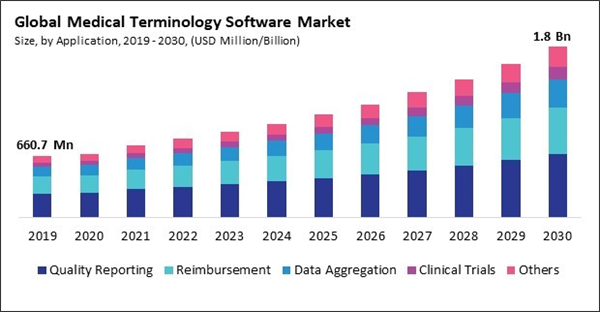

Data aggregation enables medical terminology software to compile a comprehensive patient profile by consolidating information from various sources. Therefore, the data aggregation segment captured $134.85 million revenue in the market in 2022. This holistic understanding aids healthcare professionals in making more informed decisions and providing personalized care. Aggregated data from it provides real-time clinical insights, aiding healthcare professionals in making timely and evidence-based decisions. This capability enhances the quality of patient care by ensuring that the most up-to-date information informs decisions. Data aggregation allows for the application of predictive analytics within it. By analyzing historical data trends, the software can identify potential issues, predict outcomes, and contribute to proactive healthcare interventions, thereby improving patient outcomes.

As healthcare organizations implement EHR systems, there is a growing need for interoperability between different systems. Medical terminology software ensures that data can be standardized and exchanged seamlessly across different platforms, allowing efficient communication and collaboration. EHRs capture vast amounts of data, often using varied terminology and coding systems. This helps standardize this diverse range of medical terms, codes, and abbreviations, ensuring consistency in documentation and reducing the risk of misinterpretation. As EHRs become central to healthcare operations, medical terminology software integration becomes essential. Additionally, CDSS uses consistent and standardized medical terminology to interpret and analyze patient data effectively. This ensures that terminology is uniform across the healthcare environment, reducing the risk of misinterpretation and improving the accuracy of decision-support recommendations. Also, this provides the foundation for CDSS to analyze and interpret complex medical information. With standardized terminology, CDSS can offer more accurate and relevant clinical insights, helping healthcare professionals make well-informed diagnoses, treatment plans, and patient management decisions. Thus, the increasing demand for clinical decision support systems directly impacts the expansion of the market.

The pandemic spurred an accelerated adoption of telemedicine to deliver healthcare services remotely. It facilitates effective virtual communication between healthcare professionals and patients. The demand for collaborative tools embedded with advanced medical terminologies soared with healthcare professionals dispersed and working remotely. Software solutions bridging the communication gap and ensuring accurate interpretation of clinical information became imperative. The scientific understanding of COVID-19 led to the emergence of new medical terminologies, necessitating swift updates and adaptations in medical terminology software. Quickly integrating and disseminating these changes became crucial for accurate communication. The surge in COVID-19 cases had overwhelmed healthcare systems globally, leading to increased pressure on data management and documentation. Therefore, the pandemic positively impacted the market.

However, the diversity in coding systems creates interoperability challenges. This must understand and map codes between systems to facilitate seamless data exchange between healthcare organizations, departments, and systems. Integrating medical terminology software with diverse coding systems is complex and resource intensive. The software must be capable of handling the intricacies of each coding system, ensuring accurate translation and interpretation of medical terms across platforms. Standardizing medical terminology across healthcare settings becomes challenging due to the diversity in coding systems. Different coding conventions and practices hinder achieving a universal standard for medical language. Multiple coding systems increase the risk of misinterpretation of medical terms. Due to the above factors, market growth will be hampered in the coming years.

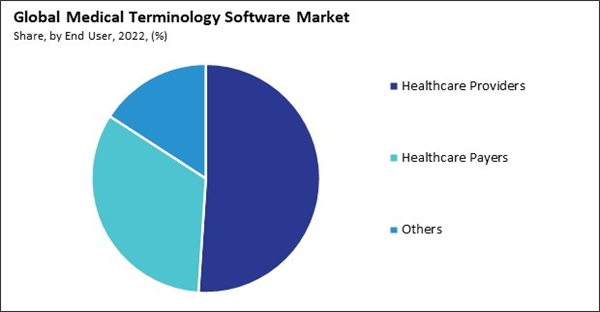

By End-User Analysis

Based on end user, the market is fragmented into healthcare providers, healthcare payers, and others. In 2022, the healthcare providers segment held the highest revenue share in the market. Medical terminology software facilitates effective communication among diverse healthcare specialists, from physicians and nurses to specialists and administrative staff. Standardized terminology bridges communication gaps, fostering collaborative and coordinated care. It provides healthcare providers real-time clinical insights by ensuring accurate and up-to-date information. This aids in making informed decisions, optimizing patient care, and aligning interventions with the latest evidence-based practices.By Application Analysis

On the basis of application, the market is segmented into quality reporting, reimbursement, data aggregation, clinical trials, and others. The reimbursement segment acquired a substantial revenue share in the market in 2022. The availability of favorable reimbursement models significantly influences the adoption of medical terminology software. Healthcare institutions are more likely to invest in these solutions when they align with reimbursement structures that justify the cost of implementation. Reimbursement mechanisms that reward innovation and the development of advanced features in this stimulate the creation of more sophisticated and effective solutions.By Regional Analysis

Region-wise, the market is analyzed across North America, Europe, Asia Pacific, and LAMEA. In 2022, the North America region registered the highest revenue share in the market. This results from the prevalence of key players, including Wolters Kluwer NV and Intelligent Medical Objects Inc., and the widespread use of electronic health records. A rise in clinical trials in this region also contributes to the market's expansion. Additionally, increased purchasing power and awareness regarding the numerous benefits of clinical decision support systems (CDSS) and electronic health records (EHRs) are anticipated to fuel market expansion.List of Key Companies Profiled

- Wolters Kluwer N.V.

- Intelligent Medical Objects, Inc.

- Clinical Architecture, LLC

- B2i Healthcare Kft

- HiveWorx Limited

- 3M Company

- West Coast Informatics, Inc.

- TermSolutions GmbH

- BITAC, Inc.

- Apelon, Inc.

Market Report Segmentation

By Application- Quality Reporting

- Reimbursement

- Data Aggregation

- Clinical Trials

- Others

- Healthcare Providers

- Healthcare Payers

- Others

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Table of Contents

Companies Mentioned

- Wolters Kluwer N.V.

- Intelligent Medical Objects, Inc.

- Clinical Architecture, LLC

- B2i Healthcare Kft

- HiveWorx Limited

- 3M Company

- West Coast Informatics, Inc.

- TermSolutions GmbH

- BITAC, Inc.

- Apelon, Inc.