Increasing Awareness of Implementing Technologies in Construction Industry fuel the South & Central America Construction Accounting Software Market

The construction industry has begun to undergo technological transformation. Companies are implementing technologies to reduce costs and improve safety, efficiency, and quality of construction activities. As construction companies increasingly emphasize accounting decisions to determine the ROI and future of respective businesses, the demand for construction accounting software is rising. Analyzing the financials using accounting software before starting a business allows emerging entrepreneurs to carry out unique business ideas and rapidly and efficiently reflect their vision. A business plan software analysis also enables new business owners to understand the fundraising strategies and expansion policies. Additionally, the software-based accounting plans help the end-user foresee potential problems and obstacles. Thus, many companies are offering construction accounting software due to the rising awareness among new entrepreneurs, which is expected to offer lucrative business opportunities for market players in the coming years.South & Central America Construction Accounting Software Market Overview

South & Central America includes countries such as Brazil and Argentina. The region has witnessed more than 17,000 construction projects, which depicts the region's growing construction industry. According to the Association of Equipment Manufacturers (AEM), the construction industry witnessed modest growth in past year. Brazil holds the most extensive construction market share in the region, and the country’s government continuously invests a substantial amount in developing its commercial and industrial infrastructures. Moreover, Colombia and Argentina are expected to witness faster growth in construction, which is mainly attributed to the public-private partnership (PPP) projects.In the context of the construction industry, the government had stated plans to initiate ~7,000 construction projects with an investment of US$ 40 billion (BRL 131 billion) by the end of 2018. Moreover, several publicly funded infrastructure projects such as “My House, My Life” and the National Education Plan 2014-2024 program will boost the construction industry's growth. Such government initiatives will help stimulate the development of the construction industry in the region. Moreover, the region promotes economic growth via increased public spending and increasing infrastructure bottlenecks to assist private sector development; this focus is further expected to contribute to the construction industry's business growth. The more the construction projects, the higher will be the penetration of construction accounting software.

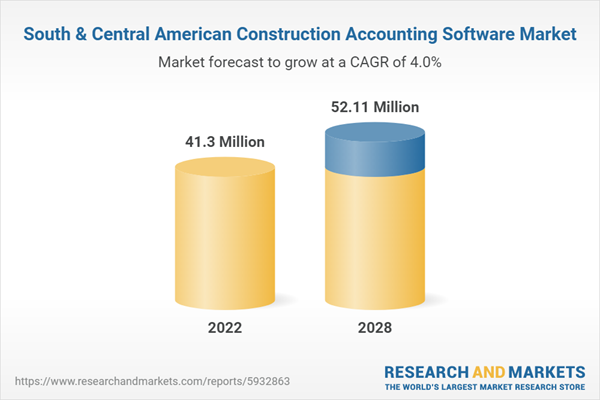

South & Central America Construction Accounting Software Market Revenue and Forecast to 2028 (US$ Million)

South & Central America Construction Accounting Software Market Segmentation

The South & Central America construction accounting software market is segmented based on offering, deployment, application, and country. Based on offering, the South & Central America construction accounting software market is bifurcated into solution and services. The solution segment held a larger market share in 2022.Based on deployment, the South & Central America construction accounting software market is bifurcated into on-premises and cloud. The cloud segment held a larger market share in 2022.

Based on application, the South & Central America construction accounting software market is bifurcated into small and mid-sized construction companies and large construction companies. The large construction companies segment held a larger market share in 2022.

Based on country, the South & Central America construction accounting software market is segmented into Brazil, Argentina, and the Rest of South & Central America. Brazil dominated the South & Central America construction accounting software market in 2022.

Intuit Inc, Xero Ltd, Trimble Inc., and Procore Technologies are some of the leading players operating in the South & Central America construction accounting software market.

Table of Contents

Executive Summary

At 4.0% CAGR, the South & Central America Construction Accounting Software Market is Speculated to be worth US$ 52.11 million by 2028.According to this research,, the South & Central America construction accounting software market was valued at US$ 41.30 million in 2022 and is expected to reach US$ 52.11 million by 2028, registering a CAGR of 4.0% from 2022 to 2028. Growing construction industry and rising penetration of ERP modules in construction industry are the critical factors attributed to the South & Central America construction accounting software market expansion.

The construction accounting software market players use dedicated servers and data centers to store customer data and company’s crucial information and plan samples. Several companies across industries face a significant threat from cyber attackers, and in the recent past, numerous cyber-attacks have been recorded. The data loss affects the reputation of accounting software providers, ultimately resulting in financial loss. To eliminate the risk of customer data loss and financial crisis, construction accounting software developing companies invest significant amounts in enhancing their security systems. The players are also developing and integrating robust anti-cyber threat solutions to prevent the loss of crucial information and data. Thus, by strengthening the security level with advanced encryption patches and using a robust anti-piracy or anti-cyber threat solution, the companies are expected to attract an increased number of clienteles and propel financial growth. This factor is anticipated to boost the growth of the construction accounting software market in the coming years.

On the contrary, high reliance on traditional accounting tools hurdles the growth of South & Central America construction accounting software market.

Based on offering, the South & Central America construction accounting software market is bifurcated into solution and services. The solution segment held 81.9% market share in 2022, amassing US$ 33.81 million. It is projected to garner US$ 43.40 million by 2028 to expand at 4.2% CAGR during 2022-2028.

Based on deployment, the South & Central America construction accounting software market is bifurcated into on-premises and cloud. The cloud segment held 67.8% market share in 2022, amassing US$ 27.99 million. It is projected to garner US$ 37.19 million by 2028 to expand at 4.8% CAGR during 2022-2028.

Based on application, the South & Central America construction accounting software market is bifurcated into small and mid-sized construction companies and large construction companies. The large construction companies segment held 69.7% market share in 2022, amassing US$ 28.78 million. It is projected to garner US$ 34.78 million by 2028 to expand at 3.2% CAGR during 2022-2028.

Based on country, the South & Central America construction accounting software market has been categorized into Brazil, Argentina, and the Rest of South & Central America. Our regional analysis states that Brazil captured 70.7% share of South & Central America construction accounting software market in 2022. It was assessed at US$ 29.19 million in 2022 and is likely to hit US$ 37.98 million by 2028, exhibiting a CAGR of 4.5% during 2022-2028.

Key players operating in the South & Central America construction accounting software market are Intuit Inc, Xero Ltd, Trimble Inc., and Procore Technologies among others.

In Nov 2021, Trimble Civil Construction Field Software Now Available Via Subscription Service Worldwide. In July 2021, New Procore ERP Connector Platform Provides Real-Time Insight on Financial Health of Construction Projects.

Companies Mentioned

- Intuit Inc

- Xero Ltd

- Trimble Inc.

- Procore Technologies

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 70 |

| Published | November 2023 |

| Forecast Period | 2022 - 2028 |

| Estimated Market Value in 2022 | 41.3 Million |

| Forecasted Market Value by 2028 | 52.11 Million |

| Compound Annual Growth Rate | 4.0% |

| No. of Companies Mentioned | 4 |