Rapid urbanization in nations such as China, India, and Southeast Asia has led to the construction of high-rise buildings, commercial complexes, and residential projects. This surge in construction activities has increased the demand for fire protection systems, including fire sprinklers, to ensure the safety of these structures. Consequently, the APAC region registered $2,152.3 million revenue in the market in 2022. The increasing awareness about fire safety regulations and the need for advanced fire protection systems across commercial, residential, and industrial sectors are propelling the demand for fire sprinklers. In addition, infrastructure development initiatives such as smart cities and industrial parks contribute to expanding the market in the region. Some of the factors impacting the market are growth in awareness regarding safety from fire, strict regulations regarding the installation of fire sprinkler systems, and fluctuation in raw material prices.

Many countries and regions have implemented strict fire safety regulations and building codes. Awareness of these regulations has made it clear that fire sprinkler systems are necessary for various types of buildings, like commercial, industrial, and residential properties. This has led to an increased demand for compliance with these safety standards. Fire safety organizations and government agencies have launched public awareness campaigns to enlighten individuals about the importance of fire safety. These campaigns often emphasize the life-saving benefits of fire sprinkler systems, encouraging building owners and homeowners to invest in these systems. Building owners and managers increasingly recognize that investing in fire sprinkler systems is not only a regulatory requirement but also a responsible and ethical decision to protect occupants and assets. They are proactively seeking out fire protection solutions to enhance safety. Additionally, many countries and regions have made it mandatory for specific types of buildings to install fire sprinkler systems. This includes commercial, industrial, and residential properties. Strict regulations leave building owners with no choice but to comply, thereby driving the demand for these systems. Regulations often specify safety standards that fire sprinkler systems must meet. This ensures that the installed systems are effective and reliable in suppressing fires. As a result, building owners and developers seek high-quality fire sprinkler systems that meet these standards. Regulatory bodies periodically update fire safety codes to incorporate the latest technologies and best practices. This creates a continuous demand for new and upgraded fire sprinkler systems to ensure compliance with the most recent standards. Many regulations impose penalties and fines for non-compliance with fire safety requirements. As laws continue to evolve and adapt to changing safety needs, the market is likely to see sustained growth.

However, Changes in raw material prices can lead to cost variability in manufacturing fire sprinkler components. Manufacturers may need to adjust their pricing or absorb increased costs, impacting profit margins. When raw material prices rise significantly, building owners and developers may experience budget constraints. This can lead to delays in installing fire sprinkler systems or choosing alternative, cost-effective solutions. Manufacturers and suppliers in the market may face competitive pricing pressure. In response to market demand, some may keep prices steady or reduce them, impacting profitability. Rapid price fluctuations can disrupt the supply chain, as manufacturers may face challenges securing affordable and available raw materials. This can lead to uncertainties in production and project completion. Fluctuations in raw material prices challenge the market growth.

Product Outlook

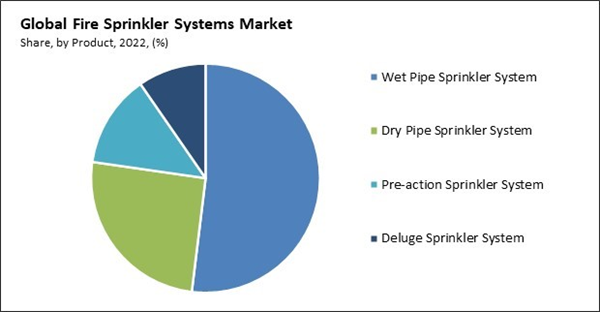

On the basis of product, the market is segmented into wet pipe sprinkler system, dry pipe sprinkler system, pre-action sprinkler system, and deluge sprinkler system. In 2022, the wet pipe sprinkler system segment dominated the market with the maximum revenue share. Wet-pipe sprinkler systems are reliable, which makes them highly cost-effective, ensuring widespread adoption across various industries and building types. They offer immediate response capabilities, as they are constantly filled with water, enabling rapid suppression of fires upon activation. In addition, their low maintenance requirements and ease of installation make them attractive to facility owners and operators. The exceptional track record of wet-pipe sprinklers in saving lives, minimizing property damage, and reducing the spread of fires has bolstered their reputation as a dependable and effective fire suppression technology, driving their widespread implementation worldwide.Component Outlook

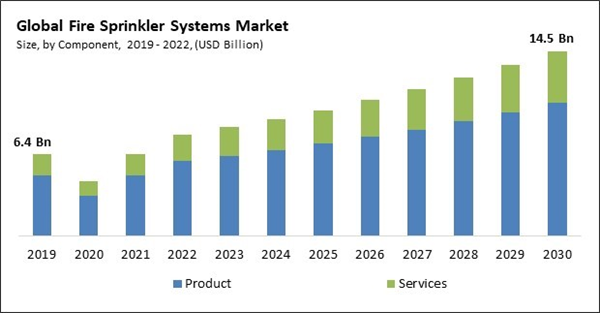

Based on component, the market is fragmented into product and services. In 2022, the product segment held the highest revenue share in the market. The increasing urbanization and construction endeavors worldwide, especially in emerging economies, have bolstered the need for fire sprinklers as modern buildings and infrastructure projects necessitate dependable fire protection measures. Technological advancements have played a significant role in creating more efficient and successful fire sprinkler systems, encompassing innovative designs, enhanced detection capabilities, and improved integration with fire alarm systems. These developments have further accelerated the global demand for these products.End-use Outlook

By end-use, the market is classified into residential, commercial, and industrial. The residential segment recorded a remarkable revenue share in the market in 2022. With the increasing urbanization and population density, the risk of fire incidents has significantly grown, which is expected to increase demand for fire sprinklers from the residential sector. Increasing multistoried residential building projects globally have resulted in growing concern among contractors about dealing with fire incidents caused by electrical faults. This increasing fire concern has resulted in deploying fire sprinklers in residential spaces.Regional Outlook

Region-wise, the market is analyzed across North America, Europe, Asia Pacific, and LAMEA. In 2022, the North America region generated the highest revenue share in the market. Stringent building safety regulations from the government have resulted in installing fire sprinkler systems in commercial and residential properties. In addition, the increasing importance of fire safety measures and growing concerns over property damage and loss of life due to fires have further accelerated the adoption of fire sprinkler systems. Moreover, the construction industry's continuous expansion, driven by infrastructure development projects, has fuelled the demand for fire sprinkler systems as an integral part of new building constructions.The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include HD Fire Protect Pvt. Ltd., Honeywell International, Inc., Minimax Fire Solutions International GmbH (Minimax Viking GmbH), Potter Electric Signal Company, LLC, Rapidrop Global Ltd., The Reliable Automatic Sprinkler Co., Inc., GW Sprinkler A/S, Victaulic, Johnson Controls International PLC, and Robert Bosch GmbH.

Scope of the Study

Market Segments Covered in the Report:

By Component- Product

- Services

- Commercial

- Industrial

- Residential

- Wet Pipe Sprinkler System

- Dry Pipe Sprinkler System

- Pre-action Sprinkler System

- Deluge Sprinkler System

- North America

- US

- Canada

- Mexico

- Rest of North America- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Key Market Players

List of Companies Profiled in the Report:

- HD Fire Protect Pvt. Ltd.

- Honeywell International, Inc.

- Minimax Fire Solutions International GmbH (Minimax Viking GmbH)

- Potter Electric Signal Company, LLC

- Rapidrop Global Ltd.

- The Reliable Automatic Sprinkler Co., Inc.,

- GW Sprinkler A/S

- Victaulic

- Johnson Controls International PLC

- Robert Bosch GmbH

Unique Offerings

- Exhaustive coverage

- The highest number of Market tables and figures

- Subscription-based model available

- Guaranteed best price

- Assured post sales research support with 10% customization free

Table of Contents

Companies Mentioned

- HD Fire Protect Pvt. Ltd.

- Honeywell International, Inc.

- Minimax Fire Solutions International GmbH (Minimax Viking GmbH)

- Potter Electric Signal Company, LLC

- Rapidrop Global Ltd.

- The Reliable Automatic Sprinkler Co., Inc.,

- GW Sprinkler A/S

- Victaulic

- Johnson Controls International PLC

- Robert Bosch GmbH