These tapes are ideal products in the electrical and electronics industry for assembling electronic components. The number of companies in the automotive, construction, electronics, and healthcare sectors is growing considerably, which is aiding the speciality tapes market.

Key Trends and Developments

The specialty tapes market is expanding driven by a focus on sustainability, technological innovations, increasing demand from the automotive and electronics sectors, and the growth of medical applications.November 2024

Berry Global sold its specialty tapes business to private equity firm Nautic Partners for USD 540 million, as part of a strategy under CEO Kevin Kwilinski to focus on consumer packaging. This followed recent divestitures, including the spin-off of its Health, Hygiene, and Specialties business. The deal is expected to close in Q1 2025.October 2023

UPM Specialty Papers and Lohmann collaborated to promote recycling in the tape industry. They focused on improving the recyclability of paper liners, which had previously been challenging due to technical barriers. By introducing a new white paper liner and utilising UPM's LinerLoop recycling solution, they aimed to enhance sustainability and reduce waste in the sector.November 2022

Bostik launched two new adhesives in India to enhance the tape and label market. The first, Bostik HM2060, supports high-speed label production in FMCG, pharmaceutical, and logistics industries. The second, Bostik HM2070, is a sustainable tape adhesive for e-commerce packaging, addressing the shift towards eco-friendly solutions. Both products improve efficiency and support circular economy goals.August 2021

Ajit Industries Private Limited (AIPL) launched its eco-friendly green tapes in India for the first time. The company introduced a range of sustainable products, including recyclable and biodegradable tapes. AIPL, known for its industrial tapes and die-cut solutions, has been committed to promoting environmentally responsible practices under its "Mission Green" initiative.Focus on Sustainability is Creating New Opportunities in the Specialty Tapes Market

Sustainability has become a key trend in the market, with companies focusing on eco-friendly products made from recyclable materials and implementing sustainable manufacturing processes. This shift is driven by rising environmental concerns and consumer demand for greener alternatives. In December 2024, Ahlstrom introduced MasterTape® Cristal, a fibre-based transparent tape backing designed to reduce plastic waste. Made from renewable materials, it provides the same strength and transparency as plastic tape while being recyclable and compostable. The product has received positive feedback from early users, including schools, offices, and retailers, for its environmental benefits and strong performance.Technological Advancements are Shaping the Specialty Tapes Market Dynamics and Trends

Technological innovation is driving key changes in the market, with companies focusing on advanced adhesives, improved bonding, and greater durability. Smart tapes, conductive tapes, and multifunctional adhesives are becoming increasingly popular, supporting sectors such as electronics, automotive, and healthcare. New technologies have also enhanced PSA tape precision, reduced waste, and improved coating methods, ensuring more efficient large-scale production. Furthermore, materials like acrylic and silicone are providing stronger, more flexible solutions for challenging conditions and diverse applications.Demand for Automotive and Electronics are Fueling the Specialty Tapes Market Growth

The growing demand from the automotive and electronics industries is driving the specialty tapes market, as these sectors require lightweight, high-performance, and durable materials. Adhesive solutions are increasingly utilised in automotive assembly, electronics packaging, and components. This demand is further supported by advancements in electric vehicles and consumer electronics. STICOL™ Tapes are widely used in the automotive sector for various applications, including masking, protection, insulation, and mounting, and are tailored to customer specifications with a range of adhesives and base materials.Expansion of Medical Applications is Boosting Demand for the Specialty Tapes Market

The medical industry is driving an increased demand for specialty tapes, especially in wound care, medical device assembly, and surgical uses. These tapes offer precision, comfort, and safety, ensuring reliable adhesion in sensitive medical settings. The global rise in healthcare needs and medical innovations further accelerates this trend. In November 2023, H.B. Fuller launched Swift®melt 1515-I, a bio-compatible adhesive for medical applications, ensuring secure skin attachment even in high-temperature and humid conditions, with ISO 10993-5 certification confirming its safety.Market Segmentation

Speciality tapes have application-specific designs to improve the adhesive tape’s specific capacities. This may include abrasion and chemical resistance, adhesion characteristics, or any other characteristics that are not frequently found in general adhesive tape variants. The speciality tapes market can be divided on the basis of segments like resin type, end-use, and backing material. The industry can be segmented based on its resin type as acrylic, rubber, and silicone, among others.Market Breakup by Resin Type

- Acrylic

- Rubber

- Silicone

- Others

Market Breakup by Backing Material

- Polyvinyl Chloride (PVC)

- Woven/Non-Woven

- Paper

- PET

- Foam

- Polypropylene (PP)

- Others

Market Breakup by End Use

- Electrical and Electronics

- Healthcare and Hygiene

- Automotive

- White Goods

- Paper and Printing

- Building and Construction

- Retail and Graphics

- Others

Market Breakup by Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Market Analysis

The high demand for speciality tapes in healthcare and hygiene, electrical and electronics, automotive, and building and construction industries as manufacturers focus primarily on presenting a new product range with improved properties is aiding the speciality tapes industry. The use of healthcare services, awareness of hygiene products, the development of infrastructure, and the upgrading of electronic equipment are increasing the demand for speciality tapes. Manufacturers are therefore producing tapes with an exceptional focus on both heat and weather resistance features, which is also driving the market for speciality tapes. It is expected that the PVC segment will account for the largest industry share of speciality tapes. During the forecast period, the healthcare and hygiene segment is expected to account for the largest market share as speciality tapes are applied to surgical containers in the healthcare industry and in monitoring electrodes and other medical devices, along with having applications for wound care.Competitive Landscape

The specialty tapes market key players focus on providing high-performance adhesive solutions across industrial, commercial, and consumer sectors. With a strong emphasis on innovation and sustainability, they offer a diverse range of products, including tapes for the automotive, electronics, packaging, and healthcare industries. Renowned for their advanced technology, these companies develop solutions that improve productivity, minimise environmental impact, and optimise manufacturing efficiency. Their commitment to quality, research and development, and customer-focused solutions has contributed to a robust global reputation.3M Company

Headquartered in Minnesota, United States, 3M was established in 1902 and is a global leader in innovation. The company specialises in a wide range of products, including adhesives, healthcare solutions, and consumer goods. By combining research and development, 3M delivers sustainable and advanced solutions that drive efficiency and improve lives across multiple industries, including automotive and electronics.Nitto Denko Corporation

Founded in 1918 and headquartered in Osaka, Japan, Nitto Denko is a multinational leader in advanced materials and technologies. The company manufactures a diverse range of products, including adhesive tapes, automotive components, and electronic materials. Committed to sustainability and innovation, Nitto Denko creates solutions that meet the evolving needs of industries worldwide.Tesa SE

Tesa SE, established in 1906 and based in Hamburg, Germany, is a global leader in adhesive tape manufacturing. Offering a broad range of high-quality products for industrial, commercial, and consumer use, Tesa is renowned for its innovative solutions. The company focuses on enhancing productivity and sustainability in sectors such as automotive, healthcare, and electronics.LINTEC Corporation

LINTEC Corporation, established in 1942 and headquartered in Tokyo, Japan, is a global leader in adhesive materials and films. Serving industries like packaging, automotive, and electronics, LINTEC develops innovative solutions that improve product performance, safety, and efficiency. The company places a strong emphasis on sustainability and strives to meet global industry demands through advanced technologies.Other key players in the specialty tapes market report are Avery Dennison Corporation, Scapa Group plc, and Compagnie de Saint-Gobain SA, among others.

Table of Contents

Companies Mentioned

The key companies featured in this Speciality Tapes market report include:- 3M Company

- Nitto Denko Corporation

- Tesa SE

- LINTEC Corporation

- Avery Dennison Corporation

- Scapa Group plc

- Compagnie de Saint-Gobain SA

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 154 |

| Published | August 2025 |

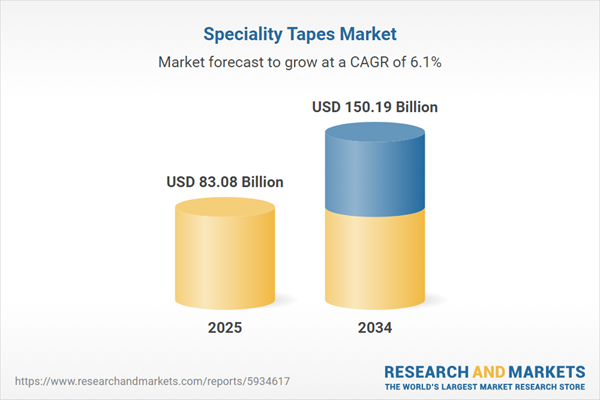

| Forecast Period | 2025 - 2034 |

| Estimated Market Value ( USD | $ 83.08 Billion |

| Forecasted Market Value ( USD | $ 150.19 Billion |

| Compound Annual Growth Rate | 6.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 8 |