This has created a higher demand for viral vectors in producing these therapies. Regulatory agencies recognizing the potential of gene therapies and offering support, expedited review processes, and incentives have contributed to the growth of the gene therapy. Consequently, the Gene Therapy segment would generate approximately 65.6 share of the market by 2030. This positive regulatory environment has encouraged the development and production of viral vectors. Thus, the rise in demand and awareness for gene therapy has positively impacted the market by creating a growing and dynamic landscape.

Engineering viral vectors for reduced immunogenicity, improved targeting, and controlled gene expression contributes to developing vectors tailored for specific therapeutic applications. Developing next-generation viral vector platforms, such as synthetic and hybrid vectors, expands the toolbox for gene delivery. These platforms aim to overcome limitations associated with traditional vectors, offering improved safety profiles and increased efficiency in gene transfer. Therefore, these advancements collectively drive the expansion of the market. Moreover, A growing pipeline in gene therapy addresses a diverse range of therapeutic targets, including genetic disorders, rare diseases, neurodegenerative conditions, and certain types of cancer. This diversity broadens the application of viral vectors, leading to increased production needs. The expansion of clinical trials in gene therapy and viral vaccines, driven by a robust pipeline, necessitates large-scale production of viral vectors for investigational treatments. Due to the above aspects, the market is expected to grow significantly.

Furthermore, Viral vector platforms, particularly adenoviruses, had been instrumental in developing several COVID-19 vaccines. This surge in demand had led to an increased focus on optimizing viral vector production processes to meet the global need for large-scale vaccine manufacturing. The pandemic had prompted an unprecedented acceleration of research and development efforts in the biopharmaceutical sector. This emphasis on equitable distribution had implications for the manufacturing capacity and scalability of viral vector production, driving innovations in production processes to meet the demands of a global vaccination effort. Thus, COVID-19 had a positive impact on the market.

However, Viral vector production involves complex and intricate processes, including cell culture, transfection, purification, and quality control. The complexity of these processes contributes to increased production costs, particularly in terms of skilled labor, specialized equipment, and consumables. Also, the production of viral vectors often requires specialized facilities with controlled environments to ensure the integrity and safety of the final product. Due to the above factors, market growth will be hampered in the coming years.

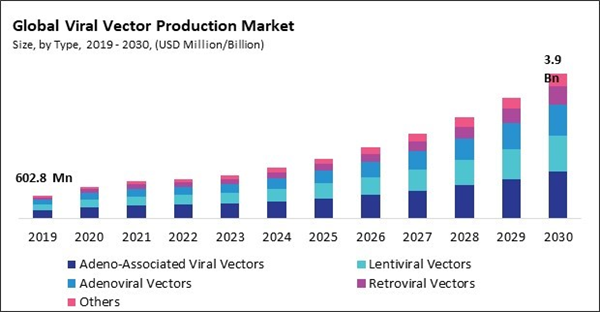

By Type Analysis

By type, the market is classified into adenoviral vectors, lentiviral vectors, retroviral vectors, adeno-associated viral vectors, and others. In 2022, the adeno-associated viral vectors segment registered the highest revenue share in the market. Adeno-associated viral vectors (AAVs) typically induce a minimal immune response, allowing for repeated administration without significant immune reactions. This low immunogenicity is advantageous for long-term and repeated treatments. AAVs can establish stable and long-lasting gene expression in dividing and non-dividing cells. This property is crucial for sustained therapeutic effects and reduces the need for frequent vector administration. They can infect both dividing and non-dividing partitions, making them versatile for targeting various cell types, including neurons, muscle cells, and liver cells.By Indication Analysis

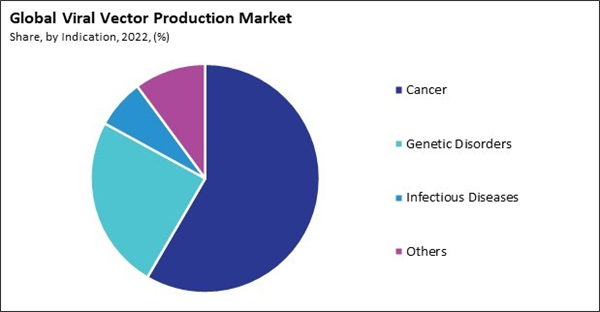

On the basis of indication, the market is segmented into cancer, genetic disorders, infectious diseases, and others. The genetic disorders segment acquired a substantial revenue share in the market in 2022. Viral vectors deliver therapeutic genes into target cells in patients with genetic disorders. The viral vector works as a delivery vehicle, carrying the corrected or functional gene to the cells affected by the genetic abnormality. This approach aims to replace or supplement the defective gene, addressing the root cause of the genetic disorder. Genetic disorders caused by enzyme deficiencies, such as lysosomal storage disorders, can be targeted using viral vectors. Introducing functional genes encoding missing enzymes into affected cells can help restore enzymatic activity and alleviate the accumulation of substrates that lead to disease symptoms.By Application Analysis

Based on application, the market is fragmented into gene therapy and vaccinology. In 2022, the gene therapy segment held the highest revenue share in the market. Gene therapy can be applied using in vivo or ex vivo approaches. In in vivo gene therapy, viral vectors are directly administered to the patient to target specific tissues or organs. Ex vivo gene therapy involves modifying cells outside the patient's body before reinfusing them. The preference of approach depends on the target tissue and the therapeutic strategy. The increasing number of clinical trials and regulatory approvals is evidence of the success of viral vector-based gene therapies. Positive outcomes in clinical studies contribute to validating and accepting gene therapy as a viable treatment option for genetic disorders.By Regional Analysis

Region-wise, the market is analysed across North America, Europe, Asia Pacific, and LAMEA. The Asia Pacific region covered a considerable revenue share in the market in 2022. In recent years, the Asia-Pacific region has witnessed substantial growth in the biotechnology and pharmaceutical sectors. This growth is propelled by increasing investment in research and development, expanding healthcare infrastructure, and increasing government support for the biotech industry. As a result, there is a growth in demand for viral vectors in the region to support the development and production of advanced therapies. In addition, the Asia-Pacific region has a high hindrance of cancer, genetic disorders, and infectious diseases. As a result, there is an increased focus on developing gene therapies and viral vector-based vaccines to address these healthcare challenges. The demand for viral vectors as essential tools in developing therapies drives the growth of the market.Recent Strategies Deployed in the Market

- Dec-2023: Oxford Biomedica plc has entered into an agreement with TSGH SAS to acquire ABL Europe SAS, a dedicated GMP CMO (Good Manufacturing Practice Contract Manufacturing Organization). Through this acquisition, Oxford Biomedica seeks to enhance its presence in the cell and gene therapy sector. Furthermore, this acquisition will not only increase Oxford Biomedica's capabilities in process and analytical development and early-stage manufacturing but also address the rising client demand for process development.

- Oct-2023: Andelyn Biosciences, Inc. entered into partnership with Purespring Therapeutics Limited, a biotech company. Through this partnership, the companies aim to speed up the manufacturing of their gene therapies for the treatment of chronic renal diseases. Additionally, it empowers Purespring to quicken the clinical development of its gene therapy program focused on chronic kidney diseases.

- May-2023: Oxford Biomedica plc, a Contract Development and Manufacturing Organization (CDMO) specializing in high-quality and innovative viral vectors, has launched its fourth-generation lentiviral vector delivery system, TetraVectaTM. This technology from Oxford Biomedica enhances the quality, potency, and packaging capacity of lentiviral vectors. It also integrates new and improved safety features, further enriching the company's client offerings and reinforcing its position as a leader in the LentiVector platform.

- Mar-2023: Charles River Laboratories International, Inc. unveiled its ready-made pHelper offering. Through this product, the company aims to ensure a stable supply and simplify adeno-associated virus (AAV)-based gene therapy programs from the initial stages of discovery to commercial manufacturing. Furthermore, the product is readily accessible in Research Grade (RG), High Quality (HQ), and Good Manufacturing Practice (GMP)-grade.

- Oct-2022: Andelyn Biosciences, Inc. has broadened its manufacturing capacities by inaugurating a new GMP clinical and commercial manufacturing facility. This facility is intended to enhance the company's ability to produce and advance cell and gene therapy (CGT). Moreover, it will facilitate viral vector production through different methods, such as adherent, iCELLis, and suspension platforms.

- Aug-2022: Thermo Fisher Scientific, Inc. has enhanced its capabilities in cell and gene therapy by inaugurating a new viral vector manufacturing facility in Plainville, Mass. This expansion includes the support for the development, testing, and production of viral vectors - essential components in the process of developing and bringing gene therapies to market.

List of Key Companies Profiled

- Andelyn Biosciences, Inc.

- Charles River Laboratories International, Inc.

- Danaher Corporation

- FinVector Oy (Ferring Ventures S/A)

- Thermo Fisher Scientific, Inc.

- Novartis AG

- Takara Bio Inc. (Takara Holdings Inc.)

- Avid Bioservices, Inc.

- Oxford Biomedica plc

- Lonza Group Ltd.

Market Report Segmentation

By Type- Adeno-Associated Viral Vectors

- Lentiviral Vectors

- Adenoviral Vectors

- Retroviral Vectors

- Others

- Cancer

- Genetic Disorders

- Infectious Diseases

- Others

- Gene Therapy

- Vaccinology

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Table of Contents

Companies Mentioned

- Andelyn Biosciences, Inc.

- Charles River Laboratories International, Inc.

- Danaher Corporation

- FinVector Oy (Ferring Ventures S/A)

- Thermo Fisher Scientific, Inc.

- Novartis AG

- Takara Bio Inc. (Takara Holdings Inc.)

- Avid Bioservices, Inc.

- Oxford Biomedica plc

- Lonza Group Ltd.