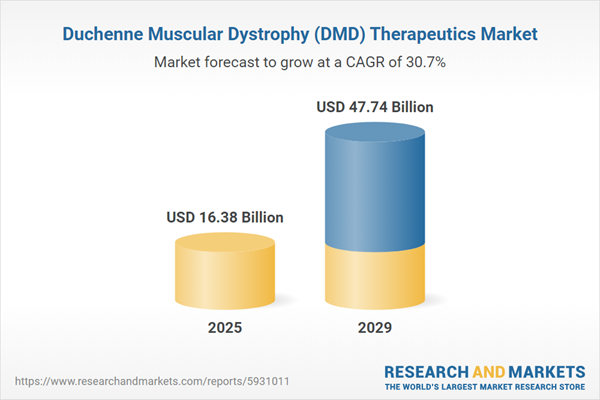

The duchenne muscular dystrophy (DMD) therapeutics market size is expected to see exponential growth in the next few years. It will grow to $47.74 billion in 2029 at a compound annual growth rate (CAGR) of 30.7%. The growth in the forecast period can be attributed to growing investments in for duchenne muscular dystrophy treatments, adoption of combination therapies, emergence of biomarker,growing number of screening programs for duchenne muscular dystrophy. Major trends in the forecast period include innovative treatments for duchenne muscular dystrophy, development of targeted therapies, introduction of novel medications and therapies, innovative disease-modifying therapies, active drug developments.

The forecast of 30.7% growth over the next five years reflects a modest reduction of 0.4% from the previous estimate for this market. This reduction is primarily due to the impact of tariffs between the US and other countries. Tariff escalations are likely to burden U.S. hospitals by driving up the cost of exon-skipping drugs and muscle biopsy equipment sourced from Italy and Belgium, exacerbating treatment costs and increasing pediatric neurology service burdens. The effect will also be felt more widely due to reciprocal tariffs and the negative effect on the global economy and trade due to increased trade tensions and restrictions.

The growth of the Duchenne muscular dystrophy (DMD) therapeutics market is anticipated to be propelled by the increasing number of clinical trials. Clinical trials represent essential research studies involving human participants aimed at assessing the safety, efficacy, and potential advantages of new medical treatments, interventions, or medications. The upsurge in clinical trials dedicated to exploring Duchenne muscular dystrophy treatments underscores the ongoing commitment to research, innovation, and a diverse range of therapeutic possibilities. This trend is poised to result in improved patient outcomes, heightened investments, and the accelerated development and accessibility of effective DMD therapies. For example, in August 2023, as reported by Clinicaltrials.gov, a branch of the National Institutes of Health (NIH), the number of registered clinical trials has increased to 464,218, marking a significant rise from 399,496 in 2021. These trials are conducted across all 50 states of the United States and in 221 countries. Additionally, 31% of these studies, totaling 142,700, are registered within the U.S., while the remaining 53% of studies (248,310) are documented in international locations. Consequently, the escalating count of clinical trials is expected to be a driving force behind the expansion of the Duchenne muscular dystrophy (DMD) therapeutics market.

The rising prevalence of genetic disorders is expected to drive the growth of the Duchenne muscular dystrophy (DMD) market in the future. Genetic disorders are conditions caused by abnormalities or mutations in an individual's DNA or genetic material. As the occurrence of genetic disorders increases, a larger population may be at risk of developing DMD due to genetic mutations or family history, leading to greater demand for DMD-related diagnostics, treatments, and therapies. For example, in February 2022, the World Health Organization (WHO), a Switzerland-based intergovernmental body, reported that birth abnormalities cause 240,000 newborn deaths within the first 28 days of life each year. Furthermore, an additional 170,000 children aged 1 month to 5 years die due to birth abnormalities, such as heart defects, neural tube defects, and Down syndrome. As a result, the growing prevalence of genetic disorders is driving the expansion of the DMD market.

The leading companies in the field of Duchenne muscular dystrophy (DMD) therapeutics are embracing innovative technologies to enhance the effectiveness and accessibility of treatments for DMD patients while maintaining their competitive edge in the market. A case in point is Bit Bio Ltd., a UK-based synthetic biology company, which, in July 2023, introduced disease model products aimed at advancing Duchenne muscular dystrophy (DMD) treatments. These disease models, specifically the ioSkeletal Myocytes DMD Exon 44 Deletion and ioSkeletal Myocytes DMD Exon 52 Deletion, consist of human skeletal myocytes engineered to carry deletions in the gene responsible for dystrophin protein production. Derived from induced pluripotent stem cells (iPSCs), Bit Bio's models offer a reliable and scalable source of human cells for research, addressing challenges associated with variability and the sourcing of primary cells. These models provide valuable insights into disease mechanisms and potential therapies, supporting the development of treatments for DMD. This technological advancement has the potential to expedite the work of researchers striving to find effective solutions for Duchenne muscular dystrophy.

In December 2022, Solid Biosciences Inc., a biotechnology firm headquartered in the United States, successfully completed the acquisition of AavantiBio, Inc. The financial details of the transaction remain undisclosed. This acquisition represents a significant move by Solid Biosciences to extend its collection of gene therapy programs, focusing on neuromuscular and cardiac diseases. The incorporation of AavantiBio, Inc. has not only broadened the company's capabilities but also brought in valuable expertise and financial resources for advancing research and development efforts and reaching potential milestones. AavantiBio, Inc., a gene therapy company based in the United States, specializes in the development of groundbreaking treatments for Duchenne muscular dystrophy and various other neuromuscular and cardiac diseases.

Major companies operating in the duchenne muscular dystrophy (dmd) therapeutics market are CVS Health Corporation, Pfizer Inc., F. Hoffmann-La Roche Ltd., Bristol-Myers Squibb Company, Eli Lilly and Co., Otsuka Holdings Co. Ltd., Daiichi Sankyo Co. Ltd., BioMarin Pharmaceutical Inc., Nippon Shinyaku Co. Ltd., CRISPR Therapeutics AG, Sarepta Therapeutics Inc., PTC Therapeutics Inc., Halozyme Therapeutics Inc., FibroGen Inc., Exonics Therapeutics Inc., Italfarmaco S.p.A., Wave Life Sciences Ltd., MeiraGTx Holdings PLC, Editas Medicine Inc., NS Pharma Inc., Solid Biosciences Inc., Santhera Pharmaceuticals Holding, Avidity Biosciences LLC, ReveraGen BioPharma Inc., Capricor Therapeutics Inc., Dynacure S.A., Summit Therapeutics plc.

North America was the largest region in the DMD therapeutics market in 2024. The regions covered in duchenne muscular dystrophy (DMD) therapeutics report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East and Africa. The countries covered in the duchenne muscular dystrophy (DMD) therapeutics market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, and Spain.

Note that the outlook for this market is being affected by rapid changes in trade relations and tariffs globally. The report will be updated prior to delivery to reflect the latest status, including revised forecasts and quantified impact analysis. The report’s Recommendations and Conclusions sections will be updated to give strategies for entities dealing with the fast-moving international environment.

The sudden escalation of U.S. tariffs and the resulting trade tensions in spring 2025 are having a significant impact on the pharmaceutical sector. Companies are grappling with higher costs on imported active pharmaceutical ingredients (APIs), glass vials, and laboratory equipment - many of which have limited alternative sources. Generic drug manufacturers, already operating with minimal profit margins, are particularly affected, with some scaling back production of low-margin medications. Biotech firms are also experiencing delays in clinical trials due to shortages of specialized reagents linked to tariffs. In response, the industry is shifting API production to regions like India and Europe, building up inventory reserves, and advocating for tariff exemptions on essential medicines.

The duchenne muscular dystrophy (DMD) therapeutics market research report is one of a series of new reports that provides duchenne muscular dystrophy (DMD) therapeutics market statistics, including duchenne muscular dystrophy (DMD) therapeutics industry global market size, regional shares, competitors with a duchenne muscular dystrophy (DMD) therapeutics market share, detailed duchenne muscular dystrophy (DMD) therapeutics market segments, market trends and opportunities and any further data you may need to thrive in the duchenne muscular dystrophy (DMD) therapeutics industry. This duchenne muscular dystrophy (DMD) therapeutics market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

Duchenne muscular dystrophy (DMD) therapeutics encompass a range of medical interventions and treatments devised to address and mitigate the symptoms associated with DMD, a genetic ailment characterized by progressive muscle weakening and deterioration. The primary objective of these therapeutic strategies is to retard the advancement of the disease, enhance muscle function, and augment the overall well-being of individuals afflicted by Duchenne muscular dystrophy.

The principal categories of DMD therapeutics consist of small molecules and biologics. Small molecules are compounds with low molecular weight that can specifically interact with certain proteins or targets within the body. These can be tailored to address various facets of DMD, such as mitigating inflammation, fostering muscle regeneration, or targeting specific genetic mutations. The distribution of these therapeutics occurs through both offline and online channels, catering to applications in hospitals, clinics, and home care settings.

The duchenne muscular dystrophy (DMD) therapeutics market includes revenues earned by entities by providing services including gene therapies, genetic testing and counseling, telehealth and remote monitoring. The market value includes the value of related goods sold by the service provider or included within the service offering. The duchenne muscular dystrophy (DMD) therapeutics market also include sales of casimersen, eteplirsen and golodirsen. Values in this market are ‘factory gate’ values, that is the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 1-3 business days.

Table of Contents

Executive Summary

Duchenne Muscular Dystrophy (DMD) Therapeutics Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on duchenne muscular dystrophy (dmd) therapeutics market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as geopolitical conflicts, trade policies and tariffs, post-pandemic supply chain realignment, inflation and interest rate fluctuations, and evolving regulatory landscapes.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for duchenne muscular dystrophy (dmd) therapeutics? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward, including technological disruption, regulatory shifts, and changing consumer preferences? The duchenne muscular dystrophy (dmd) therapeutics market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include: the technological advancements such as AI and automation, Russia-Ukraine war, trade tariffs (government-imposed import/export duties), elevated inflation and interest rates.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Type: Small Molecules; Biologics2) By Distribution Channel: Offline; Online

3) By Application: Hospitals; Clinics; Home Care

Subsegments:

1) By Small Molecules: Exon Skipping Therapies; Antisense Oligonucleotides; Read-Through Compounds2) By Biologics: Gene Therapies; Cell Therapies; Protein Replacement Therapies

Companies Mentioned: CVS Health Corporation; Pfizer Inc.; F. Hoffmann-La Roche Ltd.; Bristol-Myers Squibb Company; Eli Lilly and Co.; Otsuka Holdings Co. Ltd.; Daiichi Sankyo Co. Ltd.; BioMarin Pharmaceutical Inc.; Nippon Shinyaku Co. Ltd.; CRISPR Therapeutics AG; Sarepta Therapeutics Inc.; PTC Therapeutics Inc.; Halozyme Therapeutics Inc.; FibroGen Inc.; Exonics Therapeutics Inc.; Italfarmaco S.p.A.; Wave Life Sciences Ltd.; MeiraGTx Holdings plc; Editas Medicine Inc.; NS Pharma Inc.; Solid Biosciences Inc.; Santhera Pharmaceuticals Holding; Avidity Biosciences LLC; ReveraGen BioPharma Inc.; Capricor Therapeutics Inc.; Dynacure S.A.; Summit Therapeutics plc.

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

The companies featured in this Duchenne Muscular Dystrophy (DMD) Therapeutics market report include:- CVS Health Corporation

- Pfizer Inc.

- F. Hoffmann-La Roche Ltd.

- Bristol-Myers Squibb Company

- Eli Lilly and Co.

- Otsuka Holdings Co. Ltd.

- Daiichi Sankyo Co. Ltd.

- BioMarin Pharmaceutical Inc.

- Nippon Shinyaku Co. Ltd.

- CRISPR Therapeutics AG

- Sarepta Therapeutics Inc.

- PTC Therapeutics Inc.

- Halozyme Therapeutics Inc.

- FibroGen Inc.

- Exonics Therapeutics Inc.

- Italfarmaco S.p.A.

- Wave Life Sciences Ltd.

- MeiraGTx Holdings plc

- Editas Medicine Inc.

- NS Pharma Inc.

- Solid Biosciences Inc.

- Santhera Pharmaceuticals Holding

- Avidity Biosciences LLC

- ReveraGen BioPharma Inc.

- Capricor Therapeutics Inc.

- Dynacure S.A.

- Summit Therapeutics plc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 250 |

| Published | September 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 16.38 Billion |

| Forecasted Market Value ( USD | $ 47.74 Billion |

| Compound Annual Growth Rate | 30.7% |

| Regions Covered | Global |

| No. of Companies Mentioned | 28 |