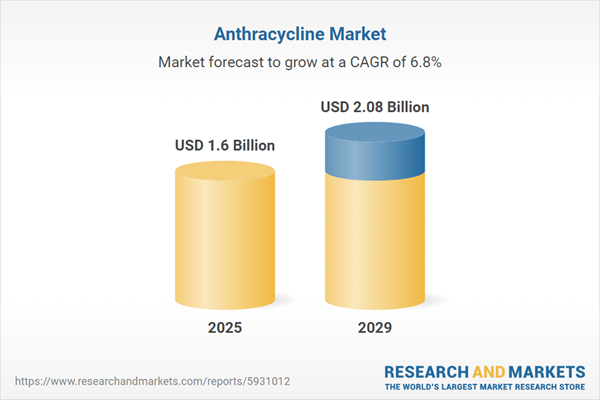

The anthracycline market size is expected to see strong growth in the next few years. It will grow to $2.08 billion in 2029 at a compound annual growth rate (CAGR) of 6.8%. The growth in the forecast period can be attributed to growing awareness about cancer treatment, investments in research and development for cancer treatments, growing demand for effective and convenient treatments for cancer, growing number of screening programs for cancer, government initiatives. Major trends in the forecast period include advancements in anthracycline formulations, combination therapies, cardioprotective strategies, developing biosimilars of anthracyclines.

The forecast of 6.8% growth over the next five years reflects a modest reduction of 0.2% from the previous estimate for this market. This reduction is primarily due to the impact of tariffs between the US and other countries. Tariff barriers are expected to hamper U.S. oncology centers by increasing the cost of doxorubicin and other anthracycline chemotherapies sourced from Italy and Israel, thereby limiting cancer treatment options and elevating chemotherapy drug expenses. The effect will also be felt more widely due to reciprocal tariffs and the negative effect on the global economy and trade due to increased trade tensions and restrictions.

The burgeoning prevalence of cancer is poised to act as a major catalyst for the future growth of the anthracycline market. Cancer, a group of disorders characterized by the unbridled proliferation of abnormal cells that can manifest in virtually any organ or tissue within the body, often transcending their typical boundaries and potentially spreading to other body parts or invading neighboring tissues. In this landscape, anthracyclines, a class of potent chemotherapy drugs, assume a crucial role in cancer treatment. They achieve this by impeding cell division through the disruption of DNA structure, effectively terminating its normal function. For instance, as of 2023, data from the American Cancer Society Inc., a US-based nonprofit health organization, projects a rise in new cancer cases with an estimated 1.9 million diagnoses in the United States. This marks an increase from the 1.8 million new cancer cases diagnosed in 2020. Furthermore, the anticipated figures for cancer-related deaths in 2023 stand at approximately 609,820, compared to the expected 606,520 in 2020. Consequently, the mounting incidence of cancer is the driving force behind the burgeoning anthracycline market.

The anthracycline market is primed for substantial growth in the foreseeable future, primarily attributed to the escalating adoption of personalized medicine. Personalized medicine, often referred to as precision medicine, represents a niche within medical treatment characterized by tailoring therapeutic approaches to the unique attributes of individual patients. This level of customization takes into account the genetic, molecular, and specific disease characteristics of patients, allowing for the precise integration of anthracycline chemotherapy drugs in combination with targeted therapies. The result is the delivery of more effective and less harmful treatment strategies.For instance, as of October 2022, reports from STAT, a US-based health-focused news entity, revealed that there are in excess of 75,000 genetic testing products and 300 personalized medicines in existence. Furthermore, data from the Personalized Medicine Coalition, a representative organization based in the United States, indicated that in 2022, the FDA approved personalized medicines for 34% of newly developed drugs. This trend has been consistent over the preceding eight years, with at least 25% of new drugs receiving approval as personalized medicines. Consequently, the escalating demand for personalized medicine stands as the driving force behind the expansion of the anthracycline market.

Leading companies in the anthracycline market are focusing on developing innovative products, such as non-cardiotoxic formulations, to enhance the safety of chemotherapy treatments. Non-cardiotoxic formulations are designed to minimize or eliminate damage to the heart, addressing the harmful effects typically associated with certain chemotherapy drugs, like anthracyclines, which can lead to heart failure or other cardiac issues. For example, in April 2024, the European Medicines Agency (EMA) granted Orphan Drug Designation to Annamycin, a next-generation anthracycline, for the treatment of acute myeloid leukemia (AML). This designation provides significant incentives for developing treatments for rare diseases, including seven years of market exclusivity post-approval, preventing other manufacturers from marketing the same drug for the same indication. Additionally, the designation offers tax credits covering up to 50% of clinical trial costs, application fee waivers, and regulatory support from the FDA, helping to alleviate the financial burden of developing drugs for small patient populations.

In August 2023, CNX Therapeutics Limited, a UK-based specialty pharmaceutical company, acquired four cancer support products - Cardioxane (dexrazoxane), Savene (dexrazoxane), Totect (dexrazoxane), and Ethyol (amifostine) - from Clinigen Limited for an undisclosed amount. Cardioxane is used in adults with advanced or metastatic breast cancer to prevent long-term cardiac damage caused by certain anthracyclines. Savene treats anthracycline extravasation, a rare condition in cancer patients, while Totect addresses both anthracycline extravasation and cardiovascular prevention related to doxorubicin in women with metastatic breast cancer. This acquisition strengthens CNX Therapeutics' portfolio of essential hospital products, broadening its established presence in over 40 countries and unlocking new opportunities across multiple global markets. Clinigen Limited is a UK-based pharmaceutical services company that provides commercial medicines for clinical study use.

Major companies operating in the anthracycline market are Pfizer Inc., F. Hoffmann-La Roche Ltd., Novartis AG, Bristol-Myers Squibb Company, Fresenius SE & Co. KGaA, Merck & Co. Inc., Gilead Sciences Inc., Zydus Lifesciences Limited, Viatris Inc., Baxter International Inc., Teva Pharmaceutical Industries Ltd., Sun Pharmaceutical Industries Limited, Jazz Pharmaceuticals Inc., Gland Pharma Limited, Dr. Reddy's Laboratories Ltd., Hikma Pharmaceuticals PLC, Endo Pharmaceuticals Inc., Amneal Pharmaceuticals Inc., Zhejiang Hisun Pharmaceutical Co. Ltd., Accord Healthcare Limited, Athenex Inc., Miracalus Pharma Pvt. Ltd., Transo-Pharm Usa LLC, BluePoint Laboratories, Areva Pharmaceuticals Inc., GeneraMedix Inc., Salius Pharma Pvt. Ltd.

Asia-Pacific was the largest region in the anthracycline market in 2024. The regions covered in anthracycline report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East and Africa. The countries covered in the anthracycline market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, and Spain.

Note that the outlook for this market is being affected by rapid changes in trade relations and tariffs globally. The report will be updated prior to delivery to reflect the latest status, including revised forecasts and quantified impact analysis. The report’s Recommendations and Conclusions sections will be updated to give strategies for entities dealing with the fast-moving international environment.

The sudden escalation of U.S. tariffs and the resulting trade tensions in spring 2025 are having a significant impact on the pharmaceutical sector. Companies are grappling with higher costs on imported active pharmaceutical ingredients (APIs), glass vials, and laboratory equipment - many of which have limited alternative sources. Generic drug manufacturers, already operating with minimal profit margins, are particularly affected, with some scaling back production of low-margin medications. Biotech firms are also experiencing delays in clinical trials due to shortages of specialized reagents linked to tariffs. In response, the industry is shifting API production to regions like India and Europe, building up inventory reserves, and advocating for tariff exemptions on essential medicines.

The anthracycline market research report is one of a series of new reports that provides anthracycline market statistics, including anthracycline industry global market size, regional shares, competitors with an anthracycline market share, detailed anthracycline market segments, market trends and opportunities and any further data you may need to thrive in the anthracycline industry. This anthracycline market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

Anthracyclines represent a class of potent chemotherapy drugs derived from specific Streptomyces bacteria strains. These drugs exert their therapeutic action by disrupting the DNA (deoxyribonucleic acid) within cancer cells, effectively impeding their growth and replication. Anthracyclines find application in the treatment of a range of cancer types, including but not limited to breast cancer, various lymphomas, leukemia, and more.

The primary anthracycline drugs encompass daunorubicin, doxorubicin, epirubicin, idarubicin, mitoxantrone, and valrubicin. Daunorubicin, for instance, serves as an anthracycline chemotherapy agent that operates by hindering the synthesis of both DNA and RNA. This inhibition is achieved through the intercalation of daunorubicin into the DNA helix, coupled with the inhibition of topoisomerase II. This dual mechanism results in cell cycle arrest and the induction of apoptosis, particularly in rapidly dividing cells. Anthracycline drugs are available in various formulations, including powders, capsules, solutions, injections, suspensions, and others. These formulations serve multiple therapeutic applications, addressing conditions such as acute lymphocytic leukemia, acute myelogenous leukemia, Hodgkin's lymphoma, non-Hodgkin's lymphoma, bladder cancer, breast cancer, and more. The diverse array of end users for these medications includes hospitals, home care settings, specialty clinics, and others.

The anthracycline market consists of sales of aclarubicin and pixantrone. Values in this market are ‘factory gate’ values, that is, the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 1-3 business days.

Table of Contents

Executive Summary

Anthracycline Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on anthracycline market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as geopolitical conflicts, trade policies and tariffs, post-pandemic supply chain realignment, inflation and interest rate fluctuations, and evolving regulatory landscapes.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for anthracycline? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward, including technological disruption, regulatory shifts, and changing consumer preferences? The anthracycline market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include: the technological advancements such as AI and automation, Russia-Ukraine war, trade tariffs (government-imposed import/export duties), elevated inflation and interest rates.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Drugs: Daunorubicin; Doxorubicin; Epirubicin; Idarubicin; Mitoxantrone; Valrubicin2) By Dosage: Powder; Capsule; Solution; Injection; Suspension; Other Dosages

3) By Application: Acute Lymphocytic Leukemia; Acute Myelogenous Leukemia; Hodgkin's Lymphoma; Non-Hodgkin's Lymphoma; Bladder Cancer; Breast Cancer; Other Metastatic Cancers

4) By End User: Hospitals; Homecare; Specialty Clinics; Other End Users

Subsegments:

1) By Daunorubicin: Daunorubicin Hydrochloride; Liposomal Daunorubicin2) By Doxorubicin: Doxorubicin Hydrochloride; Liposomal Doxorubicin

3) By Epirubicin: Epirubicin Hydrochloride

4) By Idarubicin: Idarubicin Hydrochloride

5) By Mitoxantrone: Mitoxantrone Hydrochloride

6) By Valrubicin: Valrubicin Hydrochloride

Companies Mentioned: Pfizer Inc.; F. Hoffmann-La Roche Ltd.; Novartis AG; Bristol-Myers Squibb Company; Fresenius SE & Co. KGaA; Merck & Co. Inc.; Gilead Sciences Inc.; Zydus Lifesciences Limited; Viatris Inc.; Baxter International Inc.; Teva Pharmaceutical Industries Ltd.; Sun Pharmaceutical Industries Limited; Jazz Pharmaceuticals Inc.; Gland Pharma Limited; Dr. Reddy's Laboratories Ltd.; Hikma Pharmaceuticals PLC; Endo Pharmaceuticals Inc.; Amneal Pharmaceuticals Inc.; Zhejiang Hisun Pharmaceutical Co. Ltd.; Accord Healthcare Limited; Athenex Inc.; Miracalus Pharma Pvt. Ltd; Transo-Pharm Usa LLC; BluePoint Laboratories; Areva Pharmaceuticals Inc.; GeneraMedix Inc.; Salius Pharma Pvt. Ltd.

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

The companies featured in this Anthracycline market report include:- Pfizer Inc.

- F. Hoffmann-La Roche Ltd.

- Novartis AG

- Bristol-Myers Squibb Company

- Fresenius SE & Co. KGaA

- Merck & Co. Inc.

- Gilead Sciences Inc.

- Zydus Lifesciences Limited

- Viatris Inc.

- Baxter International Inc.

- Teva Pharmaceutical Industries Ltd.

- Sun Pharmaceutical Industries Limited

- Jazz Pharmaceuticals Inc.

- Gland Pharma Limited

- Dr. Reddy's Laboratories Ltd.

- Hikma Pharmaceuticals PLC

- Endo Pharmaceuticals Inc.

- Amneal Pharmaceuticals Inc.

- Zhejiang Hisun Pharmaceutical Co. Ltd.

- Accord Healthcare Limited

- Athenex Inc.

- Miracalus Pharma Pvt. Ltd

- Transo-Pharm Usa LLC

- BluePoint Laboratories

- Areva Pharmaceuticals Inc.

- GeneraMedix Inc.

- Salius Pharma Pvt. Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 250 |

| Published | September 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 1.6 Billion |

| Forecasted Market Value ( USD | $ 2.08 Billion |

| Compound Annual Growth Rate | 6.8% |

| Regions Covered | Global |

| No. of Companies Mentioned | 28 |