Increasing Use of Nuclear Imaging Techniques fuel the North America Hair Extension Market

PET and SPECT are among the nuclear medicine radiology modalities employed in clinical settings. Their use is increasing as they offer accurate detection, localization, and characterization of diseases. Ionizing radiation for diagnosis and treatment benefits millions of patients globally. Radiation in medicine helps earlier diagnosis and often offers less invasive treatments for human diseases. Advanced radiation technology has opened new horizons in diagnostic and nuclear medicine, radiotherapy, and interventional radiology. According to World Health Organization, over 3,600 million diagnostic radiology examinations are performed, 37 million nuclear medicine procedures are carried out, and 7.5 million radiotherapy treatments are given annually. The development and introduction of new radiopharmaceuticals for PET/CT and SPECT/CT procedures, which are used in novel clinical applications such as neurology and orthopedics, and the growing accuracy of different tumor staging methods contribute to the growth of the radioactive tracer market. For instance, newly introduced cardiac radiopharmaceuticals such as flurpiridaz F-18 and ammonia N-13 help in more precise imaging of cardiovascular conditions. Thus, constant technological advancements for improving the quality and efficacy of nuclear imaging techniques favor the growth of the radioactive tracer market.North America Radioactive Tracer Market Overview

The North America radioactive tracer market is segmented into the US, Canada, and Mexico. In 2022, the US held the largest share of the North America radioactive tracer market. Rising number of patients suffering from chronic conditions and viral diseases, increasing activities in research and development in advanced diagnosis method are the key factors propelling the market for radioactive tracer. Also, the increasing use of nuclear imaging techniques are favoring market expansion.North America Radioactive Tracer Market Revenue and Forecast to 2030 (US$ Million)

North America Radioactive Tracer Market Segmentation

The North America radioactive tracer market is segmented based on tracer type, test type, end user, application, and country. Based on tracer type, the North America radioactive tracer market is segmented into technetium-99m & Tc-97m, iodine-131, iron-59, lutetium-171, rubidium (Rb-82) chloride & ammonia (N-13), scandium-46, seaborgium-269, hassium-269, Gallium citrate Ga 67, Prostate-Specific Membrane Antigen (PSMA) (Ga-68), FDDNP (F-18) & FDOPA (F-18), phosphorus-32 & chromium-51, thallium-201, F-18 FDG, F-18 FAPI, Ga-68 FAPI, F-18 PSMA, DOTATOC/DOTANOC/DOTATATE (Ga-68), and others. The others segment held the largest market share in 2022.Based on test type, the North America radioactive tracer market is segmented into PET, SPECT, and others. The SPECT segment held the largest market share in 2022.

Based on end user, the North America radioactive tracer market is segmented into hospitals & clinics, diagnostic centers, academic & research institutes, and others. The hospitals & clinics segment held the largest market share in 2022.

Based on application, the North America radioactive tracer market is segmented into oncology, pulmonary, neurology, cardiology, and others. The oncology segment held the largest market share in 2022.

Based on country, the North America radioactive tracer market is segmented into the US, Canada, and Mexico. The US dominated the North America radioactive tracer market share in 2022.

Rotem Industries Ltd, Invicro LLC, Cardinal Health Inc, Newcastle University, Novartis AG, Curium, Blue Earth Diagnostics Limited, General Electric Co, and IBA Radiopharma Solutions are some of the leading players operating in the North America radioactive tracer market.

Table of Contents

Executive Summary

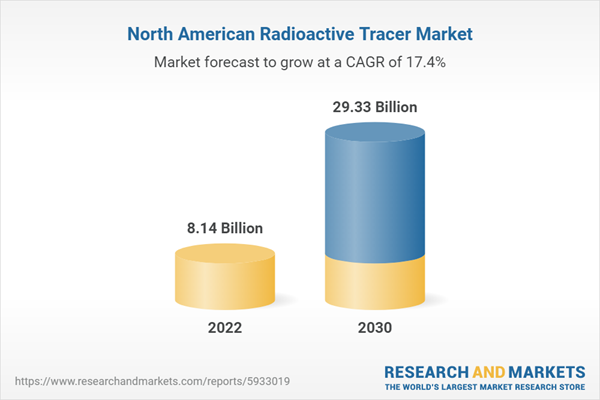

At 17.4% CAGR, the North America Radioactive Tracer Market is Speculated to be worth US$ 29,331.01 million by 2030.According to this research,, the North America radioactive tracer market was valued at US$ 8,139.16 million in 2022 and is expected to reach US$ 29,331.01 million by 2030, registering a CAGR of 17.4% from 2022 to 2030. Rising prevalence of chronic diseases and increasing use of nuclear imaging techniques are the critical factors attributed to the North America radioactive tracer market expansion.

Increasing aging population, changing social behavior, rising adoption of a sedentary lifestyle, and accelerating urbanization are the key factors boosting the prevalence of obesity and other chronic diseases such as diabetes. Further, studies have long established that genes can cause chronic conditions such as cardiovascular disease (CVD), diabetes, obesity, Alzheimer's disease (AD), and depression. According to the National Council on Aging, Inc., 80% of adults aged 65 and above suffer from at least one chronic condition, while 68% suffer from two or more. According to the Centers for Disease Control and Prevention (CDC), in 2020, ~6 in 10 people in the US suffered from at least one chronic disease, and 4 in 10 people suffered from two or more chronic conditions. CVDs, such as atherosclerosis, angina pectoris, and acute myocardial infarction, caused due to hectic lifestyles have become significant causes of mortality worldwide. As per the data provided by the WHO, CVDs are the predominant cause of death worldwide, recording estimated 17.9 million deaths each year. Diabetes is a life-threatening chronic disease with no functional cure. Diabetes of all types can lead to various complications in different body parts and increase the overall risk of premature death. Heart attack, stroke, kidney failure, leg amputation, vision loss, and nerve damage are among the major complications associated with diabetes. According to the International Diabetes Federation (IDF), diabetic cases in North America are expected to reach 62 million by 2045 from 46 million in 2017. The data further reported that 425 million people suffered from diabetes in 2017, and the count is expected to reach 629 million worldwide by 2045. The disease prevalence will likely increase by nearly 35% during the forecast period. Thus, an effective examination is a must for properly treating chronic diseases; hence, nuclear substances are used for diagnosis and examination purposes. These nuclear substances are used in diagnostic tests such as positron emission tomography (PET) and single-photon emission computerized tomography (SPECT) to diagnose chronic diseases such as neurological, cardiovascular, chronic lung, and chronic kidney diseases. the availability of several radiotracer across the globe makes it selection easy depending on the type of disease and its prognosis. Thus, the increasing incidences of chronic diseases are surging the demand for radioactive tracer, positively favoring market expansion.

On the contrary, short shelf-life of radioactive tracer hurdles the growth of North America radioactive tracer market.

Based on tracer type, the North America radioactive tracer market is categorized into technetium-99m & Tc-97m, iodine-131, iron-59, lutetium-171, rubidium (Rb-82) chloride & ammonia (N-13), scandium-46, seaborgium-269, hassium-269, Gallium citrate Ga 67, Prostate-Specific Membrane Antigen (PSMA) (Ga-68), FDDNP (F-18) & FDOPA (F-18), phosphorus-32 & chromium-51, thallium-201, F-18 FDG, F-18 FAPI, Ga-68 FAPI, F-18 PSMA, DOTATOC/DOTANOC/DOTATATE (Ga-68), and others. The others segment held 64.1% market share in 2022, amassing US$ 5,215.06 million. It is projected to garner US$ 17,788.12 million by 2030 to expand at 16.6% CAGR during 2022-2030.

Based on test type, the North America radioactive tracer market is categorized into PET, SPECT, and others. The SPECT segment held 44.5% share of North America radioactive tracer market in 2022, amassing US$ 3,618.01 million. It is projected to garner US$ 12,991.18 million by 2030 to expand at 17.3% CAGR during 2022-2030.

Based on end user, the North America radioactive tracer market is categorized into hospitals & clinics, diagnostic centers, academic & research institutes, and others. The hospitals & clinics segment held 70.1% share of North America radioactive tracer market in 2022, amassing US$ 5,704.25 million. It is projected to garner US$ 20,579.86 million by 2030 to expand at 17.4% CAGR during 2022-2030.

Based on application, the North America radioactive tracer market is categorized into oncology, pulmonary, neurology, cardiology, and others. The oncology segment held 63.2% share of North America radioactive tracer market in 2022, amassing US$ 5,146.83 million. It is projected to garner US$ 18,053.87 million by 2030 to expand at 17.0% CAGR during 2022-2030.

Based on country, the North America radioactive tracer market has been categorized into the US, Canada, and Mexico. Our regional analysis states that the US captured 84.8% share of North America radioactive tracer market in 2022. It was assessed at US$ 6,899.57 million in 2022 and is likely to hit US$ 24,605.78 million by 2030, exhibiting a CAGR of 17.2% during 2022-2030.

Key players operating in the North America radioactive tracer market are Rotem Industries Ltd, Invicro LLC, Cardinal Health Inc, Newcastle University, Novartis AG, Curium, Blue Earth Diagnostics Limited, General Electric Co, and IBA Radiopharma Solutions, among others.

Companies Mentioned

- Rotem Industries Ltd

- Invicro LLC

- Cardinal Health Inc

- Newcastle University

- Novartis AG

- Curium

- Blue Earth Diagnostics Limited

- General Electric Co

- IBA Radiopharma Solutions

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 112 |

| Published | December 2023 |

| Forecast Period | 2022 - 2030 |

| Estimated Market Value in 2022 | 8.14 Billion |

| Forecasted Market Value by 2030 | 29.33 Billion |

| Compound Annual Growth Rate | 17.4% |

| Regions Covered | North America |

| No. of Companies Mentioned | 9 |