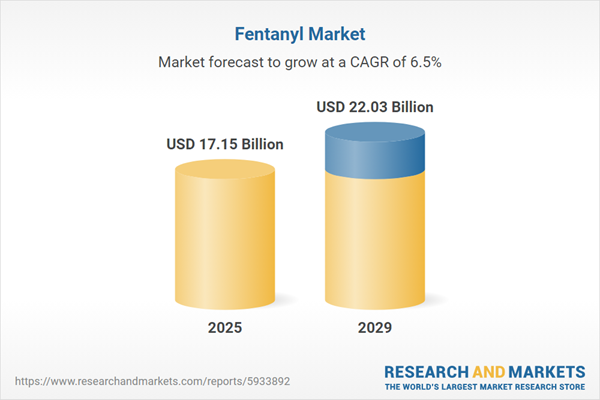

The fentanyl market size is expected to see strong growth in the next few years. It will grow to $22.03 billion in 2029 at a compound annual growth rate (CAGR) of 6.5%. The growth in the forecast period can be attributed to rise in chronic pain cases, expanding oncology therapies, increasing surgical procedures, public health initiatives, regulatory approval for new indications. Major trends in the forecast period include technological advancements in drug formulations, technological innovations in detection, public health and harm reduction strategies, rise in pharmaceutical applications, international collaboration and information sharing.

The forecast of 6.5% growth over the next five years reflects a slight reduction of 0.1% from the previous projection. This reduction is primarily due to the impact of tariffs between the US and other countries. Tariff escalations could challenge U.S. pain management by driving up the cost of transdermal patch components and controlled substance monitoring technologies sourced from China and Canada, increasing palliative care expenses and opioid crisis management burdens. The effect will also be felt more widely due to reciprocal tariffs and the negative effect on the global economy and trade due to increased trade tensions and restrictions.

The rising prevalence of chronic diseases is anticipated to drive the growth of the fentanyl market in the future. Chronic diseases are medical conditions that last for an extended period, typically three months or longer, and often persist throughout a person's life. Fentanyl is primarily used in chronic disease management to alleviate severe, persistent pain that other treatments or medications do not adequately control. For example, in October 2024, the Centers for Disease Control and Prevention (CDC), a US-based public health agency, reported in their Heart Disease Facts that coronary heart disease (CHD) was responsible for 371,506 deaths in the United States in 2022, contributing to a total of 702,880 deaths from heart disease, which accounted for roughly 1 in every 5 deaths. Consequently, the increasing prevalence of chronic diseases is fueling the growth of the fentanyl market.

The growing demand for pain management is projected to propel the growth of the fentanyl market in the coming years. Pain management is a medical field dedicated to alleviating pain and enhancing the quality of life for patients. Fentanyl is a powerful opioid that provides effective pain relief, particularly for individuals experiencing severe or chronic pain, by reducing pain levels, improving physical functioning, and addressing the root causes of pain. For instance, in May 2022, the Pain Relief Foundation, a UK-based charity, reported that arthritis and musculoskeletal conditions affect over 17 million people in the UK, leading to 30 million lost working days each year, while chronic pain impacts up to 62% of individuals over the age of 75, highlighting the increasing burden of pain in an aging population. Therefore, the rising demand for pain management is driving the growth of the fentanyl market.

Leading companies in the fentanyl market are actively innovating by developing groundbreaking products such as Opvee, securing regulatory approvals to expand their customer base, drive higher sales, and achieve increased revenue. Opvee, also known as nalmefene, serves as a potent opioid receptor blocker specifically designed for treating confirmed or suspected opioid overdose induced by natural or synthetic opioids, including fentanyl. An illustrative example is the accomplishment of Indivior PLC, a prominent U.S.-based pharmaceutical company, which obtained approval from the U.S. Food and Drug Administration for Opvee nasal spray in May 2023. This nasal spray operates by averting the impact of opioids on the brain, aiding patients recently subjected to overdose in restoring normal respiration and blood pressure. The convenience of administering Opvee as a nasal spray enhances its effectiveness during emergency situations, contributing significantly to the arsenal of medications combating opioid overdoses and saving lives.

In April 2023, SK Capital Partners LP, a distinguished U.S.-based private investment company, successfully completed the acquisition of Apotex Pharmaceutical Holdings Inc. This transaction, executed for an undisclosed amount, is geared towards diversifying Apotex's product portfolio, positioning it as a Canadian global health firm, and leveraging its proficiency in producing cost-effective drugs. Apotex Pharmaceutical Holdings Inc., headquartered in Canada, specializes in the manufacturing of fentanyl transdermal systems. This strategic acquisition underscores SK Capital Partners LP's commitment to strengthening its presence in the pharmaceutical industry while enhancing its capabilities and offerings.

Major companies operating in the fentanyl market report are Pfizer Inc., Johnson & Johnson, Sinopharm Group, Merck & Co. Inc., Bayer AG, Novartis AG, Kyowa Kirin Co. Ltd., Fresenius Kabi Oncology Ltd., Abbott Laboratories, Sanofi S.A, Boehringer Ingelheim GmbH, Viatris Inc., Baxter International Inc., Teva Pharmaceutical Industries Limited, Jiangsu Nhwa Pharmaceutical Co. Ltd., Cephalon LLC, AstraZeneca PLC, Apotex Inc., Hisamitsu Pharmaceutical Co. Inc., Alvogen, Luye Pharma Group, Henan Lingrui Pharmaceutical Ltd., Insys Therapeutics Inc., Exela Pharma Sciences LLC, Paladin Labs Inc., Bryant Ranch Prepack Inc., Galena Biopharma Inc., Validus Pharmaceuticals LLC, Quality Care Products LLC, Dispensing Solutions Inc.

North America was the largest region in the fentanyl market in 2024. Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in the fentanyl market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the fentanyl market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

Note that the outlook for this market is being affected by rapid changes in trade relations and tariffs globally. The report will be updated prior to delivery to reflect the latest status, including revised forecasts and quantified impact analysis. The report’s Recommendations and Conclusions sections will be updated to give strategies for entities dealing with the fast-moving international environment.

The sudden escalation of U.S. tariffs and the resulting trade tensions in spring 2025 are having a significant impact on the pharmaceutical sector. Companies are grappling with higher costs on imported active pharmaceutical ingredients (APIs), glass vials, and laboratory equipment - many of which have limited alternative sources. Generic drug manufacturers, already operating with minimal profit margins, are particularly affected, with some scaling back production of low-margin medications. Biotech firms are also experiencing delays in clinical trials due to shortages of specialized reagents linked to tariffs. In response, the industry is shifting API production to regions like India and Europe, building up inventory reserves, and advocating for tariff exemptions on essential medicines.

The fentanyl market research report is one of a series of new reports that provides fentanyl market statistics, including fentanyl industry global market size, regional shares, competitors with a fentanyl market share, detailed fentanyl market segments, market trends and opportunities, and any further data you may need to thrive in the fentanyl industry. This fentanyl market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

Fentanyl is a synthetic opioid known for its high potency and is commonly used for pain relief and anesthesia purposes. Physicians prescribe fentanyl to manage severe pain, particularly post-surgery and in advanced-stage cancer patients. Fentanyl is available in the form of transdermal patches or lozenges.

The primary types of fentanyl include fentanyl injections and fentanyl TTS (transdermal therapeutic system). Fentanyl injections are a medication delivery method that administers the opioid directly into the bloodstream. These injections are primarily employed to alleviate severe pain during and after surgical procedures. Fentanyl is utilized for various applications, including anesthesia, maintaining anesthesia, general analgesia, postoperative analgesia, and managing breakthrough cancer pain. The recipients of fentanyl treatment include hospitals, clinics, ambulatory surgical centers, and other healthcare facilities.

The fentanyl market consists of sales of fentanyl patch, fentanyl lozenge, fentanyl nasal spray, fentanyl sublingual spray, fentanyl sublingual tablets, fentanyl lollipop, and fentanyl film. Values in this market are ‘factory gate’ values, that is the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors, and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 1-3 business days.

Table of Contents

Executive Summary

Fentanyl Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on fentanyl market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as geopolitical conflicts, trade policies and tariffs, post-pandemic supply chain realignment, inflation and interest rate fluctuations, and evolving regulatory landscapes.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for fentanyl? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward, including technological disruption, regulatory shifts, and changing consumer preferences? The fentanyl market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include: the technological advancements such as AI and automation, Russia-Ukraine war, trade tariffs (government-imposed import/export duties), elevated inflation and interest rates.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Type: Fentanyl Injections; Fentanyl TTS (Transdermal Therapeutic System)2) By Application: Inducting Anesthesia; Maintain Anesthesia; General Analgesic; Postoperative Analgesia; Breakthrough Cancer Pain

3) By End User: Hospitals; Clinics; Ambulatory Surgical Centers; Other End Users

Subsegments:

1) By Fentanyl Injections: Injectable Solutions; Premixed Injection Formulations2) By Fentanyl TTS (Transdermal Therapeutic System): Patch Formulations; Matrix Patch Systems

Companies Mentioned: Pfizer Inc.; Johnson & Johnson; Sinopharm Group; Merck & Co. Inc.; Bayer AG; Novartis AG; Kyowa Kirin Co. Ltd.; Fresenius Kabi Oncology Ltd.; Abbott Laboratories; Sanofi S.A; Boehringer Ingelheim GmbH; Viatris Inc.; Baxter International Inc.; Teva Pharmaceutical Industries Limited; Jiangsu Nhwa Pharmaceutical Co. Ltd.; Cephalon LLC; AstraZeneca plc; Apotex Inc.; Hisamitsu Pharmaceutical Co. Inc.; Alvogen; Luye Pharma Group; Henan Lingrui Pharmaceutical Ltd.; Insys Therapeutics Inc.; Exela Pharma Sciences LLC; Paladin Labs Inc.; Bryant Ranch Prepack Inc.; Galena Biopharma Inc.; Validus Pharmaceuticals LLC; Quality Care Products LLC; Dispensing Solutions Inc.

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

The companies featured in this Fentanyl market report include:- Pfizer Inc.

- Johnson & Johnson

- Sinopharm Group

- Merck & Co. Inc.

- Bayer AG

- Novartis AG

- Kyowa Kirin Co. Ltd.

- Fresenius Kabi Oncology Ltd.

- Abbott Laboratories

- Sanofi S.A

- Boehringer Ingelheim GmbH

- Viatris Inc.

- Baxter International Inc.

- Teva Pharmaceutical Industries Limited

- Jiangsu Nhwa Pharmaceutical Co. Ltd.

- Cephalon LLC

- AstraZeneca plc

- Apotex Inc.

- Hisamitsu Pharmaceutical Co. Inc.

- Alvogen

- Luye Pharma Group

- Henan Lingrui Pharmaceutical Ltd.

- Insys Therapeutics Inc.

- Exela Pharma Sciences LLC

- Paladin Labs Inc.

- Bryant Ranch Prepack Inc.

- Galena Biopharma Inc.

- Validus Pharmaceuticals LLC

- Quality Care Products LLC

- Dispensing Solutions Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 250 |

| Published | September 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 17.15 Billion |

| Forecasted Market Value ( USD | $ 22.03 Billion |

| Compound Annual Growth Rate | 6.5% |

| Regions Covered | Global |

| No. of Companies Mentioned | 31 |