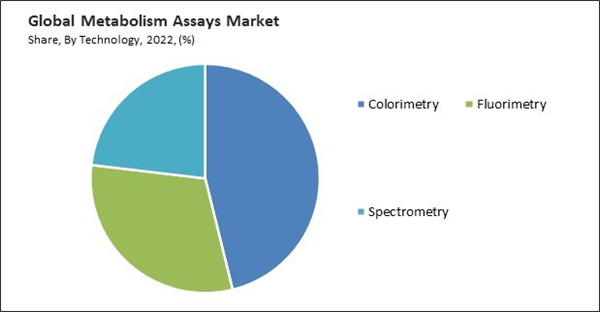

Spectrometry encompasses a range of methods, including mass spectrometry and nuclear magnetic resonance (NMR) spectroscopy, enabling the quantification and characterization of metabolites, proteins, and enzymes involved in metabolic pathways. Consequently, the Spectrometry segment registered $327.3 Million revenue in the market in 2022. This technology Its high sensitivity and specificity make it an essential tool for both basic research and drug development, aiding in the identification of biomarkers, assessment of metabolic phenotypes, and the evaluation of potential therapeutic compounds. Some of the factors impacting the market are increasing funding and investments in metabolic research, rise in prevalence of chronic diseases and high cost of metabolism assay analyzers.

Increasing funding and investments in metabolic research have played a pivotal role in driving the growth of the market. These are essential tools in metabolic research, and the availability of financial support has enabled advancements in technology, expanded research horizons, and facilitated the development of innovative assays. Funding allows researchers to explore novel avenues of metabolic research. This has led to significant advancements in understanding metabolic pathways, biomarkers, and the molecular mechanisms underlying metabolic disorders. Moreover, Chronic diseases are characterized by long-lasting and often progressive health conditions that can significantly impact a person's quality of life and overall health. Metabolism assays play a crucial role in diagnosing, monitoring, and managing these chronic diseases, making them indispensable tools for healthcare providers and researchers. Diabetes, especially type 2 diabetes, has become increasingly prevalent globally. Metabolism assays, such as glucose testing, HbA1c measurements, and insulin assays, are essential for diabetes diagnosis and monitoring, driving the demand for these assays. As chronic diseases grow, the market is expected to expand further to meet the increasing demand for these essential diagnostic tools.

Additionally, the COVID-19 had a significant impact on the market. Like many other industries, the market experienced disruptions in supply chains due to lockdowns, restrictions on international trade, and transportation challenges. This impacted the availability of assay reagents and equipment. During the initial phases of the pandemic, there was a significant shift in research priorities towards virology and immunology. As healthcare systems adapted to the pandemic, there was an increased focus on telehealth and remote patient monitoring. Metabolism assays related to monitoring and managing chronic conditions remotely gained importance. Companies implemented strategies to ensure resilience in the face of future disruptions. Therefore, the market will grow positively after the pandemic.

However, the cost of acquiring, operating, and maintaining these analyzers can be a barrier for many healthcare providers, laboratories, and research institutions. High upfront costs make investing in metabolism assay analyzers complex for smaller healthcare facilities, clinics, and research labs. This limits access to advanced metabolic testing and diagnostics in certain regions or settings. The cost of purchasing, calibrating, and maintaining assay analyzers strains the budgets of healthcare organizations. This can lead to delays in adopting the latest technologies or replacing outdated equipment. Patients may face high out-of-pocket expenses when using expensive analyzers for metabolic assays. The high cost of analyzers can limit the overall market potential by reducing the number of potential customers and slowing market expansion. Due to the high cost of analyzers, market growth will be hindered.

Application Outlook

Based on application, the market is fragmented into diagnostics and research. In 2022, the diagnostics segment held the highest revenue share in the market. Diagnostics applications in the market are crucial for detecting, diagnosing, and monitoring various metabolic disorders and assessing overall metabolic health. These applications encompass various tests and assays that help healthcare providers, clinicians, and researchers gain insights into patients' metabolic profiles. Metabolism assays are widely used in diagnosing and monitoring diabetes mellitus, a condition characterized by abnormal blood glucose levels. They empower healthcare providers and researchers to make informed decisions for better patient care and outcomes.Technology Outlook

By technology, the market is categorised into colorimetry, fluorimetry, and spectrometry. The fluorimetry segment recorded a remarkable revenue share in the market in 2022. Fluorimetry technology is a powerful analytical technique used extensively in the market for quantitatively measuring various metabolic parameters and biomolecules. Fluorimetry relies on detecting fluorescence emission from molecules when they absorb and then emit light at specific wavelengths. In metabolism assays, fluorimetry technology finds applications in various assays related to enzyme activity, nucleic acids, and specific metabolites. It is a versatile tool used extensively in metabolic research, drug discovery, and clinical diagnostics within the market.Product Outlook

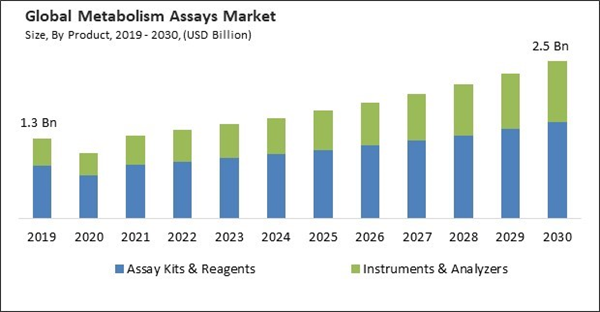

On the basis of product, the market is segmented into instruments & analyzers and assay kits & reagents. The instruments & analyzers segment acquired a substantial revenue share in the market in 2022. Instruments and analyzers for metabolism assays encompass specialized equipment to measure various metabolic parameters and biomarkers. These tools are essential for conducting metabolic research, diagnosing disorders, and optimizing clinical interventions. Metabolic carts are versatile instruments for measuring respiratory gases (oxygen and carbon dioxide) during metabolic assessments, including VO2 max analysis and RMR measurements.End User Outlook

Based on end user, the market is classified into hospitals, diagnostics laboratories, pharmaceutical & biotechnology companies, and CROs & academic research institutes. In 2022, the hospitals segment witnessed the largest revenue share in the market. Hospitals use metabolism assays to monitor blood glucose levels in diabetic patients. Continuous glucose monitoring and HbA1c assays are examples of metabolism assays that help assess glycemic control and guide insulin therapy adjustments. Hospitals use metabolism assays to assess the nutritional status of patients, measuring essential nutrients such as vitamins, minerals, and trace elements.Regional Outlook

Region-wise, the market is segmented into North America, Europe, Asia Pacific, and LAMEA. In 2022, the North America region generated the highest revenue share in the market. The expansion of the market in North America is expected to continue, driven by these factors. As the region's healthcare system evolves, focusing on early diagnosis, disease prevention, and personalized treatment plans will likely further boost the demand for metabolism assays. Additionally, ongoing research and technological innovations will contribute to the market's growth and the development of more accurate and efficient metabolic diagnostic tools.The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Merck KGaA, Thermo Fisher Scientific, Inc., Abcam Plc, Agilent Technologies, Inc, Promega Corporation, Kaneka Eurogentec S.A (Kaneka Corporation), RayBiotech Life, Inc, Sartorius AG, Elabscience Biotechnology Inc. and Bmg Labtech GmbH.

Strategies deployed in the Market

- Sep-2021: Thermo Fisher Scientific, Inc. launched fully -automated analyzers specifically designed for enzymes assay applications. This new system combines hardware and new custom software to deliver fully-automated systems, reagent additions, and acuurate measurement calculations all these just on a single touch of a button.

- Sep-2021: Thermo Fisher Scientific, Inc Joined hands with AstraZeneca, a one of the world's most forward thinking and connected Biopharmaceuticals companies. Through this collaboration Thermo fisher aimed to develop jointly a next-generation sequencing based companion diagnostics which will support AstraZeneca to expand its portfolios of targeted therapies and allow patients to matched with the right therapies more quickly and precisely.

- Jan-2020: Abcam Plc completed the acquisition of Proteomics and Immunology buisness of Expedeon AG, an expert in cutting-edge innovative reagents and services for life sciences and diagnostics. Through this acquisition Abcam aimed to deliver the precision research tools required to address the most of life science assays with the help of expedeon portifolio and other conjugation technologies.

- Nov-2019: Abcam Plc, Formed a partnership with BrickBio, Inc., an expert in site-specific protein modification and a Tiger Gene Portifolio company. Through this partnership Abcam will get a exclusive rights to the platform for the creation of novel-conjugation ready recombinant products which will help them to deliver an easy and reliable conjugation ready solutions in the market and strengthen its market share in recombinant antibody space.

- Jul-2019: Abcam plc completed the acquisition of EdiGene Inc, a leading company focused on developing genome editing technologies into novel therapeutics. Through this acquisition Abcam aimed to Enter into the cell editing market and make a stronger and wider base in cell line market because currently it is in their early stages of development.

- Sep-2023: Agilent Technologies Inc. signed an agreement with the ACTRIS Singapore generally known as a The Advanced Cell Therapy Research Institute. Through this Partnership Agilent aims to increase the nation's role as a leading cell and gene therapy manufacturer and it also show a strong picture of company's innovative technology advances in supporting the most widely known areas of medical research.

- Jul-2019: Agilent Technologies Inc. signed an agreement with BioTek Instruments, a Privately held Vermont based manufacturer of Scientific Instruments. With this agreement Agilent aimed to accelerate its multi-year growth strategy to expand its position in the market of Cell Analysis.

Scope of the Study

Market Segments Covered in the Report:

By Product- Instruments & Analyzers

- Assay Kits & Reagents

- Diagnostics

- Diabetes

- Obesity

- Cardiovascular Diseases

- Cancer

- Others

- Research

- Colorimetry

- Fluorimetry

- Spectrometry

- Hospitals

- Diagnostics Laboratories

- Pharmaceutical & Biotechnology Companies and CROs & Academic Research Institutes

- North America

- US

- Canada

- Mexico

- Rest of North America- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Key Market Players

List of Companies Profiled in the Report:

- Merck KGaA

- Thermo Fisher Scientific, Inc.

- Abcam Plc

- Agilent Technologies, Inc

- Promega Corporation

- Kaneka Eurogentec S.A (Kaneka Corporation)

- RayBiotech Life, Inc

- Sartorius AG

- Elabscience Biotechnology Inc

- Bmg Labtech GmbH

Unique Offerings

- Exhaustive coverage

- The highest number of Market tables and figures

- Subscription-based model available

- Guaranteed best price

- Assured post sales research support with 10% customization free

Table of Contents

Companies Mentioned

- Merck KGaA

- Thermo Fisher Scientific, Inc.

- Abcam Plc

- Agilent Technologies, Inc

- Promega Corporation

- Kaneka Eurogentec S.A (Kaneka Corporation)

- RayBiotech Life, Inc

- Sartorius AG

- Elabscience Biotechnology Inc

- Bmg Labtech GmbH