Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Moreover, the ongoing positive trend towards vehicle electrification is playing a crucial role in driving the expansion of the market. With the increasing demand for lightweight and energy-efficient components, there is a growing need to develop materials that can enhance fuel efficiency and extend battery range, specifically for electric vehicles. This presents a significant opportunity for transportation composites, as they possess unique properties that can help address these challenges and further improve overall performance. By leveraging the advantages of transportation composites, such as high strength-to-weight ratio and corrosion resistance, manufacturers can not only meet the requirements of electric vehicle technology but also contribute to the advancement of sustainable transportation solutions.

However, it is important to acknowledge that the market also faces certain challenges. One of the primary concerns is the relatively high production costs associated with composites. These costs include not only the raw materials but also the specialized manufacturing processes required to produce high-quality composite products. Although the benefits they offer, such as increased strength-to-weight ratio and corrosion resistance, outweigh the costs in the long run, the initial investment can be a significant barrier for some manufacturers, especially smaller ones.

In summary, the transportation composites market is witnessing remarkable growth due to the increasing demand for lightweight materials, driven by various transportation applications. The utilization of carbon fiber and glass fiber composites, along with the electrification of vehicles, is propelling the market forward. Nonetheless, addressing cost concerns and advancing recyclability efforts are key areas of focus to foster sustainable growth in the industry.

Additionally, the recyclability of composites remains a topic of ongoing research and development. While composites are known for their durability and longevity, finding sustainable solutions for end-of-life composites is crucial to minimize environmental impact and ensure the long-term viability of the industry. This includes exploring various recycling techniques, such as mechanical, thermal, and chemical recycling, to efficiently recover and reuse composite materials. Furthermore, advancements in composite design and manufacturing processes are being made to enhance recyclability and enable the development of more eco-friendly composites.

By diligently addressing these challenges and consistently investing in cutting-edge research and innovation, the composite industry can successfully overcome obstacles and firmly establish itself as a sustainable and indispensable component of numerous sectors. From aerospace and automotive to renewable energy, the composite industry continues to revolutionize the way we build and operate, providing lightweight, durable, and eco-friendly solutions that drive progress and shape a brighter future.

Key Market Drivers

Lightweighting Imperative in Automotive Industry

A primary driver for the Global Transportation Composites Market is the automotive industry's relentless pursuit of lightweighting to improve fuel efficiency and reduce emissions. Composite materials, such as carbon fiber-reinforced polymers (CFRPs) and glass fiber-reinforced polymers (GFRPs), offer an attractive solution by providing high strength-to-weight ratios. The use of composites in automotive components, including body panels, chassis, and interior parts, contributes to a significant reduction in overall vehicle weight.Lightweight vehicles exhibit improved fuel efficiency, better handling, and reduced environmental impact. As automakers face increasingly stringent emissions standards and consumers demand more sustainable transportation options, the adoption of composite materials becomes instrumental. The Global Transportation Composites Market, therefore, experiences a surge in demand as automakers integrate composites to achieve weight reduction without compromising structural integrity or safety.

Aerospace Industry Embracing Advanced Materials

The aerospace sector serves as a major driver for the Global Transportation Composites Market, leveraging advanced composite materials for aircraft construction. Composites, including CFRPs and aramid fiber-reinforced polymers (AFRPs), are extensively used in aircraft components, such as wings, fuselage sections, and interior structures. These materials contribute to the aerospace industry's pursuit of lightweight, high-strength solutions to enhance fuel efficiency and overall performance.The aerospace sector's reliance on composites is driven by the need to reduce aircraft weight, leading to lower fuel consumption and operating costs. Additionally, composites offer resistance to corrosion and fatigue, prolonging the lifespan of aircraft. The ongoing development of composite materials with improved characteristics, such as increased fracture toughness and damage tolerance, ensures their continued adoption in the aerospace industry, bolstering the Global Transportation Composites Market.

Stringent Emission Regulations in the Automotive Sector

The Global Transportation Composites Market experiences a significant boost due to stringent emission regulations worldwide, particularly in the automotive sector. Governments and regulatory bodies are imposing strict standards to curb greenhouse gas emissions and promote cleaner, more sustainable transportation. Composite materials contribute to this goal by enabling automakers to manufacture lighter vehicles with lower fuel consumption and reduced exhaust emissions.Electric and hybrid vehicles, in particular, benefit from the use of composites as they strive to optimize energy efficiency and extend battery range. The adoption of composites aligns with the automotive industry's commitment to meeting emission targets and achieving a more sustainable mobility landscape. As regulatory pressures intensify, the demand for composite materials in the transportation sector is poised to escalate, driving innovation and market expansion.

Advancements in Composite Manufacturing Technologies

Technological advancements in composite manufacturing processes play a pivotal role in propelling the Global Transportation Composites Market. Innovations such as automated fiber placement (AFP), resin transfer molding (RTM), and out-of-autoclave (OOA) processes enhance the efficiency, scalability, and cost-effectiveness of composite production. These advancements address historical challenges related to high production costs and limited throughput, making composites more viable for large-scale automotive and aerospace applications.Improved manufacturing technologies contribute to the widespread adoption of composites by reducing cycle times, enhancing material utilization, and enabling the production of complex geometries. As composite manufacturing becomes more accessible and economically viable, industries within the transportation sector are increasingly integrating composite materials into their designs. This trend stimulates market growth by unlocking new opportunities and expanding the application scope of transportation composites.

Growing Demand for Electric and Autonomous Vehicles

The rise of electric and autonomous vehicles represents a significant driver for the Global Transportation Composites Market. Both vehicle categories prioritize weight reduction to maximize battery efficiency in electric vehicles and enhance overall performance in autonomous platforms. Composites, with their high strength and light weight, are integral to achieving these objectives.Electric vehicles (EVs) benefit from composites as they contribute to extending the vehicle's range by reducing weight. Additionally, the integration of composites in autonomous vehicle components, such as sensor housings and structural elements, supports the development of lightweight, technologically advanced platforms. As the automotive industry undergoes a transformative shift towards electric and autonomous mobility, the demand for transportation composites is propelled by the unique material requirements associated with these innovative vehicle technologies.

Key Market Challenges

High Material Costs and Price Volatility

One of the primary challenges confronting the Global Transportation Composites Market is the high cost of composite materials. Advanced composites, such as carbon fiber-reinforced polymers (CFRPs) and aramid fiber-reinforced polymers (AFRPs), often come with a hefty price tag due to the complex manufacturing processes and the raw materials involved. The cost of precursor materials, such as carbon fibers, significantly contributes to the overall expense.Price volatility in raw materials further exacerbates the challenge, as fluctuations in the costs of resin systems, fibers, and other components impact the financial stability of manufacturers and end-users. High material costs pose a barrier to widespread adoption, particularly in cost-sensitive industries such as automotive manufacturing. Balancing the need for cost-effective solutions with the demand for high-performance composite materials remains a critical challenge for stakeholders in the transportation composites market.

Recycling and End-of-Life Considerations

The Global Transportation Composites Market faces challenges related to the recycling and end-of-life management of composite materials. Many traditional composite materials, especially those incorporating thermosetting resins, pose difficulties in terms of recyclability. The intricate bonding and curing processes make it challenging to separate and recover the constituent materials efficiently.Regulatory pressures and increased environmental awareness heighten the importance of sustainable practices in the transportation industry. Addressing the recycling challenge requires the development of innovative recycling technologies and the design of composite materials with end-of-life considerations in mind. Industry stakeholders must invest in research and development to create recyclable composite materials and establish effective recycling processes to mitigate the environmental impact of composite waste.

Limited Standardization and Certification

The absence of comprehensive standards and certifications for composite materials in the transportation sector poses a significant challenge. Unlike traditional materials with well-established standards, composite materials often lack uniform specifications, making it difficult for manufacturers and end-users to navigate the selection and implementation of composites in various applications.Standardization is crucial for ensuring the reliability, safety, and performance of transportation components made from composite materials. The absence of widely accepted standards hampers the adoption of composites in critical applications, such as structural components in aircraft or safety-critical parts in automobiles. Achieving greater standardization and certification for transportation composites requires collaboration among industry participants, regulatory bodies, and standard-setting organizations.

Complexity in Manufacturing and Integration

The complex manufacturing processes and intricate integration requirements for composite materials present a substantial challenge for the Global Transportation Composites Market. Unlike traditional materials that often allow for simpler manufacturing techniques, composites demand specialized knowledge, equipment, and processes. Manufacturers must navigate challenges such as precise fiber placement, resin curing, and maintaining consistent quality throughout the production process.Integration challenges arise when incorporating composite components into existing transportation systems, especially in industries with well-established manufacturing practices. The need for specialized expertise and equipment adds complexity to the production cycle, influencing production costs and timelines. Addressing these challenges requires ongoing investments in manufacturing technologies, workforce training, and collaboration between composite material suppliers and transportation system manufacturers.

Durability and Long-Term Performance Concerns

Durability and long-term performance are critical considerations in the Global Transportation Composites Market, particularly in industries such as aerospace and automotive where components must withstand rigorous operating conditions. Concerns regarding the long-term performance of composite materials, including issues such as fatigue, environmental degradation, and structural integrity over extended service life, pose challenges for widespread adoption.The durability challenge is especially pronounced in applications subject to harsh environmental conditions, dynamic loading, and temperature extremes. Manufacturers and end-users must address questions related to the long-term reliability of composites, conducting thorough testing and lifecycle assessments to ensure that composite components meet or exceed the performance expectations established for traditional materials. Overcoming durability concerns requires ongoing research, testing, and advancements in material formulations and manufacturing processes.

Key Market Trends

Increased Adoption of Carbon Fiber Composites

Carbon fiber composites are gaining prominence in the Global Transportation Composites Market, particularly in high-performance applications across automotive, aerospace, and other transportation sectors. Carbon fiber-reinforced polymers (CFRPs) offer an exceptional strength-to-weight ratio, making them ideal for lightweighting initiatives. In the automotive industry, carbon fiber components contribute to reduced vehicle weight, improving fuel efficiency and overall performance.The aerospace sector has been a pioneer in the adoption of carbon fiber composites for aircraft components, including wings, fuselage sections, and interior structures. The increasing affordability of carbon fiber, advancements in manufacturing processes, and ongoing research to enhance its properties contribute to the expanding use of carbon fiber composites in the transportation industry. As industries strive for greater fuel efficiency and sustainability, carbon fiber composites are becoming integral to the design and construction of lightweight, high-strength transportation components.

Rise of Sustainable and Bio-based Composites

Sustainability is a key trend shaping the Global Transportation Composites Market, leading to an increased focus on the development and adoption of sustainable and bio-based composites. Manufacturers are exploring alternative raw materials, such as bio-based resins and natural fibers, to create composites with lower environmental impact. These sustainable composites offer advantages in terms of reduced carbon footprint, energy consumption, and reliance on non-renewable resources.Sustainable composites find applications in various transportation sectors, including automotive interiors, marine components, and construction materials. Bio-based resins derived from renewable sources, such as plant-based feedstocks, contribute to the overall sustainability of composite materials. This trend aligns with the transportation industry's commitment to environmentally friendly practices and the reduction of reliance on traditional, non-renewable composite materials.

Advancements in Automated Manufacturing Technologies

The Global Transportation Composites Market is witnessing advancements in automated manufacturing technologies that enhance the efficiency and scalability of composite production. Automated fiber placement (AFP), automated tape laying (ATL), and robotic composite manufacturing are gaining traction, allowing for precision in fiber placement and resin application. These technologies streamline the manufacturing process, reduce cycle times, and enhance the overall cost-effectiveness of composite production.Automation in composite manufacturing is particularly beneficial for large-scale applications in the automotive and aerospace industries. By leveraging automated technologies, manufacturers can achieve consistency in product quality, optimize material utilization, and produce complex geometries with greater precision. As automated manufacturing becomes more prevalent, it contributes to the broader trend of making composite materials more accessible and economically viable for a wider range of transportation applications.

Growing Application in Electric Vehicles (EVs)

The surge in the adoption of electric vehicles (EVs) is influencing the Global Transportation Composites Market, with composite materials playing a crucial role in the design and production of electric vehicles. The lightweight properties of composites contribute to extending the range of electric vehicles, addressing one of the key challenges in EV development. Composite materials are utilized in various components, including body panels, chassis parts, and interior structures, to achieve weight reduction without compromising safety or performance.

Electric vehicle manufacturers are increasingly incorporating composite materials to optimize energy efficiency, enhance battery range, and improve overall vehicle dynamics. The trend aligns with the automotive industry's transition towards sustainable mobility solutions, with composites playing a pivotal role in shaping the design and performance characteristics of electric vehicles. As the demand for electric vehicles continues to rise, the application of composites in this sector is expected to expand further.

Integration of Smart Technologies in Composite Structures

The integration of smart technologies in composite structures is emerging as a notable trend in the Global Transportation Composites Market. Smart composites incorporate sensors, actuators, and other embedded technologies to enable real-time monitoring, data collection, and responsive functionalities. This integration enhances the structural health monitoring of composite components, providing valuable insights into their performance, durability, and potential maintenance needs.Smart composites find applications in critical transportation components, such as aircraft wings, automotive structures, and marine components, where continuous monitoring is essential for safety and reliability. The use of sensors embedded in composites allows for early detection of damage, strain, or fatigue, enabling proactive maintenance and extending the lifespan of composite structures. As the demand for intelligent, connected systems grows, the integration of smart technologies in transportation composites is poised to become more widespread.

Segmental Insights

Vehicle Type Analysis

The global Transportation Composites Market has experienced significant growth, largely driven by advancements in vehicle designs across multiple industries. A diverse range of vehicle types – from passenger cars to commercial vehicles, and from marine vessels to aircraft – have increasingly adopted composite materials. These materials are prized for their strength-to-weight ratio and resistance to corrosion, which enable the creation of fuel-efficient and environmentally friendly modes of transportation. Moreover, the versatility of composites supports design innovations, allowing manufacturers to deliver vehicles with increased performance and safety features.Application Analysis

The global Transportation Composites Market is witnessing significant growth, primarily driven by the increasing demand for lightweight materials in the automotive industry. As the need for fuel efficiency continues to rise, composites, especially carbon fiber, are being extensively utilized in vehicle production. By incorporating composites, automakers can reduce weight and enhance fuel efficiency, leading to lower emissions and a greener transportation sector.In addition to the automotive industry, composites play a crucial role in the aviation sector. With their exceptional strength-to-weight ratio, composites are widely employed in manufacturing aircraft components. From wings and fuselages to interior panels and structural reinforcements, composites contribute to the overall efficiency, durability, and safety of modern aircraft.

The growth of the Transportation Composites Market is further fueled by continuous advancements in composite manufacturing and processing technologies. Innovations in resin systems, fiber reinforcements, and manufacturing techniques have resulted in improved performance, enhanced quality control, and increased production efficiency.

However, it is important to address the challenges associated with composites. The high cost of composites compared to traditional materials remains a barrier to widespread adoption. Additionally, the environmental impact of composite disposal raises concerns. Developing sustainable and cost-effective solutions for composite recycling and end-of-life management is crucial to ensure the long-term viability of the market.

Overall, the Transportation Composites Market is poised for continued growth as industries recognize the benefits of lightweight and high-performance materials. With ongoing research and development efforts, coupled with sustainable practices, the market is expected to thrive in the coming years.

Regional Insights

Regionally, the global Transportation Composites Market exhibits diverse trends and opportunities. The North American region, with its advanced automotive and aerospace sectors, demonstrates a high demand for composite materials, driven by a continuous quest for fuel-efficient and lightweight vehicles. Conversely, in the Asia Pacific region, rapid industrialization coupled with expanding public transportation networks propels the market. Meanwhile, in Europe, strict environmental regulations are pushing for the adoption of composites in transportation to reduce carbon emissions.Report Scope:

In this report, the Global Transportation Composites Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Transportation Composites Market, By Material Type:

- Glass Fiber

- Natural Fiber

- Carbon Fiber Composite

Transportation Composites Market, By Vehicle Type:

- Passenger Cars

- Commercial Vehicles

- Agriculture

- Threshers

Transportation Composites Market, By Resin:

- Thermoset

- Thermoplastic

Transportation Composites Market, By Application:

- Interior

- Exterior

- Underbody

Transportation Composites Market, By Region:

- Asia-Pacific

- China

- India

- Japan

- Indonesia

- Thailand

- South Korea

- Australia

- Europe & CIS

- Germany

- Spain

- France

- Russia

- Italy

- United Kingdom

- Belgium

- North America

- United States

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- South Africa

- Turkey

- Saudi Arabia

- UAE

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Transportation Composites Market.Available Customizations:

Global Transportation Composites Market report with the given market data, the publisher offers customizations according to a company's specific needs.This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Hexcel Corporation

- Solvay S.A.

- Owens Corning

- Toray Industries, Inc.

- Teijin Limited

- Mitsubishi

- Chemical Holdings Corporation

- Jushi Group Co. Ltd.

- SGL Group

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 178 |

| Published | November 2023 |

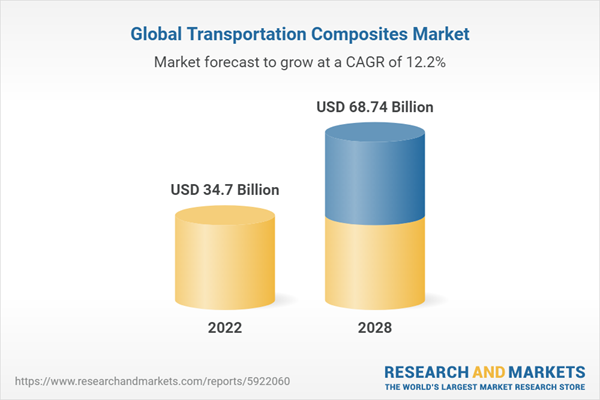

| Forecast Period | 2022 - 2028 |

| Estimated Market Value ( USD | $ 34.7 Billion |

| Forecasted Market Value ( USD | $ 68.74 Billion |

| Compound Annual Growth Rate | 12.2% |

| Regions Covered | Global |

| No. of Companies Mentioned | 9 |