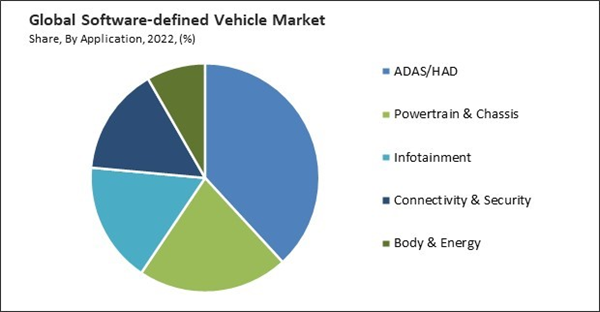

Powertrain & chassis applications utilize software to optimize the vehicle's energy usage and mechanical systems. Thus, the powertrain & chassis segment acquired $50,020.0 million in 2022. This can involve managing the power distribution in hybrid and electric vehicles for optimal efficiency and energy recovery through regenerative braking. Powertrain applications drive the adoption of electrification and hybridization. Electric powertrains and hybrid systems rely on software to manage the integration of electric motors with traditional internal combustion engines, optimizing energy usage and delivering improved fuel economy. Chassis and powertrain applications enable real-time monitoring and diagnostics of key vehicle components. Chassis applications use software to control torque vectoring and stability systems. These features enhance vehicle stability and handling in various driving conditions, improving safety and performance.

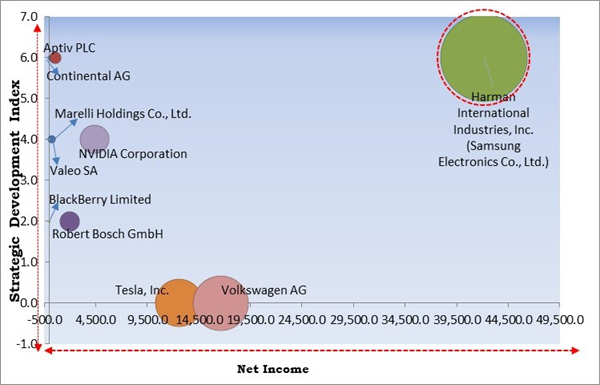

The major strategies followed by the market participants are Partnerships & Collaborations as the key developmental strategy to keep pace with the changing demands of end users. For instance, In September, 2023, Continental AG came into partnership with Google Cloud to develop an innovative lineup of automotive solutions that prioritize safety, efficiency, and user-centric features. alongside a set of management tools. Additionally, In August, 2023, Aptiv PLC came into partnership with Horizon Robotics to revolutionize China's automotive industry by leveraging its distinctive expertise, ultimately offering Chinese drivers and passengers a safer, more convenient, and enjoyable travel experience.

Cardinal Matrix

Market Competition Analysis

Based on the Analysis presented in the Cardinal Matrix; Harman International Industries, Inc. is the forerunners in the Market. In January, 2023, Harman International Industries came into partnership with Ferrari, an Italian luxury sports car manufacturer based in Maranello, Italy. Through this partnership, Ferrari would focus on bringing the next generation of in-cabin experiences to market with the help of Harman International Industries. Companies such as Volkswagen AG, Tesla, Inc., NVIDIA Corporation are some of the key innovators in the Market.Market Growth Factors

Expansion of autonomous driving technologies

The development of autonomous vehicles relies on extensive software systems for perception, decision-making, and control. SDVs are a fundamental platform for autonomous driving development. Artificial intelligence and sophisticated machine learning algorithms are used for decision-making, path planning, and object recognition. High-definition maps and precise localization technologies, including GPS and inertial navigation systems, help autonomous vehicles understand their position relative to their environment. These maps are often combined with real-time sensor data for accuracy. The increasing number of autonomous driving technologies contributes to expanding the market.Increasing adoption of electric and hybrid vehicles

Electric powertrains are highly software dependent. Software controls the electric motor's performance, delivering instant torque for acceleration and smooth operation. EVs often include user interfaces that provide information about the vehicle's range based on driving conditions. The software continuously calculates and updates these range predictions. This connectivity enables features like finding charging stations, reserving charging slots, and monitoring charging progress. Telematics systems in electric and hybrid vehicles provide real-time data on battery status, charging options, and energy consumption. This information is valuable for drivers and fleet managers. The expansion of the electric and hybrid vehicle industry is increasing the market.Market Restraining Factors

Complexity and interoperability issues

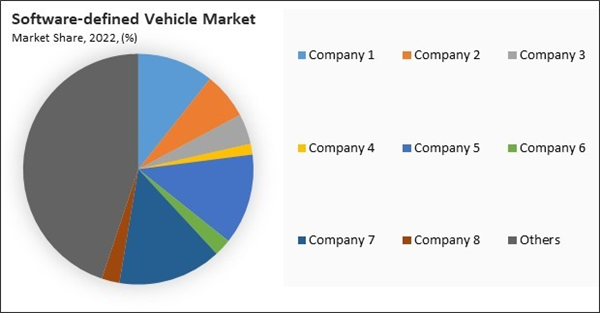

Modern vehicles, especially autonomous or highly automated ones, rely on intricate software systems. Managing and maintaining this complexity can be challenging, involving multiple software layers and components. Ensuring the safety of complex software systems is a critical challenge. Developers rigorously test and validate software to minimize the risk of system failures or errors. Handling the vast amount of data generated by software-defined vehicles is complex. Efficient data storage, processing, and analysis are necessary, which can strain existing infrastructure. Integrating various vehicle systems, such as infotainment, connectivity, autonomous driving, and powertrain management, seamlessly and harmoniously is complex due to the diversity of technologies involved. Complexity and interoperability issues are significant challenges that can slow down the market growth.The leading players in the market are competing with diverse innovative offerings to remain competitive in the market. The above illustration shows the percentage of revenue shared by some of the leading companies in the market. The leading players of the market are adopting various strategies in order to cater demand coming from the different industries. The key developmental strategies in the market are Partnerships, Collaborations & Agreements.

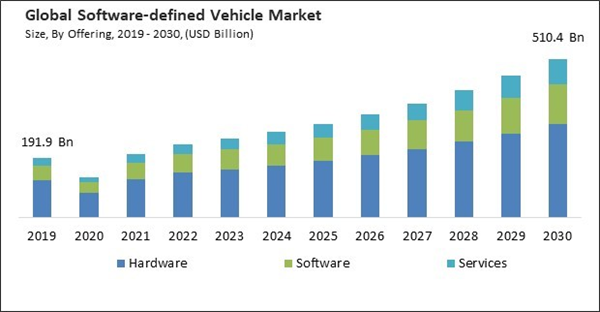

Offering Outlook

By offering, the market is categorized into hardware, software, and services. In 2022, the hardware segment held the highest revenue share in the market. Advanced microprocessors and control units are the brains behind SDVs. These hardware components are responsible for processing the vast amount of data collected by sensors and making real-time decisions. High-performance processors, often with multiple cores, are used to run complex algorithms for tasks like object recognition and path planning. Connectivity is a fundamental aspect of software-defined vehicles. Hardware modules for cellular, Wi-Fi, and V2X (vehicle-to-everything) communication enable data exchange between vehicles, infrastructure, and the cloud. These modules support remote software updates, data sharing, and vehicle-to-vehicle communication for enhanced safety and traffic management.Application Outlook

By application, the market is segmented into powertrain & chassis, ADAS/HAD, body & energy, infotainment, and connectivity & security. The powertrain & chassis segment recorded a remarkable revenue share in the market in 2022. Powertrain & chassis applications utilize software to optimize the vehicle's energy usage and mechanical systems. This can involve managing the power distribution in hybrid and electric vehicles for optimal efficiency and energy recovery through regenerative braking. Powertrain applications drive the adoption of electrification and hybridization.Vehicle Type Outlook

Based on vehicle type, the market is classified into ICE, BEV, and HEV/PHEV. The HEV/PHEV segment acquired a substantial revenue share in the market in 2022. HEVs and PHEVs combine traditional internal combustion engines (ICE) with electric propulsion systems. Integrating electric power allows these vehicles to operate more efficiently, reducing fuel consumption and emissions. In the context of SDVs, efficiency is essential for optimizing powertrain performance and extending the range of electric-only driving. HEVs and PHEVs feature regenerative braking systems that capture and store energy during braking and deceleration. This energy is subsequently used to recharge the vehicle's battery. Regenerative braking systems are an essential part of energy efficiency in SDVs.Regional Outlook

Region-wise, the market is analysed across North America, Europe, Asia Pacific, and LAMEA. In 2022, the Asia Pacific region led the market by generating the highest revenue share. The Asia Pacific region is leading the world in the adoption of EVs, with China being the largest EV sector. Many startups in the Asia Pacific region focus on developing mobility solutions and SDV technologies. Many cities in the region embraced smart city concepts, leading to the integration of software-defined mobility solutions.The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Robert Bosch GmbH, Continental AG, Valeo SA, Aptiv PLC, Marelli Holdings Co., Ltd., Tesla, Inc., NVIDIA Corporation, Volkswagen AG, Harman International Industries, Inc. (Samsung Electronics Co., Ltd), BlackBerry Limited, Medtronic PLC

Strategies deployed in the Market

Partnerships, Collaborations, and Agreements:

- Sep-2023: Continental AG came into partnership with Google Cloud, a suite of cloud computing services that provides a series of modular cloud services including computing, data storage, data analytics, and machine learning. This partnership would enhance Continental’s proficiency in automotive technology with Google's data and AI capabilities, aiming to develop an innovative lineup of automotive solutions that prioritize safety, efficiency, and user-centric features. alongside a set of management tools.

- Aug-2023: Aptiv PLC came into partnership with Horizon Robotics, a Motor Vehicle Manufacturing company in China. Through this partnership, Aptiv PLC would intend to revolutionize China's automotive industry by leveraging its distinctive expertise, ultimately offering Chinese drivers and passengers a safer, more convenient, and enjoyable travel experience.

- May-2023: Valeo SA came into partnership with Renault Group, a French multinational automobile manufacturing company. Through this partnership, Valeo SA would streamline the development process and cut down on expenses related to electrical and electronic architecture, all the while prioritizing high performance, compatibility, and safety.

- May-2023: NVIDIA Corporation came into partnership with MediaTek, a Taiwanese fabless semiconductor company that provides chips for wireless communications, high-definition television, and handheld mobile devices. This partnership will offer the automotive sector increased adaptability and ease, enabling the delivery of highly inclusive solutions in terms of both features and extent.

- Mar-2023: NVIDIA Corporation came into partnership with BYD, a publicly listed Chinese conglomerate manufacturing company headquartered in Shenzhen, Guangdong, China. Through this partnership, BYD would extend the utilization of DRIVE Orin through an enhanced partnership across multiple models in its forthcoming Dynasty and Ocean series of vehicles, with the aim of introducing safe and intelligent vehicles to the market.

- Jan-2023: Valeo SA came into partnership with C2A Security, a Computer and Network Security company in Israel. Through this partnership, Valeo SA would be able to bolster its product cybersecurity management, providing an additional level of assurance to Valeo's clients and transforming cybersecurity into a genuine driver of business success.

- Jan-2023: Marelli Holdings Co., Ltd. came into collaboration with Sibros, a software development company in San Jose, California. Through this collaboration, both the companies would develop some new and innovative solutions to unleash a diverse array of fresh customer advantages through a unified platform.

- Jan-2023: Harman International Industries came into partnership with Ferrari, an Italian luxury sports car manufacturer based in Maranello, Italy. Through this partnership, Ferrari would focus on bringing the next generation of in-cabin experiences to market with the help of Harman International Industries. Additionally, Ferrari intends to utilize HARMAN's Ready Upgrade hardware and software solutions to efficiently and affordably introduce fully customizable consumer electronics-grade experiences in all their vehicle models.

- Sep-2022: BlackBerry Limited came into partnership with L-SPARK Accelerator, a Canadian tech accelerator that specializes in helping early-stage B2B SaaS companies grow and succeed. Through this partnership, both companies would work together to develop Vehicles and IoT devices that can be more reliable, secure, and scalable, ensuring greater safety.

- Feb-2022: Robert Bosch GmbH came into partnership with Microsoft Corporation, an American multinational technology corporation headquartered in Redmond, Washington. Through this partnership, Bosch would streamline and expedite the creation and implementation of software for vehicles, ensuring that it will comply with the established standards for automotive quality across the entire lifespan of the vehicle.

- Apr-2020: Marelli Holdings Co., Ltd. came into partnership with Transphorm Inc., a semiconductor company focused on producing transistors made from gallium nitride for use in switched-mode power supplies. Through this partnership, Marelli and Transphorm were engaged in the sharing of expertise and information to develop innovative power conversion solutions for the automotive and electric vehicle (EV) industry.

Acquisition and Mergers:

- Oct-2023: Continental AG acquired KINEXON, a Technology, Information, and Internet company in Germany. Through this acquisition, Continental AG would be expanding its worldwide development team and reinforcing their proficiency in mobile robotics systems.

- Dec-2022: Aptiv PLC acquired Intercable Automotive Solutions, a Plastics Manufacturing company in Brunico/South Tyrol. Through this acquisition, Intercable Automotive Solutions will bolster Aptiv's standing as a worldwide frontrunner in vehicle architecture systems.

- Feb-2022: Harman International Industries took over Apostera, a Germany-based automotive technology company. Through this acquisition, Harman International Industries would enhance the range of automotive products and establish the company as a leader in designing automotive augmented reality/mixed reality experiences.

Scope of the Study

Market Segments Covered in the Report:

By Offering- Hardware

- Software

- Services

- ADAS/HAD

- Powertrain & Chassis

- Infotainment

- Connectivity & Security

- Body & Energy

- ICE

- BEV

- HEV/PHEV

- North America

- US

- Canada

- Mexico

- Rest of North America- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Key Market Players

List of Companies Profiled in the Report:

- Robert Bosch GmbH

- Continental AG

- Valeo SA

- Aptiv PLC

- Marelli Holdings Co., Ltd.

- Tesla, Inc.

- NVIDIA Corporation

- Volkswagen AG

- Harman International Industries, Inc. (Samsung Electronics Co., Ltd)

- BlackBerry Limited

- Medtronic PLC

Unique Offerings

- Exhaustive coverage

- The highest number of Market tables and figures

- Subscription-based model available

- Guaranteed best price

- Assured post sales research support with 10% customization free

Table of Contents

Companies Mentioned

- Robert Bosch GmbH

- Continental AG

- Valeo SA

- Aptiv PLC

- Marelli Holdings Co., Ltd.

- Tesla, Inc.

- NVIDIA Corporation

- Volkswagen AG

- Harman International Industries, Inc. (Samsung Electronics Co., Ltd)

- BlackBerry Limited

- Medtronic PLC