Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

However, the market faces a substantial obstacle in the form of widespread counterfeit and non-compliant products that do not offer sufficient protection. These inferior items frequently skip necessary certification procedures, creating liability dangers for companies and risking worker safety. According to the British Safety Industry Federation, testing conducted in 2024 showed that 88 percent of safety footwear from non-registered suppliers failed to satisfy documentation requirements or performance claims. This situation forces authentic manufacturers to vie against ineffective, low-cost options, thereby complicating compliance initiatives and jeopardizing the integrity of the market.

Market Drivers

The rapid growth of the global infrastructure and construction industries serves as a major catalyst for the safety footwear market, creating a need for durable protective gear for an expanding workforce. As private companies and governments pour resources into commercial developments and urbanization, the hiring of on-site workers has increased, leading directly to higher procurement of boots built to resist punctures and heavy impacts. This increase in labor is evidenced by economic trends; according to the Associated General Contractors of America's "Construction Employment Analysis" from June 2024, the sector added 251,000 jobs between May 2023 and May 2024, signaling a sustained demand for skilled workers necessitating compliant safety equipment.Furthermore, rising activities in industrial manufacturing and production drive market growth, as facilities require specialized footwear to reduce risks related to slippery floors and heavy machinery. The continuous increase in global production compels facility managers to implement stringent personal protective equipment standards to ensure worker safety and operational stability. According to the United Nations Industrial Development Organization's "World Manufacturing Production Report" from December 2024, global manufacturing output rose by 0.4 percent in the third quarter of 2024, demonstrating the resilient industrial activity that supports PPE usage. This high level of operation requires strict adherence to safety protocols to avoid accidents; notably, the National Safety Council reported in 2024 that Fall Protection General Requirements were the most cited violation with 6,307 instances, emphasizing the crucial need for stabilizing and slip-resistant footwear in hazardous settings.

Market Challenges

The growth of the Global Industrial Safety Footwear Market is significantly hindered by the influx of counterfeit and non-compliant merchandise. These substandard products, which often look identical to certified equipment, saturate the market at much lower prices, undermining legitimate manufacturers who spend considerable resources on research and compliance. This price gap compels established brands to defend their market position against illicit competitors that avoid expensive testing, leading to reduced profit margins. As a result, the industry encounters a skewed competitive environment where low cost frequently supersedes quality, threatening the financial viability of compliant producers.Moreover, the existence of inadequate safety gear introduces major liability risks for industrial purchasers. If protective footwear fails, employers encounter legal consequences and employee injuries, causing reluctance during the purchasing process. Buyers must enact rigorous, time-intensive verification measures to guarantee authenticity, which slows down transaction rates. The gravity of this problem is underscored by recent statistics; according to the British Safety Industry Federation, market surveillance in 2025 indicated that 90 percent of personal protective equipment obtained from non-registered suppliers failed to meet essential regulatory safety standards. This ongoing non-compliance destroys market trust and impedes the wider acceptance of high-quality protective solutions.

Market Trends

The rise of gender-specific safety footwear is transforming product development as manufacturers respond to the essential safety and fit needs of the increasing number of women in the industrial workforce. Previously, women in trades were often limited to "unisex" boots that were simply smaller male versions, leading to discomfort, poor ergonomics, and higher accident risks due to ill-fitting gear. This trend forces brands to design footwear using female-specific lasts that accommodate differences in foot volume, heel width, and arch shape. The necessity of this change is highlighted by industry feedback; according to the "She Builds Nation" report by Lumber in March 2024, 67 percent of surveyed tradeswomen noted a significant lack of gender-appropriate safety equipment, specifically pointing out the shortage of properly sized protective gear in the market.Concurrently, the use of eco-friendly and sustainable materials has become a key focus for manufacturers aiming to achieve corporate environmental, social, and governance (ESG) objectives. Brands are progressively substituting traditional heavy leathers and petroleum-based plastics with bio-based polymers, recycled synthetics, and responsibly sourced textiles to decrease production carbon footprints. This shift goes beyond upper materials to encompass eco-conscious sole technologies that uphold strict safety standards while lessening environmental impact. For example, according to Bata Industrials' launch announcement for their "Enduro ACT" collection in February 2024, the manufacturer successfully incorporated 20 percent bio-based polyurethane compounds into midsole production, illustrating a concrete move toward reducing reliance on fossil fuels in industrial PPE.

Key Players Profiled in the Industrial Safety Footwear Market

- JAL Group

- COFRA S.r.l

- Dunlop Boots

- Hewats Edinburgh

- Honeywell International Inc.

- RAHMAN Group

- Rock Fall (UK) Ltd.

- Uvex Group

- VF Corporation

- Wolverine

Report Scope

In this report, the Global Industrial Safety Footwear Market has been segmented into the following categories:Industrial Safety Footwear Market, by Type:

- Leather

- Rubber

- Plastic

- Others

Industrial Safety Footwear Market, by Application:

- Construction

- Manufacturing

- Mining

- Oil And Gas

- Chemical

- Food

- Pharmaceuticals

- Transportation

- Others

Industrial Safety Footwear Market, by Distribution Channel:

- Offline

- Online

Industrial Safety Footwear Market, by Region:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Industrial Safety Footwear Market.Available Customization

The analyst offers customization according to your specific needs. The following customization options are available for the report:- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The key players profiled in this Industrial Safety Footwear market report include:- JAL Group

- COFRA S.r.l

- Dunlop Boots

- Hewats Edinburgh

- Honeywell International Inc

- RAHMAN Group

- Rock Fall (UK) Ltd

- Uvex Group

- VF Corporation

- Wolverine

Table Information

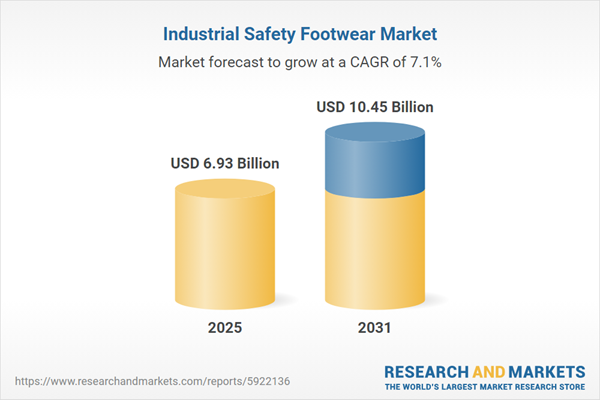

| Report Attribute | Details |

|---|---|

| No. of Pages | 185 |

| Published | January 2026 |

| Forecast Period | 2025 - 2031 |

| Estimated Market Value ( USD | $ 6.93 Billion |

| Forecasted Market Value ( USD | $ 10.45 Billion |

| Compound Annual Growth Rate | 7.0% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |