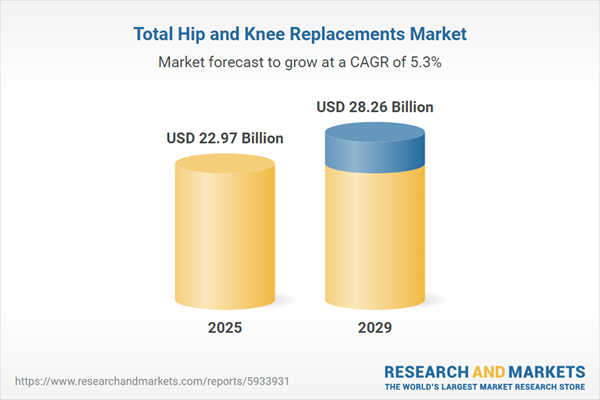

The total hip and knee replacements market size has grown strongly in recent years. It will grow from $21.68 billion in 2024 to $22.97 billion in 2025 at a compound annual growth rate (CAGR) of 6%. The growth in the historic period can be attributed to osteoarthritis and joint degeneration, patient awareness and education, healthcare infrastructure development, reimbursement policies, globalization of medical tourism.

The total hip and knee replacements market size is expected to see strong growth in the next few years. It will grow to $28.26 billion in 2029 at a compound annual growth rate (CAGR) of 5.3%. The growth in the forecast period can be attributed to regenerative medicine advances, biocompatible implant materials, value-based healthcare initiatives, personalized medicine approaches, growing demand for joint preservation strategies. Major trends in the forecast period include technological advancements in implants, minimally invasive techniques, robot-assisted surgery, value-based care and bundled payment models, telehealth and remote patient monitoring.

The growing prevalence of obesity is expected to drive the expansion of the total hip and knee replacement market. Obesity is a medical condition where excess body fat accumulates to the point that it negatively impacts health. Hip and knee replacement surgeries are often utilized in obese patients to address joint issues and enhance their quality of life. Obesity can lead to joint pain and degeneration, particularly in the hips and knees, due to the added stress and pressure on these weight-bearing joints. For example, the World Heart Foundation, a Switzerland-based global cardiovascular organization, reported in March 2023 that approximately 2.3 billion adults and children worldwide are obese or overweight. With the current obesity trend, it is projected that the number of people affected by obesity will reach 2.7 billion by 2025. As a result, the rising number of obesity patients is contributing to the growth of the total hip and knee replacement market.

The growth of the total hip and knee replacement market is expected to be driven by a rise in sports injuries. These injuries encompass a wide range of physical damage caused by participation in various athletic activities, affecting muscles, bones, tendons, ligaments, and joints. High-impact or repetitive sports injuries, such as torn ligaments, cartilage damage, and fractures, often require joint replacement surgery as a long-term solution for significant damage to the hip and knee joints. For example, a report from the National Safety Council, a US-based non-profit organization, revealed that in 2023, emergency departments treated 3.7 million individuals for injuries related to sports and recreational equipment. This marked an 8% increase, with 482,886 injuries reported in 2023, up from 445,642 in 2022. Consequently, the rising number of sports injuries is expected to boost the demand for total hip and knee replacements.

Leading companies in the total hip and knee replacement market are concentrating on developing advanced technologies, such as innovative bearing surfaces, to improve implant longevity, reduce wear and corrosion, enhance patient outcomes, and lower the risk of complications like dislocation. Advanced bearing surfaces refer to the use of cutting-edge materials and designs in joint implants that minimize wear and enhance durability. This technology improves the performance of hip and knee replacements by reducing friction and corrosion, resulting in better outcomes for patients. For example, in August 2023, Smith & Nephew plc, a UK-based medical technology company, introduced the OR3OTM Dual Mobility System. The OR3O system incorporates a small diameter femoral head that locks into a larger polyethylene insert, increasing stability and providing a wider range of motion compared to traditional hip implants.

In July 2022, Enovis Corporation, a US-based medical technology company primarily dedicated to orthopedic advancements, completed the acquisition of Insight Medical Systems Inc., with the financial details remaining undisclosed. This strategic acquisition signifies Enovis's endeavor to broaden its medical device portfolio by incorporating Insight's flagship solution, ARVIS. ARVIS stands as an FDA-cleared augmented reality solution meticulously engineered to cater to the specific requirements of hip and knee replacement surgeries. Insight Medical Systems, Inc., the acquired company, specializes in the manufacture of medical devices, particularly in the realm of total hip, total knee, and Unicompartmental arthroplasty systems.

Major companies operating in the total hip and knee replacements market report are Johnson & Johnson, Stryker Corporation, B. Braun SE, DePuy Synthes Companies, Zimmer Biomet Holdings Inc., Smith & Nephew PLC, Shenzhen Mindray Bio-Medical Electronics Co Ltd., Medtronic PLC, NuVasive Inc., Globus Medical Inc., Wright Medical Group N.V., MicroPort Scientific Corp, Exactech Inc., Beijing Chunlizhengda Medical Instruments, AK Medical Holdings Ltd., Mathys AG Bettlach, Corin Group, Waldemar Link GmbH Co., DJO Global Inc., Groupe Lépine, FH Orthopedics S.A.S, Conformis Inc., Peter Brehm GmbH, Adler Ortho S.R.L, implantcast GmbH.

North America was the largest region in the total hip and knee replacements market in 2024. Asia Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in the total hip and knee replacements market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the total hip and knee replacements market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

The total hip and knee replacement market consists of revenues earned by entities that provide services such as rehabilitation and physical therapy, revision surgery, consultation, and assessment. The market value includes the value of related goods sold by the service provider or included within the service offering. The total hip and knee replacement market also includes sales of ceramic implants, mental implants, and plastic implants. Values in this market are ‘factory gate’ values, that is the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors, and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

Total hip and knee replacements involve surgical procedures that replace damaged or arthritic hip or knee joints with artificial implants made of metal, plastic, or ceramic materials. These procedures are utilized to address conditions such as knee damage or arthritis.

The main categories of procedures for total hip and knee replacement include total hip replacement, partial hip replacement, revision hip replacement, total knee replacement, partial knee replacement, and revision knee replacement. Total hip replacement, for instance, is a surgical procedure that replaces a damaged or diseased hip joint with an artificial prosthetic joint. This procedure aims to alleviate pain, restore mobility, and improve the function of the hip joint in individuals with conditions such as osteoarthritis, rheumatoid arthritis, and arthritis. Various implant types, such as mobile bearings, fixed bearings, and others, are used in total hip and knee replacement procedures. End-users include hospitals, ambulatory surgical centers, orthopedic clinics, and others.

The total hip and knee replacements market research report is one of a series of new reports that provides total hip and knee replacements market statistics, including total hip and knee replacements industry global market size, regional shares, competitors with a total hip and knee replacements market share, detailed total hip and knee replacements market segments, market trends and opportunities, and any further data you may need to thrive in the total hip and knee replacements industry. This total hip and knee replacements market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Total Hip and Knee Replacements Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on total hip and knee replacements market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for total hip and knee replacements? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The total hip and knee replacements market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include:

- The forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Procedure Type: Total Hip Replacement; Partial Hip Replacement; Revision Hip Replacement; Total Knee Replacement; Partial Knee Replacement; Revision Knee Replacement2) By Implant Type: Mobile Bearing; Fixed Bearing; Other Implant Types

3) By End-User: Hospitals; Ambulatory Surgical Centers; Orthopedic Clinics; Other End-Users

Subsegments:

1) By Total Hip Replacement: Primary Total Hip Replacement; Revision Total Hip Replacement2) By Partial Hip Replacement: Hemiarthroplasty; Resurfacing Procedures

3) By Revision Hip Replacement: Complex Revision Procedures; Standard Revision Procedures

4) By Total Knee Replacement: Primary Total Knee Replacement; Revision Total Knee Replacement

5) By Partial Knee Replacement: Unicompartmental Knee Replacement; Patellofemoral Replacement

6) By Revision Knee Replacement: Complex Revision Procedures; Standard Revision Procedures

Key Companies Mentioned: Johnson & Johnson; Stryker Corporation; B. Braun SE; DePuy Synthes Companies; Zimmer Biomet Holdings Inc

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

Some of the major companies featured in this Total Hip and Knee Replacements market report include:- Johnson & Johnson

- Stryker Corporation

- B. Braun SE

- DePuy Synthes Companies

- Zimmer Biomet Holdings Inc

- Smith & Nephew Plc

- Shenzhen Mindray Bio-Medical Electronics Co Ltd

- Medtronic Plc

- NuVasive Inc

- Globus Medical Inc

- Wright Medical Group N.V.

- MicroPort Scientific Corp

- Exactech Inc

- Beijing Chunlizhengda Medical Instruments

- AK Medical Holdings Ltd

- Mathys AG Bettlach

- Corin Group

- Waldemar Link GmbH Co.

- DJO Global Inc

- Groupe Lépine

- FH Orthopedics S.A.S

- Conformis Inc

- Peter Brehm GmbH

- Adler Ortho S.R.L

- implantcast GmbH

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | March 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 22.97 Billion |

| Forecasted Market Value ( USD | $ 28.26 Billion |

| Compound Annual Growth Rate | 5.3% |

| Regions Covered | Global |

| No. of Companies Mentioned | 26 |