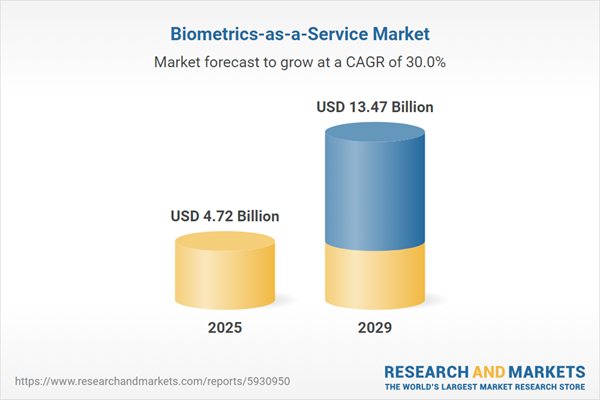

The biometrics-as-a-service market size has grown exponentially in recent years. It will grow from $3.75 billion in 2024 to $4.72 billion in 2025 at a compound annual growth rate (CAGR) of 25.8%. The growth in the historic period can be attributed to increasing digital transformation, rise of cloud services, rise of remote work and access, improved accuracy and reliability.

The biometrics-as-a-service market size is expected to see exponential growth in the next few years. It will grow to $13.47 billion in 2029 at a compound annual growth rate (CAGR) of 30%. The growth in the forecast period can be attributed to increased security demands, increasing mobile and iot integration, growth in healthcare and telemedicine, infrastructure growth. Major trends in the forecast period include growing use of mobile biometrics, cloud-based baas solutions, enhanced security for online transactions, technological advancements.

The increasing adoption of biometrics is expected to drive the growth of the biometrics-as-a-service market in the coming years. Biometrics refers to the measurement and statistical analysis of individuals' physical characteristics, which are used to recognize or verify their identity. The demand for biometrics is rising due to the need for enhanced security, user convenience, and identity verification across sectors such as banking, healthcare, and government services. Biometrics as a service allows for the verification of a user's identity to grant access to secure physical or digital sites, protect transactions, and support workforce management functions. For instance, in February 2024, the Information Commissioner's Office, a UK-based government agency, projected a significant increase in the demand for biometric recognition, with global market revenues expected to nearly double from $43 billion in 2022 to $83 billion by 2027. As a result, the growing adoption of biometrics is driving the expansion of the biometrics-as-a-service market.

The increasing sophistication of security threats is expected to be a major catalyst for the growth of the biometrics-as-a-service market in the coming years. Security threats represent potential dangers or risks that can jeopardize the confidentiality, integrity, or availability of information and resources. Biometrics as a service plays a crucial role in enhancing security by offering convenient and reliable identity verification, thus reducing the likelihood of unauthorized access and identity-related security breaches. For example, in June 2022, the Anti-Phishing Working Group, a US-based organization, reported a total of 1,025,968 phishing attacks in the first quarter of 2022, marking a 15% increase from the fourth quarter of 2021, when 888,585 attacks were recorded. Hence, the rising sophistication of security threats is a driving force behind the growth of the biometrics-as-a-service market.

Leading companies in the biometrics-as-a-service market are embracing advanced technologies like multimodal biometric authentication to offer reliable services and fortify their market presence. Multimodal biometric authentication involves using two or more distinct biometric identifiers for multi-factor authentication. For example, in November 2022, NEC Corporation, a prominent Japanese information technology and electronics company, introduced Bio-IDiom, a multimodal biometric authentication solution. This system combines face recognition and iris recognition, enabling high-precision, rapid authentication with an impressively low false acceptance rate of less than one in 10 billion. The biometric authentication facilitated by this technology allows for a unified ID, streamlining seamless collaboration across various services and enhancing the development of innovative client experiences and services. Additionally, the solution ensures precise data capture by automatically adjusting the camera's position based on the user's height.

In May 2022, LexisNexis Risk Solutions, a US-based analytics company, acquired BehavioSec for an undisclosed amount. This acquisition fortified LexisNexis' capability to effectively detect and authenticate digital identities. BehavioSec, a US-based advanced technology provider, is known for its expertise in behavioral biometrics.

Major companies operating in the biometrics-as-a-service market are Accenture PLC, Fujitsu Ltd., NEC Corporation, Thales Group, Leidos Holdings Inc., IDEMIA SA, Nuance Communications Inc., HID Global Corporation, Bytes Technology Group PLC, VoiceIt Technologies LLC, Imprivata Inc., Uniphore Software Systems Private Limited., Suprema Inc., BioEngagable Technologies Pvt Ltd., Aware Inc., Cognitec Systems GmbH, Integrated Biometrics LLC, IRITECH Inc., CERTIFY Global Inc., M2SYS Technology Inc., SecuGen Corporation, Athena Sciences Corporation, ImageWare Systems Inc., Mogimo Inc., Accu -Time Systems Inc., Clearview AI Inc., Biometrics Research Group Inc., Union Community Co Ltd., Skybiometry, Speech Technology Center Limited.

North America was the largest region in the biometrics-as-a-service market in 2024. Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in biometrics-as-a-service report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East and Africa. The countries covered in the biometrics-as-a-service market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

The biometrics-as-a-service market consists of revenues earned by entities by providing such as fraud prevention, access control and identity verification. The market value includes the value of related goods sold by the service provider or included within the service offering. The biometrics-as-a-service market also includes sales of palm or finger vein pattern sensors, cameras, signature pads and document readers. Values in this market are ‘factory gate’ values, that is the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

Biometrics-as-a-Service (BaaS) is a cloud-based software solution that offers biometric authentication and identification services to users. It enables organizations to effectively verify the identities of individuals, whether they are customers, employees, or other stakeholders.

The biometrics-as-a-service scanners encompass a range of technologies, including fingerprint recognition, iris recognition, palm recognition, facial recognition, voice recognition, and others. Fingerprint recognition involves an automated process that verifies or identifies a person by comparing two fingerprints. These biometric modalities, whether unimodal or multimodal, can be deployed across public, private, and hybrid cloud environments. They find applications in various sectors including government, retail, IT, telecom, BFSI, healthcare, and others, serving purposes such as site access control, time recording, mobile applications, web-based solutions, and workplace applications.

The biometrics-as-a-service market research report is one of a series of new reports that provides biometrics-as-a-service market statistics, including biometrics-as-a-service industry global market size, regional shares, competitors with a biometrics-as-a-service market share, detailed biometrics-as-a-service market segments, market trends and opportunities and any further data you may need to thrive in the biometrics-as-a-service industry. This biometrics-as-a-service market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Biometrics-As-A-Service Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on biometrics-as-a-service market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for biometrics-as-a-service? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The biometrics-as-a-service market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include:

- The forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Scanner Type: Fingerprint Recognition; Iris Recognition; Palm Recognition; Facial Recognition; Voice Recognition; Other Scanner Types2) By Modality: Unimodal; Multimodal

3) By Deployment Model: Public Cloud; Private Cloud; Hybrid Cloud

4) By Application: Site Access Control; Time Recording; Mobile Application; Web And Workplace

5) By End-User: Government; Retail; IT (Information Technology) And Telecom; Banking, Financial Services And Insurance (BFSI); Healthcare; Other End-Users

Subsegments:

1) By Fingerprint Recognition: Optical Fingerprint Scanners; Capacitive Fingerprint Scanners; Ultrasonic Fingerprint Scanners2) By Iris Recognition: Camera-based Iris Scanners; Smartphone Iris Recognition Systems

3) By Palm Recognition: Palm Print Scanners; Palm Vein Recognition Systems

4) By Facial Recognition: 2D Facial Recognition Systems; 3D Facial Recognition Systems

5) By Voice Recognition: Speaker Verification Systems; Voiceprint Recognition Systems

6) By Other Scanner Types: Behavioral Biometrics; Multimodal Biometric Systems

Key Companies Mentioned: Accenture plc; Fujitsu Ltd.; NEC Corporation; Thales Group; Leidos Holdings Inc.

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

Some of the major companies featured in this Biometrics-as-a-Service market report include:- Accenture plc

- Fujitsu Ltd.

- NEC Corporation

- Thales Group

- Leidos Holdings Inc.

- IDEMIA SA

- Nuance Communications Inc.

- HID Global Corporation

- Bytes Technology Group PLC

- VoiceIt Technologies LLC

- Imprivata Inc.

- Uniphore Software Systems Private Limited.

- Suprema Inc.

- BioEngagable Technologies Pvt Ltd.

- Aware Inc.

- Cognitec Systems GmbH

- Integrated Biometrics LLC

- IRITECH Inc.

- CERTIFY Global Inc.

- M2SYS Technology Inc.

- SecuGen Corporation

- Athena Sciences Corporation

- ImageWare Systems Inc.

- Mogimo Inc.

- Accu -Time Systems Inc.

- Clearview AI Inc.

- Biometrics Research Group Inc.

- Union Community Co Ltd.

- Skybiometry

- Speech Technology Center Limited

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | March 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 4.72 Billion |

| Forecasted Market Value ( USD | $ 13.47 Billion |

| Compound Annual Growth Rate | 30.0% |

| Regions Covered | Global |

| No. of Companies Mentioned | 31 |