Sustainability and Green Economy Drives South & Central America Industrial Robotics Market

Sustainability and environmental considerations are anticipated to be vital trends in the South & Central America industrial robotics market. Industrial robots are being designed to be more energy efficient with improved power management systems and energy-saving features. In coming years, the robotics sector will focus on developing energy-efficient robots that would help companies lower their carbon footprint and achieve sustainability goals. Industrial robots can also improve material efficiency, optimize processes, and reduce waste. Additionally, advancements in recycling robot components and materials can reduce the industry's environmental impact. Industrial robotics are expected to involve green manufacturing practices to reduce the use of hazardous substances and minimize emissions. Manufacturers would be able to explore the usage of eco-friendly materials and sustainable design principles by introducing industrial robots. This will include selecting materials with lower environmental impact. By embracing sustainability and environmental considerations, the South & Central America industrial robotics market can contribute to a more sustainable manufacturing sector. These above-mentioned future trends will drive the development of more environment friendly robotics systems aligning with global efforts toward a greener and more sustainable future.South & Central America Industrial Robotics Market Overview

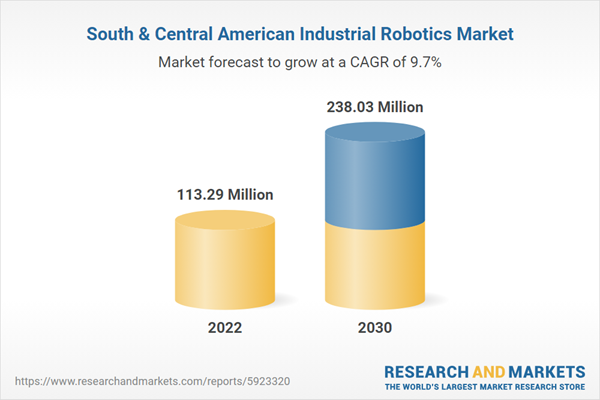

The South & Central America industrial robotics market is segmented into Brazil, Argentina, and the Rest of South & Central America. The region held the smallest share of the market in the global analysis. In the past few years, South & Central America has witnessed business potential for warehouse and manufacturing automation. For instance, in 2021, ABB Ltd announced its plan to develop SafeMove collaborative robot technology at the manufacturing facility of Nestle SA, Brazil. The company, in collaboration with Nestle SA’s engineering team, developed an ABB IRB 660 robot with SafeMove technology, aimed at improving productivity by 53%. According to the statistical yearbook released by the International Federation of Robotics 2022, robot installations in Brazil were registered at 1,702 units in 2021, with an average annual growth rate of 7% compared to 2016. Further, end-use industries prefer suitable lubrication systems to decrease the wear and tear of robotic components and reduce downtime. Thus, the key factors such as growth in automobile and manufacturing sector are propelling the demand for industrial robots in South & Central America are anticipated which is expected to boost the South & Central America industrial robotics market during the forecast period. Moreover, various industrial robot manufacturers are launching new products in South & Central America. For instance, in 2021, Mitsubishi introduced the Assista collaboration robot to the region. Assista is built with ease of deployment for original equipment makers and end users, as its high-quality internal wiring and plumbing decrease the chance of cables becoming hooked or snagged, enhancing uptime and reducing the need for repairs. The South & Central America industrial robotics market in the region is expected to grow owing to factors such as the increasing adoption of robotics for the automotive and food & beverages industries. For instance, Nestle's confectionery plants benefit from ABB's SafeMove collaborative robot technology, which improves employee safety while enhancing efficiency. Nestlé, the world's largest food and beverage corporation, is deploying an ABB palletizing robot system to increase pallet loading productivity in its chocolate manufacturing plants in Brazil by 53%.South & Central America Industrial Robotics Market Revenue and Forecast to 2030 (US$ Million)

South & Central America Industrial Robotics Market Segmentation

The South & Central America industrial robotics market is segmented into types, function, industry, and country.Based on types, the South & Central America industrial robotics market is segmented into articulated, cartesian, SCARA, collaborative, parallel, and others. In 2022, the articulated segment registered the largest share in the South & Central America industrial robotics market.

Based on function, the South & Central America industrial robotics market is segmented into soldering and welding, material handling, assembling and disassembling, painting and dispensing, milling, and cutting and processing. In 2022, the soldering and welding segment registered the largest share in the South & Central America industrial robotics market.

Based on industry, the South & Central America industrial robotics market is segmented into automotive, medical and pharmaceuticals, electrical and electronics, rubber and plastics, metal and machinery, and food and agriculture. In 2022, the automotive segment registered the largest share in the South & Central America industrial robotics market.

Based on country, the South & Central America industrial robotics market is segmented into Brazil, Argentina, and the Rest of South & Central America. In 2022, Brazil registered the largest share in the South & Central America industrial robotics market.

ABB Ltd, Comau SpA, Fanuc Corp, Kawasaki Heavy Industries Ltd, Kuka AG, Mitsubishi Electric Corp, Seiko Epson Corp, Staubli International AG, Universal Robots AS, and Yaskawa Electric Corp are the leading companies operating in the South & Central America industrial robotics market.

Reasons to Buy

- Save and reduce time carrying out entry-level research by identifying the growth, size, leading players, and segments in the South & Central America industrial robotics market.

- Highlights key business priorities in order to assist companies to realign their business strategies

- The key findings and recommendations highlight crucial progressive industry trends in the South & Central America industrial robotics market, thereby allowing players across the value chain to develop effective long-term strategies

- Develop/modify business expansion plans by using substantial growth offering developed and emerging markets

- Scrutinize in-depth South & Central America market trends and outlook coupled with the factors driving the industrial robotics market, as well as those hindering it

- Enhance the decision-making process by understanding the strategies that underpin commercial interest with respect to client products, segmentation, pricing, and distribution

Table of Contents

Companies Mentioned

- ABB Ltd

- Comau SpA

- Fanuc Corp

- Kawasaki Heavy Industries Ltd

- Kuka AG

- Mitsubishi Electric Corp

- Seiko Epson Corp

- Staubli International AG

- Universal Robots AS

- Yaskawa Electric Corp

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 165 |

| Published | November 2023 |

| Forecast Period | 2022 - 2030 |

| Estimated Market Value in 2022 | 113.29 Million |

| Forecasted Market Value by 2030 | 238.03 Million |

| Compound Annual Growth Rate | 9.7% |

| No. of Companies Mentioned | 10 |