China is the largest producer of chemicals across the world. According to Cefic, the European Chemical Industry Council, in 2021, the country contributed 43% of global chemical sales of around US$ 1,839.1 billion (EUR 1,729 billion). Various market players in the country are working on expanding their manufacturing facilities. In January 2023, China's Sinopec Corp announced that they had started constructing a US$ 1.56 billion (CNY 10.8 billion) project in a northern subsidiary refinery to manufacture high-end chemicals. The project is built alongside Sinopec's Shijiangzhuang refinery in Hebei province. In addition, in October 2022, BASF announced that it would be constructing a Neopentyl Glycol (NPG) plant at its new Zhanjiang Verbund site in China. The plant is expected to be operational by Q4 of 2025 and will have an annual production capacity of 80,000 metric tons. Similarly, the chemical industry in South Korea has witnessed tremendous growth in the recent years. According to the International Trade Administration (ITA), in 2020, the country was ranked fifth across the world as per the production scale. Various chemical manufacturers in the country are constructing new production facilities to boost production. In September 2021, Hanwha Corp. announced its plan to build a nitric acid production plant by 2024. This plant will provide an annual capacity of 400,000 tons in Yeosu Industrial Complex, South Korea. For this, the company will invest US$ 162 million (190 billion won). Also, in February 2023, LOTTE INEOS Chemical announced its plan to increase Vinyl Acetate Monomer (VAM) production capacity from the current 450,000 tonnes to 700,000 tonnes. For this, the company will be constructing its third VAM production plant in South Korea, which is scheduled to be operational by the end of 2025. Thus, the growing construction of chemical manufacturing plants in the above countries will raise the demand for safety instrumented systems as it can help to reduce risks such as accidents and injury and improve productivity, fueling the growth of the safety instrumented system market in the forecasted period.

ABB Ltd, Applied Control Engineering Inc, AVEVA Group plc, Emerson Electric Co, HIMA, Honeywell International, Rockwell Automation Inc, Schneider Electric, Siemens AG, and Yokogawa Electric Corporation are among the key safety instrumented system market players profiled in this market study. Several other essential safety instrumented system market players were analyzed for a holistic view of the market and its ecosystem.

The overall safety instrumented system market size has been derived using both primary and secondary sources. To begin the safety instrumented system market research process, exhaustive secondary research has been conducted using internal and external sources to obtain qualitative and quantitative information related to the safety instrumented system market. The process also serves the purpose of obtaining an overview and market forecast of the safety instrumented system market growth with respect to all market segments. Also, multiple primary interviews have been conducted with industry participants and commentators to validate the data and gain more analytical insights about the topic. Participants of this process include industry experts such as VPs, business development managers, market intelligence managers, and national sales managers - along with external consultants such as valuation experts, research analysts, and key opinion leaders - specializing in the safety instrumented system market.

Table of Contents

Companies Mentioned

- Safety Instrumented System Market

- ABB Ltd

- Applied Control Engineering Inc

- AVEVA Group plc

- Emerson Electric Co

- HIMA, Honeywell International

- Rockwell Automation Inc

- Schneider Electric

- Siemens AG

- Yokogawa Electric Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 150 |

| Published | December 2023 |

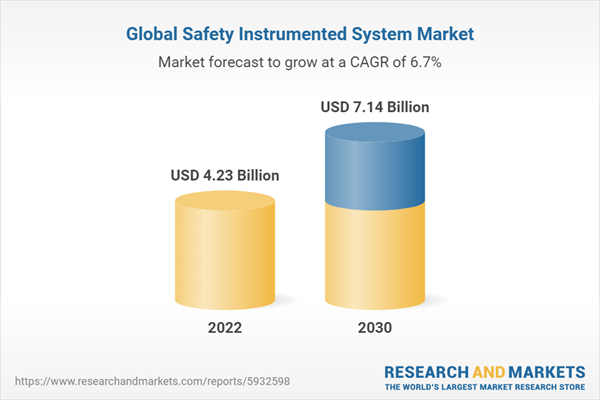

| Forecast Period | 2022 - 2030 |

| Estimated Market Value ( USD | $ 4.23 Billion |

| Forecasted Market Value ( USD | $ 7.14 Billion |

| Compound Annual Growth Rate | 6.7% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |