Growing Integration of Digital Technology in Helicopter MRO Market

Helicopter engines gradually become contaminated with particles such as dirt, oil, sand, and salt over time. These are pulled into the compressor and form a coating on the components, reducing their aerodynamic efficiency. A contaminated engine increases fuel consumption and the overall temperature of the engine, which might cause engine failure. The adoption of helicopters has increased in many critical applications such as emergency medical services, rescue missions, and firefighting applications. Failure in the engine can adversely affect the overall mission and challenge the safety of the passengers. Thus, engine maintenance has become one of the important services in the helicopter MRO market. Increased partnerships and collaborations, business expansions, and network expansion strategies are among the factors driving the engine maintenance demand in the helicopter MRO market. In June 2023, Saudi Arabia Military Industries signed a maintenance and repair deal with Safran Helicopter Engines. The arrangement covers technical support and qualification, technical infrastructure development, and technical training for Saudi technicians.Apart from the maintenance investments and business expansion strategies by helicopter MRO market players, the adoption of engine health monitoring technology has fueled the engine maintenance service's demand. Engine health monitoring system enables helicopter operators to monitor various engine life parameters. The technology detects low signals at an early stage, preventing engine repairs and replacement. In addition, with the help of this technology, the service providers can provide personalized maintenance services according to the fleet operator's usage, increasing the overall efficiency of the maintenance services and enhancing health of helicopter. Thus, increased investments in engine maintenance, business and network expansion strategies by service providers, and technological integration boost the overall demand for engine maintenance services, ultimately driving the helicopter MRO market.

helicopter MRO market share of Asia Pacific is expected to register the highest CAGR during the forecast period owing to increasing sales of helicopters and rising demand for helicopter MRO services across countries such as China, Japan, and India. China has the largest number of helicopters owing to rising military spending on the development of advanced helicopters. According to the Aviation Industry Corporation in China (AVIC) Report in 2022, there were more than 1,037 helicopters in operation across China and are expected to reach 1,449 units by 2027. As of 2021, China’s military owned nearly 912 helicopters. Indian military had more than 805 helicopters, followed by South Korea, which owned 739 helicopters during the same time period. Such growth in the number of helicopters across China drives the helicopter MRO market growth. Third-party MRO service providers are active in Asia Pacific owing to growing demand from helicopter owners.

In South America, countries such as Brazil, Chile, and Argentina have shown sluggish growth. According to the National Civil Aviation Agency (NCVA), in 2022, Brazil had more than 2,000 helicopter fleets, which require MRO services frequently in order to have safe flying. The helicopter MRO market growth in all the major geographic regions is estimated to positively influence the market outlook during the forecast period (2022-2030).

Based on helicopter type, the global helicopter MRO market share is segmented into light helicopter, medium helicopter, and heavy helicopter. The demand for heavy helicopters is mainly driven by increasing adoption by the defense sector. In contrast, the demand for light helicopters is mainly driven by growing commercial applications such as air ambulance and tourism. Medium-sized helicopters are widely used in commercial as well as defense sectors. For instance, in May 2023, Corewell Health added a new Sikorsky S-76 C++ helicopter to its air ambulance fleet. In January 2023, Sikorsky, a Lockheed Martin subsidiary, delivered the 5,000th"Hawk variant helicopter, a US Army UH-60M Black Hawk. In the coming years, this aircraft will continue to fulfill medium-lift requirements for the US military and international operators. Thus, such activities are projected to create lucrative demand for light, medium, and heavy helicopters in the coming years.

AAL Group Ltd., Abu Dhabi Aviation, Airbus, Elbit Systems Ltd., GAL (EDGE Group PJSC), Gulf Helicopters, HELICONIA, Israel Aerospace Industries, Leonardo SpA, and Saudi Rotorcraft Support Company Ltd. are among the key helicopter MRO market players profiled during this market study. In addition to these players, several other essential helicopter MRO market players have also been studied and analyzed to get a holistic view of the global market and its ecosystem.

Reasons to Buy

- Save and reduce time carrying out entry-level research by identifying the growth, size, leading players and segments in the helicopter MRO market.

- Highlights key business priorities in order to assist companies to realign their business strategies

- The key findings and recommendations highlight crucial progressive industry trends in the helicopter MRO market, thereby allowing players across the value chain to develop effective long-term strategies

- Develop/modify business expansion plans by using substantial growth offering developed and emerging markets

- Scrutinize in-depth global market trends and outlook coupled with the factors driving the market, as well as those hindering it

- Enhance the decision-making process by understanding the strategies that underpin commercial interest with respect to client products, segmentation, pricing and distribution

Table of Contents

Companies Mentioned

- Sikorsky Aircraft

- MTU Maintenance

- Pratt & Whitney

- Heli-One

- StandardAero

- Honeywell Aerospace

- RUAG International Holding Ltd.

- Russian Helicopter

- Mid-Canada Mod Center

- Transwest Helicopters

- Rolls Royce Holdings Plc

- Rostec

- Safran SA

- Textron Inc.

- The Carlyle Group Inc.

- PHI Group, Inc.

- Jones Metal Products

- Indocopters

- Avia Solutions Group

- Global Vectra Helicorp Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 168 |

| Published | December 2023 |

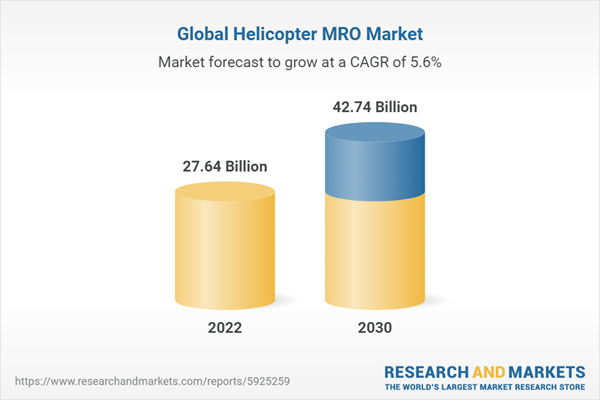

| Forecast Period | 2022 - 2030 |

| Estimated Market Value in 2022 | 27.64 Billion |

| Forecasted Market Value by 2030 | 42.74 Billion |

| Compound Annual Growth Rate | 5.6% |

| Regions Covered | Global |

| No. of Companies Mentioned | 20 |