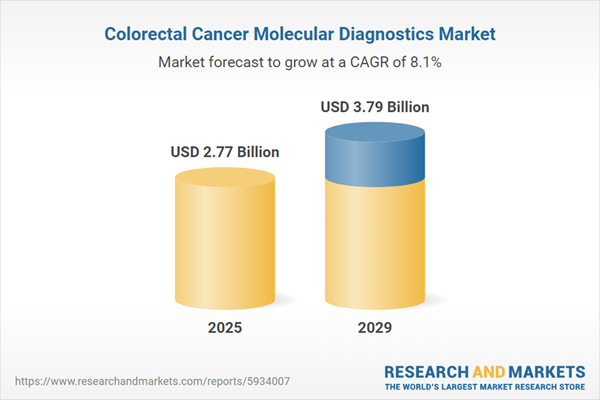

The colorectal cancer molecular diagnostics market size has grown strongly in recent years. It will grow from $2.56 billion in 2024 to $2.77 billion in 2025 at a compound annual growth rate (CAGR) of 8.1%. The growth in the historic period can be attributed to increasing incidence of colorectal cancer, growing awareness, and screening initiatives, rising emphasis on personalized medicine, government initiatives for cancer control.

The colorectal cancer molecular diagnostics market size is expected to see strong growth in the next few years. It will grow to $3.79 billion in 2029 at a compound annual growth rate (CAGR) of 8.1%. The growth in the forecast period can be attributed to aging population and increased risk factors, integration of genomic data into clinical practice, rise in precision medicine approaches, global efforts in cancer research and collaboration. Major trends in the forecast period include increasing emphasis on early detection biomarkers, integration of artificial intelligence (ai) in data analysis, rise of circulating tumor DNA (CTDNA) analysis, expansion of companion diagnostics for targeted therapies, focus on immunotherapy biomarkers.

The rising incidence of inflammatory bowel diseases (IBD) is projected to drive the growth of the colorectal cancer molecular diagnostic market in the future. Inflammatory bowel diseases (IBD) are chronic gastrointestinal disorders marked by inflammation of the digestive tract, primarily affecting the colon and rectum, and are associated with symptoms such as abdominal pain, diarrhea, and weight loss. These conditions are typically managed through medications, lifestyle modifications, and sometimes surgery. The growing incidence of IBD is increasing the demand for accurate, efficient, and advanced diagnostic solutions, which are crucial since determining systemic therapy for colorectal cancer (CRC) largely depends on the results obtained from molecular assessments of the tumor. For instance, in April 2024, research conducted by Crohn’s & Colitis UK revealed that approximately 500,000 people in the UK are living with inflammatory bowel disease (IBD), nearly double previous estimates. Therefore, the rising incidences of inflammatory bowel diseases (IBD) will propel the growth of the colorectal cancer molecular diagnostic market.

The escalating prevalence of colorectal cancer is forecasted to drive the growth of the colorectal cancer molecular diagnostics market. Colorectal cancer affects the colon or rectum, resulting from the uncontrolled growth of cells in these digestive system areas, leading to tumor formation. The upsurge in colorectal cancer cases intensifies the demand for molecular diagnostic tools crucial in cancer detection and treatment. As highlighted by the American Cancer Society in March 2023, an estimated 153,020 individuals are anticipated to receive a colorectal cancer diagnosis, with around 52,550 projected deaths. This forecast includes 19,550 cases and 3,750 deaths among individuals under 50 years old. Thus, the rising prevalence of colorectal cancer is a key driver fueling growth within the colorectal cancer molecular diagnostics market.

Major companies are dedicated to pioneering innovative solutions in molecular diagnostics and personalized medicine, exemplified by the introduction of the Shield Blood Test approach for early-stage colorectal cancer detection. Guardant Health, a prominent US-based biotechnology company specializing in oncology molecular diagnostic products, launched the Shield Blood Test in May 2022. This groundbreaking blood test offers a convenient screening method involving a simple blood draw, addressing challenges associated with patient reluctance to undergo screening. The test demonstrated a sensitivity of 91% for detecting colorectal cancer and 20% for identifying advanced adenomas, with a specificity of 92%. Leveraging data from diverse cohorts comprising over 2,000 individuals with colorectal cancer, 357 with advanced adenoma, and 3,757 healthy subjects, the Shield test identifies early signals of colorectal cancer in the blood.

In July 2023, New Day Diagnostics LLC, a reputable US-based medical equipment manufacturing company, completed the acquisition of Epigenomics AG assets for an undisclosed sum. This strategic acquisition broadens New Day Diagnostics' portfolio in the realm of cancer diagnostics by acquiring intellectual property from Epigenomics AG. Notably, the acquisition includes Epi ProColon, an innovative screening technology specifically designed for the non-invasive detection of colorectal cancer. Epigenomics AG, headquartered in Germany, is a recognized player in the field of colorectal cancer molecular diagnostics, emphasizing the development of cutting-edge technologies for cancer detection.

Major companies operating in the colorectal cancer molecular diagnostics market report are Johnson & Johnson, Bayer AG, Abbott Laboratories, Danaher Corporation, Becton Dickinson and Company, Biocartis Group NV, Agilent Technologies Inc., Grifols S.A, Hologic Inc., Biomérieux SA, Quidel Corporation, Bio-Rad Laboratories Inc., Qiagen N.V., Exact Sciences Corporation, Illumina Inc., Cepheid, Myriad Genetics Inc., Guardant Health, Luminex Corporation, GenMark Diagnostics, Amoy Diagnostics Co. Ltd., MDxHealth Inc., HTG Molecular Diagnostics Inc., GenPath Diagnostics, geneOmbio Technologies Pvt.

North America was the largest region in the colorectal cancer molecular diagnostics market in 2024. Asia Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in the colorectal cancer molecular diagnostics market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the colorectal cancer molecular diagnostics market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

The colorectal cancer molecular diagnostics market consists of revenues earned by entities by providing diagnostic genetic mutation analysis, biomarker profiling, and epigenetic analysis. The market value includes the value of related goods sold by the service provider or included within the service offering. The colorectal cancer molecular diagnostics market consists of sales of molecular diagnostic biochips, liquid biopsy kits, and bioinformatics software. Values in this market are ‘factory gate’ values, that is the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors, and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

Colorectal cancer, also known as colon cancer or rectal cancer, is a malignant tumor that forms in the colon (large intestine) or rectum (final part of the digestive tract before the anus). It originates from the inner lining of these gastrointestinal segments. Colorectal cancer molecular diagnostics involve advanced techniques to identify specific genetic mutations, alterations, and biomarkers crucial for understanding the development, progression, and treatment response of colorectal cancer.

The primary components of colorectal cancer molecular diagnostics include instruments, reagents, kits, and services. Instruments are specialized tools or devices designed for analyzing and detecting molecular changes, such as genetic mutations, variations in gene expression, or specific biomolecules, within biological samples from patients with colorectal cancer. Molecular diagnostic solutions employ technologies such as polymerase chain reaction (PCR), sequencing, mass spectrometry, transcription-mediated amplification, chips and microarrays, and isothermal nucleic acid amplification technology (INAAT). These diagnostics are utilized by various end-users, including hospitals, ambulatory surgical centers, diagnostic laboratories, and homecare settings.

The colorectal cancer molecular diagnostics market research report is one of a series of new reports that provides colorectal cancer molecular diagnostics market statistics, including colorectal cancer molecular diagnostics industry global market size, regional shares, competitors with a colorectal cancer molecular diagnostics market share, detailed colorectal cancer molecular diagnostics market segments, market trends and opportunities, and any further data you may need to thrive in the colorectal cancer molecular diagnostics industry. This colorectal cancer molecular diagnostics market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Colorectal Cancer Molecular Diagnostics Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on colorectal cancer molecular diagnostics market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for colorectal cancer molecular diagnostics? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The colorectal cancer molecular diagnostics market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include:

- The forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Type: Instruments; Reagents And Kits; Services2) By Technology: Polymerase Chain Reaction (PCR); Sequencing; Mass Spectrometry; Transcription Mediated Amplification; Chips And Microarrays; Isothermal Nucleic Acid Amplification Technology (INAAT)

3) By End Users: Hospitals; Ambulatory Surgical Centers; Diagnostic Laboratories; Homecare Settings

Subsegments:

1) By Instruments: PCR Machines; Sequencers; Microarrays2) By Reagents And Kits: DNA Or RNA Extraction Kits; Assay Kits; Reagent Packs

3) By Services: Diagnostic Testing Services; Genetic Testing Services; Consultation Services

Key Companies Mentioned: Johnson & Johnson; Bayer AG; Abbott Laboratories; Danaher Corporation; Becton Dickinson and Company

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

Some of the major companies featured in this Colorectal Cancer Molecular Diagnostics market report include:- Johnson & Johnson

- Bayer AG

- Abbott Laboratories

- Danaher Corporation

- Becton Dickinson and Company

- Biocartis Group NV

- Agilent Technologies Inc.

- Grifols S.A

- Hologic Inc.

- Biomérieux SA

- Quidel Corporation

- Bio-Rad Laboratories Inc.

- Qiagen N.V.

- Exact Sciences Corporation

- Illumina Inc.

- Cepheid

- Myriad Genetics Inc.

- Guardant Health

- Luminex Corporation

- GenMark Diagnostics

- Amoy Diagnostics Co. Ltd.

- MDxHealth Inc.

- HTG Molecular Diagnostics Inc.

- GenPath Diagnostics

- geneOmbio Technologies Pvt.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | March 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 2.77 Billion |

| Forecasted Market Value ( USD | $ 3.79 Billion |

| Compound Annual Growth Rate | 8.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 25 |