Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Bioprocess bags are primarily used to contain, store, and transport liquids and materials involved in biopharmaceutical manufacturing and bioprocessing. Bioprocess bags are typically made from specialized materials that are chosen for their strength, flexibility, and compatibility with bioprocessing fluids and chemicals. These materials must meet stringent quality and regulatory standards to ensure product safety and integrity. In response to growing environmental concerns, some bioprocess bags are designed with eco-friendly materials, such as biodegradable or recyclable options, to reduce their environmental impact.

The growing demand for biopharmaceuticals, including monoclonal antibodies, gene therapies, and vaccines, is a major driver. Bioprocess bags are essential to produce these advanced therapies. The adoption of single use bioprocessing systems, including bioprocess bags, is increasing due to their cost-effectiveness, flexibility, and reduced risk of contamination.

Bioprocess bags offer scalability from small-scale research and development to large-scale production, providing the flexibility required to meet varying market demands. Single-use systems, including bioprocess bags, reduce the need for time-consuming and costly cleaning and sterilization processes associated with traditional stainless-steel equipment. Innovations in bioprocess bag design and materials have improved their performance, sterility, and compatibility with various bioprocessing systems. Manufacturers offering customization options for bioprocess bags enable companies to tailor the bags to their specific needs further driving demand.

Key Market Drivers

Technological Advancements

Technological advancements in bioprocess bags have contributed to the evolution and improvement of these critical components in biopharmaceutical manufacturing and bioprocessing. These innovations aim to enhance performance, sterility, ease of use, and the overall efficiency of bioprocess operations. Manufacturers have developed novel materials for bioprocess bags that offer improved strength, flexibility, and resistance to various chemicals. These materials are designed to ensure the bags' integrity throughout the production process. Enhanced aseptic manufacturing processes and improved closures and connectors help maintain the sterility of bioprocess bags, reducing the risk of contamination during production.Some bioprocess bags now feature baffle systems, which are internal structures that promote better mixing and oxygen transfer during cell culture and fermentation processes. This improves the homogeneity of the culture and enhances yield. Technological advancements have allowed for better scalability of bioprocess bags, facilitating the transition from small-scale research and development to large-scale manufacturing without significant process changes.

Bioprocess bags with integrated sensors can provide real-time data on critical process parameters like temperature, pH, and dissolved oxygen. This data helps operators monitor and control the process more effectively. Smart bioprocess bags can communicate with control systems and software, allowing for automated process monitoring and control. This helps optimize process parameters in real time. Advanced bag designs incorporate improved mixing technologies, such as rocking or wave-induced motion, to enhance cell culture and fermentation performance.

Key Market Challenges

Raw Material Costs

Bioprocess bags require materials that meet rigorous quality and sterility requirements. These materials are often more expensive than standard plastics, contributing to the overall cost of production. Bioprocess bags must comply with strict regulatory standards, particularly in the biopharmaceutical industry. Ensuring materials meet these standards can require additional quality control measures and may involve higher costs. Bioprocess bags are often customized to meet the specific requirements of individual companies and processes. Customization can lead to variations in material requirements, making it challenging to manage costs efficiently.As environmental concerns grow, some companies may seek eco-friendly materials for bioprocess bags. While these materials may have a lower environmental impact, they can sometimes be more expensive than traditional materials. Raw material costs can be subject to market fluctuations, which can impact the overall production cost of bioprocess bags. Disruptions in the supply chain, such as those experienced during global events like the COVID-19 pandemic, can lead to shortages and price increases for certain materials. Manufacturers may invest in research and development to improve bioprocess bag materials, which can lead to increased costs associated with developing and producing these advanced materials. Ensuring consistent quality and performance of materials in bioprocess bags may require stringent quality control processes, adding to the overall production cost.

Key Market Trends

Bioprocess Bag Customization

Biopharmaceutical companies have unique processes and equipment setups. Customized bioprocess bags can be designed to seamlessly integrate with existing systems, optimizing the overall production process. Bioprocess bag manufacturers offer customization options to ensure compatibility with a wide range of bioprocessing equipment, such as bioreactors, mixers, and connectors.This compatibility is essential for efficient and successful operations. Customization allows companies to specify the bag size, configuration, and ports that best suit their processes. This level of tailoring ensures that the bags are an exact fit for the application. Some biopharmaceutical processes are unique and require specialized equipment and containers. Customized bioprocess bags can accommodate these distinctive requirements.

Companies can choose the materials that best align with their product and process needs, considering factors like material strength, flexibility, and sterility. Customized bags can incorporate quality control features specific to a company's processes, such as integrated sensors for real-time monitoring of critical parameters. Companies focused on sustainability may request custom bioprocess bags made from eco-friendly materials or with reduced plastic content.

Customization can address specific regulatory requirements and standards relevant to a particular application, ensuring that the bags meet compliance standards. By tailoring bioprocess bags to their exact needs, companies can improve process efficiency and reduce waste. This can lead to cost savings and higher overall productivity. Customization allows companies to differentiate their products and processes in the market. It can be a competitive advantage and may attract customers who seek tailored solutions.

Key Market Players

- Meissner Filtration Products, Inc.

- Thermo Fisher Scientific Inc.

- Sartorius AG

- Danaher Corporation

- Merck KGaA

- Saint-Gobain

- Corning Incorporated

- Entegris

- PROAnalytics, LLC

- CellBios Healthcare and Lifesciences Pvt Ltd.

Report Scope:

In this report, the Global Bioprocess Bags Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Bioprocess Bags Market, By Type:

- 2D Bioprocess Bags

- 3D Bioprocess Bags

- Other Bags & Accessories

Bioprocess Bags Market, By Workflow:

- Upstream Process

- Downstream Process

- Process Development

Bioprocess Bags Market, By End-User:

- Pharmaceutical & Biopharmaceutical Companies

- CMOs & CROs

- Academic & Research Institutes

Bioprocess Bags Market, By region:

- North America

- United States

- Canada

- Mexico

- Asia-Pacific

- China

- India

- South Korea

- Australia

- Japan

- Europe

- Germany

- France

- United Kingdom

- Spain

- Italy

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Bioprocess Bags Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

Meissner Filtration Products, Inc.- Thermo Fisher Scientific Inc.

- Sartorius AG

- Danaher Corporation

- Merck KGaA

- Saint-Gobain

- Corning Incorporated

- Entegris

- PROAnalytics, LLC

- CellBios Healthcare and Lifesciences Pvt Ltd.

Table Information

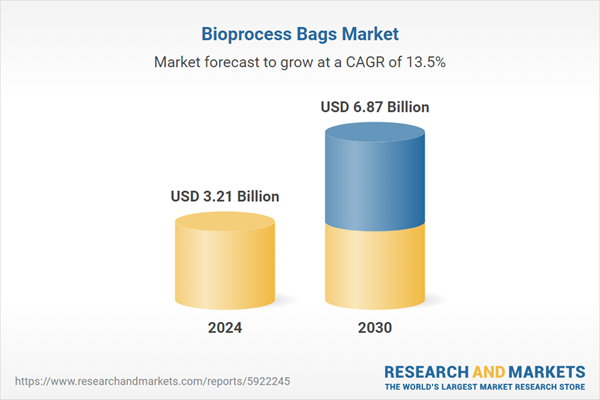

| Report Attribute | Details |

|---|---|

| No. of Pages | 180 |

| Published | March 2025 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 3.21 Billion |

| Forecasted Market Value ( USD | $ 6.87 Billion |

| Compound Annual Growth Rate | 13.5% |

| Regions Covered | Global |

| No. of Companies Mentioned | 2 |