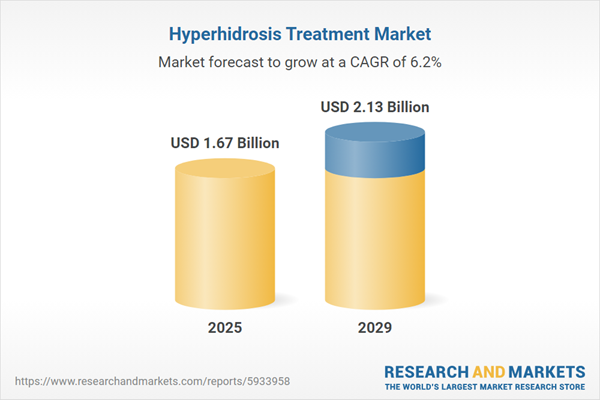

The hyperhidrosis treatment market size has grown strongly in recent years. It will grow from $1.58 billion in 2024 to $1.67 billion in 2025 at a compound annual growth rate (CAGR) of 5.9%. The growth in the historic period can be attributed to cosmetic concerns, psychosocial impact awareness, regulatory support.

The hyperhidrosis treatment market size is expected to see strong growth in the next few years. It will grow to $2.13 billion in 2029 at a compound annual growth rate (CAGR) of 6.2%. The growth in the forecast period can be attributed to patient-centric treatment approaches, global health awareness, advancements in topical therapies, innovations in surgical procedures, inclusion in comprehensive dermatology practices. Major trends in the forecast period include personalized treatment approaches, technological innovations in medical devices, research and development in oral medications, telemedicine for consultations and follow-ups, collaborations and partnerships.

The rising prevalence of diabetes mellitus is expected to drive the growth of the hyperhidrosis treatment market in the coming years. Diabetes mellitus occurs when the body either does not produce enough insulin or does not respond properly to it, leading to elevated blood sugar (glucose) levels. This condition can damage the nerves that control sweat glands, leading to excessive sweating or hyperhidrosis. Diabetes also affects the body’s ability to regulate temperature and produce the necessary amount of sweat for cooling. For example, in March 2024, the Office for Health Improvement & Disparities in the UK reported a 22% increase in individuals with type 1 diabetes receiving all eight recommended care processes between March 2022 and March 2023. Additionally, for type 2 diabetes, the percentage rose by 21%, while the percentage of individuals achieving target HbA1c levels reached 37.9%, the highest ever reported by the National Diabetes Audit (NDA). As such, the growing prevalence of diabetes mellitus is contributing to the expansion of the hyperhidrosis treatment market.

Rising healthcare expenditures are expected to fuel the growth of the hyperhidrosis treatment market in the coming years. Healthcare expenditure refers to the spending on medical goods and services, including medical expenses, equipment, supplies, and pharmaceuticals. As healthcare spending increases, so does awareness of conditions like hyperhidrosis and its impact on patients' daily lives and overall quality of life. This includes the development of new treatment options, surgical procedures, and the management of related comorbidities. For instance, in March 2022, the Centers for Medicare & Medicaid Services (CMS) published the 2021-2030 National Health Expenditure (NHE) report, which predicted that national health spending would rise by an average of 5.1% annually, reaching approximately $6.8 trillion by 2030. Furthermore, Medicare expenditures are expected to grow at an annual rate of 7.2%, while Medicaid spending is projected to increase by 5.6% annually over the same period. As healthcare spending rises, it is expected to drive the expansion of the hyperhidrosis treatment market.

Key players within the hyperhidrosis treatment market are intensifying their efforts to introduce wipe formulations, strategically aiming to boost market revenues. Wipe formulations serve as a delivery method for applying medications or antiperspirants to the skin through pre-moistened wipes. These formulations effectively apply antiperspirant medication to alleviate excessive sweating. An illustration of this strategy can be seen with Maruho Co. Ltd.'s May 2022 launch of Rapifort Wipes 2.5% in Japan. These wipes feature glycopyrronium tosilate hydrate as an active component, reducing sweat production by impeding the activation of acetylcholine receptors in sweat glands. Application of this medication solution once daily to both underarms with a single-use non-woven cloth in each packet minimizes sweating. This convenient, hygienic single-use wipe addresses primary axillary hyperhidrosis, a condition characterized by unexplained excessive underarm sweating that can disrupt daily activities.

In June 2023, miraDry Inc., a United States-based company specializing in non-invasive hyperhidrosis treatment, entered into a partnership with the International Hyperhidrosis Society (IHhS). This collaboration is designed to facilitate cooperation between miraDry and the International Hyperhidrosis Society (IHhS) in order to enhance hyperhidrosis therapy. The partnership underscores miraDry's commitment to improving the lives of individuals experiencing excessive sweating. The International Hyperhidrosis Society (IHhS) is a non-profit organization based in the United States that serves millions of individuals affected by hyperhidrosis.

Major companies operating in the hyperhidrosis treatment market report are Pfizer Inc., AbbVie Inc., Sanofi S.A., AstraZeneca PLC, GSK PLC, Teva Pharmaceutical Industries Ltd., Mylan N.V., Cynosure LLC, Ipsen SA, Galderma S.A., Merz Pharma GmbH & Co. KGaA, Daewoong Pharmaceutical Co. Ltd., Supernus Pharmaceuticals Inc., Kaken Pharmaceutical Co Ltd., Avanor Healthcare Ltd., HUGEL Inc., Evolus Inc., Revance Therapeutics Inc., Dermira Inc., Sesderma SL, Miramar Labs Inc., Dermavant Sciences Inc., Theravida Inc., SweatBlock, Brickell Biotech Inc., Fresh Tracks Therapeutics Inc., Advin Health Care Inc., Dermadry Laboratories Inc., Ulthera Inc., Dermata Therapeutics Inc.

North America was the largest region in the hyperhidrosis treatment market in 2024. Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in the hyperhidrosis treatment market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the hyperhidrosis treatment market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

The hyperhidrosis treatment market consists of revenues earned by entities by providing services such as microwave therapy, iontophoresis, sympathectomy, and sweat gland removal. The market value includes the value of related goods sold by the service provider or included within the service offering. The hyperhidrosis treatment market also includes sales of drysol, xerac AC, glycopyrrolate, benztropine and beta blockers. Values in this market are ‘factory gate’ values, that is the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

Hyperhidrosis is a medical condition characterized by excessive sweating beyond what is necessary for regulating the body's temperature. It can affect various areas of the body, such as the underarms, palms, and soles of the feet. Hyperhidrosis treatment involves medical interventions and therapies designed to alleviate or manage the symptoms associated with excessive sweating, aiming to enhance the quality of life for individuals affected by this condition.

The primary types of hyperhidrosis treatments include topical treatments, surgical interventions, botulinum toxin A injections, iontophoresis, laser treatments, and other therapeutic approaches. Topical treatments involve the application of agents directly to the skin to address hyperhidrosis symptoms. Surgical treatments may be considered for certain cases, and botulinum toxin A injections are utilized to reduce excessive sweating. Iontophoresis and laser treatments are additional methods used to manage hyperhidrosis. These treatments can be administered through various routes, including oral and injectable, to address specific types of hyperhidrosis, such as axillary, palmar, plantar, and others. Hyperhidrosis treatments are available through different distribution channels, including hospitals, ambulatory surgical centers, retail pharmacies, and online platforms.

The hyperhidrosis treatment market research report is one of a series of new reports that provides hyperhidrosis treatment market statistics, including hyperhidrosis treatment industry global market size, regional shares, competitors with a hyperhidrosis treatment market share, detailed hyperhidrosis treatment market segments, market trends and opportunities, and any further data you may need to thrive in the hyperhidrosis treatment industry. This hyperhidrosis treatment market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Hyperhidrosis Treatment Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on hyperhidrosis treatment market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for hyperhidrosis treatment? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The hyperhidrosis treatment market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include:

- The forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Treatment Type: Topical Treatments; Surgical Treatments; Botulin Toxin A; Iontophoresis; Laser Treatments; Other Treatments2) By Route Of Administration: Oral; Injectable

3) By Disease Type: Axillary Hyperhidrosis; Palmar Hyperhidrosis; Plantar Hyperhidrosis; Other Diseases

4) By Distribution Channel: Hospitals; Ambulatory Surgical Centers; Retail Pharmacies; Online

Subsegments:

1) By Topical Treatments: Aluminum Chloride Solutions; Antiperspirants2) By Surgical Treatments: Sympathectomy; Excision

3) By Botulin Toxin A: Injection Treatments; Combination Therapies

4) By Iontophoresis: Home Devices; Clinical Devices

5) By Laser Treatments: Microwave Therapy; Laser Ablation

6) By Other Treatments: Oral Medications; Alternative Therapies

Key Companies Mentioned: Pfizer Inc.; AbbVie Inc.; Sanofi S.A.; AstraZeneca Plc; GSK plc

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

Some of the major companies featured in this Hyperhidrosis Treatment market report include:- Pfizer Inc.

- AbbVie Inc.

- Sanofi S.A.

- AstraZeneca Plc

- GSK plc

- Teva Pharmaceutical Industries Ltd.

- Mylan N.V.

- Cynosure LLC

- Ipsen SA

- Galderma S.A.

- Merz Pharma GmbH & Co. KGaA

- Daewoong Pharmaceutical Co. Ltd.

- Supernus Pharmaceuticals Inc

- Kaken Pharmaceutical Co Ltd

- Avanor Healthcare Ltd.

- HUGEL Inc.

- Evolus Inc.

- Revance Therapeutics Inc.

- Dermira Inc.

- Sesderma SL

- Miramar Labs Inc.

- Dermavant Sciences Inc.

- Theravida Inc.

- SweatBlock

- Brickell Biotech Inc.

- Fresh Tracks Therapeutics Inc.

- Advin Health Care Inc

- Dermadry Laboratories Inc.

- Ulthera Inc.

- Dermata Therapeutics Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | March 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 1.67 Billion |

| Forecasted Market Value ( USD | $ 2.13 Billion |

| Compound Annual Growth Rate | 6.2% |

| Regions Covered | Global |

| No. of Companies Mentioned | 31 |