is a versatile chemical used in various applications, including pharmaceuticals, textiles, and the production of cellulose acetate fibers and plastics. However, its production and usage have raised environmental apprehensions, primarily related to the responsible disposal of waste materials.Improper handling and disposal of acetic anhydride residues can lead to water and soil pollution, affecting ecosystems and public health. Furthermore, the production process itself may generate emissions and waste that contribute to environmental pollution.

As environmental awareness grows and regulatory measures become more stringent, the India Acetic Anhydride market is under pressure to adopt cleaner and more sustainable production methods, efficient waste management, and responsible disposal practices. Collaboration with regulatory authorities, the adoption of green and eco-friendly production techniques, and investment in research and development for cleaner technologies are essential to address these environmental concerns and ensure the long-term sustainability of the acetic anhydride market in India.

Key Market Trends

Growing Emphasis on Adopting Green and Sustainable Practices

The growing emphasis on adopting green and sustainable practices is a significant trend in the India Acetic Anhydride market. Acetic anhydride is a crucial chemical used in various industries, including pharmaceuticals, textiles, and food processing. As environmental consciousness and regulatory standards continue to evolve, there is an increasing demand for eco-friendly and sustainable production processes and materials.Manufacturers and industries are actively seeking ways to minimize their environmental impact by adopting cleaner and more sustainable practices. This includes optimizing manufacturing processes, reducing waste, and conserving energy. The adoption of green and sustainable practices is not only driven by regulatory pressures but also by changing consumer preferences, as people increasingly seek products and processes that are environmentally responsible.

The trend reflects India's commitment to sustainability, eco-conscious manufacturing, and responsible industrial practices. It underscores the importance of minimizing the environmental footprint in the production and use of chemicals like acetic anhydride. As this trend continues to gain momentum, the India Acetic Anhydride market is expected to evolve towards greener and more sustainable production methods, meeting both the environmental goals of the nation and the shifting preferences of consumers and industries.

Pharmaceutical Innovations

Pharmaceutical innovations have become a key trend in the India Acetic Anhydride market. Acetic anhydride is a vital chemical reagent used in various pharmaceutical processes, including the synthesis of various drugs and active pharmaceutical ingredients (APIs). The pharmaceutical industry in India is continually advancing, with a growing emphasis on research and development, the creation of novel drugs, and the enhancement of drug delivery methods. This innovation is driving the demand for acetic anhydride as a key chemical in the synthesis of these pharmaceutical compounds.Pharmaceutical innovations are focusing on developing new and more effective medications for various medical conditions, including those with high therapeutic value and reduced side effects. Acetic anhydride plays a crucial role in these innovative drug formulations, contributing to the success of these pharmaceutical products.

Moreover, the Indian pharmaceutical sector's growth is supported by the country's regulatory environment, which encourages innovation and the development of generic drugs. As India continues to make strides in pharmaceutical research and development, the demand for acetic anhydride is expected to increase as a vital component in these innovative processes. This trend highlights the pivotal role of acetic anhydride in pharmaceutical innovations, shaping the India Acetic Anhydride market and supporting advancements in the healthcare and pharmaceutical sectors.

Segmental Insights

Application Insights

Based on the application, the coating material segment emerged as the dominant player in the Indian market for Acetic Anhydride in 2023, driven by its pivotal role in various industrial and consumer applications. The dominance of the coating material segment can be attributed to the versatile and valuable properties of Acetic Anhydride in coatings. Acetic Anhydride is a key chemical used in the synthesis of cellulose acetate, a significant component in the production of high-quality coatings and lacquers. These coatings are widely utilized in the automotive, furniture, and construction industries, as well as for wood finishing and architectural applications.Furthermore, India's growing construction and automotive sectors, coupled with increased consumer awareness of product quality, have fueled the demand for coatings that provide enhanced durability, gloss, and protection. Acetic Anhydride's role in the production of high-performance coatings has made it a preferred choice in the coating material segment.

Moreover, the segment caters to the increasing emphasis on sustainable and eco-friendly coatings by supporting the development of water-based and low-VOC (volatile organic compounds) coatings. Acetic Anhydride contributes to the formulation of such environmentally responsible coatings.

In conclusion, the coating material segment's dominance in the Indian Acetic Anhydride market is a result of its critical role in providing high-quality coatings for a range of applications, its alignment with the nation's growth in construction and automotive industries, and its contribution to sustainable and eco-friendly coating solutions. This dominance is expected to persist as India's demand for advanced coatings continues to expand.

End User Insights

The pharmaceutical segment is projected to experience rapid growth during the forecast period, driven by its crucial role in pharmaceutical manufacturing and the pharmaceutical industry's growing demand for high-quality and pure chemicals. The dominance of the pharmaceutical segment can be attributed to Acetic Anhydride's significance in the synthesis of various pharmaceutical compounds and active ingredients. It is a key reagent in pharmaceutical research and production processes, playing a vital role in the creation of medications, including analgesics, antibiotics, and other essential drugs.The pharmaceutical sector in India has witnessed substantial growth, both domestically and in terms of exports. The country is a prominent player in the global pharmaceutical industry, and its commitment to quality and regulatory compliance has led to an increasing need for pure and high-quality chemicals like Acetic Anhydride.

Moreover, the stringent quality standards and regulations governing pharmaceutical manufacturing have further reinforced the dominance of this segment. Acetic Anhydride's reliability, consistency, and purity make it a preferred choice for pharmaceutical applications.

In conclusion, the pharmaceutical segment's dominance in the Indian Acetic Anhydride market is a result of its indispensable role in pharmaceutical production, its alignment with the nation's expanding pharmaceutical industry, and its contribution to the development of essential medications. This dominance is expected to persist as the pharmaceutical sector continues to grow and prioritizes product quality and regulatory compliance.

Regional Insights

Based on region, the Western region has firmly established itself as the dominant player, propelled by several key factors that have contributed to its strong presence and influence. One of the primary reasons for the Western region's dominance is its industrial strength and the presence of significant pharmaceutical and chemical manufacturing sectors. States like Maharashtra and Gujarat are home to a substantial number of pharmaceutical companies and chemical industries, all of which are major consumers of Acetic Anhydride. The region's robust industrial infrastructure, research and development facilities, and a conducive environment for manufacturing have played a pivotal role in its prominence.Furthermore, Gujarat, in particular, hosts numerous pharmaceutical manufacturing facilities, ensuring a consistent supply of high-quality Acetic Anhydride. The state's well-developed port infrastructure and logistical advantages make it an ideal location for the import and distribution of this essential chemical, meeting the demands of industries across the country.

The Western region's proactive approach to environmental regulations and its commitment to sustainability have also driven the demand for Acetic Anhydride, especially in the pharmaceutical and chemical industries, which prioritize eco-friendly and high-quality production processes.

In conclusion, the Western region's industrial diversity, well-established infrastructure, and strategic advantages have collectively established it as the dominant player in the Indian Acetic Anhydride market. This dominance is expected to persist as the region continues to thrive in various manufacturing sectors, especially in pharmaceuticals and chemicals, and as the demand for high-quality chemicals remains on the rise.

Report Scope:

In this report, the India Acetic Anhydride Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:India Acetic Anhydride Market, By Application:

- Coating Material

- Explosive

- Plasticizer

- Synthesizer

- Other

India Acetic Anhydride Market, By End User:

- Tobacco

- Pharmaceutical

- Laundry & Cleaning

- Agrochemical

- Textile

- Other

India Acetic Anhydride Market, By Region:

- West India

- North India

- South India

- East India

Competitive Landscape

Company Profiles: Detailed analysis of the major companies presents in the India Acetic Anhydride Market.Available Customizations:

India Acetic Anhydride Market report with the given market data, the publisher offers customizations according to a company's specific needs.This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Ralingtonpharma LLP

- Jubilant Ingrevia Limited

- Kakdiya Chemicals

- Shree Maruti IMPEX India

- Laxmi Organic Industries Limited

- Balaji Amines

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 182 |

| Published | November 2023 |

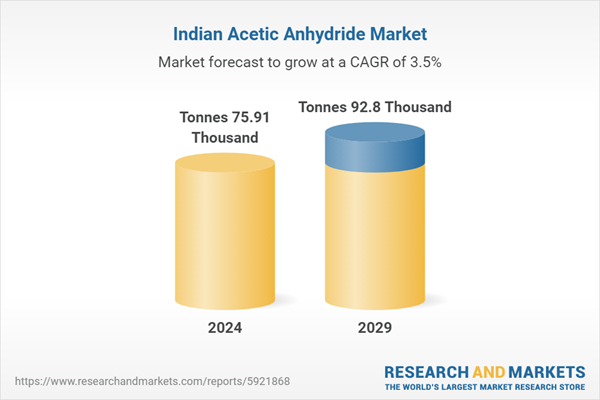

| Forecast Period | 2024 - 2029 |

| Estimated Market Value ( Tonnes | Tonnes 75.91 Thousand |

| Forecasted Market Value ( Tonnes | Tonnes 92.8 Thousand |

| Compound Annual Growth Rate | 3.4% |

| Regions Covered | India |

| No. of Companies Mentioned | 6 |