The LAMEA segment offers significant opportunities for the manufacturers due to its diverse economies, growing middle-class demographic, and expanding food and beverage industry. Therefore, the LAMEA segment captured $243.5 million revenue in the market in 2022. With the acceleration of urbanization and the rise in disposable incomes, there is an emerging preference for convenience foods and ready-to-drink beverages. Consequently, this trend generates a heightened need for citric acid, an essential product component. Additionally, the region's thriving pharmaceutical and personal care sectors contribute to local consumption.

It is widely acknowledged for enhancing the flavor profile of food and beverages. Its natural, tangy taste acts as a versatile acidulant, providing a pleasant and refreshing acidity to a diverse range of products, including beverages, jams, confectionery, and sauces. In the food and beverages industry, maintaining the right pH level is essential for the stability and quality of products. It is an effective pH regulator, helping control acidity levels in formulations. Additionally, biotechnological processes involve the optimization of microbial strains, particularly strains of the fungus Aspergillus niger. Through genetic engineering and selection, researchers can enhance the performance of these strains, leading to increase its yields during fermentation. Researchers are working on improving the ability of microorganisms to utilize various substrates for the production efficiently. Biotechnological innovations have led to the development of continuous fermentation systems, where the fermentation process occurs without interruption. Continuous systems offer advantages in terms of productivity, cost-effectiveness, and the ability to scale production as needed. Due to the above-mentioned aspects, the market is expected to grow.

However, changes in the costs of raw materials, especially sugars, can lead to cost instability for the manufacturers. Sudden and unpredictable increases in raw material costs can significantly impact production expenses, reducing manufacturer profit margins. The market operates in a competitive market, and manufacturers may face challenges in passing on increased raw material costs to customers. The uncertainty associated with raw material prices can create challenges for long-term investment planning by the producers. Additionally, uncertain cost structures make it difficult for companies to make strategic decisions and plan for future expansions or technological upgrades. Due to the above factors, market growth will be hampered in the coming years.

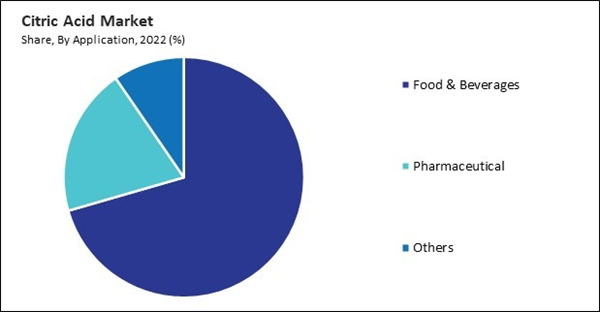

By Application Analysis.

Based on application, the market is fragmented into pharmaceutical, food & beverages, and others. In 2022, the food & beverages segment held the highest revenue share in the market. It serves as a natural acidulant in the production of beverages. Its sour taste enhances the overall flavor profile of carbonated drinks, fruit juices, sports drinks, and flavored water. Additionally, it helps balance sweetness and acidity, providing consumers with a refreshing and palatable experience. As a weak organic acid, citric acid regulates pH levels in food and beverage products. It serves as a buffer, helping to maintain the desired acidity in various formulations. This is particularly important in producing jams, jellies, and preserves, where pH control is essential for product stability.By Form Analysis.

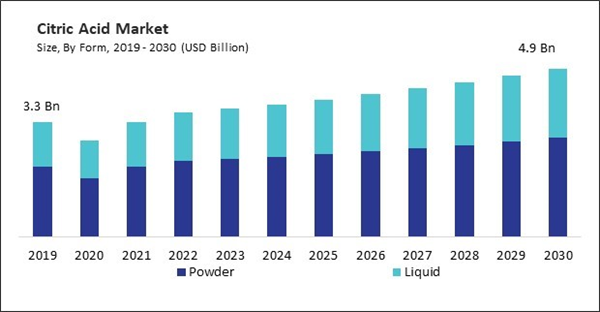

On the basis of form, the market is segmented into liquid and powder. The liquid segment acquired a substantial revenue share in the market in 2022. Its positive features, such as acidifying agents, texture alteration, and flavor enhancement, are why the liquid form is utilized in various food and dairy products. Iron control additives in liquid form are also utilized in the oil sector to chelate and regulate the pH of acidizing fluids. This is done to reduce the amount of iron that precipitates in oil. Liquid citric acid minimizes the risk of aggregation, which can occur in some powdered forms. This attribute enhances the ease of handling during manufacturing processes and contributes to a smoother production workflow.By Regional Analysis

Region-wise, the market is analysed across North America, Europe, Asia Pacific, and LAMEA. In 2022, the Asia Pacific region registered the highest revenue share in the market. China is one of the top producers and exporters of food additives among Asian countries. It accounts for roughly three-quarters of the market for ingredients in most categories of ingredients used in the food and beverage sector. Because of its large-scale production of components and ability to supply them at lower prices than other countries, China is a prominent exporter of the acid. Increased urbanization, robust economic expansion, and industrialization have all contributed to the region's heightened demand for processed pharmaceuticals and personal care items.List of Key Companies Profiled

- Pfizer, Inc.

- Tate & Lyle Plc.

- Cargill, Incorporated

- Archer Daniels Midland Company

- Jungbunzlauer Suisse AG

- HUANGSHI XINGHUA BIOCHEMICAL CO.LTD.

- RZBC Group CO., LTD.

- Kenko Corporation

- Gadot Biochemical Industries Ltd.

- Citribel N.V.

Market Report Segmentation

By Form (Volume, Kilo Tonnes, USD Billion, 2019-2030)- Powder

- Liquid

- Food & Beverages

- Pharmaceutical

- Others

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Table of Contents

Companies Mentioned

- Pfizer, Inc.

- Tate & Lyle Plc.

- Cargill, Incorporated

- Archer Daniels Midland Company

- Jungbunzlauer Suisse AG

- HUANGSHI XINGHUA BIOCHEMICAL CO.LTD.

- RZBC Group CO., LTD.

- Kenko Corporation

- Gadot Biochemical Industries Ltd.

- Citribel N.V.