This report comes with 10% free customization, enabling you to add data that meets your specific business needs.

1h Free Analyst TimeSpeak directly to the analyst to clarify any post sales queries you may have.

Smart factories leverage IoT devices to connect and communicate seamlessly across the manufacturing floor. Sensors and actuators collect real-time data from machines, products, and other elements in the production process, providing valuable insights for decision-making. AI algorithms analyze vast datasets generated by IoT devices to identify patterns, optimize production processes, and predict potential issues. Smart factories deploy advanced robotics for tasks ranging from assembly and packaging to material handling. Automated systems enhance precision, speed, and consistency, while human workers can focus on more complex and strategic aspects of manufacturing.

The massive amounts of data collected by smart factories are processed and analyzed using big data analytics. This allows manufacturers to gain actionable insights into operational efficiency, production bottlenecks, and overall performance. The integration of physical processes with digital systems forms cyber-physical systems, enabling real-time monitoring and control. This interconnectedness facilitates a more responsive and adaptable manufacturing environment. The increased connectivity and reliance on digital systems make smart factories vulnerable to cybersecurity threats.

Robust security measures are essential to protect sensitive data and maintain the integrity of operations. The transition to smart factories requires a workforce with digital literacy and skills in managing advanced technologies. Training and upskilling programs are essential to ensure a smooth adoption process. Implementing smart factory technologies involves a significant upfront investment. However, the long-term benefits often outweigh the initial costs.

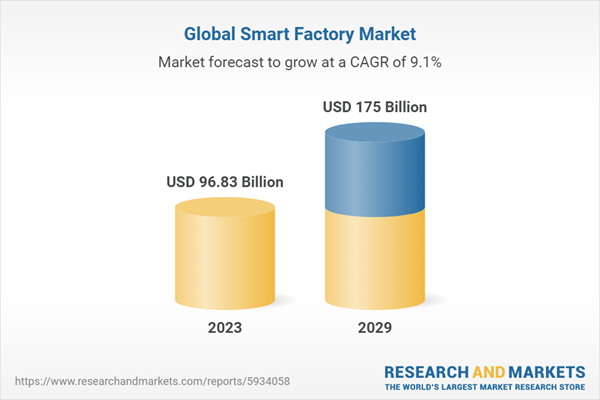

According to the research report, 'Global Smart Factory Market Outlook, 2029', the market is anticipated to cross USD 175 Billion by 2029, increasing from USD 96.83 Billion in 2023. The market is expected to grow with 9.05% CAGR by 2024-29. The adoption of smart factories contributes to economic growth by fostering innovation, creating high-tech job opportunities, and attracting investment. Countries that actively embrace these technologies position themselves as leaders in the global manufacturing landscape. Smart factories are designed to streamline operations, reduce downtime, and enhance productivity. This increased efficiency translates to higher production output, which can stimulate economic growth and job creation.

The optimization of manufacturing processes through smart technologies leads to reduced energy consumption, minimized waste, and overall improved environmental sustainability. This aligns with global efforts to achieve more eco-friendly industrial practices. The widespread adoption of these technologies has led to increased efficiency, streamlined processes, and enhanced decision-making capabilities, ultimately translating into improved productivity and reduced costs for companies across various sectors.

Moreover, the demand for innovative solutions to address evolving consumer needs and preferences has spurred a wave of investment in research and development, further fueling market growth. Additionally, globalization and interconnected supply chains have opened up new opportunities for businesses to reach broader markets, fostering increased competition and innovation. The current market boom is not merely a short-term trend; it reflects a fundamental shift towards a more technologically-driven and interconnected global economy, setting the stage for continued expansion and evolution in the years to come.

Market Drivers

- Technological Advancements: One of the primary drivers propelling the global smart factory market is the rapid advancement of key technologies. The integration of the Internet of Things (IoT), artificial intelligence (AI), robotics, and data analytics is transforming traditional manufacturing processes into intelligent and interconnected systems. This convergence of technologies allows for real-time data collection, analysis, and decision-making, leading to increased operational efficiency, predictive maintenance, and overall enhanced productivity.

- Demand for Operational Excellence: The growing demand for operational excellence and the need for efficient and flexible production processes are significant drivers for the smart factory market. Companies are increasingly adopting smart manufacturing solutions to optimize their supply chains, reduce production costs, minimize downtime, and improve the overall quality of products. The ability of smart factories to adapt quickly to changing market demands and provide a high degree of customization is a crucial factor attracting industries across sectors.

Market Challenges

- Initial Investment and Implementation Costs: A major challenge facing the adoption of smart factory solutions is the substantial upfront investment required for implementing advanced technologies. The cost of integrating IoT devices, AI systems, and automation can be a barrier for some businesses, particularly smaller enterprises. Overcoming this challenge involves strategic planning, careful consideration of return on investment, and exploring collaborative initiatives to share implementation costs.

- Workforce Skill Gaps: The transition to smart factories demands a workforce with skills in digital technologies, data analytics, and automation. However, there is a significant gap in the existing workforce's skillset, posing a challenge to the seamless adoption of smart manufacturing practices. Addressing this challenge involves investing in training programs, upskilling initiatives, and educational partnerships to ensure that the workforce is adequately equipped to operate and manage the sophisticated technologies within smart factories.

Market Trends

- Edge Computing and Decentralized Intelligence: A notable trend in the global smart factory market is the increasing adoption of edge computing. By processing data closer to the source (at the edge of the network), smart factories can reduce latency, improve real-time decision-making, and enhance overall system responsiveness. Decentralized intelligence within the manufacturing environment allows for distributed control and better scalability, aligning with the trend towards more autonomous and adaptive production systems.

- Integration of 5G Technology: The deployment of 5G networks is becoming a key trend in the smart factory landscape. The high data transfer speeds, low latency, and increased network capacity provided by 5G technology enable seamless communication between devices, facilitating the efficient exchange of data in real time. This trend supports the development of more connected and responsive smart factories, unlocking new possibilities for remote monitoring, control, and collaboration across geographically dispersed manufacturing facilities.

COVID-19 Impact

The pandemic exposed vulnerabilities in global supply chains, disrupting the flow of materials and components. Smart factories, equipped with advanced technologies like real-time monitoring and predictive analytics, have been pivotal in helping manufacturers identify and respond to supply chain disruptions promptly. The crisis has underscored the importance of building resilient and agile supply chains, encouraging the adoption of smart manufacturing solutions to enhance supply chain visibility and responsiveness. Despite the positive impacts, the pandemic also brought forth challenges in implementing smart factory technologies. The sudden need for remote operations revealed gaps in workforce digital skills.Companies faced the challenge of up-skilling or reskilling their workforce to effectively utilize smart manufacturing technologies, emphasizing the importance of investing in human capital alongside technological infrastructure. The pandemic acted as a catalyst for the acceleration of Industry 4.0 adoption, with companies recognizing the strategic importance of digital transformation. Smart factories, with their emphasis on automation, data analytics, and connectivity, became essential for maintaining operational continuity and responding to rapidly changing market dynamics.

The crisis highlighted the benefits of smart manufacturing, spurring increased investments in technologies that support remote operations, predictive maintenance, and overall operational efficiency. The unpredictability of the pandemic emphasized the importance of minimizing downtime and ensuring the reliability of manufacturing equipment. Smart factories, employing predictive maintenance powered by AI and IoT, proved crucial in anticipating and preventing equipment failures.

This focus on predictive maintenance has persisted post-pandemic, as companies recognize its potential to enhance operational efficiency and reduce overall maintenance costs. The need to adapt quickly to changing circumstances led to an increased emphasis on digitizing various manufacturing processes. Smart factories, by digitizing operations, could adjust production schedules, optimize resource allocation, and meet fluctuating demand. This digitization trend is likely to continue as manufacturers seek more flexible and responsive production systems.

Industrial sensors are leading in the smart factories market due to their pivotal role in enabling real-time data collection, monitoring, and analysis, which is essential for optimizing manufacturing processes and unlocking the full potential of smart factory technologies.

Industrial sensors serve as the eyes and ears of smart factories, providing a constant stream of real-time data that is crucial for making informed decisions and driving operational efficiency. These sensors are embedded in various components of the manufacturing process, collecting data on variables such as temperature, pressure, humidity, vibration, and more. The ability to gather comprehensive data from different stages of production allows manufacturers to monitor equipment health, identify potential issues, and implement predictive maintenance strategies.

Moreover, industrial sensors contribute to quality control by ensuring that products meet specified standards through continuous monitoring. This constant flow of data enables smart factories to respond dynamically to changing conditions, optimize resource utilization, and enhance overall productivity. As a result, the widespread adoption of industrial sensors has become a linchpin in the success of smart factories, shaping the industry's landscape by providing the foundation for data-driven decision-making and advanced automation.

Product Lifecycle Management (PLM) is leading in the smart factories market because it provides a comprehensive and integrated approach to managing the entire lifecycle of a product, from its conception and design to manufacturing, maintenance, and eventual disposal, ensuring seamless collaboration, efficient workflows, and improved decision-making throughout the entire manufacturing process.

At the heart of smart factories, Product Lifecycle Management (PLM) emerges as a centralizing force that orchestrates the diverse elements involved in the manufacturing journey. PLM acts as a cohesive platform, integrating data, processes, and stakeholders across the entire product lifecycle. From the initial design and prototyping phases to production, maintenance, and end-of-life considerations, PLM ensures that all relevant information is accessible in real-time. This integration allows for collaborative decision-making, reducing silos between different departments and enabling cross-functional teams to work together seamlessly.

PLM systems provide a centralized repository for design documentation, engineering changes, and manufacturing instructions, fostering consistency and accuracy in product development. Moreover, PLM's role extends beyond the design phase, facilitating the management of supply chain logistics, regulatory compliance, and maintenance operations. By streamlining workflows and offering a holistic view of the product lifecycle, PLM enhances efficiency, reduces time-to-market, and ultimately contributes to the optimization of smart factory operations. The ability to harness PLM technologies positions smart factories to adapt swiftly to market changes, innovate continuously, and ensure that products are developed and manufactured with the highest quality and efficiency throughout their entire lifecycle.

The discrete industry is leading in the smart factories market primarily because of its intricate manufacturing processes, which benefit significantly from the precision, automation, and data-driven decision-making capabilities offered by smart factory technologies, thereby enhancing overall operational efficiency and product quality.

The discrete manufacturing sector, encompassing industries like automotive, aerospace, electronics, and machinery, has emerged as a frontrunner in the smart factories market due to the inherent complexity and precision required in its production processes. Smart factories bring a transformative impact to discrete manufacturing by introducing advanced technologies such as the Internet of Things (IoT), robotics, artificial intelligence, and data analytics. In the discrete industry, where products are typically distinct and easily countable, smart factories play a crucial role in automating intricate assembly lines, ensuring precision, and minimizing error rates.

Real-time monitoring and data analytics enable manufacturers to optimize production schedules, predict maintenance needs, and enhance overall equipment efficiency. The demand for customization in discrete manufacturing aligns well with the agility and adaptability offered by smart factories, allowing manufacturers to quickly reconfigure production lines to meet varying customer requirements. Additionally, the discrete industry's emphasis on quality control and compliance is well-served by the continuous monitoring capabilities of smart factories, ensuring that each product meets stringent standards. As a result, the discrete industry stands at the forefront of smart factory adoption, leveraging these technologies to not only streamline operations but also to stay competitive in an ever-evolving global market.

The oil and gas industry is leading in the smart factories market because of the sector's intricate and high-stakes operations, where the integration of smart technologies offers unprecedented efficiency gains, cost savings, and improved safety measures across exploration, production, refining, and distribution processes.

The oil and gas industry's prominence in the smart factories market is attributed to the unique challenges and complexities inherent in its operations. Smart factories, powered by technologies such as the Internet of Things (IoT), sensors, and advanced analytics, bring a transformative impact to the entire value chain of the oil and gas sector. In exploration and production, smart technologies enable real-time monitoring of drilling operations, equipment health, and reservoir conditions, optimizing extraction processes and minimizing downtime. For refining, the precision offered by smart factories enhances the efficiency of complex refining processes, reduces energy consumption, and ensures compliance with stringent environmental regulations.

The integration of smart technologies also extends to pipeline monitoring and distribution networks, where the continuous tracking of pipeline conditions and the use of predictive analytics contribute to the prevention of leaks, minimizing environmental impact and operational disruptions. Moreover, the oil and gas industry's commitment to safety is bolstered by smart factories through the implementation of remote monitoring and control, reducing the need for personnel to be in hazardous environments. The ability to make data-driven decisions, enhance operational efficiency, and improve safety measures positions the oil and gas industry at the forefront of smart factory adoption, demonstrating the transformative potential of these technologies in a traditionally complex and critical sector.

The automotive industry is leading in the smart factories market because of its pursuit of advanced manufacturing processes, rapid technological innovation, and the demand for highly customized products, where smart factory technologies play a pivotal role in optimizing production efficiency, ensuring quality, and meeting dynamic market demands.

The automotive industry's prominence in the smart factories market is driven by its inherent need for precision, efficiency, and adaptability in the face of evolving consumer preferences. Smart factories offer a transformative solution to the complex manufacturing processes involved in automotive production. The integration of technologies such as the Internet of Things (IoT), artificial intelligence (AI), and robotics enables real-time monitoring and control of production lines, ensuring optimal efficiency and reducing manufacturing costs.

In the automotive sector, where customization and rapid time-to-market are critical, smart factories facilitate the seamless adaptation of production lines to varying specifications, allowing manufacturers to meet the demand for personalized vehicles. The use of sensors and data analytics in smart factories ensures stringent quality control, minimizing defects and enhancing overall product reliability.

Moreover, the automotive industry is at the forefront of incorporating advanced technologies like autonomous vehicles and electric cars, both of which heavily rely on the capabilities offered by smart factories for precision manufacturing and real-time decision-making. As a result, the automotive industry's commitment to innovation, efficiency, and customization aligns seamlessly with the advantages offered by smart factory technologies, making it a leader in the adoption of these transformative manufacturing processes.

North America is leading in the smart factories market due to its robust technological infrastructure, a concentration of advanced manufacturing industries, a culture of innovation, and a proactive approach by businesses towards Industry 4.0 adoption.

North America's leadership in the smart factories market can be attributed to the region's well-established technological foundation and a high concentration of industries that are early adopters of advanced manufacturing technologies. The United States and Canada, in particular, boast a robust ecosystem of technology providers, research institutions, and innovative enterprises that actively drive the development and adoption of Industry 4.0 solutions. The region is home to a diverse range of industries, including automotive, aerospace, electronics, and pharmaceuticals, which are at the forefront of embracing smart manufacturing practices.

The presence of a highly skilled workforce and a culture that values innovation and technology adoption further contributes to North America's leadership in smart factories. Businesses in the region are keenly aware of the advantages offered by smart manufacturing, including increased operational efficiency, cost savings, and improved competitiveness in the global market. Moreover, government initiatives and supportive policies aimed at fostering technological innovation and digital transformation contribute to the accelerated adoption of smart factory technologies across various sectors in North America. As a result, the region stands out as a key player in shaping the future of smart manufacturing, setting the pace for the rest of the world in embracing the transformative potential of Industry 4.0.

The smart factory market is fragmented, with significant players like ABB Ltd, Cognex Corporation, Siemens AG, Schneider Electric SE, and Yokogawa Electric Corporation. Players in the market are adopting strategies such as innovations, partnerships, mergers, and acquisitions to improve their product offerings and achieve sustainable competitive advantage.

- In March 2023, Schneider Electric, a solution provider for the digital transformation of industrial automation and energy management, broke ground on its new smart factory in Hungary. With an expected investment of EUR 40 million (USD 43 million), the new site will span 25,000 m2 with a headcount of about 500 employees.

- In March 2023, Samsung Electronics, a leading consumer electronic device manufacturer, announced its plans to increase investment in setting up smart manufacturing capabilities at its mobile phone manufacturing plant in Noida. The company also announced its plans to expand its research and development facility in the country to make production more competitive and localized.

- In February 2023, Emerson combined its extensive power expertise and renewable energy capabilities into the OvationTM Green portfolio to help power generation companies meet the needs of their customers as they transition to green energy generation and storage. Emerson has broadened its power-based control architecture by integrating newly acquired Mita-Teknik software and technology with its industry-leading Ovation automation platform, extensive renewable energy knowledge base, cybersecurity solutions, and remote management capabilities.

- In January 2023, Siemens Digital Industries Software announced the launch of eXplore live at Wichita's The Smart Factory. The smart factory contains a fully experiential lab and an active product line for developing and exploring innovative smart manufacturing capabilities. The Siemens Xcelerator portfolio is used in eXplore Live at Deloitte's The Smart Factory in Wichita to help companies experience the power of digitalization and the future of smart manufacturing.

- In October 2022, ABB entered into a strategic collaboration with U.S.-based startup Scalable Robotics to improve its portfolio of user-friendly robotic welding techniques. Through 3D vision and implanted process understanding, the Scalable Robotics technology enables users to quickly program welding robots without coding.

Considered in this report

- Historic year: 2018

- Base year: 2023

- Estimated year: 2024

- Forecast year: 2029

Aspects covered in this report

- Smart Factory market Outlook with its value and forecast along with its segments

- Various drivers and challenges

- On-going trends and developments

- Top profiled companies

- Strategic recommendation

By Component

- Industrial Sensors

- Industrial Robots

- Industrial 3D Printing

- Machine Vision

By Technology

- Product Lifecycle Management (PLM)

- Human Machine Interface (HMI)

- Enterprise Resource and Planning (ERP)

- Distributed Control System (DCS)

- Manufacturing Execution System (MES)

- Programmable Logic Controller (PLC)

- Supervisory Controller and Data Acquisition (SCADA)

- Others (Industrial & PAM)

By Industry

- Process Industry

- Discrete Industry

By Process Industry

- Oil & Gas

- Chemicals

- Pharmaceuticals

- Energy & Power

- Metal & Mining

- Pulp & Paper

- Food & Beverages

- Cosmetics & Personal Care

By Discrete Industry

- Automotive

- Semiconductor & Electronics

- Aerospace & Defense

- Machine Manufacturing

- Textiles

The approach of the report:

This report consists of a combined approach of primary and secondary research. Initially, secondary research was used to get an understanding of the market and list the companies that are present in it. The secondary research consists of third-party sources such as press releases, annual reports of companies, and government-generated reports and databases. After gathering the data from secondary sources, primary research was conducted by conducting telephone interviews with the leading players about how the market is functioning and then conducting trade calls with dealers and distributors of the market. Post this; we have started making primary calls to consumers by equally segmenting them in regional aspects, tier aspects, age group, and gender. Once we have primary data with us, we can start verifying the details obtained from secondary sources.Intended audience

This report can be useful to industry consultants, manufacturers, suppliers, associations, and organizations related to the Smart Factory industry, government bodies, and other stakeholders to align their market-centric strategies. In addition to marketing and presentations, it will also increase competitive knowledge about the industry.This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Honeywell International Inc.

- Siemens AG

- Schneider Electric SE

- ABB Ltd.

- General Electric Company

- Rockwell Automation Inc.

- Emerson Electric Co.

- FANUC Corporation

- Bosch Rexroth AG

- KUKA AG

- Johnson Controls International

- Mitsubishi Electric Corporation

- SAP SE

- Oracle Corporation

- The International Business Machines Corporation

- Atos SE

- Autodesk Inc

- Cognex Corporation

- Yokogawa Electric Corporation

- PTC Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 165 |

| Published | January 2024 |

| Forecast Period | 2023 - 2029 |

| Estimated Market Value ( USD | $ 96.83 Billion |

| Forecasted Market Value ( USD | $ 175 Billion |

| Compound Annual Growth Rate | 9.0% |

| Regions Covered | Global |