1. Research Methodology

1.1. Study Objectives

1.2. Study Scope

1.3. Research Assumptions

1.4. Research Framework

2. Introduction

2.1. Market Definition

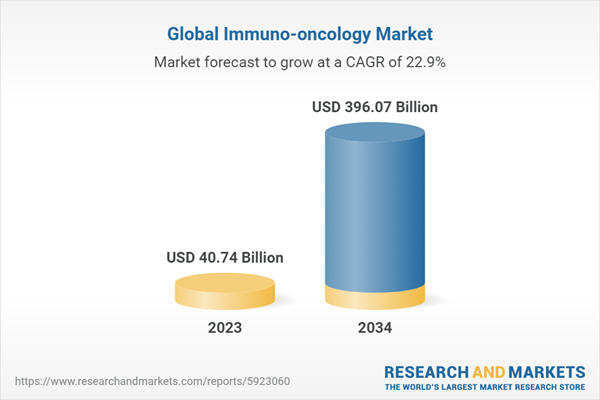

2.2. Global Immuno-oncology Market Overview

4. Market Environment Analysis

4.1. Porter’s 5 Forces Analysis

4.2. PESTEL Analysis

4.3. SWOT Analysis

5. Market Dynamics

5.1. Drivers Analysis

5.2. Restraints Analysis

5.3. Opportunities Analysis

5.4. Threats Analysis

5.5. Trend Analysis

7. Immuno-oncology Market: Treatment Type Estimates & Trend Analysis

7.1. Treatment Type Segment Opportunity Analysis

7.2. Immune Checkpoint Inhibitors

7.2.1. Immune Checkpoint Inhibitors Market Analysis & Forecast, 2023-2034 (Revenue, USD Bn)

7.3. Immune System Modulators

7.3.1. Immune System Modulators Market Analysis & Forecast, 2023-2034 (Revenue, USD Bn)

7.4. Cancer Vaccines

7.4.1. Cancer Vaccines Market Analysis & Forecast, 2023-2034 (Revenue, USD Bn)

7.5. Oncolytic Virus

7.5.1. Oncolytic Virus Market Analysis & Forecast, 2023-2034 (Revenue, USD Bn)

7.6. Others

7.6.1. Others Market Analysis & Forecast, 2023-2034 (Revenue, USD Bn)

8. Immuno-oncology Market: Disease Type Estimates & Trend Analysis

8.1. Disease Type Segment Opportunity Analysis

8.2. Melanoma

8.2.1. Melanoma Market Analysis & Forecast, 2023-2034 (Revenue, USD Bn)

8.3. Lung Cancer

8.3.1. Lung Cancer Market Analysis & Forecast, 2023-2034 (Revenue, USD Bn)

8.4. Blood Cancer

8.4.1. Blood Cancer Market Analysis & Forecast, 2023-2034 (Revenue, USD Bn)

8.5. Renal Cell Carcinoma

8.5.1. Renal Cell Carcinoma Market Analysis & Forecast, 2023-2034 (Revenue, USD Bn)

8.6. Prostate Cancer

8.6.1. Prostate Cancer Market Analysis & Forecast, 2023-2034 (Revenue, USD Bn)

8.7. Bladder Cancer

8.7.1. Bladder Cancer Market Analysis & Forecast, 2023-2034 (Revenue, USD Bn)

8.8. Others

8.8.1. Others Market Analysis & Forecast, 2023-2034 (Revenue, USD Bn)

9. Immuno-oncology Market: Distribution Channel Estimates & Trend Analysis

9.1. Distribution Channel Segment Opportunity Analysis

9.2. Hospital Pharmacies

9.2.1. Hospital Pharmacies Market Analysis & Forecast, 2023-2034 (Revenue, USD Bn)

9.3. Retail Pharmacies

Retail Pharmacies Market Analysis & Forecast, 2023-2034 (Revenue, USD Bn)

9.4. Online Pharmacies

9.4.1. Online Pharmacies Market Analysis & Forecast, 2023-2034 (Revenue, USD Bn)

10. Regional Market Analysis

10.1. Regional Market Opportunity Analysis

11. North America Immuno-oncology Market

11.1. North America Immuno-oncology Market

11.1.1. North America Immuno-oncology Market Size and Forecast, 2023-2034 (Revenue USD Bn)

11.1.2. North America Immuno-oncology Market Size and Forecast, By Country, 2023-2034 (Revenue USD Bn)

11.1.3. North America Immuno-oncology Market Size and Forecast, By Treatment Type, 2023-2034 (Revenue USD Bn)

11.1.4. North America Immuno-oncology Market Size and Forecast, By Disease Type, 2023-2034 (Revenue USD Bn)

11.1.5. North America Immuno-oncology Market Size and Forecast, By Distribution Channel, 2023-2034 (Revenue USD Bn)

11.2. U.S. Global Immuno-oncology Market

11.2.1. U.S. Immuno-oncology Market Size and Forecast, 2023-2034 (Revenue USD Bn)

11.2.2. U.S. Immuno-oncology Market Size and Forecast, By Treatment Type, 2023-2034 (Revenue USD Bn)

11.2.3. U.S. Immuno-oncology Market Size and Forecast, By Disease Type, 2023-2034 (Revenue USD Bn)

11.2.4. U.S. Immuno-oncology Market Size and Forecast, By Distribution Channel, 2023-2034 (Revenue USD Bn)

11.3. Canada Global Immuno-oncology Market

11.3.1. Canada Immuno-oncology Market Size and Forecast, 2023-2034 (Revenue USD Bn)

11.3.2. Canada Immuno-oncology Market Size and Forecast, By Treatment Type, 2023-2034 (Revenue USD Bn)

11.3.3. Canada Immuno-oncology Market Size and Forecast, By Disease Type, 2023-2034 (Revenue USD Bn)

11.3.4. Canada Immuno-oncology Market Size and Forecast, By Distribution Channel, 2023-2034 (Revenue USD Bn)

12. Europe Global Immuno-oncology Market

12.1. Europe Global Immuno-oncology Market

12.1.1. Europe Immuno-oncology Market Size and Forecast, 2023-2034 (Revenue USD Bn)

12.1.2. Europe Immuno-oncology Market Size and Forecast, By Country, 2023-2034 (Revenue USD Bn)

12.1.3. Europe Immuno-oncology Market Size and Forecast, By Treatment Type, 2023-2034 (Revenue USD Bn)

12.1.4. Europe Immuno-oncology Market Size and Forecast, By Disease Type, 2023-2034 (Revenue USD Bn)

12.1.5. Europe Immuno-oncology Market Size and Forecast, By Distribution Channel, 2023-2034 (Revenue USD Bn)

12.2. Germany Global Immuno-oncology Market

12.2.1. Germany Immuno-oncology Market Size and Forecast, 2023-2034 (Revenue USD Bn)

12.2.2. Germany Immuno-oncology Market Size and Forecast, By Treatment Type, 2023-2034 (Revenue USD Bn)

12.2.3. Germany Immuno-oncology Market Size and Forecast, By Disease Type, 2023-2034 (Revenue USD Bn)

12.2.4. Germany Immuno-oncology Market Size and Forecast, By Distribution Channel, 2023-2034 (Revenue USD Bn)

12.3. UK Global Immuno-oncology Market

12.3.1. UK Immuno-oncology Market Size and Forecast, 2023-2034 (Revenue USD Bn)

12.3.2. UK Immuno-oncology Market Size and Forecast, By Treatment Type, 2023-2034 (Revenue USD Bn)

12.3.3. UK Immuno-oncology Market Size and Forecast, By Disease Type, 2023-2034 (Revenue USD Bn)

12.3.4. UK Immuno-oncology Market Size and Forecast, By Distribution Channel, 2023-2034 (Revenue USD Bn)

12.4. France Global Immuno-oncology Market

12.4.1. France Immuno-oncology Market Size and Forecast, 2023-2034 (Revenue USD Bn)

12.4.2. France Immuno-oncology Market Size and Forecast, By Treatment Type, 2023-2034 (Revenue USD Bn)

12.4.3. France Immuno-oncology Market Size and Forecast, By Disease Type, 2023-2034 (Revenue USD Bn)

12.4.4. France Immuno-oncology Market Size and Forecast, By Distribution Channel, 2023-2034 (Revenue USD Bn)

12.5. Spain Global Immuno-oncology Market

12.5.1. Spain Immuno-oncology Market Size and Forecast, 2023-2034 (Revenue USD Bn)

12.5.2. Spain Immuno-oncology Market Size and Forecast, By Treatment Type, 2023-2034 (Revenue USD Bn)

12.5.3. Spain Immuno-oncology Market Size and Forecast, By Disease Type, 2023-2034 (Revenue USD Bn)

12.5.4. Spain Immuno-oncology Market Size and Forecast, By Distribution Channel, 2023-2034 (Revenue USD Bn)

12.6. Italy Global Immuno-oncology Market

12.6.1. Italy Immuno-oncology Market Size and Forecast, 2023-2034 (Revenue USD Bn)

12.6.2. Italy Immuno-oncology Market Size and Forecast, By Treatment Type, 2023-2034 (Revenue USD Bn)

12.6.3. Italy Immuno-oncology Market Size and Forecast, By Disease Type, 2023-2034 (Revenue USD Bn)

12.6.4. Italy Immuno-oncology Market Size and Forecast, By Distribution Channel, 2023-2034 (Revenue USD Bn)

12.7. Rest of Europe Global Immuno-oncology Market

12.7.1. Rest of Europe Immuno-oncology Market Size and Forecast, 2023-2034 (Revenue USD Bn)

12.7.2. Rest of Europe Immuno-oncology Market Size and Forecast, By Treatment Type, 2023-2034 (Revenue USD Bn)

12.7.3. Rest of Europe Immuno-oncology Market Size and Forecast, By Disease Type, 2023-2034 (Revenue USD Bn)

12.7.4. Rest of Europe Immuno-oncology Market Size and Forecast, By Distribution Channel, 2023-2034 (Revenue USD Bn)

13. Asia Pacific Global Immuno-oncology Market

13.1. Asia Pacific Global Immuno-oncology Market

13.1.1. Asia Pacific Immuno-oncology Market Size and Forecast, 2023-2034 (Revenue USD Bn)

13.1.2. Asia Pacific Immuno-oncology Market Size and Forecast, By Country, 2023-2034 (Revenue USD Bn)

13.1.3. Asia Pacific Immuno-oncology Market Size and Forecast, By Treatment Type, 2023-2034 (Revenue USD Bn)

13.1.4. Asia Pacific Immuno-oncology Market Size and Forecast, By Disease Type, 2023-2034 (Revenue USD Bn)

13.1.5. Asia Pacific Immuno-oncology Market Size and Forecast, By Distribution Channel, 2023-2034 (Revenue USD Bn)

13.2. Japan Global Immuno-oncology Market

13.2.1. Japan Immuno-oncology Market Size and Forecast, 2023-2034 (Revenue USD Bn)

13.2.2. Japan Immuno-oncology Market Size and Forecast, By Treatment Type, 2023-2034 (Revenue USD Bn)

13.2.3. Japan Immuno-oncology Market Size and Forecast, By Disease Type, 2023-2034 (Revenue USD Bn)

13.2.4. Japan Immuno-oncology Market Size and Forecast, By Distribution Channel, 2023-2034 (Revenue USD Bn)

13.3. China Global Immuno-oncology Market

13.3.1. China Immuno-oncology Market Size and Forecast, 2023-2034 (Revenue USD Bn)

13.3.2. China Immuno-oncology Market Size and Forecast, By Treatment Type, 2023-2034 (Revenue USD Bn)

13.3.3. China Immuno-oncology Market Size and Forecast, By Disease Type, 2023-2034 (Revenue USD Bn)

13.3.4. China Immuno-oncology Market Size and Forecast, By Distribution Channel, 2023-2034 (Revenue USD Bn)

13.4. India Global Immuno-oncology Market

13.4.1. India Immuno-oncology Market Size and Forecast, 2023-2034 (Revenue USD Bn)

13.4.2. India Immuno-oncology Market Size and Forecast, By Treatment Type, 2023-2034 (Revenue USD Bn)

13.4.3. India Immuno-oncology Market Size and Forecast, By Disease Type, 2023-2034 (Revenue USD Bn)

13.4.4. India Immuno-oncology Market Size and Forecast, By Distribution Channel, 2023-2034 (Revenue USD Bn)

13.5. South Korea Global Immuno-oncology Market

13.5.1. South Korea Immuno-oncology Market Size and Forecast, 2023-2034 (Revenue USD Bn)

13.5.2. South Korea Immuno-oncology Market Size and Forecast, By Treatment Type, 2023-2034 (Revenue USD Bn)

13.5.3. South Korea Immuno-oncology Market Size and Forecast, By Disease Type, 2023-2034 (Revenue USD Bn)

13.5.4. South Korea Immuno-oncology Market Size and Forecast, By Distribution Channel, 2023-2034 (Revenue USD Bn)

13.6. Australia Global Immuno-oncology Market

13.6.1. Australia Immuno-oncology Market Size and Forecast, 2023-2034 (Revenue USD Bn)

13.6.2. Australia Immuno-oncology Market Size and Forecast, By Treatment Type, 2023-2034 (Revenue USD Bn)

13.6.3. Australia Immuno-oncology Market Size and Forecast, By Disease Type, 2023-2034 (Revenue USD Bn)

13.6.4. Australia Immuno-oncology Market Size and Forecast, By Distribution Channel, 2023-2034 (Revenue USD Bn)

13.7. Rest of Asia Pacific Global Immuno-oncology Market

13.7.1. Rest of Asia Pacific Immuno-oncology Market Size and Forecast, 2023-2034 (Revenue USD Bn)

13.7.2. Rest of Asia Pacific Immuno-oncology Market Size and Forecast, By Treatment Type, 2023-2034 (Revenue USD Bn)

13.7.3. Rest of Asia Pacific Immuno-oncology Market Size and Forecast, By Disease Type, 2023-2034 (Revenue USD Bn)

13.7.4. Rest of Asia Pacific Immuno-oncology Market Size and Forecast, By Distribution Channel, 2023-2034 (Revenue USD Bn)

14. Latin America Global Immuno-oncology Market

14.1. Latin America Global Immuno-oncology Market

14.1.1. Latin America Immuno-oncology Market Size and Forecast, 2023-2034 (Revenue USD Bn)

14.1.2. Latin America Immuno-oncology Market Size and Forecast, By Country, 2023-2034 (Revenue USD Bn)

14.1.3. Latin America Immuno-oncology Market Size and Forecast, By Treatment Type, 2023-2034 (Revenue USD Bn)

14.1.4. Latin America Immuno-oncology Market Size and Forecast, By Disease Type, 2023-2034 (Revenue USD Bn)

14.1.5. Latin America Immuno-oncology Market Size and Forecast, By Distribution Channel, 2023-2034 (Revenue USD Bn)

14.2. Brazil Global Immuno-oncology Market

14.2.1. Brazil Immuno-oncology Market Size and Forecast, 2023-2034 (Revenue USD Bn)

14.2.2. Brazil Immuno-oncology Market Size and Forecast, By Treatment Type, 2023-2034 (Revenue USD Bn)

14.2.3. Brazil Immuno-oncology Market Size and Forecast, By Disease Type, 2023-2034 (Revenue USD Bn)

14.2.4. Brazil Immuno-oncology Market Size and Forecast, By Distribution Channel, 2023-2034 (Revenue USD Bn)

14.3. Mexico Global Immuno-oncology Market

14.3.1. Mexico Immuno-oncology Market Size and Forecast, 2023-2034 (Revenue USD Bn)

14.3.2. Mexico Immuno-oncology Market Size and Forecast, By Treatment Type, 2023-2034 (Revenue USD Bn)

14.3.3. Mexico Immuno-oncology Market Size and Forecast, By Disease Type, 2023-2034 (Revenue USD Bn)

14.3.4. Mexico Immuno-oncology Market Size and Forecast, By Distribution Channel, 2023-2034 (Revenue USD Bn)

14.4. Argentina Global Immuno-oncology Market

14.4.1. Argentina Immuno-oncology Market Size and Forecast, 2023-2034 (Revenue USD Bn)

14.4.2. Argentina Immuno-oncology Market Size and Forecast, By Treatment Type, 2023-2034 (Revenue USD Bn)

14.4.3. Argentina Immuno-oncology Market Size and Forecast, By Disease Type, 2023-2034 (Revenue USD Bn)

14.4.4. Argentina Immuno-oncology Market Size and Forecast, By Distribution Channel, 2023-2034 (Revenue USD Bn)

14.5. Rest of Latin America Global Immuno-oncology Market

14.5.1. Rest of Latin America Immuno-oncology Market Size and Forecast, 2023-2034 (Revenue USD Bn)

14.5.2. Rest of Latin America Immuno-oncology Market Size and Forecast, By Treatment Type, 2023-2034 (Revenue USD Bn)

14.5.3. Rest of Latin America Immuno-oncology Market Size and Forecast, By Disease Type, 2023-2034 (Revenue USD Bn)

14.5.4. Rest of Latin America Immuno-oncology Market Size and Forecast, By Distribution Channel, 2023-2034 (Revenue USD Bn)

15. MEA Global Immuno-oncology Market

15.1. MEA Global Immuno-oncology Market

15.1.1. MEA Immuno-oncology Market Size and Forecast, 2023-2034 (Revenue USD Bn)

15.1.2. MEA Immuno-oncology Market Size and Forecast, By Country, 2023-2034 (Revenue USD Bn)

15.1.3. MEA Immuno-oncology Market Size and Forecast, By Treatment Type, 2023-2034 (Revenue USD Bn)

15.1.4. MEA Immuno-oncology Market Size and Forecast, By Disease Type, 2023-2034 (Revenue USD Bn)

15.1.5. MEA Immuno-oncology Market Size and Forecast, By Distribution Channel, 2023-2034 (Revenue USD Bn)

15.2. GCC Global Immuno-oncology Market

15.2.1. GCC Immuno-oncology Market Size and Forecast, 2023-2034 (Revenue USD Bn)

15.2.2. GCC Immuno-oncology Market Size and Forecast, By Treatment Type, 2023-2034 (Revenue USD Bn)

15.2.3. GCC Immuno-oncology Market Size and Forecast, By Disease Type, 2023-2034 (Revenue USD Bn)

15.2.4. GCC Immuno-oncology Market Size and Forecast, By Distribution Channel, 2023-2034 (Revenue USD Bn)

15.3. South Africa Global Immuno-oncology Market

15.3.1. South Africa Immuno-oncology Market Size and Forecast, 2023-2034 (Revenue USD Bn)

15.3.2. South Africa Immuno-oncology Market Size and Forecast, By Treatment Type, 2023-2034 (Revenue USD Bn)

15.3.3. South Africa Immuno-oncology Market Size and Forecast, By Disease Type, 2023-2034 (Revenue USD Bn)

15.3.4. South Africa Immuno-oncology Market Size and Forecast, By Distribution Channel, 2023-2034 (Revenue USD Bn)

15.4. Rest of MEA Global Immuno-oncology Market

15.4.1. Rest of MEA Immuno-oncology Market Size and Forecast, 2023-2034 (Revenue USD Bn)

15.4.2. Rest of MEA Immuno-oncology Market Size and Forecast, By Treatment Type, 2023-2034 (Revenue USD Bn)

15.4.3. Rest of MEA Immuno-oncology Market Size and Forecast, By Disease Type, 2023-2034 (Revenue USD Bn)

15.4.4. Rest of MEA Immuno-oncology Market Size and Forecast, By Distribution Channel, 2023-2034 (Revenue USD Bn)

16. Competitor Analysis

16.1. Company Market Share Analysis, 2023

16.2. Major Recent Developments

17. Company Profiles

17.1. Bristol Myers Squibb

17.2. Merck & Co., Inc.

17.3. Roche (Genentech)

17.4. AstraZeneca

17.5. Novartis

17.6. Pfizer

17.7. Amgen

17.8. Gilead Sciences

17.9. Regeneron Pharmaceuticals

17.10. Eli Lilly and Company

17.11. Sanofi

17.12. GlaxoSmithKline (GSK)

17.13. AbbVie

17.14. Johnson & Johnson (Janssen Biotech)

17.15. Seattle Genetics