The drug coating on drug eluting stents (DES) elutes slowly over time, inhibiting tissue growth that can lead to restenosis. This has led to improved long-term outcomes for patients. Consequently, the drug eluting stents segment would generate approximately 53.1% share of the market by 2030. The lower restenosis rates associated with DES have reduced the need for repeat interventions, such as additional angioplasty or stent placement. This translates to improved patient outcomes and reduced healthcare costs. DES has been associated with a lower risk of stent thrombosis (a potentially life-threatening complication), particularly when patients adhere to dual antiplatelet therapy (DAPT).

The major strategies followed by the market participants are Partnerships, Collaborations & Agreements as the key developmental strategy to keep pace with the changing demands of end users. For instance, In June, 2023, Koninklijke Philips N.V. collaborated with Biotronik, to widen the range of cardiovascular devices available for Philips SymphonySuite customers. In January, 2023, Terumo collaborated with Siemens Healthineers, to make better heart care available to more people.

Cardinal Matrix

Market Competition Analysis

Based on the Analysis presented in the Cardinal Matrix; Abbott Laboratories and Medtronic PLC are the forerunners in the Interventional Cardiology Devices Market. Companies such as Terumo Corporation, Boston Scientific Corporation and Teleflex, Inc. are some of the key innovators in the Interventional Cardiology Devices Market. In September 2021, Terumo came into collaboration with Etiometry, to provide clinicians with an in-depth understanding of the patient's condition.COVID-19 Impact Analysis

During the early stages of the pandemic, many elective and non-urgent interventional cardiology procedures were postponed or canceled to prioritize the treatment of COVID-19 patients and to conserve healthcare resources. This led to a temporary decline in cardiac procedures and reduced use of related devices. Hospitals and healthcare facilities shifted their focus toward treating emergent and high-priority cases, such as acute myocardial infarctions (heart attacks), which continued to require interventional cardiology procedures. Delays in producing and distributing interventional cardiology devices, including stents, catheters, and guidewires, affected the market. With the need to limit in-person interactions and reduce the risk of virus transmission, there was a greater emphasis on remote monitoring of cardiac patients. Thus, the COVID-19 pandemic had a moderate effect on the market.Market Growth Factors

Increasing prevalence of cardiovascular diseases

Cardiovascular diseases (CVDs) such as coronary artery disease (CAD), heart attacks, and heart failure remain a leading cause of morbidity and mortality globally. The growing prevalence of CVDs drives the demand for interventional cardiology procedures and devices. Cardiovascular diseases are among the leading causes of morbidity and mortality globally. They affect millions of people, resulting in a substantial patient population in need of diagnosis and treatment. As the global population ages, there is a higher incidence of age-related cardiovascular conditions. Older adults are more susceptible to CVDs, increasing the demand for cardiovascular interventions and devices. As the global burden of CVDs continues to increase, the market for interventional cardiology devices is expected to expand to meet the growing healthcare needs.Rising proportion of the aging population

As the global population ages, there is a higher incidence of age-related cardiovascular conditions. Older adults are more likely to require interventional cardiology interventions, such as stenting and angioplasty. Aging is a major risk factor for cardiovascular diseases (CVDs) such as coronary artery disease (CAD), heart attacks, heart failure, and arrhythmias. Individuals are more likely to develop these conditions as they age, leading to an increased demand for interventional cardiology procedures and devices. Aging is associated with the progressive buildup of atherosclerotic plaques in the coronary arteries. As a result, older individuals are at a higher risk of experiencing acute coronary events, such as heart attacks, which require urgent intervention. These technologies enhance the utilization of interventional cardiology devices, driving market growth while improving patient outcomes and healthcare efficiency.Market Restraining Factors

High cost and economic pressures

However, the high cost of interventional cardiology devices can strain healthcare budgets and limit access to advanced treatments, especially in resource-constrained settings. Striking a balance between innovation and affordability is a persistent challenge. Interventional cardiology devices, such as drug-eluting stents, balloons, and imaging equipment, can be expensive to manufacture and purchase. The high upfront costs can strain healthcare budgets, limiting access to advanced treatments and technologies, particularly in regions with limited resources. Regulatory changes, updates, or evolving interpretations of guidelines can introduce uncertainty into the approval process. Delays in regulatory decisions can impact market entry timelines.End-use Outlook

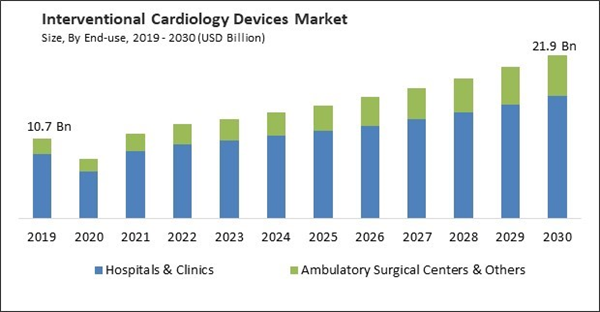

By end-use, the market is segmented into hospitals & clinics, ambulatory surgical centers, and others. The ambulatory surgical centers garnered a significant revenue share in market in 2022. Ambulatory surgical centers (ASCs) are well-suited for minimally invasive interventional cardiology procedures, such as cardiac catheterization, angioplasty, and stent placement. Patients benefit from less invasive approaches, leading to quicker recovery times and reduced post-operative discomfort. The focused and patient-centered environment of ASCs can result in a more positive and personalized patient experience. The setting is often less intimidating than a hospital, which can reduce anxiety and stress for patients.Product Outlook

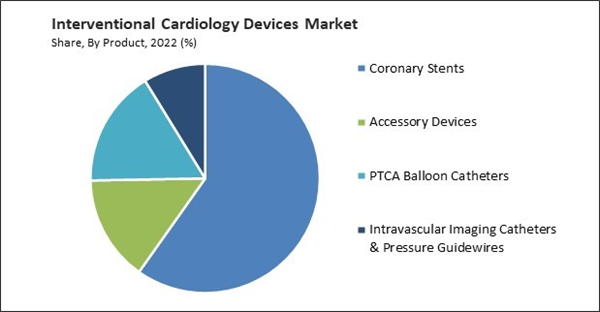

By Product, the market is categorized into coronary stents, PTCA balloon catheters, accessory devices, and others. The PTCA balloon catheters segment covered a considerable revenue share in the market in 2022. The demand for PTCA balloon catheters is expected to grow in line with the increasing prevalence of coronary artery disease (CAD) globally. As CAD remains a leading cause of morbidity and mortality, there is a continued need for interventional procedures, including angioplasty, which drives the use of PTCA balloon catheters. PTCA balloon catheters are integral to minimally invasive angioplasty procedures, which have gained popularity over traditional open-heart surgeries. Patients often prefer these less invasive approaches because they offer shorter recovery times and reduced hospital stays. PTCA balloon catheters have evolved to address more complex and challenging lesions like heavily calcified arteries. Specialized balloon catheters designed for these situations have expanded the range of treatable patients.Coronary Stents Outlook

Under coronary stents, the market is segmented into drug eluting stents, bare metal stents, and bioabsorbable stents. The bare metal stents (BMS) segment acquired a substantial revenue share in the market in 2022. BMS are metallic stents made from stainless steel or cobalt-chromium alloys. They do not have drug coating. Due to the absence of a drug coating, BMS typically requires a shorter duration of dual antiplatelet therapy (DAPT). This can be advantageous when extended DAPT poses a higher bleeding risk.PTCA Balloon Catheters Outlook

Under PTCA balloon catheters, the market is fragmented into normal, specialty, and drug coated. In 2022, the normal segment dominated the market with the maximum revenue share. Interventional cardiology procedures often improve patient outcomes, reduce symptoms, and enhance quality of life. They can help restore normal blood flow to the heart and alleviate chest pain, shortness of breath, and other symptoms. Many interventional devices, such as drug-eluting stents, help reduce the risk of restenosis and re-narrowing of arteries, reducing the need for repeat interventions. Minimally invasive procedures are generally associated with less pain, shorter hospital stays, and a quicker return to normal activities, leading to greater patient comfort.Accessory Devices Outlook

Under accessory devices, the market is classified into PTCA guidewires, diagnostic catheters, PTCA guiding catheters, and introducer sheaths. In 2022, the PTCA guidewires segment registered the maximum revenue share in the market. Workhorse guidewires are used to navigate through coronary arteries and cross lesions (blockages or stenoses) to reach the target site within the vessel. They provide the initial access and support for delivering other interventional devices, such as balloon catheters and stents. These guidewires help guide catheters to the desired location within the coronary arteries.Regional Outlook

Region-wise, the market is analyzed across North America, Europe, Asia Pacific, and LAMEA. In 2022, the Asia Pacific region acquired a significant revenue share in the market. Asia Pacific is witnessing a growing burden of cardiovascular diseases (CVDs), including coronary artery disease (CAD), stroke, and hypertension. Factors like lifestyle changes, urbanization, and an aging population contribute to the increased prevalence of CVDs. Economic growth in many Asia Pacific countries has led to increased healthcare spending, enabling the expansion of healthcare facilities, the adoption of advanced medical technologies, and improved access to interventional cardiology procedures.The market research report covers the analysis of key stakeholders of the market. Key companies profiled in the report include Abbott Laboratories, Boston Scientific Corporation, Terumo Corporation, Medtronic PLC, B. Braun Melsungen AG , Biotronik SE & Co. KG , Cardinal Health, Inc. , Teleflex, Inc. , Koninklijke Philips N.V. ,Alvimedica

Strategies deployed in the Market

Partnerships, Collaborations & Agreements:

- Jun-2023: Koninklijke Philips N.V. collaborated with Biotronik, a multi-national cardiovascular biomedical research and technology company. This collaboration aimed to widen the range of cardiovascular devices available for Philips SymphonySuite customers.

- Jan-2023: Terumo collaborated with Siemens Healthineers, a medical technology company. The collaboration focuses on reinforcing cardiac care in India. This collaboration aims at making better heart care available to more people.

- Sep-2021: Terumo came into collaboration with Etiometry, a US-based provider of clinic decision-support software. The collaboration involves introducing clinical decision support to cardiac surgery patients. Integrating Etiometry's platform with the surgical devices company's devices would provide clinicians with an in-depth understanding of the patient's condition.

- Mar-2021: Braun Interventional Systems joined hands with Infraredx, designs, develops, manufactures, and distributes medical devices. Together the companies aimed to boost the FDA investigational device exemption clinical test for the SeQuent Please ReX drug coated PTCA balloon catheter. Additionally, The SeQuent Please ReX drug-coated PTCA balloon catheter is developed to cure coronary in-stent restenosis, or the incremental re-narrowing of a coronary artery following stent transplantation.

Product Launches and Product Expansions:

- Aug-2022: Medtronic PLC launched the Onyx Frontier drug-eluting stent (DES), the Onyx Frontier DES is employed in the management of individuals suffering from coronary artery disease (CAD), a condition resulting from the accumulation of plaque within the coronary arteries. The Onyx Frontier drug-eluting stent (DES) features matrix sizes ranging from 2.0mm to 5.0mm diameters, with the expandability of sizes from 4.50-5.00mm.

- Jul-2021: Medtronic PLC introduced the Prevail drug-coated balloon (DCB) Catheter. The Prevail DCB employs a fast-absorbing drug, paclitaxel, to facilitate the treatment of de novo lesions, small vessel disease, and in-stent restenosis (ISR). The Prevail DCB would be utilized in percutaneous coronary intervention (PCI) procedures to address narrowed or obstructed coronary arteries in patients diagnosed with coronary artery disease (CAD).

Acquisition and Mergers:

- Feb-2023: Abbott Laboratories took over Cardiovascular Systems, Inc., a medical device company with an innovative atherectomy system used in treating peripheral and coronary artery disease. The acquisition of CSI enhances Abbott's vascular device offerings portfolio.

- Aug-2022: Medtronic completed the acquisition of Affera, a US-based developer of medical devices. The acquisition of Affera broadens the acquiring company's cardiac ablation platform.

- Feb-2022: Boston Scientific completed the acquisition of Baylis Medical Company, a Canada-based developer of medical devices. This acquisition enables the acquiring company to incorporate Baylis' platforms within its existing electrophysiology and structural heart offerings, thereby reinforcing its market position.

Approvals:

- May-2022: Medtronic PLC received FDA approval for the Onyx Frontier drug-eluting stent (DES). Onyx Frontier DES is aimed at the care of individuals afflicted with coronary artery disease (CAD), a condition initiated by the accumulation of plaque within the coronary artery walls.

- Feb-2022: Medtronic plc received a U.S. Food and Drug Administration approval for Freezer and Freezer Xtra Catheters for the treatment of paediatric Atrioventricular Nodal Re-entrant Tachycardia. Catheter ablation is resilient, one-use equipment used to freeze cardiac tissue and block unnecessary electrical signals within the heart. Additionally, Freezer and Freezer Xtra are the first-line antidote for the treatment of AVNRT.

Scope of the Study

Market Segments Covered in the Report:

By End Use (Volume, Thousand Units, USD Million, 2019-2030)- Hospitals & Clinics

- Ambulatory Surgical Centers & Others

- Coronary Stents

- Drug Eluting Stents

- Bare Metal Stents

- Bioabsorbable Stents

- Accessory Devices

- PTCA Guidewires

- Diagnostic Catheters

- PTCA Guiding Catheters

- Introducer Sheaths

- PTCA Balloon Catheters

- Normal

- Specialty

- Drug Coated

- Intravascular Imaging Catheters & Pressure Guidewires

- North America

- US

- Canada

- Mexico

- Rest of North America- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Key Market Players

List of Companies Profiled in the Report:

- Abbott Laboratories

- Boston Scientific Corporation

- Terumo Corporation

- Medtronic PLC

- B.Braun Melungeon AG

- Bortnick SE & Co. KG

- Cardinal Health, Inc.

- Teleflex, Inc.

- Koninklijke Philips N.V.

- Alvimedica

Unique Offerings

- Exhaustive coverage

- The highest number of Market tables and figures

- Subscription-based model available

- Guaranteed best price

- Assured post sales research support with 10% customization free

Table of Contents

Companies Mentioned

- Abbott Laboratories

- Boston Scientific Corporation

- Terumo Corporation

- Medtronic PLC

- B. Braun Melungeon AG

- Bortnick SE & Co. KG

- Cardinal Health, Inc.

- Teleflex, Inc.

- Koninklijke Philips N.V.

- Alvimedica