Speak directly to the analyst to clarify any post sales queries you may have.

Unveiling the Strategic Importance of High Altitude Pseudo Satellites as Transformative Platforms for Persistent Connectivity and Surveillance

High altitude pseudo satellites (HAPS) represent a groundbreaking class of atmospheric platforms operating at stratospheric altitudes, typically between 18 and 25 kilometers above sea level. These vehicles blend characteristics of satellites and unmanned aerial vehicles, combining extended loiter capabilities with advanced payload versatility. By remaining aloft for weeks or months at a time, HAPS can deliver persistent coverage over target regions, enabling seamless communication, surveillance, and environmental monitoring without the need for extensive ground infrastructure.As industries and governments grapple with the demand for ubiquitous connectivity, rapid disaster response, and comprehensive earth observation, HAPS have emerged as a strategic enabler. They circumvent limitations inherent to terrestrial networks, such as terrain obstruction and high deployment costs, while offering greater agility and lower latency than traditional satellite constellations. Moreover, recent technological advances in lightweight materials, solar electric propulsion, and high-throughput payloads have accelerated platform maturation, driving renewed interest among telecom operators, defense agencies, and environmental research institutions.

In addition, effective collaboration between platform developers, payload integrators, and regulatory bodies is critical to ensuring operational safety and spectrum management. Navigating airspace regulations and securing frequency allocations demands proactive engagement with international authorities. At the same time, building a resilient supply chain for specialized components and sustainable energy systems is paramount to maintaining uninterrupted operations at stratospheric altitudes. By integrating these strategic considerations, stakeholders can foster an ecosystem that supports scalable deployment and long-term viability of HAPS programs.

Mapping the Disruptive Trends Driving Evolution of High Altitude Pseudo Satellites in Connectivity, Surveillance, and Environmental Monitoring

Rapid evolution in digital infrastructure requirements has elevated high altitude pseudo satellites from experimental concepts to critical assets in global connectivity. The demand for low-latency broadband access in remote and underserved areas has intensified research and development efforts around stratospheric platforms. Simultaneously, the push for beyond-visual-line-of-sight surveillance capabilities and persistent environmental monitoring has spurred investment in innovative sensor suites and communication payloads capable of supporting diverse mission profiles. These converging market drivers have redefined the strategic value proposition of HAPS, positioning them as versatile tools for bridging terrestrial network gaps.Technological progress in lightweight composite materials, solar electric propulsion, and advanced battery storage has been instrumental in extending flight endurance and payload capacity. Developers are leveraging breakthroughs in hydrogen and methanol fuel cells alongside energy harvesting systems to reduce dependency on ground-based recharging infrastructure. In parallel, miniaturization of multispectral and hyperspectral imaging sensors, alongside increasingly sophisticated onboard data processing algorithms, enables real-time analytics and decision support at the edge. These advancements are transforming HAPS into mobile command centers capable of autonomously adapting to evolving mission parameters.

Furthermore, regulatory ecosystems are maturing to accommodate stratospheric operations. National and international aviation authorities are refining certification frameworks, spectrum licensing regimes, and air traffic integration protocols to facilitate safe cohabitation of HAPS with existing airspace users. Collaboration between platform manufacturers, payload integrators, and spectrum regulators is fostering a cooperative environment that accelerates deployment timelines. As a result, strategic alliances and public-private partnerships are emerging, underscoring the critical role of policy alignment in unlocking the full potential of HAPS. These transformative shifts set the stage for assessing the impact of external economic policies, including tariff regimes, on the HAPS supply chain.

Analyzing the Far-Reaching Consequences of United States Tariff Measures on Supply Chains, Component Sourcing, and Cost Structures for HAPS

In 2025, the implementation of United States tariff measures targeting advanced aerospace components and electronic subsystems has introduced a new layer of complexity to the high altitude pseudo satellite ecosystem. By imposing additional duties on critical parts such as high-efficiency solar panels, fiber optics, and specialized composite materials, these policies have altered sourcing strategies across the value chain. Platform developers and payload integrators alike are reassessing procurement networks to mitigate escalating input costs and potential production delays.The immediate consequence of these tariffs has been a tightening of margins for original equipment manufacturers. Increased duties on imported propulsion modules and power management systems necessitate higher capital outlays or the absorption of additional expenses by suppliers further upstream. As trade barriers compound logistical challenges-ranging from extended customs clearance times to unpredictable duty rates-companies must contend with inventory bottlenecks and uneven material availability. This environment has compelled stakeholders to explore alternative supply routes, including partnerships with domestic producers and investment in localized manufacturing capabilities.

To navigate the tightening economic conditions, several firms have diversified their material portfolios, substituting certain imported components with domestically produced equivalents where feasible. Others are establishing strategic buffer stock to cushion against potential shortages, while some are accelerating joint ventures to secure more favorable tariff classifications. These adaptive measures, however, introduce new trade-off considerations in terms of quality assurance, certification timelines, and scale-up readiness.

Consequently, the ripple effects of tariff policies extend beyond procurement, influencing overall program timelines and cost structures for HAPS initiatives. Service operators may experience adjustments to pricing models or project milestones as supplier networks realign. Such dynamics underscore the importance of a robust segmentation analysis to identify resilient market niches and inform strategic decision making for the upcoming chapters.

Uncovering Critical Market Segmentation Insights Based on Platform, Payload, Propulsion, and Application Dimensions for Strategic Targeting

A nuanced understanding of market segmentation is essential for stakeholders seeking to tailor HAPS solutions to specific operational demands. When platforms are categorized by type, distinct opportunities and constraints emerge across airships, fixed-wing vehicles, and unmanned aerial systems. Airships excel in loiter capacity and heavy-lift payload accommodation, whereas fixed-wing models offer superior cruise efficiency and streamlined aerodynamics. Meanwhile, smaller unmanned aerial vehicles provide agility and rapid deployment potential, making them ideal for tactical missions and short-cycle assignments.Delving into payload type reveals further differentiation. Communication payloads serve as the backbone for broadband relay and network extension, while environmental monitoring sensors deliver critical data on atmospheric conditions, pollution levels, and climate indicators. Imaging systems, encompassing both multispectral and hyperspectral sensors as well as optical cameras, furnish high-resolution mapping and resource assessment capabilities. Intelligence, surveillance, and reconnaissance units enhance situational awareness, and navigation payloads ensure precise geolocation and flight path maintenance.

Propulsion methods also segment the market along technology lines. Fuel cell systems, powered by hydrogen or methanol, offer extended endurance with minimal greenhouse emissions, whereas solar electric platforms leverage battery storage and energy harvesting to sustain operations through diurnal cycles. Each method carries unique implications for system weight, energy density, and maintenance protocols.

Application-focused segmentation highlights vertical market dynamics. Disaster management missions demand rapid deployment for search and rescue support, while earth observation serves agricultural monitoring, environmental and weather tracking, and detailed mapping exercises. Military operations benefit from dedicated surveillance and reconnaissance tasks such as border security and maritime domain awareness. Telecommunications and connectivity efforts prioritize emergency network restoration and provision of broadband services in rural or remote regions. By synthesizing these segmentation insights, decision makers can align their product development and go-to-market strategies with the most resilient and high-value use cases in the HAPS ecosystem.

Comparative Regional Perspectives on the Adoption, Infrastructure Readiness, and Market Drivers of HAPS Across the Americas, EMEA, and Asia-Pacific Territories

Regional dynamics play a pivotal role in shaping the trajectory of high altitude pseudo satellite deployments. In the Americas, robust private sector investment and streamlined regulatory pathways have catalyzed several high-profile demonstrations of stratospheric platforms. North American firms benefit from coordinated spectrum management policies and an established aerospace manufacturing base. Concurrently, Latin American nations are exploring HAPS for bridging digital divides, with pilot programs targeting remote communities in the Andes and Amazon regions, where terrestrial infrastructure remains sparse.Across Europe, the Middle East, and Africa, diverse policy landscapes have given rise to collaborative efforts between national space agencies, telecommunication operators, and defense organizations. European countries are advancing certification standards and spectrum harmonization initiatives, facilitating cross-border operations. In the Middle East, interest in environmental monitoring has spurred partnerships to track desertification and water resource trends. Meanwhile, select African states view HAPS as force multipliers for border security and maritime surveillance, recognizing the technology’s potential to safeguard vast territories with minimal ground presence.

In the Asia-Pacific region, burgeoning demand for rural broadband and precision agriculture solutions is driving government incentives and public-private consortia. Nations with established aeronautical research centers are accelerating prototypes, supported by favorable funding mechanisms and test ranges. Southeast Asian archipelagos are assessing HAPS for disaster management and connectivity restoration in the wake of typhoons and seismic events. In contrast, East Asian manufacturing hubs are focusing on scaling production and integrating advanced propulsion systems.

These regional variations underscore the necessity for tailored strategies that address local regulatory frameworks, partnership ecosystems, and mission priorities. By aligning product roadmaps with regional imperatives, industry participants can optimize resource allocation and accelerate market penetration across these distinct geographies.

Analyzing Competitive Dynamics, Strategic Collaborations, and Technological Leadership Among Leading High Altitude Pseudo Satellite Providers Shaping the Market

The competitive landscape for high altitude pseudo satellites features a diverse mix of established aerospace integrators, specialized startups, and defense contractors. Large commercial aerospace manufacturers leverage their deep engineering expertise and production capabilities to develop scalable platforms, while nimble technology firms often pursue niche use cases, focusing on rapid prototyping and payload customization. Defense-oriented participants bring rigorous reliability standards and integrated command-and-control solutions, further enriching the ecosystem.Strategic collaborations have emerged as a common pathway to accelerate time to market. Joint ventures between communication service providers and platform builders aim to co-develop high-throughput payloads. Consortiums involving academic institutions, governmental bodies, and technology vendors are jointly validating sensor performance and certification standards. Additionally, alliances between energy storage developers and propulsion specialists are advancing next-generation fuel cell and battery hybridization efforts, setting new benchmarks in mission endurance.

Technological leadership is increasingly differentiated by advancements in onboard artificial intelligence, which enables autonomous flight management, adaptive mission planning, and real-time data analytics. Companies investing heavily in edge computing architectures are positioning themselves to deliver premium value through immediate situational insights. Concurrently, breakthroughs in nanomaterials and additive manufacturing are driving weight reduction and structural resilience, bolstering long-duration flight capabilities.

Research and development investments remain a critical differentiator. Several prominent firms have established dedicated stratospheric research divisions, while others pursue acquisitions to enhance their sensor portfolios or secure specialized propulsion patents. These moves reflect an industry-wide recognition that innovation velocity and intellectual property strength will dictate long-term competitiveness in a rapidly evolving market.

Ultimately, the ability to integrate cross-disciplinary expertise-combining aeronautics, electronics, materials science, and software-will determine which players emerge as leaders in the high altitude pseudo satellite domain.

Strategic Imperatives and Tactical Recommendations to Drive Market Leadership and Operational Excellence in the High Altitude Pseudo Satellite Sector

To secure market leadership in the high altitude pseudo satellite arena, industry stakeholders should prioritize sustained investment in research and development, with an emphasis on propulsion innovation and payload miniaturization. Establishing collaborative R&D partnerships with universities and research organizations can accelerate the validation of novel materials and energy systems. By fostering an open innovation culture, companies can tap into emerging breakthroughs that drive platform endurance and operational efficiency.Supply chain resilience represents another critical imperative. Organizations must diversify their procurement networks for key components, from solar cells to high-precision optics, to mitigate tariff-induced disruptions and logistical bottlenecks. Building strategic buffer inventories and qualifying multiple suppliers for critical subsystems will enable uninterrupted production cycles and support rapid deployment in response to emergent opportunities.

Proactive engagement with aviation authorities and spectrum regulators is essential to streamline certification processes and secure the necessary frequency allocations. Early dialogue can help shape safety guidelines and influence policy frameworks that accommodate stratospheric operations. Demonstrating compliance with air traffic management requirements will further build confidence among national and international stakeholders.

A segmentation-driven go-to-market approach can unlock high-value application scenarios. Tailoring platform configurations and payload suites to specific verticals-such as disaster response, agricultural monitoring, or rural broadband-enhances value propositions and accelerates stakeholder buy-in. Concurrently, aligning regional expansion strategies with localized regulatory norms and infrastructure readiness will optimize market entry timing and investment returns.

Finally, cultivating specialized talent is paramount. Training programs focused on stratospheric flight operations, payload integration, and regulatory compliance will ensure that organizations possess the expertise required to navigate complex mission environments. By embedding these strategic imperatives into their corporate roadmaps, industry leaders can position themselves at the forefront of a rapidly maturing HAPS market.

Comprehensive Research Methodology Leveraging Primary Engagements, Secondary Data Analysis, and Rigorous Validation to Ensure Insight Accuracy

This study employs a rigorous, multi-tiered research methodology designed to deliver robust insights into the high altitude pseudo satellite sector. The primary research component included in-depth interviews with a cross-section of industry participants, such as platform developers, payload integrators, network operators, and regulatory authority representatives. These conversations provided qualitative perspectives on technology readiness, operational constraints, and strategic priorities.Complementing the primary engagements, secondary data sources were systematically analyzed to contextualize current market dynamics. These sources encompassed technical journals, aviation safety records, patent filings, white papers, and public filings from relevant aerospace and defense firms. The synthesis of this information enabled a comprehensive mapping of technological trends, regulatory developments, and competitive activities.

Data triangulation was applied to reconcile differing viewpoints and ensure consistency across information streams. Quantitative validation techniques, such as cross-referencing supplier disclosures and frequency allocation records, were used to verify key assumptions. This iterative process enhanced the credibility of the findings and minimized potential biases.

An expert advisory panel reviewed preliminary insights to validate conclusions and refine thematic frameworks. Panel members included veterans from aviation authorities, stratospheric program managers, and senior researchers specializing in energy systems and payload integration. Their feedback shaped the final recommendation set and highlighted emerging considerations that warranted further exploration.

Throughout the research process, ethical standards and data integrity protocols were strictly observed. Confidentiality agreements were executed with all interviewees, and sensitive information was anonymized where necessary. This methodological rigor ensures that the insights presented herein are both authoritative and actionable for decision makers operating within the HAPS ecosystem.

Synthesizing Insights and Future Outlook to Equip Stakeholders with a Clear Strategic Vision for High Altitude Pseudo Satellite Market Success

This executive summary has distilled critical insights into the strategic, technological, and regulatory dimensions shaping the high altitude pseudo satellite landscape. By examining market drivers, transformative trends, and policy influences, it underscores the pivotal role that HAPS can play in closing connectivity gaps, enhancing situational awareness, and supporting environmental stewardship. Segmentation analyses shed light on platform types, payload specializations, propulsion options, and application domains, providing a framework for targeted investment decisions.Regional perspectives highlight the nuanced approaches adopted across the Americas, EMEA, and Asia-Pacific, revealing how local regulatory environments, infrastructure capabilities, and mission priorities interact to influence adoption trajectories. Competitive analysis of leading players illustrates the significance of alliances, R&D investments, and technological differentiation in securing market share and strengthening value propositions. Furthermore, the assessment of tariff impacts elucidates the need for flexible supply chain strategies to navigate evolving trade landscapes.

Looking forward, stakeholders should leverage the actionable recommendations presented to optimize research investment, fortify supply networks, and engage proactively with regulators. Embracing segmentation-led go-to-market planning and regional customization will enable organizations to capture emerging high-value opportunities. Concurrently, fostering talent development and collaborative innovation ecosystems will sustain long-term growth and operational excellence.

Ultimately, a clear strategic vision-grounded in rigorous data, stakeholder collaboration, and adaptive planning-will empower decision makers to fully realize the promise of high altitude pseudo satellites. As the ecosystem matures, those organizations that balance technological agility with strategic foresight will be best positioned to lead this dynamic and impactful market.

Additional Product Information:

- Purchase of this report includes 1 year online access with quarterly updates.

- This report can be updated on request. Please contact our Customer Experience team using the Ask a Question widget on our website.

Table of Contents

7. Cumulative Impact of Artificial Intelligence 2025

16. China High Altitude Pseudo Satellite Market

Companies Mentioned

The key companies profiled in this High Altitude Pseudo Satellite market report include:- AeroVironment, Inc.

- Airbus SE

- Altaeros Energies, Inc.

- Aurora Flight Sciences by Boeing Company

- BAE Systems PLC

- Cloudline Inc.

- Maraal Aerospace Pvt Ltd.

- Mira Aerospace by Space 42 Company

- Sceye Inc.

- Skydweller Aero Inc.

- Swift Engineering Inc.

- TAO-Group

- Thales Group

- World View Enterprises, Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 184 |

| Published | January 2026 |

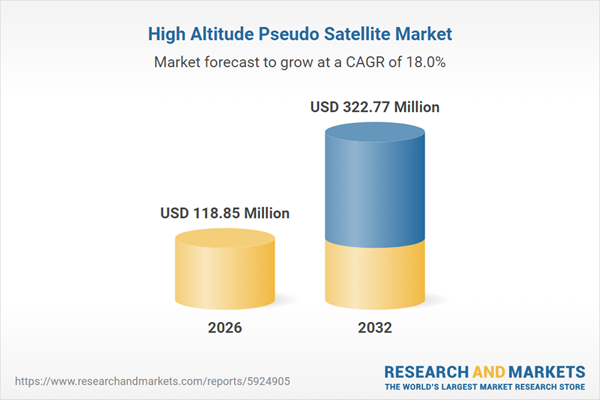

| Forecast Period | 2026 - 2032 |

| Estimated Market Value ( USD | $ 118.85 Million |

| Forecasted Market Value ( USD | $ 322.77 Million |

| Compound Annual Growth Rate | 17.9% |

| Regions Covered | Global |

| No. of Companies Mentioned | 15 |