Favorable Regulations in Brazil and Argentina fuel the South & Central America Homeopathy Market

In Brazil, there is widespread use of homeopathy as an alternative medicine. Homeopathy was introduced to Brazil in 1840 by the French homeopathic physician. There are approximately 15,000 homeopathic physicians, specialized pharmacists, veterinarians, and dental surgeons practicing the profession in Brazil. This generally states a brief overview on when homeopathy was introduced in Brazil and the state of art. In 2020, over 50 million Brazilians had treated themselves with homeopathic medications at least once. In Brazil, homeopathy is regulated by Anvisa, which creates rules for the production and prescription by pharmacies, industrialization, and sale of these medications, in an attempt to guarantee their quality. Industrialized homeopathic medications can be found in pharmacies and drugstores and must clearly state the initials MS and a sequence of 8 to 13 numbers which always start with number. In addition, there are a significant number of homeopathic laboratories and pharmacies producing and selling industrialized homeopathic medicines. Boiron, which is the biggest worldwide laboratory of homeopathic medications started selling its products owing to high demand in the country. Thus, abovementioned factors are driving the homeopathy market during the forecast period.In Argentina, homoeopathic remedies are duly accepted by the Ministry of Public Health, owing to which pharmacies and laboratories prepare and sell their medicines under the same controls as those on general remedies. At present there are more than 500 physicians practicing Unified Homoeopathy. Rise in geriatric population, increase in the prevalence of chronic disorders, and rise in the demand for homeopathy medicines are some factors that will aid the growth of homeopathic medicine in Argentina. As per the IDF Diabetes Atlas 2021 reports, 10.5% of the adult population (20-79 years) has diabetes, with almost half unaware of the condition. According to the LIGA MEDICORUM HOMOEOPATHICA INTERNATIONALIS, homeopathy in Argentina is recognized for its well-known tradition and its high academic standards. Homeopathic training in Argentina is guaranteed in high-level courses for medical doctors, dentists, veterinarians and pharmacists by institutions that follow the educational standards suggested by the Liga Medicorum Homoeopathica Internationalis (LMHI). Teachers from Argentinean institutions are frequently requested in different countries of the world because of their level of excellence. This shows that Argentinean homeopathy is still valid since the times of Dr. Tomás Pablo Paschero, who was a well-known President of the LMHI. The Federación de Asociaciones Médicas Homeopáticas Argentinas (FAMHA, or Federation of Argentinean Homeopathic Medical Associations) unites prestigious educational institutions that keep the legacy alive. The FAMHA continues fighting for homeopathy's legal recognition. In that regard, homeopaths are allowed to prescribe homeopathic remedies, but the practice of this therapeutic method has not yet been considered a medical act. Despite being criticized and attacked by conservative groups among the health system, homeopathy in Argentina is appreciated in other health environments and by all the patients who have benefited from this healing methodology.

South & Central America Homeopathy Market Overview

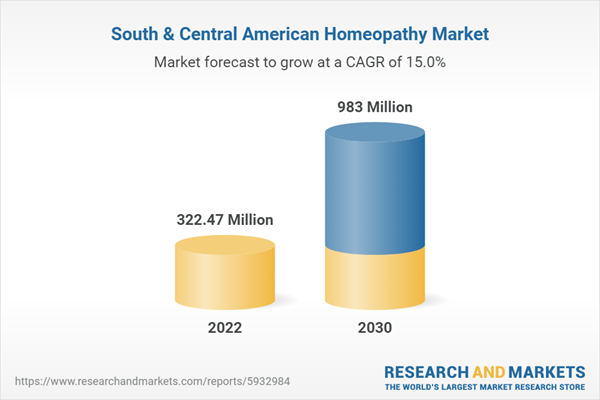

The South & Central America homeopathy market is segmented into Brazil, Argentina, and the Rest of South & Central America. The market is likely to propel during the forecast period owing to the increasing availability and accessibility of homeopathic products and service, the increasing regulatory support by the health authorities ensuring the sale of homeopathic products.South & Central America Homeopathy Market Revenue and Forecast to 2030 (US$ Million)

South & Central America Homeopathy Market Segmentation

The South & Central America homeopathy market is segmented based on source, type, application, distribution channel, and country. Based on sources, the South & Central America homeopathy market is segmented into plants, animals, and minerals. The plants segment held the largest market share in 2022.Based on type, the South & Central America homeopathy market is segmented into dilutions, tinctures, biochemics, ointments, tablets, and others. The dilutions segment held the largest market share in 2022.

Based on application, the South & Central America homeopathy market is segmented into analgesic and antipyretic, respiratory, neurology, immunology, gastroenterology, dermatology, and others. The immunology segment held the largest market share in 2022.

Based on distribution channel, the South & Central America homeopathy market is segmented into homeopathic clinics, retail pharmacies, e-retailers, and others. The homeopathic clinics segment held the largest market share in 2022.

Based on country, the South & Central America homeopathy market is segmented into Brazil, Argentina, and the Rest of South & Central America. Brazil dominated the South & Central America homeopathy market share in 2022.

Fourrts, Boiron, Biologische Heilmittel Heel GmbH, DHU-Arzneimittel GmbH & Co. KG, and Dr Reckeweg & Co GmbH are some of the leading players operating in the South & Central America homeopathy market.

Table of Contents

Executive Summary

At 15.0% CAGR, the South & Central America Homeopathy Market is Speculated to be worth US$ 983.00 million by 2030.According to this research,, the South & Central America homeopathy market was valued at US$ 322.47 million in 2022 and is expected to reach US$ 983.00 million by 2030, registering a CAGR of 15.0% from 2022 to 2030. Safety associated with homeopathic products and rise in adoption of homeopathic medicine are the critical factors attributed to the South & Central America homeopathy market expansion.

Homeopathic medicines are widely considered safe as they are prescribed after special preparation processes. These involve the repeated steps of dilution and succussion of shaking at each dilution. Common potencies used are “30C,” diluted 1:100 30-times, and “200C,” diluted 1:100 20,000-times. Thus, such highly diluted medicines are prescribed by skilled professionals, which are deemed safe and are not likely to cause severe side effects. On December 6, 2022, FDA issued a final guidance, Homeopathic Drug Products, that describes the agency’s approach to prioritizing regulatory actions for homeopathic products posing the greatest risk to patients. The FDA is prioritizing specific categories of drugs, such as those intended for populations at greater risk for adverse reactions. This is expected to drive the South & Central America homeopathy market during the forecast period.

On the contrary, stringent approach by regulatory authorities and shortage of homeopathic facilities & doctors hurdles the growth of South & Central America homeopathy market.

Based on source, the South & Central America homeopathy market is categorized into plants, animals, and minerals. The plants segment held 61.8% market share in 2022, amassing US$ 199.43 million. It is projected to garner US$ 614.35 million by 2030 to expand at 15.1% CAGR during 2022-2030.

Based on type, the South & Central America homeopathy market is categorized into dilutions, tinctures, biochemics, ointments, tablets, and others. The dilutions segment held 25.3% share of South & Central America homeopathy market in 2022, amassing US$ 81.71 million. It is projected to garner US$ 245.94 million by 2030 to expand at 14.8% CAGR during 2022-2030.

Based on application, the South & Central America homeopathy market is categorized into analgesic and antipyretic, respiratory, neurology, immunology, gastroenterology, dermatology, and others. The immunology segment held 23.7% share of South & Central America homeopathy market in 2022, amassing US$ 76.44 million. It is projected to garner US$ 243.94 million by 2030 to expand at 15.6% CAGR during 2022-2030.

Based on distribution channel, the South & Central America homeopathy market is categorized into homeopathic clinics, retail pharmacies, e-retailers, and others. The homeopathic clinics segment held 34.9% share of South & Central America homeopathy market in 2022, amassing US$ 112.47 million. It is projected to garner US$ 353.21 million by 2030 to expand at 15.4% CAGR during 2022-2030.

Based on country, the South & Central America homeopathy market has been categorized into Brazil, Argentina, and the Rest of South & Central America. Our regional analysis states that Brazil captured 68.8% share of South & Central America homeopathy market in 2022. It was assessed at US$ 221.86 million in 2022 and is likely to hit US$ 682.60 million by 2030, exhibiting a CAGR of 15.1% during 2022-2030.

Key players operating in the South & Central America homeopathy market are Fourrts, Boiron, Biologische Heilmittel Heel GmbH, DHU-Arzneimittel GmbH & Co. KG, and Dr Reckeweg & Co GmbH among others.

In Mar 2022, New pharmaceutical production for homeopathic manufacturer Dr. Reckeweg. In May 2020, Fourrts marketed Arsenicum Album 30C against COVID.

Companies Mentioned

- Biologische Heilmittel Heel GmbH

- Boiron

- DHU-Arzneimittel GmbH & Co. KG

- Dr Reckeweg & Co GmbH

- Fourrts

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 77 |

| Published | December 2023 |

| Forecast Period | 2022 - 2030 |

| Estimated Market Value in 2022 | 322.47 Million |

| Forecasted Market Value by 2030 | 983 Million |

| Compound Annual Growth Rate | 15.0% |

| No. of Companies Mentioned | 5 |