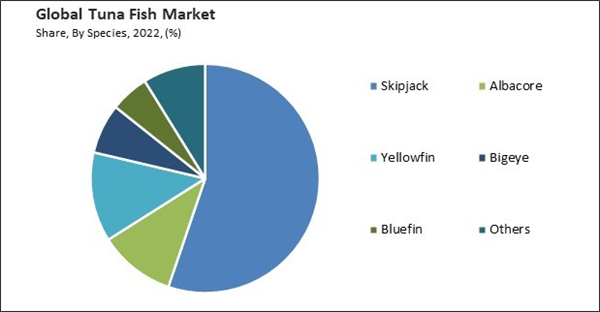

Albacore tuna has a mild, meaty flavor that appeals to a wide range of consumers. Its versatile taste makes it suitable for various culinary preparations, including grilling, searing, baking, and using it in salads, sandwiches, sushi, and more. Consequently, the Albacore segment would generate approximately 11.35% share of the market by 2030. Albacore tuna is highly versatile and can be prepared in various ways, including grilling, broiling, baking, or consuming raw in dishes like sushi and sashimi. It is also commonly used in canned tuna products, where it can be incorporated into salads, sandwiches, and a variety of recipes.

The major strategies followed by the market participants are Merger & Acquisition as the key developmental strategy to keep pace with the changing demands of end users. For instance, In September, 2023, Dongwon Enterprises Co. Ltd. took over StarKist Co., which provides healthy food products in the United States. Under this acquisition, the companies aimed to extend their businesses by selling family owners' holdings in other companies and luring investors in before becoming public. Additionally, In January, 2022, Century Pacific Food Inc. expanded its canned marine products portfolio by acquiring Ligo. This aligns with the company's mission to offer affordable nutrition, enabling regional production of Ligo products.

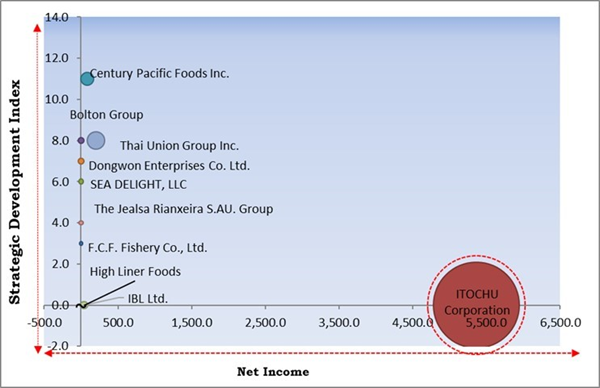

Cardinal Matrix

Market Competition Analysis

Based on the Analysis presented in the Cardinal Matrix; ITOCHU Corporation is the forerunner in the Market. and Companies such as Century Pacific Foods Inc., Dongwon Enterprises Co. Ltd., Thai Union Group PLC are some of the key innovators in the Market. In May, 2021, Thai Union Group PLC completed theacquisition of the remaining 49 percent of shares in Rugen Fisch AG, produces and sells canned fish. This strategic move underscored the significant valueit added to the company and reaffirmed Thai Union's dedication to the German market.Market Growth Factors

Technological advancements in the supply chain of tuna

The use of advanced technology, such as blockchain and electronic tagging, has improved traceability throughout the tuna supply chain. This has allowed stakeholders, from fishermen to consumers, to trace the origin of the tuna they purchase. The ability to track the journey of tuna from catch to plate ensures transparency and helps combat illegal, unreported, and unregulated (IUU) fishing, which is essential for maintaining the sustainability of tuna stocks. Technological innovations in fishing gear and methods have made it possible for the industry to adopt more sustainable practices. This includes the development of selective fishing methods that reduce bycatch and minimize the impact on non-target species. In summary, technological advancements have had a highly positive impact on the market.Rising disposable income and urbanization

As disposable incomes increase, there is a notable surge in consumer spending power, allowing individuals to diversify their dietary choices. In this context, the demand for tuna products experiences a significant upswing, driven by the accessibility to premium and high-quality tuna offerings. The transformation of urban areas, marked by expanding populations, contributes to an environment where a variety of culinary preferences and dining experiences are embraced. Tuna, with its adaptability across diverse culinary applications, has become a popular choice among urban residents. These factors have propelled the growth of the market.Market Restraining Factors

Regulations on bycatch and unsustainable fishing practices

Bycatch, which refers to the unintentional capture of non-target species during tuna fishing, often results from certain fishing methods, such as purse seine nets and longlines. This issue poses several challenges to the industry. The high incidence of bycatch contributes to environmental harm. Non-target species like sharks, turtles, and dolphins can become entangled in fishing gear, resulting in injury or death. This has consequences for marine ecosystems and biodiversity, as these species often have ecological roles that are important for the balance of the oceans. In the upcoming years, these factors are anticipated to impede market growth.Species Outlook

Based on species, the market is divided into skipjack, albacore, yellowfin, bigeye, bluefin, and others. The skipjack segment garnered the highest revenue share in the market in 2022. High-quality protein can be found in abundance in skipjack tuna. Protein is necessary for general growth, muscular building, and tissue repair. It is an ideal food for individuals looking to increase their protein intake, such as athletes and bodybuilders. Skipjack tuna is highly versatile and can be used in various culinary preparations, including salads, sandwiches, sushi, and pasta dishes. Canned skipjack tuna is a convenient pantry staple for quick and easy meal preparation.Type Outlook

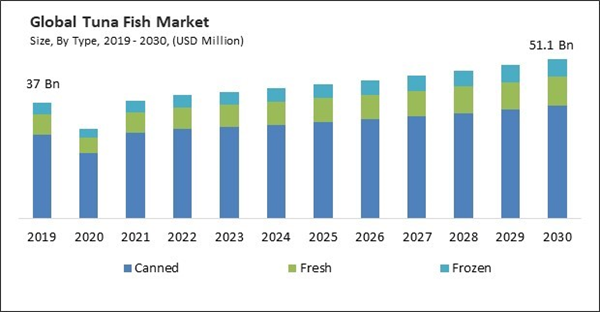

On the basis of type, the market is segmented into canned, fresh, and frozen. The fresh segment witnessed a significant revenue share in the market in 2022. Fresh tuna offers a more robust flavor and firmer texture compared to canned tuna. Its taste and texture are preferred by those who appreciate the distinctive characteristics of the fish. When choosing fresh tuna, consumers can select local and sustainably sourced options, contributing to responsible seafood consumption. Fresh tuna can be grilled, seared, broiled, or baked to the preferred level of doneness, allowing for a wide range of culinary applications.Regional Outlook

Region-wise, the market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The Asia Pacific region procured a remarkable growth rate in the market in 2022. Demand for foods high in protein, like tuna, has surged in nations like China and India due to population growth and rising per capita income. The world's top four aquaculture-producing countries are all in Asia, according to the European Market Observatory for Fisheries and Aquaculture Products Report 2022. Additionally, residents in this region can find well-paying jobs in the aquaculture industry. These developments will boost the market's advancement by quickening the aquaculture sector's growth.The market research report covers the analysis of key stakeholders of the market. Key companies profiled in the report include Bolton Group, Century Pacific Foods Inc., The Jealsa Rianxeira S.AU. Group, ITOCHU Corporation, Thai Union Group PLC, Dongwon Enterprises Co. Ltd., IBL Ltd., F.C.F. Fishery Co., Ltd., SEA DELIGHT, LLC, and High Liner Foods.

Strategies deployed in the Market

Partnerships, Collaborations, and Agreements:

- Mar-2022: Thai Union Group PLC partnered with Sustainable Fisheries Partnership (SFP) to enhance transparency in its supply chains and broaden considerations for biodiversity impact. This collaboration enables Thai Union to extend its involvement in the Ocean Disclosure Project (ODP), making supply chain and sustainability information accessible through the ODP platform.

- Feb-2022: SEA DELIGHT, LLC, joined hands with Prime Seafood by the International Pole and Line Foundation (IPNsLF). Under this collaboration, the companies aimed to increase the visibility of this artisanal fishery in the main markets, which, in turn, has led to a more sustainable food system and protected the livelihoods of fishermen and their families.

- Jan-2020: SEALECT Tuna, from Thai Union Group PLC, collaborated with the renowned local brand Pa Waen to introduce five new flavors of spicy tuna flakes. This innovative product, the first of its kind in the Thai market, blends nutritious tuna with authentic local chili paste. The SEALECT Tuna x Pa Waen Chili tuna flakes, launched at major supermarkets and online channels in Thailand, offer a unique fusion of flavors.

Product Launches and Product Expansions:

- Mar-2023: Dongwon F & B, under Dongwon Enterprises, launched My Plant, a vegan line featuring plant-based tuna and vegetable dumplings. The My Plant series includes five tuna products (one canned, four pouches) and debuts with kimchi and regular dumplings. This expansion reflects Dongwon's response to the growing demand for plant-based alternatives.

- Jul-2022: Century Pacific Food, Inc. expanded its "unMEAT" portfolio with the introduction of a plant-based, fish-free tuna. The latest addition, unMEAT Fish-free Tuna, replicates the taste, texture, and appearance of traditional tuna while being entirely plant-based. Crafted from ingredients such as non-GMO soy, natural oils, and flavors, this innovative product aligns with the growing demand for sustainable and plant-derived alternatives in the food industry.

Acquisition and Mergers:

- Sep-2023: Dongwon Enterprises Co. Ltd. took over StarKist Co., which provides healthy food products in the United States. Under this acquisition, the companies aimed to extend their businesses by selling family owners' holdings in other companies and luring investors in before becoming public.

- Jan-2022: Century Pacific Food Inc. expanded its canned marine products portfolio by acquiring Ligo, a legacy brand known for its range of high-quality sardines and other marine products. This aligns with the company's mission to offer affordable nutrition, enabling regional production of Ligo products.

- Aug-2021: Bolton Group acquired Wild Planet Foods, a pioneer in the sustainable canned fish market in the US. This move reflects Bolton's commitment to international development goals and enhances its position in the world's largest tuna market.

- May-2021: Thai Union Group PLC completed the acquisition of the remaining 49 percent of shares in Rügen Fisch AG, produces and sells canned fish. This strategic move underscored the significant value it added to the company and reaffirmed Thai Union's dedication to the German market.

- Mar-2021: Century Pacific Food Inc. has acquired Pacific Meat Company, a provider of processed meat to food service establishments, supermarkets, and butcher shops, expanding into a growing food segment with synergies to its shelf-stable portfolio. This strategic move enhanced capabilities and positions the company for opportunities in the evolving food industry.

- Jan-2020: F.C.F. Fishery Co., Ltd. acquired Bumble Bee Foods, a 120-year-old beloved marketer of seafood and specialty protein products. Through this acquisition, FCF has bolstered its sustainability efforts and positioned itself for sustained leadership in the tuna and seafood industries.

Scope of the Study

Market Segments Covered in the Report:

By Type (Volume, Killo Tonnes, USD Million, 2019-2030)- Canned

- Fresh

- Frozen

- Skipjack

- Albacore

- Yellowfin

- Bigeye

- Bluefin

- Others

- North America

- US

- Canada

- Mexico

- Rest of North America- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Key Market Players

List of Companies Profiled in the Report:

- Bolton Group

- Century Pacific Foods Inc.

- The Jealsa Rianxeira S.AU. Group

- ITOCHU Corporation

- Thai Union Group PLC

- Dongwon Enterprises Co. Ltd.

- IBL Ltd.

- F.C.F. Fishery Co., Ltd.

- SEA DELIGHT, LLC

- High Liner Foods

Unique Offerings

- Exhaustive coverage

- The highest number of Market tables and figures

- Subscription-based model available

- Guaranteed best price

- Assured post sales research support with 10% customization free

Table of Contents

Companies Mentioned

- Bolton Group

- Century Pacific Foods Inc.

- The Jealsa Rianxeira S.AU. Group

- ITOCHU Corporation

- Thai Union Group PLC

- Dongwon Enterprises Co. Ltd.

- IBL Ltd.

- F.C.F. Fishery Co., Ltd.

- SEA DELIGHT, LLC

- High Liner Foods