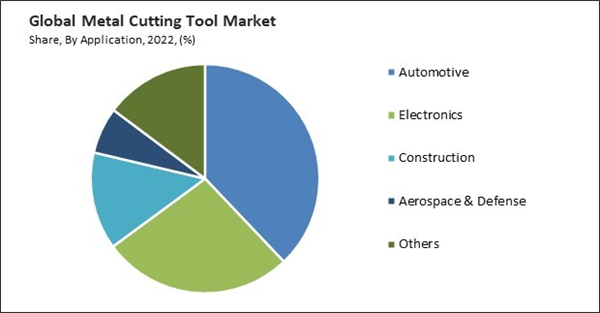

As the automobile sector continues to expand and change, there is an increase in the demand for highly precise cutting tools. Cutting tool manufacturers invest in research and development to meet the automotive industry's stringent requirements for precision and quality. Therefore, the automotive segment captured $25,015.6 million revenue in the market in 2022. The high demand for vehicles necessitates efficient and accurate manufacturing processes, and metal cutting tools play a crucial role in meeting these demands. This results in continuous technological advancements in cutting tool materials, coatings, and designs, which benefit the automotive sector and other industries that require precision machining.

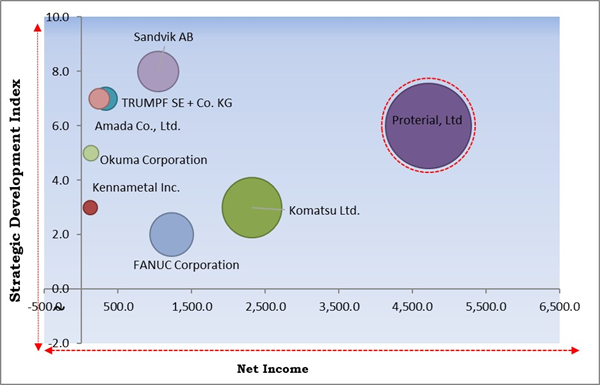

The major strategies followed by the market participants are Product Launches as the key developmental strategy to keep pace with the changing demands of end users. For instance, In July, 2023, Proterial, Ltd. introduced a motor that does not require the rare earth element neodymium to work in electric vehicles (EVs). The new motor functions using magnets that do not contain neodymium. In April, 2023, Kennametal Inc. added eight new products to its metal cutting tools and solutions portfolio. These new products provide wear resistance, better performance, productivity, and a variety of applications across various markets.

Cardinal Matrix

Market Competition Analysis

Based on the Analysis presented in the Cardinal Matrix; Proterial, Ltd is the forerunners in the market. In August, 2023, Proterial, Ltd. launched a magnet for use in electric vehicles, which need one-fifth the amount of terbium. The new magnet reduces the amount of terbium used in the production material phase to lessen risks in electric vehicle production. Companies such as Komatsu Ltd., FANUC Corporation, Sandvik AB are some of the key innovators in the market.Market Growth Factors

Rising Manufacturing Activities in Various Industries

Industries like aerospace, automotive, construction, and energy consistently need these tools to produce precision components and parts. The ongoing demand from these sectors helps create a steady and reliable market, reducing the risk of market fluctuations. The consistent demand from multiple sectors serves as a stabilizing factor for the market. Additionally, high demand encourages investment in research and development (R & D) within the industry. All these factors are expected to drive the demand for these in the upcoming years.Growing Advances in Cutting Tool Materials

New materials and coatings are engineered to be harder and more wear resistant. This results in improved tool life, which reduces the frequency of tool changes and downtime. As a result, manufacturers experience increased machining efficiency and productivity. Advanced cutting tool materials and designs allow for higher cutting speeds and feeds, improving machined parts' precision and surface finish. This is particularly critical in industries like aerospace and medical devices, where tight tolerances and smooth surfaces are essential. These factors aid in the growth of the market.Market Restraining Factors

Cost Concerns Related to High-Quality Metal Cutting Tools

SMEs often have limited budgets and resources compared to larger corporations. High upfront costs for these can deter SMEs from investing in advanced, high-quality equipment. As a result, they may opt for lower-quality or less expensive alternatives, which could affect the overall quality and precision of their machining processes. SMEs that cannot afford these tools of high-quality may find it challenging to compete with larger enterprises that can invest in top-tier equipment. These factors are expected to hinder the growth of the market.Product Type Outlook

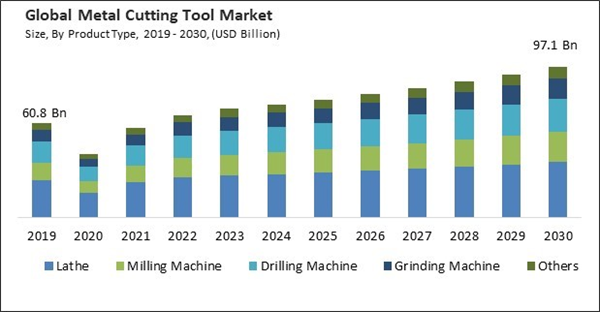

On the basis of product type, the market is divided into lathe, drilling machine, milling machine, grinding machine, and others. In 2022, the drilling machine segment witnessed a substantial revenue share in the market. The global manufacturing and construction sectors have been expanding, driven by population growth and urbanization. Drilling machines are needed in these industries for various tasks, including making holes for fasteners, pipelines, electrical wires, and structural elements.Application Outlook

On the basis of application, the market is divided into automotive, electronics, construction, aerospace & defense, and others. In 2022, the electronics segment witnessed a substantial revenue share in the market. The constant demand for smaller and more compact electronic gadgets, such as smartphones, tablets, and wearables, has necessitated the development of increasingly intricate and minute components. This demand for miniaturization requires highly precise machining, making them indispensable for the electronics sector.Tool Type Outlook

Based on tool type, the market is bifurcated into indexable inserts and solid round tools. The solid round tools segment held the largest revenue share in the market in 2022. One of the key drivers of growth in the solid round tools segment is the continuous development of advanced tool materials. Manufacturers have made significant progress in producing cutting tools with superior hardness, wear resistance, and thermal stability. High-speed steel (HSS), carbide, ceramic, and, more recently, superhard materials like cubic boron nitride (CBN) and polycrystalline diamond (PCD) have become more accessible and affordable.Regional Outlook

By region, the market is segmented into North America, Europe, Asia Pacific, and LAMEA. The Asia Pacific segment procured the highest revenue share in the market in 2022. Asia-Pacific has emerged as a global manufacturing hub, with countries such as China, Japan, South Korea, and India playing pivotal roles. The rapid industrialization and growth of manufacturing industries in the region have fuelled the demand for these. These tools are essential for shaping raw materials into various components in diverse sectors, including automotive, aerospace, electronics, and construction.The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Proterial, Ltd (Hitachi, Ltd), TRUMPF SE + Co. KG, Tiangong International Company Limited, Kennametal Inc., FANUC Corporation, Berkshire Hathaway, Inc. (International Dairy Queen Inc.), Sandvik AB, Amada Co., Ltd., Komatsu Ltd., and Okuma Corporation

Strategies deployed in the Market

Partnerships, Collaborations & Agreements:

- Sep-2023: Fanuc India, a subsidiary of FANUC Corporation, formed a partnership with Marshall Machines Limited, which manufactures a wide range of CNC turning centres. Through this partnership, the tool manufacturing business was enhanced in India and abroad. Additionally, the partnership resulted in the manufacture of products to compete with those imported from Japan and Europe.

- Aug-2023: Okuma Corporation partnered with Emuge-Franken USA, a cutting-edge technology and performance leader. Under this partnership, the tool-cutting solutions and applications offered by Emuge-Franken were combined with the machine-tool technologies of Okuma to broaden their technology product portfolio and provide a better customer experience.

Product Launches and Product Expansions:

- Aug-2023: Proterial, Ltd. launched a magnet for use in electric vehicles, which need one-fifth the amount of terbium. The new magnet reduces the amount of terbium used in the production material phase to lessen risks in electric vehicle production.

- Jul-2023: Proterial, Ltd. introduced a motor that does not require the rare earth element neodymium to work in electric vehicles (EVs). The new motor functions using magnets that do not contain neodymium.

- Apr-2023: Kennametal Inc. added eight new products to its metal cutting tools and solutions portfolio. These new products provide wear resistance, better performance, productivity, and a variety of applications across various markets.

- Feb-2023: AMADA Co. Ltd. announced the launch of its NC equipment 'AMNC 4ie' for fibre laser cutting and press brakes. Equipping the machines with AMNC 4ie advances them into environmentally friendly machines.

- Apr-2022: TRUMPF SE + Co. KG released its new range of TruFiber P fibre lasers. The new fibre lasers have up to six kilowatts of power output and serve as multipurpose tools for cutting and welding challenging materials. Additionally, the fibre lasers increased the product options of the customers, which impacted the product portfolio of the company.

- Apr-2020: Komatsu Industries Corp., a subsidiary of Komatsu Ltd., introduced the TWISTER “TFP510-3, a plasma cutting machine. TFP510-3 provides great performance in cutting technology in the case of cutting plates of medium and heavy thickness.

- Jun-2020: Okuma Corporation introduced the MB-80V, a new bridge-style machining centre, to expand its CNC metal cutting machine portfolio. The MB-80V has a combination of vertical and double columns, which provides flexibility to the machines while working.

Acquisition and Mergers:

- Aug-2022: Sandvik AB completed an agreement to acquire Sphinx Tools Ltd, known for precision solid round tools and surgical cutting tools, serving automotive, aerospace, and medical sectors. With this acquisition, Sandvik has poised to expand its product portfolio in the high-growth area of micro tools.

- May-2022: Sandvik AB completed the acquisition of Preziss S.L., a leading company in the production of precision polycrystalline diamond (PCD). Through this acquisition, Sandvik improved its products in the lightweight segment of the automotive industry.

- Mar-2021: TRUMPF SE + Co. KG acquired Lantek, a global leader providing software systems and solutions to companies. Through this acquisition, Trumpf increased its product base with sheet metal process chains from different customers and introduced a wide range of products to their customers.

- Jan-2020: AMADA Co. Ltd. acquired LKI Käldman LTD, the Finnish manufacturing company. The acquisition of LKI Käldman has enabled AMADA to expedite the provision of machines integrated with automation equipment tailored for European customers. After the acquisition, Amanda changed its name to AMADA AUTOMATION EUROPE LTD, making it a totally owned subsidiary.

Scope of the Study

Market Segments Covered in the Report:

By Product Type (Volume, Thousand Units, USD Billion, 2019 to 2030)- Lathe

- Milling Machine

- Drilling Machine

- Grinding Machine

- Others

- Automotive

- Electronics

- Construction

- Aerospace & Defense

- Others

- Solid Round Tools

- Indexable Inserts

- North America

- US

- Canada

- Mexico

- Rest of North America- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Key Market Players

List of Companies Profiled in the Report:

- Proterial, Ltd (Hitachi, Ltd)

- TRUMPF SE + Co. KG

- Tiangong International Company Limited

- Kennametal Inc.

- FANUC Corporation

- Berkshire Hathaway, Inc. (International Dairy Queen Inc.)

- Sandvik AB

- Amada Co., Ltd.

- Komatsu Ltd.

- Okuma Corporation

Unique Offerings

- Exhaustive coverage

- The highest number of Market tables and figures

- Subscription-based model available

- Guaranteed best price

- Assured post sales research support with 10% customization free

Table of Contents

Companies Mentioned

- Proterial, Ltd (Hitachi, Ltd)

- TRUMPF SE + Co. KG

- Tiangong International Company Limited

- Kennametal Inc.

- FANUC Corporation

- Berkshire Hathaway, Inc. (International Dairy Queen Inc.)

- Sandvik AB

- Amada Co., Ltd.

- Komatsu Ltd.

- Okuma Corporation