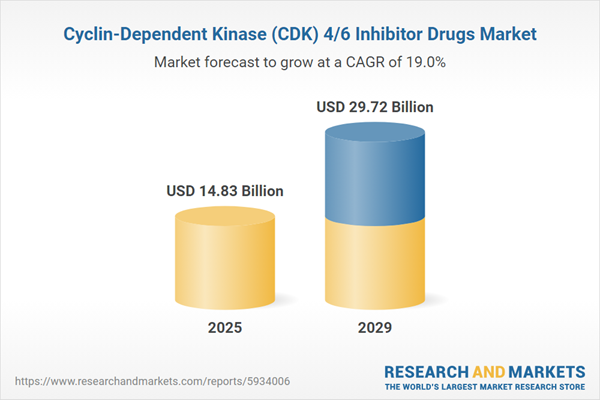

The cyclin-dependent kinase (cdk) 4/6 inhibitor drugs market size is expected to see rapid growth in the next few years. It will grow to $29.72 billion in 2029 at a compound annual growth rate (CAGR) of 19%. The growth in the forecast period can be attributed to expanding indications, emerging pipeline molecules, market competition and pricing dynamics, personalized medicine approaches, global healthcare infrastructure improvements. Major trends in the forecast period include advancements in biomarker identification, rise of oral CDK 4/6 inhibitors, emergence of CDK 4/6 inhibitors in other cancer types, focus on overcoming resistance mechanisms, clinical trials exploring novel CDK 4/6 inhibitors.

The forecast of 19% growth over the next five years reflects a slight reduction of 0.1% from the previous projection. This reduction is primarily due to the impact of tariffs between the US and other countries. The imposition of tariffs may pose a significant challenge for breast cancer treatment by increasing costs of CDK 4/6 inhibitor drugs imported from France and the UK, potentially delaying HR+ metastatic breast cancer therapy and raising oncology medication expenditures. The effect will also be felt more widely due to reciprocal tariffs and the negative effect on the global economy and trade due to increased trade tensions and restrictions.

The anticipated increase in the prevalence of breast cancer is poised to drive the growth of the cyclin-dependent kinase (CDK) 4/6 inhibitor drug market. Breast cancer, originating in breast cells, prompts the demand for targeted therapies such as CDK4/6 inhibitors, addressing specific types of breast cancer and contributing to managing the escalating prevalence of the disease. As reported by the American Cancer Society in January 2023, breast cancer cases surged from 284,200 in 2021 to 300,590 in 2023, marking a significant increase of 5.76%. Consequently, the rising prevalence of breast cancer is forecasted to be a pivotal driver propelling growth within the cyclin-dependent kinase (CDK) 4/6 inhibitor drug market.

The augmented investment in research and development endeavors for breast cancer treatment is expected to significantly boost the cyclin-dependent kinase (CDK) 4/6 inhibitor drugs market. The increased funding in breast cancer treatment facilitates the innovation and expansion of CDK4/6 inhibitor drugs, enhancing their efficacy and broadening their applications, thereby fostering market expansion. For instance, Susan G. Komen, a reputable US-based breast cancer organization, allocated $21.7 million in June 2022 to sponsor 48 novel research initiatives at 26 esteemed academic medical institutions across the United States. These initiatives aim to enhance patient outcomes, particularly for individuals grappling with aggressive forms of breast cancer or facing recurrence or metastasis. Hence, the amplified investment in research and development for breast cancer treatment emerges as a key factor driving the growth of the cyclin-dependent kinase (CDK) 4/6 inhibitor drug market.

Major companies in the cyclin-dependent kinase (CDK) 4/6 inhibitor drugs market are concentrating on developing technologically advanced solutions, including AI-based tools to reduce toxicities in treatment and address various critical industry needs. These AI tools for hormonal breast cancer treatment aim to personalize therapies, minimize toxicities, predict adverse effects, and support timely interventions, ultimately enhancing the safety and effectiveness of treatments. For example, in May 2024, SOLTI, an innovative breast cancer research company based in Spain, launched an AI-based tool designed to reduce toxicities in the treatment of patients with hormonal breast cancer. This groundbreaking tool analyzes both cancerous and non-cancerous elements in breast tissue samples, allowing for more accurate predictions of treatment outcomes and helping to identify patients who may not need aggressive chemotherapy. By mitigating unnecessary side effects and enabling personalized treatment plans, the AI tool seeks to improve patient quality of life and enhance overall treatment efficacy. This advancement follows promising results from SOLTI's PATRICIA study, which emphasized the advantages of combining hormone therapy with targeted treatments for advanced ER+/HER2+ breast cancer.

In July 2022, Pfizer Inc., a renowned US-based pharmaceutical company specializing in CDK4/6 inhibitor drugs, embarked on a collaboration with Arvinas Inc., a prominent biopharmaceutical company also based in the United States. Their joint objective involves the development and commercialization of ARV-471, an investigative oral PROTAC (PROteolysis TArgeting Chimera) estrogen receptor protein degrader. This partnership is geared towards addressing the treatment needs of patients coping with locally advanced or metastatic breast cancer. Pfizer Inc. intends to synergize its expertise in CDK4/6 inhibitor drugs to maximize the therapeutic potential and effectiveness of ARV-471 in treating this challenging medical condition.

Major companies operating in the cyclin-dependent kinase (CDK) 4/6 inhibitor drugs market report are Pfizer Inc., Merck & Co. Inc., Novartis AG, Bristol Myers Squibb Company, AstraZeneca PLC, Eli Lilly and Company, Boehringer Ingelheim International GmbH, Gilead Sciences Inc., Incyte Corporation, Jiangsu Hengrui Pharmaceuticals Co. Ltd., Dr. Reddy’s Laboratories Ltd., Piramal Group, Hanmi Pharm Co. Ltd., Incepta Pharmaceuticals Ltd., Beacon Pharmaceuticals PLC, Bluepharma, Astex Pharmaceuticals, Arvinas Inc, G1 Therapeutics Inc., Carisma Therapeutics Inc., Beta Pharma Inc., Syros Pharmaceuticals Inc., Cyclacel Pharmaceuticals Inc., Onconova Therapeutics Inc., Context Therapeutics Inc., NanoDaru.

North America was the largest region in the cyclin-dependent kinase (CDK) 4/6 inhibitor drugs market in 2024. The regions covered in the cyclin-dependent kinase (cdk) 4/6 inhibitor drugs market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the cyclin-dependent kinase (cdk) 4/6 inhibitor drugs market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

Note that the outlook for this market is being affected by rapid changes in trade relations and tariffs globally. The report will be updated prior to delivery to reflect the latest status, including revised forecasts and quantified impact analysis. The report’s Recommendations and Conclusions sections will be updated to give strategies for entities dealing with the fast-moving international environment.

The sudden escalation of U.S. tariffs and the resulting trade tensions in spring 2025 are having a significant impact on the pharmaceutical sector. Companies are grappling with higher costs on imported active pharmaceutical ingredients (APIs), glass vials, and laboratory equipment - many of which have limited alternative sources. Generic drug manufacturers, already operating with minimal profit margins, are particularly affected, with some scaling back production of low-margin medications. Biotech firms are also experiencing delays in clinical trials due to shortages of specialized reagents linked to tariffs. In response, the industry is shifting API production to regions like India and Europe, building up inventory reserves, and advocating for tariff exemptions on essential medicines.

The cyclin-dependent kinase (CDK) 4/6 inhibitor drugs market research report is one of a series of new reports that provides cyclin-dependent kinase (CDK) 4/6 inhibitor drugs market statistics, including cyclin-dependent kinase (CDK) 4/6 inhibitor drugs industry global market size, regional shares, competitors with a cyclin-dependent kinase (CDK) 4/6 inhibitor drugs market share, detailed cyclin-dependent kinase (CDK) 4/6 inhibitor drugs market segments, market trends and opportunities, and any further data you may need to thrive in the cyclin-dependent kinase (CDK) 4/6 inhibitor drugs industry. This cyclin-dependent kinase (CDK) 4/6 inhibitor drugs market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future- scenario of the industry.

Cyclin-dependent kinase (CDK) 4/6 inhibitor drugs are a class of targeted therapy medications employed in the treatment of specific types of hormone receptor-positive, HER2-negative breast cancer. These drugs focus on inhibiting enzymes known as CDK4 and CDK6, disrupting signals that stimulate the proliferation of malignant cells.

The primary CDK 4/6 inhibitor drugs include palbociclib (Ibrance), ribociclib (Kisqali), and abemaciclib (Verzenio). Palbociclib, for instance, is a targeted therapy medication designed for treating hormone receptor-positive (HR+) and human epidermal growth factor receptor 2-negative (HER2-) breast cancer. It is often utilized in combination with endocrine therapy, offering an effective treatment option for patients with advanced or metastatic breast cancer. These drugs cater to various patient groups, such as premenopausal, postmenopausal, and others. The end users encompass hospitals, clinics, research laboratories, and retail pharmacies.

The cyclin-dependent kinase (CDK) 4/6 inhibitor drug market consists of sales of trilaciclib and ramiven drugs. Values in this market are ‘factory gate’ values, that is, the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors, and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 1-3 business days.

Table of Contents

Executive Summary

Cyclin-Dependent Kinase (CDK) 4/6 Inhibitor Drugs Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on cyclin-dependent kinase (cdk) 4/6 inhibitor drugs market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as geopolitical conflicts, trade policies and tariffs, post-pandemic supply chain realignment, inflation and interest rate fluctuations, and evolving regulatory landscapes.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for cyclin-dependent kinase (cdk) 4/6 inhibitor drugs? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward, including technological disruption, regulatory shifts, and changing consumer preferences? The cyclin-dependent kinase (cdk) 4/6 inhibitor drugs market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include: the technological advancements such as AI and automation, Russia-Ukraine war, trade tariffs (government-imposed import/export duties), elevated inflation and interest rates.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Drug Type: Palbociclib (Ibrance); Ribociclib (Kisqali); Abermaciclib (Verzenio)3) By Patient: Pre-Menopausal; Post-Menopausal; Other Patients

3) By End-Users: Hospitals; Clinics; Research Laboratories; Retail Pharmacies

Companies Mentioned: Pfizer Inc.; Merck & Co. Inc.; Novartis AG; Bristol Myers Squibb Company; AstraZeneca PLC; Eli Lilly and Company; Boehringer Ingelheim International GmbH; Gilead Sciences Inc; Incyte Corporation; Jiangsu Hengrui Pharmaceuticals Co. Ltd.; Dr. Reddy’s Laboratories Ltd; Piramal Group; Hanmi Pharm Co. Ltd.; Incepta Pharmaceuticals Ltd; Beacon Pharmaceuticals PLC; Bluepharma; Astex Pharmaceuticals; Arvinas Inc ; G1 Therapeutics Inc.; Carisma Therapeutics Inc.; Beta Pharma Inc.; Syros Pharmaceuticals Inc.; Cyclacel Pharmaceuticals Inc.; Onconova Therapeutics Inc.; Context Therapeutics Inc.; NanoDaru

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

The companies featured in this Cyclin-Dependent Kinase (CDK) 4/6 Inhibitor Drugs market report include:- Pfizer Inc.

- Merck & Co. Inc.

- Novartis AG

- Bristol Myers Squibb Company

- AstraZeneca PLC

- Eli Lilly and Company

- Boehringer Ingelheim International GmbH

- Gilead Sciences Inc

- Incyte Corporation

- Jiangsu Hengrui Pharmaceuticals Co. Ltd.

- Dr. Reddy’s Laboratories Ltd

- Piramal Group

- Hanmi Pharm Co. Ltd.

- Incepta Pharmaceuticals Ltd

- Beacon Pharmaceuticals PLC

- Bluepharma

- Astex Pharmaceuticals

- Arvinas Inc

- G1 Therapeutics Inc.

- Carisma Therapeutics Inc.

- Beta Pharma Inc.

- Syros Pharmaceuticals Inc.

- Cyclacel Pharmaceuticals Inc.

- Onconova Therapeutics Inc.

- Context Therapeutics Inc.

- NanoDaru

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 250 |

| Published | September 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 14.83 Billion |

| Forecasted Market Value ( USD | $ 29.72 Billion |

| Compound Annual Growth Rate | 19.0% |

| Regions Covered | Global |

| No. of Companies Mentioned | 26 |