Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Veterinarians focus on preventive healthcare measures like vaccinations, regular check-ups, parasite control, dental care, and nutrition advice to safeguard animals from diseases and injuries. They employ diagnostic tools such as laboratory tests, imaging techniques (like X-rays, ultrasound, MRI), and physical examinations to identify health issues and provide appropriate treatments, including medications, surgeries, and other therapies. Veterinary surgeons perform a wide range of surgical procedures, from routine ones like spaying and neutering to more complex interventions for injuries, congenital abnormalities, and various medical conditions in animals.

Increasing awareness and concern for animal health and welfare, encompassing both pets and livestock, are driving the demand for veterinary products and services. This includes preventive care, vaccinations, and treatments for different health conditions. The integration of advanced technologies in veterinary diagnostics, treatments, and record-keeping enhances the efficiency and effectiveness of veterinary services, serving as a significant market driver. Awareness of zoonotic diseases, which can transfer between animals and humans, emphasizes the importance of preventive measures and disease control, further increasing the demand for veterinary services and products. Economic prosperity, particularly in the UAE, fosters higher spending on pet-related goods and services, including veterinary care. As disposable incomes increase, pet owners are more inclined to invest in the health and well-being of their animals.

Key Market Drivers

Increasing Pet Ownership

The surge in pet ownership across the UAE has emerged as a significant driver of the veterinary medicine market, reshaping the landscape of animal healthcare and creating substantial growth opportunities. Since the pandemic, pet ownership in the UAE has surged by over 30%, with a notable increase driven by two key demographic groups: young singles and seniors. These segments are primarily adopting cats and dogs, reflecting a significant shift in lifestyle preferences and companionship trends within the region. The UAE's growing expatriate population, coupled with an increase in disposable incomes, has contributed to a cultural shift in which pet ownership is becoming more widespread and socially accepted.Between 2016 and 2020, the number of pet dogs in the UAE increased by over 10,000. Despite the introduction of criminal penalties for pet abandonment in 2018, the issue persists, with a growing number of puppies and dogs being abandoned on the streets. This trend highlights a complex challenge within the pet ownership landscape, despite regulatory efforts to curb such behaviors. As more households adopt pets as companions, there is a corresponding rise in the demand for veterinary care, creating sustained opportunities for providers of medicines, vaccines, and healthcare solutions. With pets being increasingly viewed as family members, owners are prioritizing their health and well-being.

This has led to a surge in demand for preventive healthcare products, such as vaccines, deworming medications, flea and tick treatments, and nutritional supplements. This proactive approach to pet health drives steady sales in the veterinary pharmaceutical sector. The growing pet population has encouraged the expansion of veterinary clinics and hospitals, offering specialized services tailored to the needs of pets. These services often require advanced medicines and treatments, including antibiotics, pain management drugs, and chronic disease treatments, thus boosting market growth.

In the UAE, there is a notable trend toward the adoption of exotic pets, such as birds, reptiles, and small mammals, in addition to traditional pets like dogs and cats. These animals often require specialized care, diagnostic services, and specific medicines, driving further diversification and growth in the veterinary medicine market. Pet owners in the UAE are becoming more informed about the importance of regular veterinary check-ups and high-quality care. Awareness campaigns, often led by veterinary clinics, pet food companies, and pharmaceutical brands, have highlighted the benefits of preventive healthcare, which directly increases the demand for veterinary products and services.

The UAE’s affluent population has shown a preference for premium and specialized veterinary products, including organic or natural remedies, breed-specific nutrition, and advanced treatments for hereditary or lifestyle-related conditions in pets. This trend further propels the market toward high-value, innovative solutions. With the growing pet population, there has been a rise in cases of pet-related diseases, including parasitic infections, skin conditions, and age-related illnesses. This has amplified the need for veterinary medicines to treat a wide array of conditions, ranging from simple infections to more complex chronic diseases.

The availability of veterinary medicines and pet healthcare products on e-commerce platforms and retail stores has made it easier for pet owners to access necessary treatments. This accessibility has expanded the customer base for veterinary medicine providers, driving further growth in the sector. The growing adoption of pet insurance in the UAE is another factor driving the veterinary medicine market. With insurance covering a significant portion of medical costs, pet owners are more likely to seek advanced treatments and medications for their pets, contributing to the growth of the market. The UAE government has introduced initiatives to promote animal welfare, including mandatory vaccinations and pet registration programs.

These policies have indirectly increased the demand for veterinary medicines, as compliance with these regulations requires regular veterinary care. The increasing trend of pet ownership in the UAE is a cornerstone of growth for the veterinary medicine market. It has catalyzed demand for preventive and curative treatments, created opportunities for specialized products, and driven innovation within the sector. Businesses in the veterinary industry can capitalize on this trend by focusing on targeted marketing strategies, expanding product portfolios, and offering value-added services to meet the evolving needs of pet owners in the region.

Increasing Expatriate Population and Disposable Income

The UAE's expanding expatriate population, coupled with rising disposable incomes, plays a crucial role in driving the growth of the veterinary medicine market. Expatriates make up approximately 88% of the population in the United Arab Emirates, with Emiratis accounting for around 12%. This demographic distribution places the UAE second only to Vatican City in terms of the highest percentage of expatriates globally. The majority of immigrants are concentrated in Dubai and the capital, Abu Dhabi, where economic opportunities and urban development attract diverse international communities. These factors have created a strong demand for enhanced veterinary services, advanced medical products, and premium care for pets.The UAE’s cosmopolitan environment, fueled by a steadily growing expatriate population, has significantly contributed to increased pet ownership. Many expatriates, especially from Western and Asian countries, bring their cultural affinity for keeping pets as companions. This demographic shift has resulted in higher demand for veterinary services, medicines, vaccines, and preventive care solutions. The UAE’s high per capita income and rising disposable incomes among residents, particularly expatriates, enable pet owners to spend more on veterinary services and premium healthcare products. This includes specialized treatments, advanced diagnostics, and high-quality medicines for both preventive and curative care. Affluent consumers are also more likely to invest in luxury pet care, including personalized healthcare plans, driving further demand for advanced veterinary products.

Rising disposable incomes have led to a growing preference for premium and high-end veterinary products, such as organic supplements, breed-specific medications, and advanced treatments for chronic or hereditary conditions. This trend is particularly evident among expatriates, who often seek high-quality care to ensure the well-being of their pets, thereby boosting sales of premium medicines and treatments. With a large proportion of the UAE's population residing in urban centers such as Dubai and Abu Dhabi, there is an increased focus on the well-being of companion animals. Expatriates living in these urban areas often seek modern veterinary clinics that offer specialized services, such as dermatology, orthopedics, and dental care for pets.

These specialized services drive the need for targeted veterinary medicines and innovative healthcare solutions. Expatriates in the UAE are also known to adopt exotic pets, including birds, reptiles, and aquatic species. These animals often require unique care, including specialized diets and veterinary medicines tailored to their needs. This growing segment further diversifies the demand within the veterinary medicine market, creating opportunities for niche products and treatments. The increasing wealth of expatriates has fostered a cultural shift toward prioritizing pet health and well-being. Pet owners are more inclined to invest in preventive care, including vaccinations, regular check-ups, and nutritional supplements, to avoid long-term health complications. This proactive approach drives consistent demand for veterinary pharmaceuticals and related products.

Affluent expatriates often seek advanced medical treatments for their pets, including laser therapy, regenerative medicine, and sophisticated surgical procedures. The need for such high-end treatments fuels the development and sale of specialized veterinary medicines, contributing to market growth. The development of pet-friendly residential communities, often catering to expatriate families, has contributed to the normalization and increase of pet ownership in the UAE. These communities encourage a lifestyle that includes pets, indirectly supporting the growth of veterinary clinics, hospitals, and the pharmaceutical industry catering to pet healthcare.

Expatriates with higher incomes are more likely to opt for pet insurance plans, which cover a significant portion of veterinary expenses. This has encouraged pet owners to invest in comprehensive treatments, including advanced diagnostics and long-term medications, further driving the growth of the veterinary medicine market. With rising incomes, expatriates are more inclined toward holistic and sustainable solutions for their pets. This includes an increased demand for natural and organic veterinary medicines, eco-friendly products, and integrative healthcare solutions, which opens up new avenues for product innovation and market expansion.

The increasing expatriate population and rising disposable incomes in the UAE have created a dynamic and expanding market for veterinary medicine. By fostering higher spending on pet healthcare, encouraging demand for premium and specialized products, and driving innovation in veterinary treatments, these factors have established a strong growth trajectory for the sector. Businesses can tap into this lucrative market by offering tailored products and services, focusing on premium quality, and aligning with the evolving needs of the UAE’s diverse and affluent pet-owning population.

Rise in Zoonotic Diseases

Veterinary medicine plays a vital role in preventing and managing zoonotic diseases, which can be transmitted from animals to humans. Vaccinations, parasite control, and other preventative measures are fundamental aspects of veterinary care aimed at reducing the risk of disease transmission. Zoonotic diseases present significant public health challenges, necessitating effective veterinary interventions. By ensuring the health of animals, the potential for disease transmission is minimized, contributing to overall public health and safety.The One Health approach acknowledges the interdependence of human, animal, and environmental health, with veterinary medicine serving as a critical component in collaborative efforts to address zoonotic diseases and promote comprehensive well-being. Before this notification, the most recent MERS-CoV infection in the UAE was reported in November 2021. The first laboratory-confirmed case of MERS-CoV in the country was recorded in July 2013. Since then, the UAE has reported a total of 94 MERS-CoV cases, including the current one, resulting in 12 associated fatalities, yielding a Case Fatality Ratio (CFR) of 13%.

Veterinary professionals actively monitor animal populations to detect and control the spread of zoonotic diseases, recognizing that early detection is key to implementing effective prevention measures. The increasing prevalence of these diseases drives investments in research and development within the veterinary medicine sector, focusing on vaccines, diagnostics, and treatments tailored to zoonotic pathogens. Veterinary medicine plays a pivotal role in ensuring the safety of the food supply by monitoring and addressing diseases that can be transmitted through the consumption of animal products. With globalization and travel facilitating the spread of zoonotic diseases across borders, veterinary medicine becomes indispensable in implementing international standards, conducting health screenings, and preventing disease introduction into new regions.

Veterinary professionals also contribute to public education and awareness campaigns about zoonotic diseases, promoting responsible pet ownership and livestock management practices. During disease outbreaks, veterinary medicine is crucial for emergency response efforts, requiring rapid and coordinated responses to contain and manage diseases in both animal and human populations. Governments and regulatory bodies enforce measures to control the spread of zoonotic diseases, relying on veterinary medicine practices such as inspections, quarantines, and disease reporting for compliance. These factors are expected to drive demand in the UAE Veterinary Medicine Market.

Key Market Challenges

Market Competition

Intense competition often results in price pressure as businesses endeavor to offer competitive rates for veterinary products and services. This dynamic can impact profit margins, necessitating companies to seek ways to set themselves apart. With numerous competitors in the market, establishing and retaining customer loyalty becomes increasingly challenging. Veterinary practices and companies must prioritize investment in high-quality service, effective marketing strategies, and robust customer relationship management to retain clientele. To maintain a competitive edge, companies must continuously innovate, necessitating substantial investments in research and development to introduce new and enhanced veterinary products, technologies, and services.In highly competitive markets, there is a risk of market saturation, particularly within specific segments or geographic regions, which may constrain significant growth opportunities. Consequently, businesses may explore new markets or diversify their offerings to counteract saturation effects. In such environments, companies may need to allocate significant resources to advertising and promotional activities to differentiate themselves. These associated costs can strain budgets and impact overall profitability.

The competitive landscape can also exert pressure on the supply chain, influencing the procurement and distribution of veterinary products. Efficient supply chain management is crucial for meeting demand and ensuring product availability. Additionally, adhering to regulatory standards and compliance requirements is paramount in the veterinary medicine market. Competition often drives companies to make substantial investments in achieving and maintaining regulatory compliance, adding to operational costs.

Recruiting and retaining skilled professionals pose another challenge in competitive markets. Veterinary practices rely on qualified veterinarians, technicians, and support staff to deliver high-quality services, and heightened competition can intensify the difficulty of talent acquisition.

Climate and Environmental Factors

The United Arab Emirates (UAE) faces extreme temperatures, particularly during the summer, which can induce heat stress in animals, impacting their overall health. Veterinary medicine must address heat-related conditions and implement preventive measures to safeguard animal well-being. The desert climate of the UAE is prone to sandstorms, which can exacerbate respiratory issues in outdoor-housed animals. Veterinary care should prioritize respiratory health and devise strategies to protect animals during sandstorms.Water scarcity is a significant concern in arid regions like the UAE, emphasizing the importance of ensuring animals have access to clean, adequate water. Veterinary practices may need to address dehydration issues and waterborne diseases. Certain environmental conditions in the UAE facilitate the spread of vector-borne diseases. Veterinary medicine must focus on controlling and preventing diseases transmitted by vectors such as mosquitoes and ticks.

Livestock, notably camels, play a crucial role in the UAE's agricultural sector. Veterinary medicine should concentrate on managing diseases that can affect livestock health, considering the environmental conditions in which they are reared. With increasing urbanization, there's a potential impact on wildlife habitats. Veterinary professionals may be tasked with addressing health and well-being concerns of wildlife affected by urban development.

Key Market Trends

Focus on Pet Nutrition

The trend of treating pets as members of the family, commonly referred to as pet humanization, has heightened awareness regarding the importance of nutrition in enhancing the overall health and longevity of animals. With increasing rates of pet ownership in the UAE, the market for pet food and nutritional products has expanded significantly. Pet owners are increasingly committed to providing their pets with top-notch, tailored nutrition. The market offers a wide array of pet food choices, including specialized diets catering to different life stages, breeds, and health conditions. This diverse selection enables pet owners to select nutrition that suits their pets' specific requirements.Pet nutrition is increasingly recognized as a preventive healthcare measure. A well-balanced and nutritionally complete diet is acknowledged as a crucial element in averting various health issues and bolstering the immune system. Veterinarians play an active role in recommending personalized diets tailored to an individual pet's health, age, weight, and specific dietary needs. This individualized approach reflects a growing acknowledgment of the distinct nutritional requirements of various pets.

The market has experienced a surge in specialty and premium pet food products, including organic, grain-free, and hypoallergenic options. Pet owners are willing to invest in higher-quality nutrition for their pets, further emphasizing the importance placed on pet health and well-being. Veterinarians continue to play a pivotal role in advising on customized diets, aligning with pets' unique health and dietary considerations.

Segmental Insights

Product Type Insights

In 2024, the UAE Veterinary Medicine Market largest share was held by pharmaceuticals segment and is predicted to continue expanding over the coming years. The pharmaceuticals sector encompasses a broad spectrum of preventive and therapeutic medications for animals. This includes vaccines, antibiotics, antiparasitic drugs, analgesics, and various other treatments utilized to manage or prevent diseases in both pets and livestock. The demand for veterinary medications remains consistently high in the UAE, driven by the growing population of pets and the emphasis placed on animal health and well-being.Pet owners and livestock producers frequently turn to pharmaceutical solutions to safeguard the health of their animals. Many medications in the veterinary medicine market necessitate veterinary prescriptions, resulting in pharmaceutical companies capturing a significant share of the market by providing vital medications prescribed by veterinarians. These companies typically offer a diverse array of products to address a wide range of health concerns in animals, allowing them to cater to the varied needs of different animal species.

The pharmaceuticals sector in veterinary medicine is characterized by continual research and development endeavors. Companies invest in developing new and enhanced formulations, delivery methods, and therapeutic options, enhancing their position in the market.

Regional Insights

The Dubai region dominated the UAE Veterinary Medicine Market in 2024. Dubai is home to cutting-edge veterinary hospitals, clinics, and research centers equipped with advanced technology and specialized tools. These establishments offer a wide range of veterinary services, covering diagnostics, surgeries, and emergency care, drawing pet owners and livestock producers from all over the nation.Dubai's strategic positioning as a regional hub facilitates the import and distribution of veterinary products and medications. Its well-developed transportation and logistics networks make it an accessible hub for companies aiming to reach both the UAE and broader Middle East markets. Dubai's thriving tourism sector and substantial expatriate community drive the need for veterinary services, with pet owners from varied backgrounds seeking care for their animals. This broad customer base serves to further propel the expansion of Dubai's veterinary medicine market.

Key Market Players

- United Company for Veterinary medicines Industry LLC (UNIVET)

- Vetlife Veterinary Medicines Trading LLC

- Megavet Veterinary Medicine LLC

- Karaman VET LLC

- Metro Medicine International LLC

- Al Laseely Veterinary Medicine Trading

- MSD Animal Health

- Al Reef Al Akhdar Veterinary company

- The Veterinary Group L.L.C

- German Standard Veterinary Medicines Trading

Report Scope:

In this report, the UAE Veterinary Medicine Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:UAE Veterinary Medicine Market, By Animal Type:

- Production

- Companion

UAE Veterinary Medicine Market, By Product Type:

- Vaccine

- Pharmaceuticals

- Medicated Feed Additives

UAE Veterinary Medicine Market, By End User:

- Veterinary Hospitals & Clinics

- Reference Laboratories

- Others

UAE Veterinary Medicine Market, By Region:

- Dubai

- Abu Dhabi

- Sharjah

- Rest of UAE

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the UAE Veterinary Medicine Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- United Company for Veterinary medicines Industry LLC (UNIVET)

- Vetlife Veterinary Medicines Trading LLC

- Megavet Veterinary Medicine LLC

- Karaman VET LLC

- Metro Medicine International LLC

- Al Laseely Veterinary Medicine Trading

- MSD Animal Health

- Al Reef Al Akhdar Veterinary company

- The Veterinary Group L.L.C

- German Standard Veterinary Medicines Trading LLC

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 85 |

| Published | January 2025 |

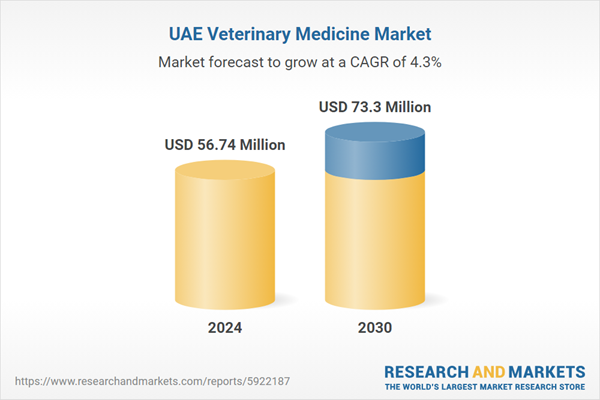

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 56.74 Million |

| Forecasted Market Value ( USD | $ 73.3 Million |

| Compound Annual Growth Rate | 4.3% |

| Regions Covered | United Arab Emirates |

| No. of Companies Mentioned | 10 |