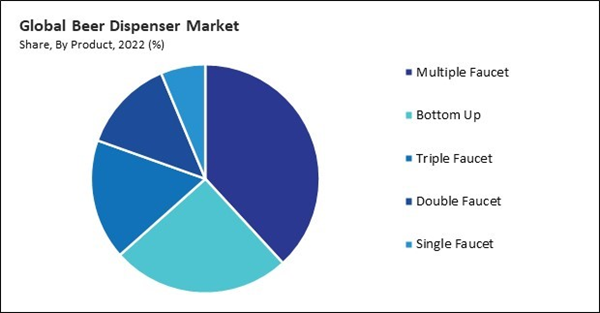

Triple faucets provide increased dispensing capacity compared to systems with fewer taps. Consequently, the Triple faucets segment captured $64,846.9 thousands revenue in the market in 2022. This benefits high-traffic venues, events, or busy bars where serving multiple customers efficiently is essential. The additional faucets help reduce wait times and enhance overall customer satisfaction. These faucets are ideal for situations where space is a consideration. Instead of dedicating separate space for each type of beverage, a triple faucet condenses multiple dispensing points into a single, more compact unit. This is especially valuable in confined areas or smaller bars where maximizing space is crucial.

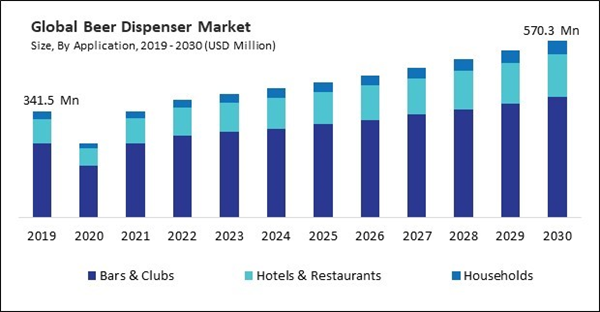

As the hospitality industry expands, there is a proportional increase in the number of bars, pubs, and restaurants. Each of these establishments may require these dispensing systems to meet the demand for a diverse range of beverages, including draft beer. The growth of the hospitality sector is often accompanied by a trend toward offering diverse and curated beverage selections. It allows establishments to showcase a variety of beers on tap, including craft brews, seasonal selections, and international favorites, catering to the preferences of an increasingly discerning consumer base. Additionally, with higher disposable income, consumers are more inclined to explore and invest in premium beverage choices, including craft beers and specialty brews. They cater to this demand by offering a suitable and aesthetically pleasing way to serve a diverse range of premium beers on tap. As consumers become more discerning and willing to spend on premium experiences, there is a growing demand for innovative dispensing technologies. Smart taps, nitro-infused beer systems, and other advanced features in these dispensers cater to consumers' preferences with higher spending capacity. Therefore, the increasing disposable income of individuals positively influences the market.

However, maintenance and repair activities often result in operational downtime for businesses. When dispensers are out of service for maintenance or repairs, establishments may experience customer service disruptions, potentially leading to dissatisfaction and revenue loss. Unexpected breakdowns or malfunctions can lead to unplanned repair expenses. Businesses, especially smaller ones with limited budgets, may find it challenging to absorb unforeseen repair costs, affecting their financial stability and profitability. This can lead to businesses exploring alternative dispensing solutions with lower maintenance requirements. The total cost of ownership for these dispensers includes the upfront purchase and installation costs and ongoing maintenance and repair expenses. High maintenance costs can impact the perceived value of the dispenser over time, potentially deterring businesses from investing in certain models or brands. Due to the above factors, market growth will be hampered in the coming years.

By Product Type Analysis

On the basis of product, the market is segmented into single faucet, double faucet, triple faucet, multiple faucet, and bottom up. In 2022, the multiple faucet segment dominated the market with the maximum revenue share. Multiple faucet beer dispensers enhance operational efficiency in bars, restaurants, and breweries by enabling simultaneous dispensing of different beer types, reducing serving time, and enhancing customer satisfaction. Multiple faucets allow bartenders to serve different beer types simultaneously, expediting service and minimizing customer wait times. Establishments with these dispensers featuring multiple taps can offer various beers, catering to different tastes and preferences.By Application Analysis

Based on application, the market is fragmented into bars & clubs, hotels & restaurants, and households. The hotels & restaurants segment garnered a significant revenue share in the market in 2022. Boutique hotels and resorts collaborate with brewing companies to unveil exclusive and limited-edition beers as a unique offering within their hospitality services. These hotels focus on serving these beers through dispensers to create a personalized customer drinking experience. For example, in August 2023, Noble House Hotels & Resorts, a family-owned boutique hotel brand, joined forces with the acclaimed Melvin Brewing, based in Wyoming, to introduce the exclusive Noble Wolf pilsner. This signature beer is available on tap across all properties and experiences within the portfolio.By Regional Analysis

Region-wise, the market is analysed across North America, Europe, Asia Pacific, and LAMEA. In 2022, the Europe region registered the highest revenue share in the market. Germany's deep-rooted beer culture and numerous beer festivals drive the country's demand for beer dispensers. Germany hosts a multitude of beer festivals, with the most famous being Oktoberfest in Munich. A dominant drinking culture in Europe plays a significant role in driving the demand for these dispensers. Consequently, this is anticipated to drive the demand for these dispensers, which allow pubs, bars, and restaurants to offer a wide variety of beers on taps and cater to the rising demand from European consumers for different styles and flavors of beer.Recent Strategies Deployed in the Market

- May-2023: PourMyBeer partnered with Cartsyde, a mobile food solution for restaurant chains. In this collaboration, Cartsyde introduced its latest innovation, the Tap Trailer: a 10-tap mobile draft system and walk-in cooler. The integration of PourMyBeer's advanced self-pour technology in the Tap Trailer aimed to minimize staffing needs, allowing customers to pour their own craft beer.

- Oct-2021: iPourIt, Inc. introduced a unique mobile app, a first in its kind, designed to complement the latest GEN 4 self-serve platform. Operating with RFID-enabled taps, the GEN 4 technology enables patrons to pour their drinks while the app tracks their tab. Customizable with operator branding, the app is available for free download on Apple iOS and Android, enhancing the experience for both patrons and operators.

- Jul-2021: Pubinno, Inc. launched "Smart Clean," a product in its "Internet of Beer" lineup that uses cutting-edge AI for automatic draft beer line cleaning. As part of the innovative scheme alongside "Smart Tap" and "Smart Hub," "Smart Clean" utilized advanced AI to swiftly and effortlessly clean beer lines. Its patented technology delivered 400 percent more pressure on inner walls, ensuring top-notch hygiene.

- Sep-2020: iPourIt, Inc. successfully launched the powerful GEN 4 platform, featuring enhanced networking, improved hardware, and software. Installed in 65+ locations with 2,200+ taps, the next-gen system maintains advanced management features of GEN 3, improving operational efficiency, simplifying installation, and reducing onboarding costs.

- Jul-2020: iPourIt, Inc. unveiled the Touchless Tap Key (TTK), a reusable RFID device enhancing safety in their self-serve system. Developed in response to the Covid-19 pandemic, TTK enables a touch-free experience, making iPourIt the safest solution for draft beverage service in restaurants and taprooms.

List of Key Companies Profiled

- Beerjet GmbH

- Bottoms Up Draft Beer Systems (GrinOn Industries)

- PourMyBeer (Innovative Tap Solutions)

- Table Tap

- BeerMatic (HOSHIZAKI

- GLOBAL AB MON. EΠΕ.)

- iPourIt, Inc.

- Revolmatic Sp z o.o

- Pubinno, Inc.

- Danby Products Ltd.

- Felix Storch Inc.

Market Report Segmentation

By Application- Bars & Clubs

- Hotels & Restaurants

- Households

- Multiple Faucet

- Bottom Up

- Triple Faucet

- Double Faucet

- Single Faucet

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Egypt

- South Africa

- Nigeria

- Rest of LAMEA

Table of Contents

Companies Mentioned

- Beerjet GmbH

- Bottoms Up Draft Beer Systems (GrinOn Industries)

- PourMyBeer (Innovative Tap Solutions)

- Table Tap

- BeerMatic (HOSHIZAKI - GLOBAL AB MON. EΠΕ.)

- iPourIt, Inc.

- Revolmatic Sp z o.o

- Pubinno, Inc.

- Danby Products Ltd.

- Felix Storch Inc.