Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Key Market Drivers

Cost Reduction

Cost reduction is a primary driver propelling the adoption of Artificial Intelligence (AI) in the global oil and gas market. The oil and gas industry, known for its capital-intensive nature, is constantly seeking innovative solutions to streamline operations and enhance economic viability. AI technologies play a pivotal role in achieving significant cost reductions across various facets of the industry. One key area where AI contributes to cost reduction is operational efficiency. Machine learning algorithms analyze vast datasets generated by sensors, drilling activities, and production processes in real-time. By identifying patterns and correlations within this data, AI systems can optimize operational workflows, resulting in increased efficiency and reduced resource wastage. Predictive maintenance powered by AI is another crucial aspect, helping operators identify and address equipment issues before they escalate into costly failures. This not only minimizes downtime but also extends the lifespan of equipment, contributing to substantial cost savings.Reservoir exploration and production optimization are also areas where AI-driven technologies significantly impact cost reduction. Advanced analytics and machine learning models enhance reservoir characterization and simulation, leading to more accurate predictions of reservoir behavior. This, in turn, enables operators to optimize production strategies, maximize recovery rates, and minimize unnecessary expenditures.

The deployment of AI in health, safety, and environmental initiatives further reduces costs associated with accidents, downtime, and regulatory non-compliance. By leveraging AI for risk prediction and mitigation, companies enhance workplace safety, reduce the likelihood of environmental incidents, and ensure compliance with stringent regulations.

Moreover, the integration of AI-driven automation and robotics in drilling and maintenance activities reduces dependency on human labor, particularly in hazardous environments. Autonomous drones and robots can perform routine inspections and tasks, minimizing operational risks and associated costs. In essence, the emphasis on cost reduction acts as a catalyst for the widespread adoption of AI in the oil and gas sector. Companies recognize that the implementation of AI technologies not only enhances efficiency and operational capabilities but also delivers a tangible impact on the bottom line, making it a strategic imperative for remaining competitive in a dynamic and challenging industry landscape.

Data Analytics and Insights

The global adoption of Artificial Intelligence (AI) in the oil and gas industry is significantly driven by the pivotal role of data analytics and insights. In an industry characterized by massive volumes of data generated from sensors, exploration activities, and production processes, AI-powered data analytics emerges as a transformative force. The ability of AI algorithms to sift through, process, and derive actionable insights from this vast data landscape is crucial for informed decision-making and operational optimization.Data analytics in the oil and gas sector, powered by AI, brings forth a paradigm shift in reservoir exploration. Machine learning models analyze geological and geophysical data, providing a deeper understanding of reservoir characteristics. This enables companies to make more accurate predictions about reservoir behavior, optimizing drilling strategies and maximizing resource recovery. The result is not only increased operational efficiency but also significant cost savings. Real-time data analytics is instrumental in monitoring and managing drilling operations. AI algorithms process streaming data from drilling activities, identifying patterns and anomalies that might indicate potential issues. This proactive approach to data analysis allows for swift decision-making, reducing downtime and minimizing the risk of costly equipment failures. Predictive maintenance, a subset of data analytics, ensures that maintenance interventions are performed precisely when needed, preventing unnecessary disruptions and optimizing asset performance.

Beyond operational aspects, AI-driven data analytics contributes to health, safety, and environmental initiatives. By analyzing historical data, AI models can predict and prevent safety incidents, fostering a safer working environment. Environmental impact assessments and compliance monitoring benefit from the analytical capabilities of AI, ensuring adherence to regulatory standards. The significance of data analytics and insights in the oil and gas industry extends to market dynamics as well. AI facilitates market forecasting, helping companies make strategic decisions based on accurate predictions of supply and demand trends.

In essence, the integration of AI-driven data analytics and insights is a transformative force in the oil and gas sector, providing a competitive edge through enhanced decision-making, operational efficiency, and cost-effectiveness. As companies recognize the value of harnessing actionable insights from their data, the global AI in oil and gas market is poised for continued growth and innovation.

Key Market Challenges

Integration with Legacy Systems

The integration of Artificial Intelligence (AI) into the global oil and gas market faces a formidable challenge in the form of compatibility issues with legacy systems. Many companies within the industry operate with long-established infrastructure and technologies that were not originally designed to accommodate the advanced capabilities of AI. This mismatch between existing legacy systems and cutting-edge AI technologies poses a significant impediment to seamless integration, potentially hampering the widespread adoption of AI in the oil and gas sector.Legacy systems, often characterized by rigid architectures and proprietary technologies, may lack the necessary interfaces and adaptability to effectively incorporate AI solutions. The integration process becomes complex, requiring meticulous planning and execution to ensure that AI systems can communicate with and complement existing infrastructure. Upgrading or replacing legacy systems altogether may be financially and operationally impractical for many companies, especially given the capital-intensive nature of the oil and gas industry. The challenge is twofold, encompassing both technical and cultural aspects. On a technical level, integrating AI with legacy systems requires a deep understanding of the existing architecture, data formats, and communication protocols. Legacy systems may not readily provide the standardized data formats and accessibility required for seamless integration with AI algorithms, leading to data interoperability challenges.

Culturally, there may be resistance to change within organizations accustomed to established workflows and technologies. Employees may require training to adapt to the new AI-driven processes, and there may be concerns about potential disruptions during the integration process.

Efforts to overcome the integration challenge involve developing robust middleware solutions that act as bridges between legacy systems and AI applications. These intermediary layers facilitate data exchange and communication, ensuring that AI technologies can leverage the data stored in legacy systems. Additionally, industry collaboration and knowledge-sharing can help establish best practices for integrating AI with diverse legacy architectures.

As the industry recognizes the transformative potential of AI in enhancing efficiency, decision-making, and overall operational excellence, addressing the integration challenge becomes crucial. Innovative solutions, collaborative approaches, and strategic planning are essential to successfully navigate the complexities of integrating AI into existing legacy systems within the oil and gas sector.

High Implementation Costs

The high implementation costs associated with adopting Artificial Intelligence (AI) in the global oil and gas market represent a significant hurdle that has the potential to impede widespread integration. The oil and gas industry, known for its capital-intensive nature, is often constrained by budgetary considerations, and the substantial upfront investments required for implementing AI technologies can be a deterrent. The integration of AI involves multifaceted expenses, including the acquisition of advanced hardware and software infrastructure capable of handling large-scale data processing, the hiring of skilled professionals, and ongoing maintenance costs. The need for specialized AI talent, such as data scientists and machine learning experts, adds to the financial burden, as these professionals command competitive salaries in a highly competitive job market. Additionally, companies may need to invest in comprehensive training programs to upskill existing employees, further contributing to the overall implementation costs.For many oil and gas companies, particularly smaller and mid-sized enterprises, the high initial investment acts as a barrier to entry into the realm of AI adoption. This can result in a digital divide, with larger, more financially robust corporations reaping the benefits of AI-driven efficiencies while smaller players struggle to justify and afford the necessary investments. The result is a potential imbalance in competitiveness within the industry.

Moreover, the dynamic nature of AI technologies means that ongoing investments are essential to stay abreast of advancements and maintain the relevance of AI applications. Upgrading hardware, refreshing software, and adapting to evolving industry standards require additional financial commitments, making the total cost of ownership for AI implementations a long-term consideration.

To overcome the challenge posed by high implementation costs, industry stakeholders, including technology providers and government bodies, must collaborate to develop cost-effective solutions, promote research and development, and establish incentive programs to support AI adoption. Additionally, advancements in cloud-based AI solutions and innovative financing models may offer more accessible options for companies looking to integrate AI into their operations without the prohibitive upfront costs. Addressing the financial barriers to AI adoption is crucial for ensuring that the transformative potential of AI is realized across the entire spectrum of the oil and gas industry.

Lack of Skilled Workforce

The shortage of a skilled workforce stands out as a formidable challenge that has the potential to hamper the growth and implementation of Artificial Intelligence (AI) in the global oil and gas market. The successful integration of AI technologies into the industry requires a workforce with specialized expertise in data science, machine learning, and AI applications. Unfortunately, there is a notable scarcity of professionals possessing these specialized skills, creating a bottleneck for the widespread adoption of AI in the oil and gas sector.The complexity of AI technologies demands a workforce that not only understands the intricacies of data analytics and machine learning algorithms but also possesses domain-specific knowledge of the oil and gas industry. This unique skill set is not readily available, and companies face challenges in recruiting and retaining talent with the necessary qualifications. The competition for skilled AI professionals is intense, with industries across the board vying for these experts, making it even more challenging for the oil and gas sector to attract and retain top-tier talent.

Furthermore, the rapid evolution of AI technologies requires continuous upskilling and training for existing employees within the industry. The lack of accessible and comprehensive training programs exacerbates the skill gap, hindering the ability of oil and gas companies to fully harness the potential of AI.

The consequences of a shortage of skilled professionals are multifaceted. Implementation of AI applications may be delayed, leading to missed opportunities for operational optimization, cost reduction, and enhanced decision-making. Companies may also face increased costs associated with outsourcing AI projects or hiring external consultants, further straining budgets. Addressing the lack of a skilled workforce in AI for oil and gas requires a concerted effort from educational institutions, industry associations, and companies themselves. Investing in training programs, fostering collaboration between academia and industry, and promoting STEM (Science, Technology, Engineering, and Mathematics) education are essential components of mitigating this challenge. As the industry recognizes the transformative potential of AI, bridging the skill gap becomes imperative for ensuring a sustainable and successful integration of AI technologies in the oil and gas sector.

Key Market Trends

Automation and Robotics

Automation and robotics, powered by Artificial Intelligence (AI), are poised to be major drivers propelling the global AI market in the oil and gas industry. This transformative synergy between AI and robotics is revolutionizing traditional operational processes, enhancing efficiency, safety, and overall productivity within the sector. In drilling operations, autonomous drilling systems equipped with AI algorithms are becoming increasingly prevalent. These systems can analyze real-time data, adjust drilling parameters, and optimize the drilling process, leading to improved precision and reduced drilling times. Routine maintenance tasks in the oil and gas industry are being reshaped by AI-driven robotics. Drones and robots, equipped with advanced AI capabilities, are deployed for inspections and maintenance activities in hazardous environments. These autonomous systems can navigate complex terrain, conduct thorough inspections, and execute necessary repairs, minimizing the need for human intervention in potentially dangerous situations. This not only enhances safety protocols but also contributes to cost savings by reducing downtime associated with maintenance activities.Furthermore, AI-powered robotics play a crucial role in asset integrity management. Robots equipped with sensors and cameras can continuously monitor the condition of equipment and infrastructure, detecting anomalies or signs of wear. This proactive approach to asset management allows for early intervention and predictive maintenance, preventing costly failures and extending the lifespan of critical assets. The deployment of AI in automation and robotics aligns with the industry's goals of operational optimization, cost reduction, and adherence to stringent safety standards. It enables oil and gas companies to streamline operations, improve the precision and accuracy of tasks, and achieve higher levels of efficiency throughout the value chain.

As the industry continues to embrace digital transformation, the integration of AI-driven automation and robotics is expected to grow. This trend not only reflects a commitment to innovation but also underscores the industry's responsiveness to the evolving landscape and the need for sustainable and technologically advanced practices. Companies that invest in and leverage AI for automation and robotics are likely to gain a competitive edge, positioning themselves as leaders in the ongoing evolution of the global AI in the oil and gas market.

Predictive Maintenance

Predictive maintenance stands out as a driving force behind the evolution of the global AI in the oil and gas market. This strategic application of Artificial Intelligence (AI) is transforming the way the industry approaches equipment upkeep and operational reliability. By harnessing the power of machine learning algorithms, predictive maintenance analyzes vast datasets generated by sensors and equipment in real-time. The primary objective is to forecast potential equipment failures before they occur, enabling proactive maintenance interventions and minimizing downtime.In the context of the oil and gas sector, where operational downtime can result in substantial financial losses, predictive maintenance powered by AI emerges as a game-changer. Machine learning models are trained on historical data, learning patterns and trends associated with equipment performance. This predictive capability allows operators to identify early signs of equipment degradation or malfunction, providing a window of opportunity for timely maintenance or replacement.

The implementation of predictive maintenance offers several key advantages. Firstly, it significantly reduces unplanned downtime, enhancing overall operational efficiency. By addressing issues before they escalate into critical failures, companies can optimize asset utilization, maximize production output, and extend the lifespan of equipment. This directly translates into cost savings and improved profitability for oil and gas enterprises.

Secondly, predictive maintenance supports a shift from traditional, calendar-based maintenance schedules to a more data-driven and condition-based approach. This means that maintenance activities are performed precisely when needed, reducing unnecessary interventions and minimizing the associated costs. This optimization of maintenance schedules contributes to a more efficient allocation of resources and manpower.

Moreover, the utilization of AI in predictive maintenance fosters a shift from reactive to proactive asset management strategies. Rather than responding to equipment failures as they happen, operators can take a preventative stance, avoiding disruptions and optimizing the overall reliability of operations. As the oil and gas industry continues to recognize the immense value of predictive maintenance, the global AI market in this sector is poised for substantial growth. Companies investing in AI-driven predictive maintenance solutions are not only enhancing their operational resilience but also positioning themselves at the forefront of innovation in a highly competitive industry landscape. The evolution towards predictive maintenance is indicative of the broader trend in leveraging AI for strategic decision-making and efficiency gains in the oil and gas sector.

Segmental Insights

Operation Insights

Upstream segment is expected to hold the largest share of AI in Oil and Gas Market for during the forecast period, Oil and Gas industries worldwide are trying to make the oil exploration processes more efficient and optimized. The operations in this field are the major factors driving the usage of AI in oil and gas companies. The AI tools can help oil and gas companies digitize records and automate the analysis of the gathered geological data and charts, which can lead to the potential identification of issues, such as pipeline corrosion or increased equipment usage.Companies like BP and Royal Dutch Shell have planned to achieve net-zero carbon emissions by 2050 and are under increasing pressure to minimize their carbon footprint in compliance with the Paris Agreement. Shell is employing AI technology to do predictive maintenance of individual pieces of equipment or entire systems to reduce its carbon footprint. This factor allows the corporations to foresee and handle probable equipment faults before they occur.

Regional Insights

North America is expected to dominate the market during the forecast period. Owing to the increasing adoption of AI technologies across the oilfield operators and service providers and the robust presence of prominent AI software and system suppliers, especially in the United States and Canada, the North American segment is anticipated to account for the largest share of the AI in oil and gas market over the forecast period.Factors such as the strong economy, the high adoption rate of AI technologies across the oilfield operators and service providers, a robust presence of prominent AI software and system suppliers, and combined investment by government and private organizations for the development and growth of R&D activities are projected to drive the demand for AI in the oil and gas sector in the region.

ExxonMobil, one of the leading oil producers in the country, announced its plans to increase the production activity in the Permian Basin of West Texas by producing more than 1 million barrels per day (BPD) of oil equivalent by as early as 2024. This capacity is equivalent to an increase of nearly 80% compared to the present production capacity.

Report Scope:

In this report, the Global AI in Oil and Gas Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Global AI in Oil and Gas Market, By Operation:

- Upstream

- Midstream

- Downstream

Global AI in Oil and Gas Market, By Service Type:

- Professional Services

- Managed Service

Global AI in Oil and Gas Market, By Component:

- Solution

- Services

Global AI in Oil and Gas Market, By Region:

- North America

- United States

- Canada

- Mexico

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Indonesia

- Europe

- Germany

- United Kingdom

- France

- Russia

- Spain

- South America

- Brazil

- Argentina

- Middle East & Africa

- Saudi Arabia

- South Africa

- Egypt

- UAE

- Israel

Competitive Landscape

Company Profiles: Detailed analysis of the major companies presents in the Global AI in Oil and Gas Market.Available Customizations:

Global AI in Oil and Gas Market report with the given market data, the publisher offers customizations according to a company's specific needs.This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Google LLC

- IBM Corporation

- FuGenX Technologies Pvt. Ltd

- C3.AI

- Microsoft Corporation

- Intel Corporation

- Royal Dutch Shell PLC

- PJSC Gazprom Neft

- Huawei Technologies Co. Ltd

- NVIDIA Corp.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 178 |

| Published | November 2023 |

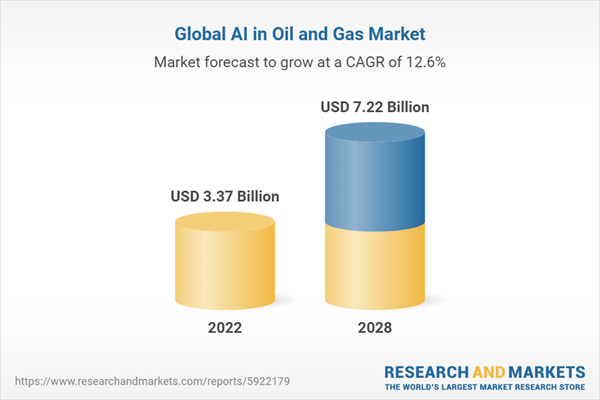

| Forecast Period | 2022 - 2028 |

| Estimated Market Value ( USD | $ 3.37 Billion |

| Forecasted Market Value ( USD | $ 7.22 Billion |

| Compound Annual Growth Rate | 12.6% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |