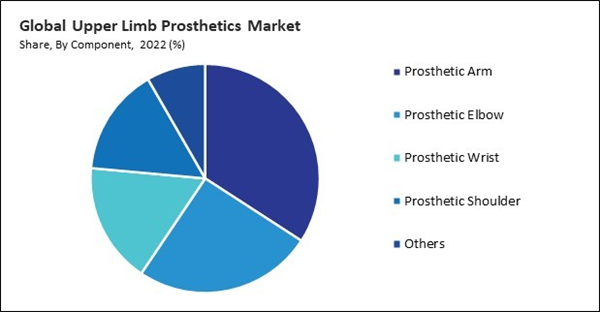

The primary benefit of a prosthetic elbow is the restoration of joint functionality. Therefore, the prosthetic elbow segment captured $172.8 million market revenue in 2022. For individuals with upper limb amputations, a prosthetic elbow allows for flexion and extension movements, enabling users to perform a wide range of activities that require bending and straightening the arm. Advanced prosthetic elbows offer enhanced flexibility and adaptability to different tasks and environments. Some prosthetic elbows have adjustable settings that users can control, allowing them to customize the joint's behavior based on specific activities or preferences.

The rising incidence of upper limb amputations, whether due to accidents, injuries, or medical conditions, contributes to the growing demand for these prosthetics. As the population ages and medical treatments improve, more individuals require prosthetic solutions to regain functionality. Certain medical conditions, such as cancer, vascular diseases, and congenital anomalies, may necessitate upper limb amputations. Diagnosing and treating these conditions contribute to the increasing demand for these among affected individuals. Military conflicts and wars can lead to a higher incidence of traumatic injuries, including limb loss. Veterans and individuals affected by war-related injuries often require advanced prosthetic solutions to regain functionality and improve their quality of life. Additionally, integrating advanced technologies, such as robotics, artificial intelligence, and 3D printing, into these enhances their capabilities. Technological innovation leads to developing more customizable, lightweight, and functionally advanced prosthetic devices, attracting users seeking cutting-edge solutions. Prosthetic devices equipped with Bluetooth enable seamless connectivity with smartphones, tablets, and other devices. This connectivity allows users to control their prosthetics through mobile apps, adjust settings, and receive software updates, enhancing the overall user experience. Thus, technological integration and innovation has been a pivotal factor in driving the growth of the market.

The pandemic disrupted global supply chains, affecting the manufacturing and distribution of medical devices, including upper limb prosthetics. Delays in the production and transportation of components and materials led to challenges in meeting demand, potentially impacting the availability of prosthetic devices. Many non-emergency medical procedures, including elective surgeries for prosthetic implantation or adjustments, were postponed, or deferred during periods of heightened COVID-19 transmission. This delay affected individuals awaiting prosthetic fittings or upgrades, leading to disruptions in the usual workflow of prosthetic clinics. The pandemic accelerated the adoption of telehealth services in healthcare delivery. Prosthetists and healthcare providers explored remote monitoring and telehealth solutions to provide virtual support to individuals with prosthetics. This shift in priorities redirected resources away from elective procedures and rehabilitation services, potentially affecting prosthetics. Thus, the COVID-19 pandemic had a moderate effect on the market.

However, the high cost of advanced prosthetic technologies may exclude a significant portion of the population, particularly those with limited financial means. This limitation in accessibility prevents many individuals from benefiting from the latest innovations in upper limb prosthetics. High costs can deter individuals from adopting prosthetic technologies, especially in regions with limited healthcare resources. This reluctance to adopt advanced prosthetics may lead to lower overall adoption rates and slower market growth. Affording advanced prosthetic technologies can impose a significant financial burden on individuals and their families. The high upfront costs and potential ongoing maintenance expenses may lead to financial strain and impact the overall well-being of prosthetic users. Inadequate insurance coverage for prosthetic devices exacerbates the financial burden on individuals. Thus, high cost of prosthetic technologies can slow down the growth of the market.

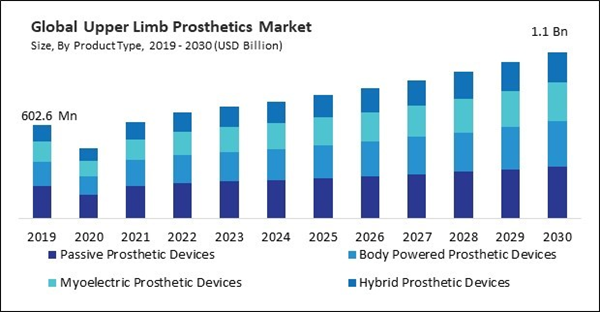

By Product Type Analysis

Based on product type, the market is classified into passive prosthetic devices, body powered prosthetic devices, myoelectric prosthetic devices, and hybrid prosthetic devices. In 2022, the passive prosthetic devices segment witnessed the largest revenue share in the market. Passive prosthetic devices are often chosen for their cosmetic and aesthetic appeal. The realistic appearance of these devices, including lifelike skin tones and textures, contributes to a more natural and integrated look. This aesthetic appeal is particularly important for users who prioritize the visual symmetry of their prosthetic limb with their intact limb. Passive prosthetic devices are often lightweight, providing user comfort during prolonged wear.By Component Analysis

By component, the market is categorized into prosthetic arm, prosthetic elbow, prosthetic wrist, prosthetic shoulder, and others. The prosthetic wrist segment procured a promising growth rate in the market in 2022. Prosthetic wrists contribute to the overall aesthetics of the upper limb prosthesis. Realistic wrist movements and appearances, including customizable designs and coverings, help create a more natural and lifelike appearance. This enhances the user's confidence and body image. Prosthetic wrists support individuals' return to work and occupational engagement. The enhanced functionality and adaptability of the wrist allow users to perform job-related tasks that involve wrist movements, contributing to improved vocational outcomes.By End User Analysis

On the basis of end-user, the market is divided into hospitals, clinics, and others. In 2022, the clinics segment dominated the market with maximum revenue share. Clinics serve as platforms for prosthetists to offer their expertise and services. Prosthetists, trained professionals specializing in prosthetic care, collaborate with clinics to provide personalized and comprehensive care to individuals with upper limb amputations. This collaboration contributes to the overall quality of prosthetic interventions. Prosthetics clinics are crucial in educating patients about their prosthetic options, care practices, and the overall adjustment process.By Regional Analysis

Region-wise, the market is analyzed across North America, Europe, Asia Pacific, and LAMEA. In 2022, the North America region led the market by generating the highest revenue share. The region has witnessed significant advancements in prosthetic technologies, including myoelectric control systems, robotics, and 3D printing. North America has a relatively high healthcare expenditure, allowing for increased accessibility to advanced medical interventions, including prosthetic care. A significant military and veteran population in North America, particularly in the United States, has contributed to advancements in prosthetics.List of Key Companies Profiled

- Ossur Hf.

- Ottobock SE & Co. KGaA

- Blatchford Group (Endolite India Ltd.)

- Fillauer LLC (Fillauer Companies, Inc.)

- Open Bionics Ltd

- Comprehensive Prosthetics & Orthotics

- COAPT LLC

- Mobius Bionics LLC

- Ortho Europe Limited

- WillowWood Global LLC

Market Report Segmentation

By Product Type- Passive Prosthetic Devices

- Body Powered Prosthetic Devices

- Myoelectric Prosthetic Devices

- Hybrid Prosthetic Devices

- Prosthetic Arm

- Prosthetic Elbow

- Prosthetic Wrist

- Prosthetic Shoulder

- Others

- Clinics

- Hospitals

- Others

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Table of Contents

Companies Mentioned

- Ossur Hf.

- Ottobock SE & Co. KGaA

- Blatchford Group (Endolite India Ltd.)

- Fillauer LLC (Fillauer Companies, Inc.)

- Open Bionics Ltd

- Comprehensive Prosthetics & Orthotics

- COAPT LLC

- Mobius Bionics LLC

- Ortho Europe Limited

- WillowWood Global LLC