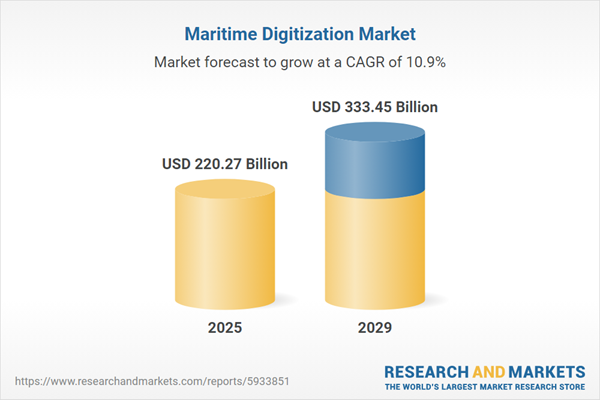

The maritime digitization market size has grown rapidly in recent years. It will grow from $200.21 billion in 2024 to $220.27 billion in 2025 at a compound annual growth rate (CAGR) of 10%. The growth in the historic period can be attributed to cultural shifts and industry mindset, demand for real-time monitoring, global trade and supply chain optimization, demand for efficiency and cost reduction, security concerns and solutions.

The maritime digitization market size is expected to see rapid growth in the next few years. It will grow to $333.45 billion in 2029 at a compound annual growth rate (CAGR) of 10.9%. The growth in the forecast period can be attributed to rise in IoT adoption, AI and machine learning integration, investments in cybersecurity, demand for remote operations, blockchain for transparency. Major trends in the forecast period include smart ports and logistics, data-driven decision-making, autonomous vessels and drones, remote monitoring and IoT integration, cybersecurity measures.

The anticipated surge in the adoption of autonomous vessels is poised to propel the maritime digitization market's growth. Autonomous vessels, also known as autonomous ships, operate with automated processes and decision support, minimizing the need for constant human intervention. Maritime digitization is instrumental in developing and operating autonomous vessels, providing essential infrastructure, data analysis capabilities, and connectivity to enhance safety, efficiency, and remote monitoring. According to NATO, the US Navy plans to have 21 operational autonomous ships by 2025, with projections estimating 143 autonomous ships operational by 2045. Hence, the increasing adoption of autonomous vessels is a key driver for the maritime digitization market.

The increasing focus on environmental sustainability is expected to drive the growth of the maritime digitization market in the coming years. Environmental sustainability involves the responsible utilization of natural resources and the safeguarding of ecosystems to fulfill current needs without jeopardizing the ability of future generations to satisfy their own needs. This concept encourages the advancement of maritime digitization through efficient resource management, reduction of emissions, data-driven decision-making, integration of renewable energy, compliance with environmental regulations, decreased paper usage, development of eco-friendly technologies, and enhanced safety, all of which align with green initiatives and industry practices. For instance, in December 2022, the United Nations Conference on Trade and Development, a Switzerland-based intergovernmental organization, announced that the FuelEU Maritime Regulation, effective in 2025, mandates a phased reduction in greenhouse gas (GHG) emissions for commercial ships within the European Union that have a gross tonnage of 5,000 or more. This regulation establishes specific GHG intensity reduction targets compared to a 2020 baseline, including a 2% reduction by 2025 and increasingly ambitious goals of up to 75% by 2050. Thus, the growing emphasis on environmental sustainability is propelling the maritime digitization market forward.

Leading companies in the maritime digitization market are intensifying their efforts to develop technologies such as maritime digital transformation to enhance market profitability. Maritime digital transformation involves leveraging digital technologies and data-driven solutions to modernize the maritime industry. For instance, in May 2022, Inmarsat Group Holdings Limited, a UK-based satellite telecommunications company, introduced Fleet Xpress Enhanced, a suite of connectivity technologies designed to facilitate the marine industry's digital transformation. It combines the capabilities of Inmarsat's Global Xpress and FleetBroadband services, offering high-speed and reliable connectivity to ships at sea.

In May 2023, Wartsila Corporation, a Finland-based provider of technologies for the marine and energy markets, partnered with DNV's cloud platform Veracity. This partnership aims to establish secure and seamless connectivity between Wartsila's Fleet Optimization Solution and Veracity, enabling the real-time transfer of operational data with customer consent. DNV, a Norway-based provider, is recognized for advancing automation and digitization solutions in the maritime sector.

Major companies operating in the maritime digitization market report are Microsoft Corporation, Huawei Technologies Co. Ltd., Siemens AG, Lockheed Martin Corporation, Intel Corporation, The International Business Machines Corporation, Cisco Systems Inc., Oracle Corporation, Schneider Electric SE, Honeywell International Inc., SAP SE, ABB Ltd., Telefonaktiebolaget LM Ericsson, Det Norske Veritas, Wärtsilä Oyj Abp, Kongsberg Gruppen ASA, Prime Marine Management Inc., Inmarsat Global Limited, American Bureau of Shipping (ABS), Iridium Communications Inc., Spire Global Inc., MariApps Marine Solutions Pte Ltd., SparkCognition Inc., Envision Enterprise Solutions Pvt Ltd., Orbcomm Inc., Windward Ltd., Marine Solutionz Ship Management Pvt Ltd.

North America was the largest region in the maritime digitization market in 2024. The regions covered in the maritime digitization market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the maritime digitization market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

The maritime digitization market consists of revenues earned by entities by providing services such as safety and security services, vessel performance monitoring, digital navigation, and maritime cybersecurity services. The market value includes the value of related goods sold by the service provider or included within the service offering. The maritime digitization market also includes sales of satellite communication systems, environmental monitoring systems, and digital cargo tracking devices. Values in this market are ‘factory gate’ values, that is the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors, and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

Maritime digitization involves the integration of digital technologies and data-driven solutions into various aspects of the maritime industry, encompassing logistics, shipping, port activities, and maritime management. Its objective is to enhance effectiveness, security, and sustainability in maritime activities through the application of digital technology and tools.

The primary technologies associated with maritime digitization include the Internet of Things (IoT), artificial intelligence, blockchain, and others. The Internet of Things (IoT) refers to a network of physical objects or things embedded with sensors, software, and other technologies to connect and exchange data over the internet. Various applications of maritime digitization include fleet management, vessel tracking, energy management, inventory management, predictive maintenance, and others. These applications find utility across different end-users such as ports and terminals, shipping companies, maritime freight forwarders, and others.

The maritime digitization market research report is one of a series of new reports that provides maritime digitization market statistics, including maritime digitization industry global market size, regional shares, competitors with maritime digitization market share, detailed maritime digitization market segments, market trends and opportunities, and any further data you may need to thrive in the maritime digitization industry. This maritime digitization market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenarios of the industry.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Maritime Digitization Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on maritime digitization market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for maritime digitization? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The maritime digitization market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include:

- The forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Technology: Internet Of Things (IoT); (Artificial Intelligence); Blockchain; Other Technologies2) By Application: Fleet Management; Vessel Tracking; Energy Management; Inventory Management; Predictive Maintenance; Other Applications

3) By End User: Ports And Terminals; Shipping Companies; Maritime Freight Forwarders; Other End Users

Subsegments:

1) By Internet Of Things (IoT): Vessel Monitoring Systems; Cargo Tracking Solutions; Predictive Maintenance Applications; Environmental Monitoring Systems2) By Artificial Intelligence (AI): Machine Learning For Navigation; AI-Powered Analytics; Autonomous Vessel Technologies; AI For Supply Chain Optimization

3) By Blockchain: Smart Contracts For Shipping; Secure Document Management; Traceability Solutions; Decentralized Logistics Platforms

4) By Other Technologies: Cloud Computing Solutions; Big Data Analytics; Augmented Reality (AR) For Training; Cybersecurity Solutions

Key Companies Mentioned: Microsoft Corporation; Huawei Technologies Co. Ltd.; Siemens AG; Lockheed Martin Corporation; Intel Corporation

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

Some of the major companies featured in this Maritime Digitization market report include:- Microsoft Corporation

- Huawei Technologies Co. Ltd.

- Siemens AG

- Lockheed Martin Corporation

- Intel Corporation

- The International Business Machines Corporation

- Cisco Systems Inc.

- Oracle Corporation

- Schneider Electric SE

- Honeywell International Inc.

- SAP SE

- ABB Ltd.

- Telefonaktiebolaget LM Ericsson

- Det Norske Veritas

- Wärtsilä Oyj Abp

- Kongsberg Gruppen ASA

- Prime Marine Management Inc.

- Inmarsat Global Limited

- American Bureau of Shipping (ABS)

- Iridium Communications Inc.

- Spire Global Inc.

- MariApps Marine Solutions Pte Ltd.

- SparkCognition Inc.

- Envision Enterprise Solutions Pvt Ltd.

- Orbcomm Inc.

- Windward Ltd.

- Marine Solutionz Ship Management Pvt Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | March 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 220.27 Billion |

| Forecasted Market Value ( USD | $ 333.45 Billion |

| Compound Annual Growth Rate | 10.9% |

| Regions Covered | Global |

| No. of Companies Mentioned | 28 |